You might be interested in

Mining

First lithium carbonate produced at Green River opens pathway for Anson’s success

Mining

Two of a pair: Anson confirms the target clastic zones at Green River are the same as those at its Paradox project

Mining

Mining

US-based lithium brines play Anson has upgraded resources again, to 1Mt LCE and 5.27Mt bromine at the flagship Paradox project.

It represents a quick turnaround from a major upgrade to 788,300t LCE announced in August.

The new, upgraded Mineral Resource was estimated from Anson Resources’ (ASX:ASN) recently completed drilling and sampling at the Cane Creek 32-1 well.

There is considerable upside remaining, with ASN now planning to commence its ‘Western Expansion’ strategy by re-entering historic drillholes in the western areas of the project.

“This may result in a significant increase in the block model grades and ultimately the product tonnages for the clastic zones and also the new Mississippian units where there are little previous recorded assays,” the company says.

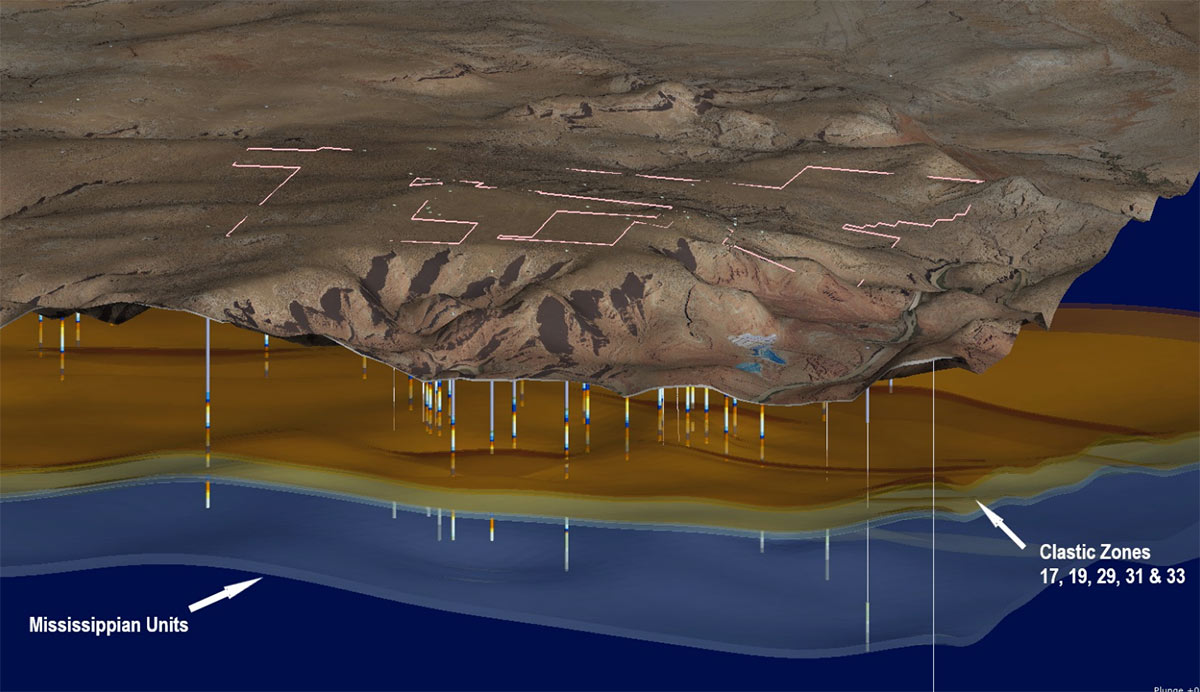

Paradox is located within a mature oil & gas district and consists of various ‘formations’ which host large volumes of brines rich in lithium and bromine, among other minerals.

The Paradox formation, about 2km below surface, includes multiple lithium rich ‘clastic’ zones.

The underexplored ‘Mississipian/Leadville’ formation, 450m below Paradox, is a massive, supersaturated brine aquifer with high grades of lithium.

The new resources will be included in the recent project DFS, which estimated up to 13,000tpa LCE production across the first 10 years of a 23-year project life (Phase 1).

The headline numbers for Phase 1 are as follows:

ASN has assumed a long-term price of ~US$19,000/t of battery grade lithium carbonate for the purposes of this economic analysis.

At current lithium carbonate spot prices of ~US$70,000 per tonne, pre-tax NPV and IRR jump to $5,149m and 98%, respectively.

That’s super profits territory.

This article was developed in collaboration with Anson Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.