You might be interested in

Mining

Bulk Buys: Why the big Pilbara producers say returns are going to slide in iron ore

Mining

Monsters of Rock: One year wait to revive manganese for South32 and Base becomes Ace

Mining

Mining

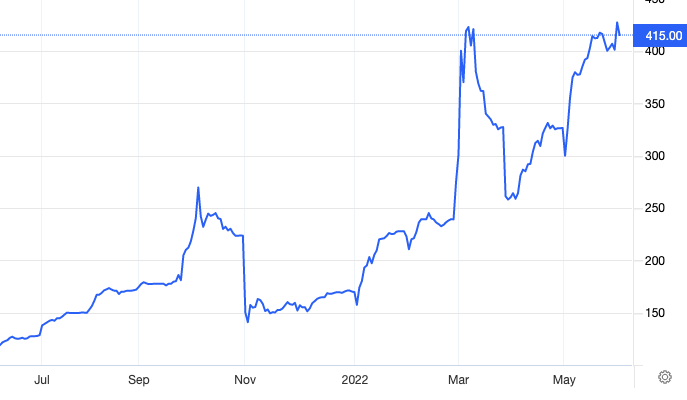

Price: US$415.00/t

%: +27.1%

For the second straight month coal prices have charged by more than 20%, reflecting an incredible shortage of the energy commodity dug up in its tens of millions of tonnes on Australia’s east coast.

While energy coal is trading for upwards of US$400/t, top quality metallurgical coal can fetch more than US$500/t, something that translates to incredible margins for Australian coal miners.

The core reason, aside from a shortage that sent prices to what were then new records in late 2021, is Russia’s war in Ukraine.

Sanctions are being ramped up against Russia, Europe’s primary supplier of coal for both energy and steelmaking.

While EU bans are only supposed to come into place in August, companies have already begun boycotting Russian coal with Indian and Japanese steelmakers also thumbing their nose at shipments from Mother Russia.

High oil and gas prices are keeping demand for coal strong despite high prices.

“It has been estimated that the current API2 coal price break-even with the current EU gas price is US$572/t. The second is further disruptions to Russian supplies of coal,” Westpac senior economist Justin Smirk noted in May.

“Finding an alternative to 50 to 100Mt of Russian coal is significantly more challenging than other commodities due to logistical constraints and quality differences.”

The question now is how high coal prices can run?

Aussie miners are enjoying the otherworldly price situation. $5.5 billion capped Whitehaven Coal (ASX:WHC) is up 6.71% over the past month, while New Hope Corp (ASX:NHC) is almost 5% higher.

Bowen Coal (ASX:BCB) was up over 15% for the month as it restarted the Bluff PCI mine in Queensland, Stanmore Coal (ASX:SMR) completed its US$1.2 billion purchase of BHP’s (ASX:BHP) ~10Mtpa 80% stake in the Poitrel and South Walker Creek mines, while Terracom (ASX:TER) paid off the last of a debt it only refinanced under a year ago in preparation for an unlikely dividend that has sent its shares up 50% in the past month.

More curious is a bid to take out minority shareholders of Australia’s largest pure play coal miner Yancoal (ASX:YAL) by its Chinese parent for convertible notes worth 16.6% less than its market value.

Yankuang’s gambit has received short-shrift from minority holders, with big fish and ~6% owner Glencore not keen to bite Yankuang Energy’s unappetising bait.

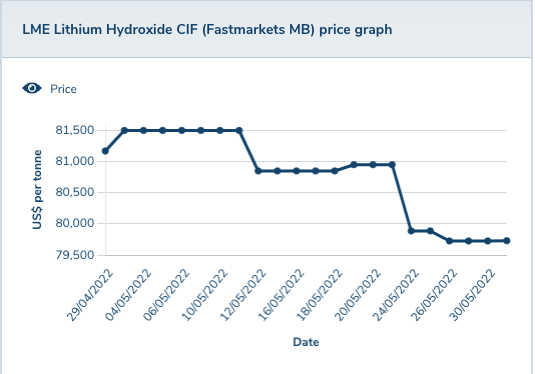

Price (Fastmarkets Lithium Carbonate): US$73,000/t

%: +4.3%

Lithium prices recovered slightly after a sell off in carbonate during April.

The primary contributor was China’s Covid lockdown, which crimped demand for EVs and put a break on battery manufacturing.

Prices recovered, remaining at the super high levels we have seen for the battery metal this year as enthusiasm grows for the country’s economic recovery and the battery market.

