There’s metal inside your neighbour’s car more valuable than gold #justsayin

Pic: John W Banagan / Stone via Getty Images

The theft of catalytic converters from car exhausts is mounting as the price of platinum group metals (PGMs) hit record highs.

Three to seven grams of platinum group metals (PGMs) — mostly platinum, palladium and rhodium – go in every catalytic converter, which sit in your car exhaust to reduce polluting emissions.

They look something like this:

You crack the outer casing open to get to the good part, filled with PGEs like platinum, palladium and rhodium:

Three to seven grams per convertor means you need a minimum of five catalytic convertors and a near-flawless extraction/recovery process to score one ounce of PGMs.

But that ounce – depending on the metal mix — could be worth a lot.

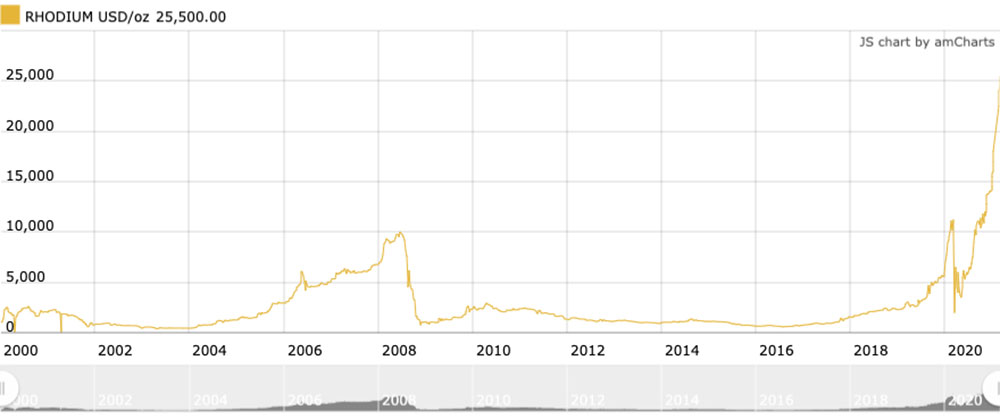

Platinum sells for $US1,155.53/oz, which is chump change next to palladium ($US2,368.60) and rhodium ($US25,500/oz).

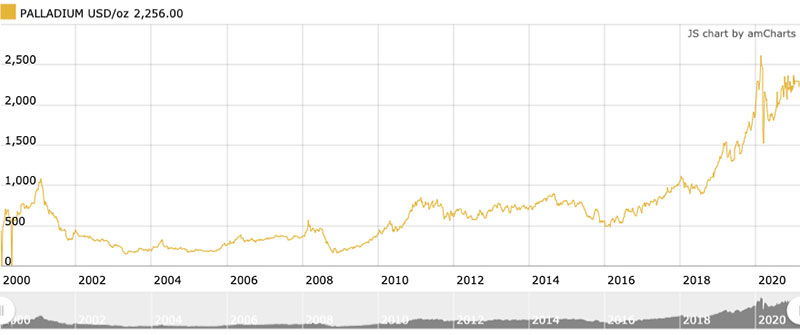

Just check out these spicy 20-year price charts for palladium and rhodium:

If you’re think about going into the second-hand catalytic convertor business, omens are good.

Metals Focus predicts palladium prices will hit all times highs above $US2,750/oz in 2021.

Why? Nine straight years of ever-enlarging supply deficits.

The gap between mine production and consumption in 2020 alone was about 1 million ounces of palladium.

That’s why palladium has been holding up strongly in the high $US2,400s at a time when other precious metals, like gold, have come under some price pressure.

Who’s finding PGEs the honest way?

Zimbabwe-based Zimplats (ASX:ZIM) is the only ASX-listed PGE producer. In the December quarter it produced 67,000oz platinum, 57,500oz of palladium and 6000oz of rhodium at a total 6E cash cost of $US648/oz.

That’s a nice profit, based on current prices.

But world class PGE deposits – especially the palladium dominated ones — are extremely hard to find.

That’s what makes Chalice Mining’s (ASX:CHN) Julimar deposit in WA – which the company calls “Australia’s first major palladium discovery” — so special.

Numerous explorers are in the neighbourhood actively hunting for a palladium payday of their own.

They include Cassini/Caspin Resources, DevEx Resources (ASX:DEV), Liontown Resources (ASX:LTR), Mandrake Resources (ASX:MAN), Anson Resources (ASX:ASN), Australian Vanadium (ASX:AVL), Lachlan Star (ASX:LSA) and Lithium Australia (ASX:LIT) … just to name a few.

The other palladium-rich explorer on the ASX is Impact Minerals (ASX:IPT), which is focused on the Broken Hill project in NSW.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.