Hydroxide prices remain strong around US$75,000/t, a situation driving strong prices for the key lithium raw material sold by Australian miners, spodumene concentrate.

Pilbara Minerals (ASX:PLS) demonstrated the still bullish environment surrounding spodumene producers with the results of its fifth Battery Material Exchange auction on May 24, when it sold a cargo of 5.5% lithia project for US$5955/t.

That’s the equivalent of US$6586/t on a 6% basis, comfortably a record price for its product.

Little good for lithium stocks, which suffered an astonishing selldown after major investment bank Goldman Sachs called the top of the battery metals boom in a note last week.

Mixed with some news about Argentine reference prices and Chinese plans to develop lithium mines in Africa saw a massacre for lithium equities last week.

Experts who follow the industry aren’t buying it, with Canaccord’s Reg Spencer saying Goldman Sachs has overestimated the “oversupply” issue it thinks will drive chemical prices down to US$16,000/t.

In major company news Firefinch (ASX:FFX) completed the $100 million raising for the demerger of its 50% share of the Goulamina lithium project in Mali into Leo Lithium, with the new company to list on the ASX later this month.

Less positive news for fellow African explorer AVZ (ASX:AVZ), which has been suspended from trade since reports emerged in May that Chinese gold giant Zijin was claiming a 15% share in the massive Manono project in the DRC, raising questions over whether AVZ will keep operating control of the deposit.

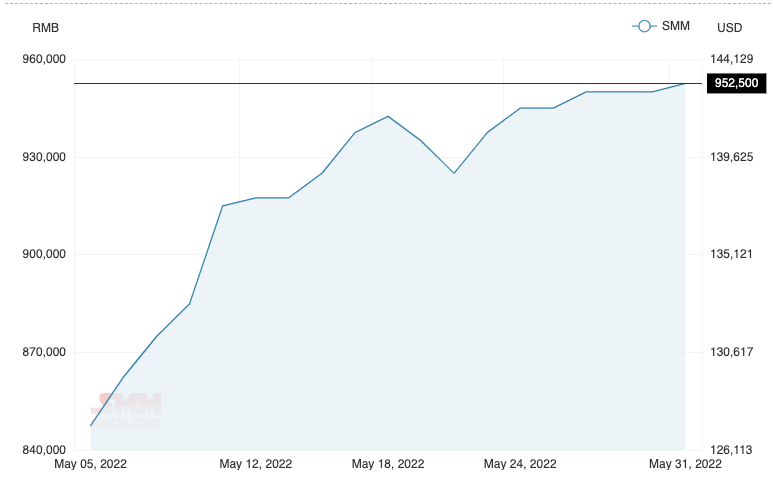

Price: US$142.26/kg

%: +10.9%

Rare earths suffered a notable drop in April but improved sentiment in China brought prices back in May, though short of their February highs of around US$175/kg.

There has been a sense the sell-off for neodymium-praseodymium was over-egged.

The key markets for neodymium and praseodymium are permanent magnets used in electric vehicles and wind turbines, markets which continue to gather pace as investments in renewables rise.

Exports of rare earth magnets from China surged last month, according to the Shanghai Metals Market, while the supply of light rare earths has been strained by maintenance at the major Mountain Pass mine in the USA.

SMM analysts say a subsidy for buyers of EVs in China designed to stimulate its economy post-Covid will improve downstream demand on the mainland as well.

“Under the background of ‘carbon peaking and carbon neutrality’, downstream applications such as industrial motors, new energy vehicles, and wind power generation have developed rapidly, and the market demand for high-performance sintered NdFeB permanent magnet materials has continued to grow,” they said.

“The automobile industry is one of the main industries for the application of magnetic materials. Traditional automobiles and new energy vehicles together account for about 50% of the magnetic material application market.

“The application prospects of new energy vehicles are very promising.”

News in the listed company space was few and far between for rare earths stocks after the outgoing federal government announced cash splashes on a string of local projects before the election on projects owned by Iluka Resources (ASX:ILU), Northern Minerals (ASX:NTU) and Hastings Technology Metals (ASX:HAS) in the name of establishing a local rare earths supply chain.

$200 million capped Ionic Rare Earths (ASX:IXR) announced a 70% increase in resources at its Makuutu project in Uganda to 532 million tonnes at 640 ppm TREO.

Makuutu is an ‘ionic clay’ rare earths resource, the style of deposit responsible for the bulk of the industry’s production in southern China.

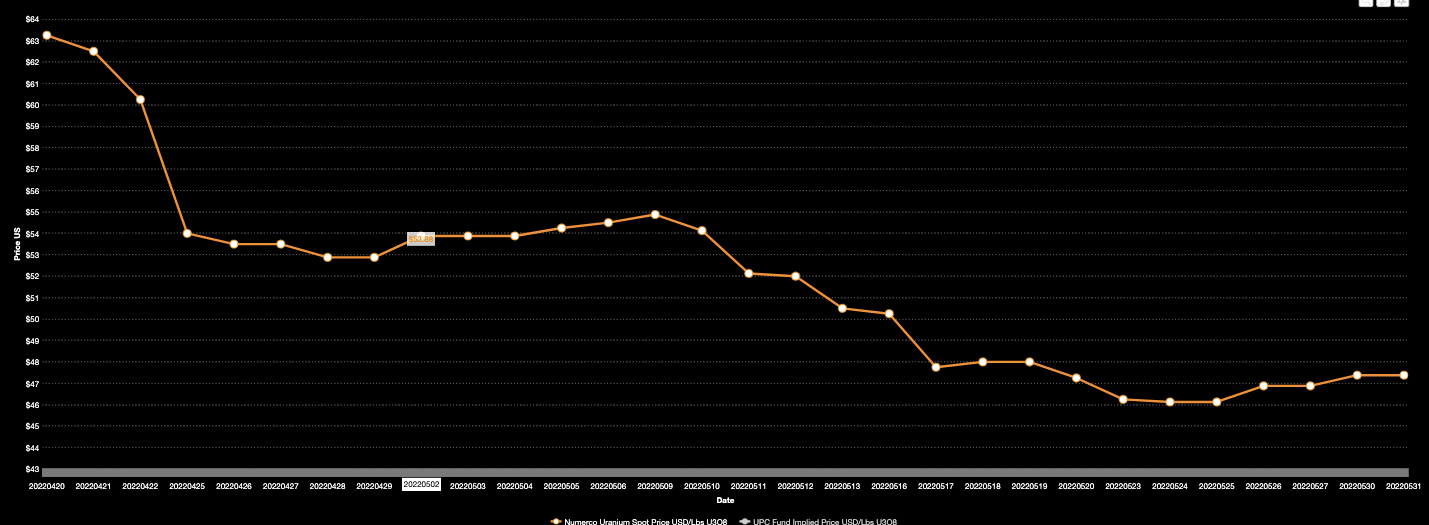

Uranium briefly climbed to spot prices upwards of US$60/lb in the weeks after Russia’s invasion of the Ukraine.

Russia is a major supplier of the nuclear fuel along with friendly nations in Uzbekistan and Kazakhstan.

Industry players think the disruption from boycotts against Russia and potentially its diplomatic partners could be significant even if they’re not being seen yet, with enthusiasm coming out of the market.

That said, veteran investor Rick Rule says it’s time to go back and have a look at your uranium stocks again, noting the overall trend is up and that there seems to be little cure for a looming chronic undersupply without incentivising new production. That means, in short, contracts will need to be written at higher prices.

“The incentive price for new production of uranium with inflation in the supply chain is $US75/lb,” Rule told Stockhead’s Oriel Morrison in a recent interview.

“Given [the world is] using 180 million pounds and producing 120 million pounds – meaning that there is a 60 million pound per year shortfall – it’s pretty simple to figure out that over the five-year time frame that the price of uranium needs to go through the incentive price of $US75.

“Either that, or the lights go out. Those are the only two choices.

“Which of those happens? I suspect that the price of uranium goes up.”

The biggest news in the sector came after the end of the month as Boss Energy (ASX:BOE) announced an FID on the $113 million restart of the Honeymoon uranium mine in South Australia.

The 2.45Mlb per annum yellowcake mine will be just the third operating in Australia alongside BHP’s Olympic Dam and the privately owned Beverley mine, also in SA.

Boss plans to be in production by the fourth quarter of 2023 with a three-year ramp-up to its full production rate, timed for a looming nuclear supply shortage expected from 2024.

Honeymoon is set to operate for an initial life of 11 years, with an IRR of 47% at a uranium price of US$60/lb.

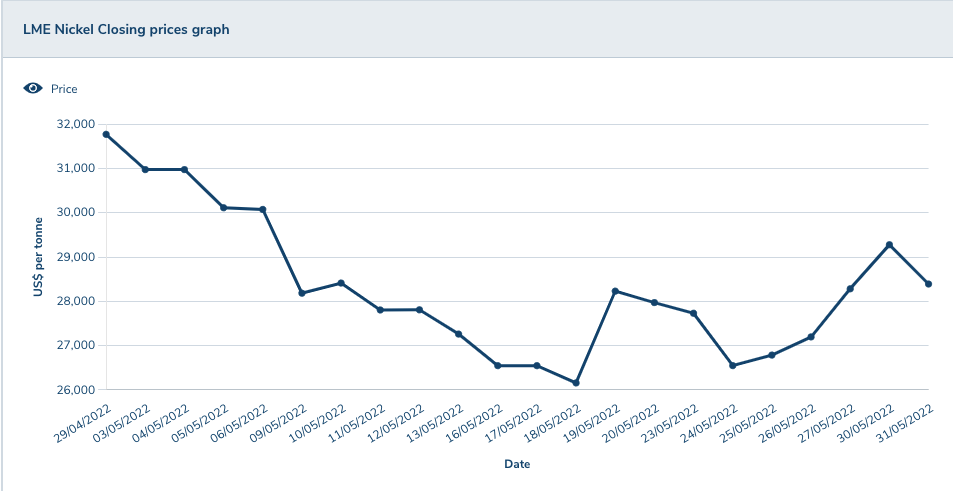

Price: US$28,392/t

%: -10.6%

The madness that saw nickel hit prices above US$100,000/t for a fleeting moment in March is but a distant memory now, with the commodity falling for the second straight month.

Nickel was one of many base metals hit hard by the Covid situation in China, which had a big impact on downstream demand for industrial metals.

LME nickel metal is trading under US$30,000/t, but is still at prices producers could only have dreamed about a couple of years ago.

Long term, the fundamentals for nickel will be tied to the growth of the market for the stainless steel ingredient in EV batteries.

In a recently released report by KJ Leuven for Eurometaux, researchers say demand for nickel could grow to 3,800,000-4,700,000t by 2030, and up to 6,000,000-9,000,000t by 2050 as need for the base metal increases.

That will require a whole lotta new mines we don’t know about yet.

One miner looking to ramp up production is Mincor Resources (ASX:MCR), which is on the cusp of cash flow from its Kambalda nickel operations after ore from its mines was used to restart concentrate production from BHP’s Kambalda nickel concentrator.

It is the first time in over six years that Mincor, which owns the bulk of the historic nickel-producing mines in the famous Kambalda province, has been in production.

Meanwhile IGO (ASX:IGO), which has a big stake in Mincor, is on the verge of completing its takeover of Western Areas (ASX:WSA) in a ~$1.3 billion deal after WSA shareholders approved a scheme of arrangement found not fair but reasonable by independent experts KPMG.

And in nickel-adjacent news, the month’s big mover was Mark Creasy-backed Galileo Mining (ASX:GAL), which soared on a palladium discovery at its Norseman project, which also boasts a large nickel-cobalt resource.

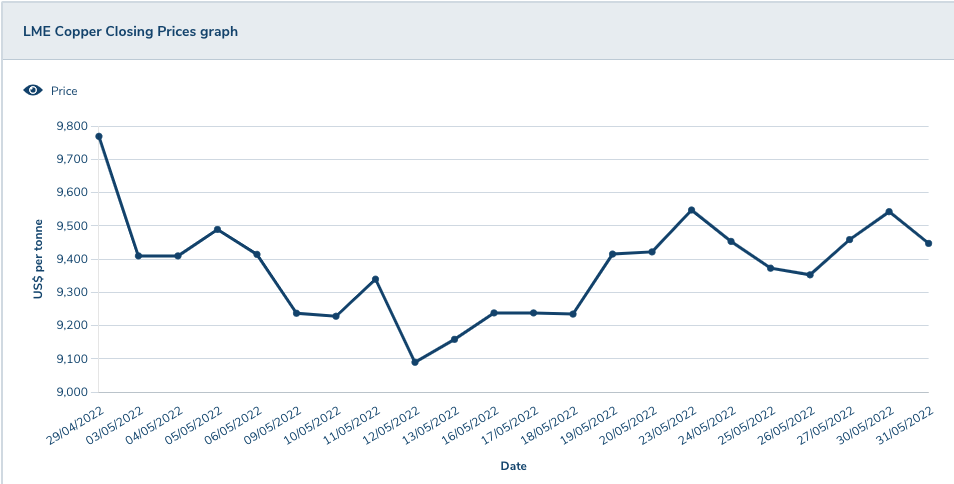

Price: US$9447.50

%: -3.3%

A familiar story for copper, which joined other base metals in falling across the month of May.

But supply continues to disappoint.

While expectations of a big increase in global supply were alive and well at the start of the year, the world’s leading producer Chile has become a millstone on production growth.

Cochilco, Chile’s copper authority, said last week the South American country had produced just 420,000t of the red metal in April, a stunning 8.9% down on a year earlier and 8.24% down month on month.

Of course, Glencore thinks copper demand will double by 2050, what with all this electrification stuff going on, so supply shortfalls won’t cut it.

Prices will need to go up to support new developments at lower grades. While Goldman Sachs’ Nick Snowdon put the fear of god into the lithium crew with the bank’s recent ‘battery metals are dead’ note, he is bullish about the potential that GS’ famous copper to US$15,000/t shout could be conservative.

Price: US$1838/oz

%: -2.9%

Gold prices have held up relatively well in the face of interest rate increases out of virtually all of the major Western countries, most notably the US Federal Reserve.

It is a push-pull dynamic that has seen gold, a safe haven investment, keep its value due to investors’ fears about geopolitical instability and rampant inflation.

After a 50bps increase last month it is almost certain to rise again.

Bullion also came off late last week after a better than expected US jobs report.

But it has remained favoured as a store of value as crypto and tech-heavy stocks have tumbled in the USA.

May was a month best described as slow for the major gold miners, as they knuckled down on production following a Covid-affected March quarter which saw production at Australian gold mines fall 6% to 76t.

Corporate activity was most vigorous overseas with South Africa’s Gold Fields announcing a US$6.7 billion merger with Canada’s Yamana Gold, a deal that will make it the world’s fourth largest gold producer.

Back home the big news was De Grey Mining (ASX:DEG), which announced a 25% increase in resources at its Hemi discovery in the Pilbara to 8.5Moz.

That takes the overall resource at the Mallina gold project to 10.6Moz with measured and indicated resources up 80% to 6.9Moz.

That last number is important, as measured and indicated resources can be included in mineable reserves, a key step towards the completing of upcoming pre and definitive feasibility studies.

The PFS is due in the September quarter with a DFS to immediately follow and environmental approvals expected to begin concurrently.

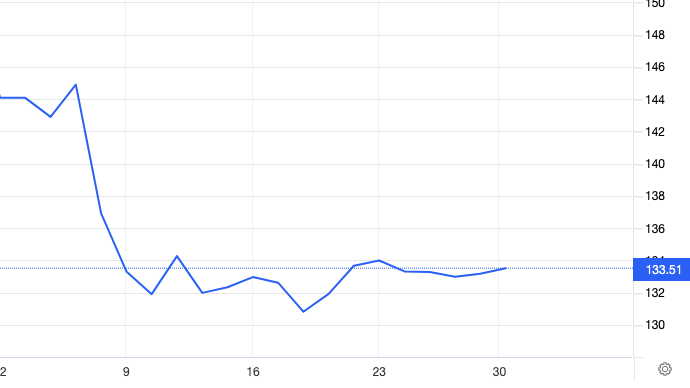

Price: US$136.07/t

%: -6.1%

Iron ore prices have begun to stir after a month under the thumb of China’s lockdowns, registering their biggest weekly gain in a month last week.

Prices rallied to close the month, lifting from month lows of around US$127/t to over US$136/t, before benchmark 62% fines lifted to US$141.95/t last week.

Singapore futures for July are now fetching US$142.45/t after lifting on Friday.

ANZ research commodity strategists Daniel Hynes and Soni Kumari warned last week this could be as good as it gets, though constrained supply from Ukraine and weak exports out of Brazil and Australia are providing a floor.

“Iron ore prices have found a floor amid renewed supply side issues. This could develop into gains as Chinese stimulus measures boost sentiment. Ultimately the upside looks limited, as constraints on China’s steel output should keep demand muted,” they said.

“With China announcing stimulus aimed at boosting economic activity, we expect a restocking effort in the second half of 2002 to stimulate demand and lift iron ore prices. However, the upside will be limited.

“Constraints on steel output remain, while easing regulations on the housing sector won’t solve its underlying issues. This may be as good as it gets.”

Silver

Price: US$21.59/oz

%: -5.2%

Tin

Price: US$34,670/t

%: -13.9%

Zinc

Price: US$3913.50/t

%: -4.7%

Cobalt

Price: $US74,000/t

%: -9.76%

Aluminium

Price: $2787/t

%: -8.7%

Lead

Price: $2182/t

%: -3.5%