Palladium prices will hit all-time highs in 2021. Here are the ASX stocks to watch

Mining

Mining

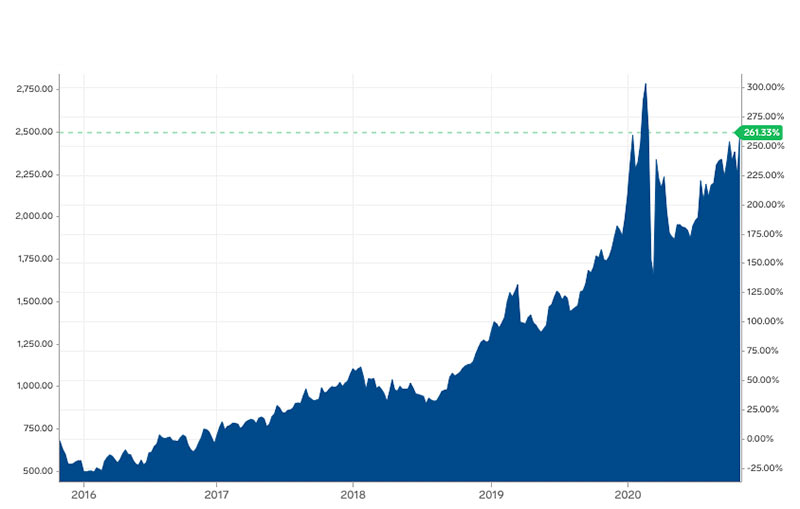

In January 2019, palladium prices hit 26-year highs of $US1328.80 an ounce and we asked “was it time to call the top?”

The answer was – and still is – a resounding no.

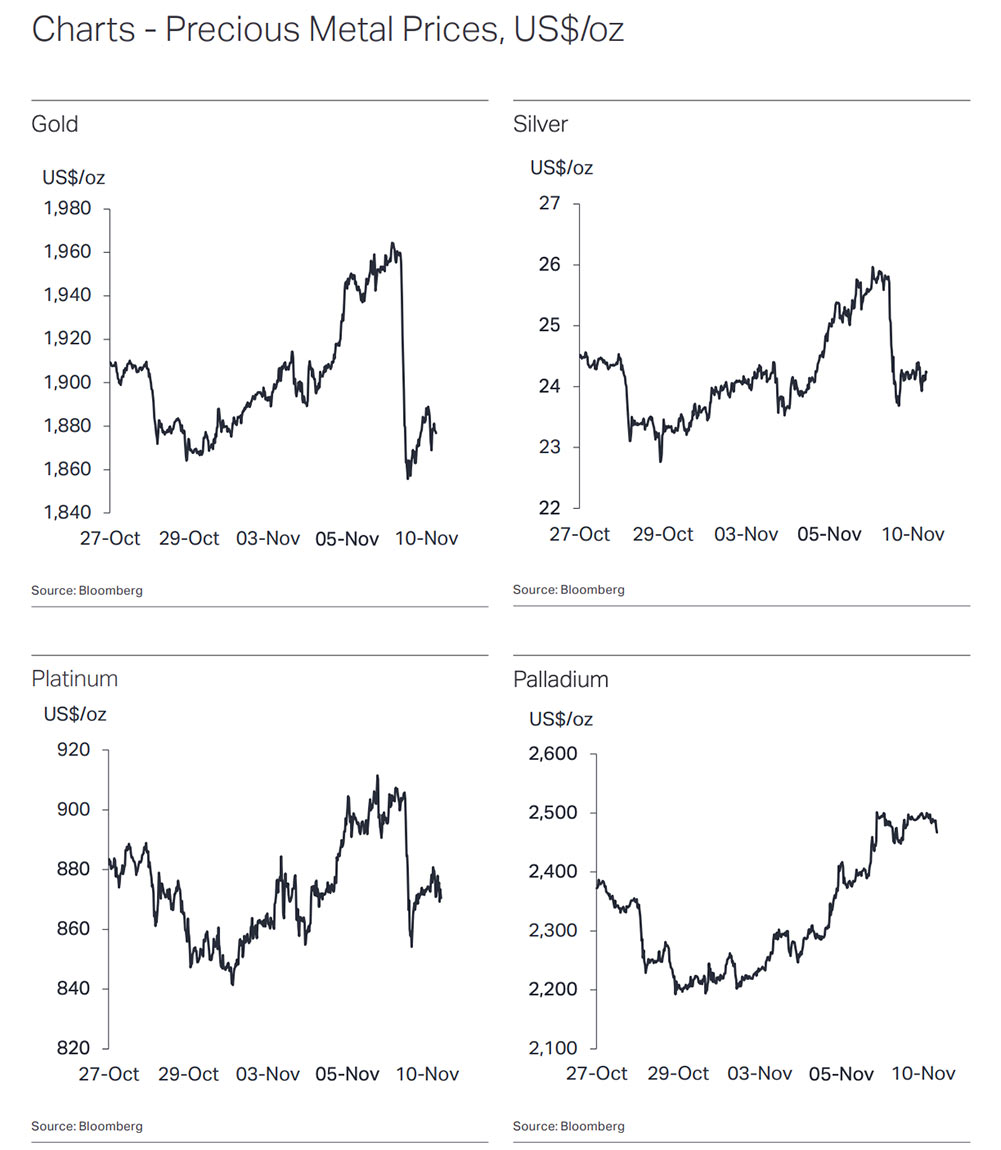

In early November this year palladium surged above $US2,500/oz for the first time since March.

This rally lost momentum, but the price has been holding up strongly in the high $US2,400s at a time when other precious metals have come under sustained pressure, says Metals Focus.

“Going forward, we retain a positive outlook for palladium, although all-time highs are unlikely to be breached until next year,” it says.

Palladium’s latest price spike is even crazier considering its main use: 80 per cent goes into ‘autocatalysts’ in car exhausts to reduce polluting emissions.

The auto sector has been decimated by COVID-19. So why is palladium thriving?

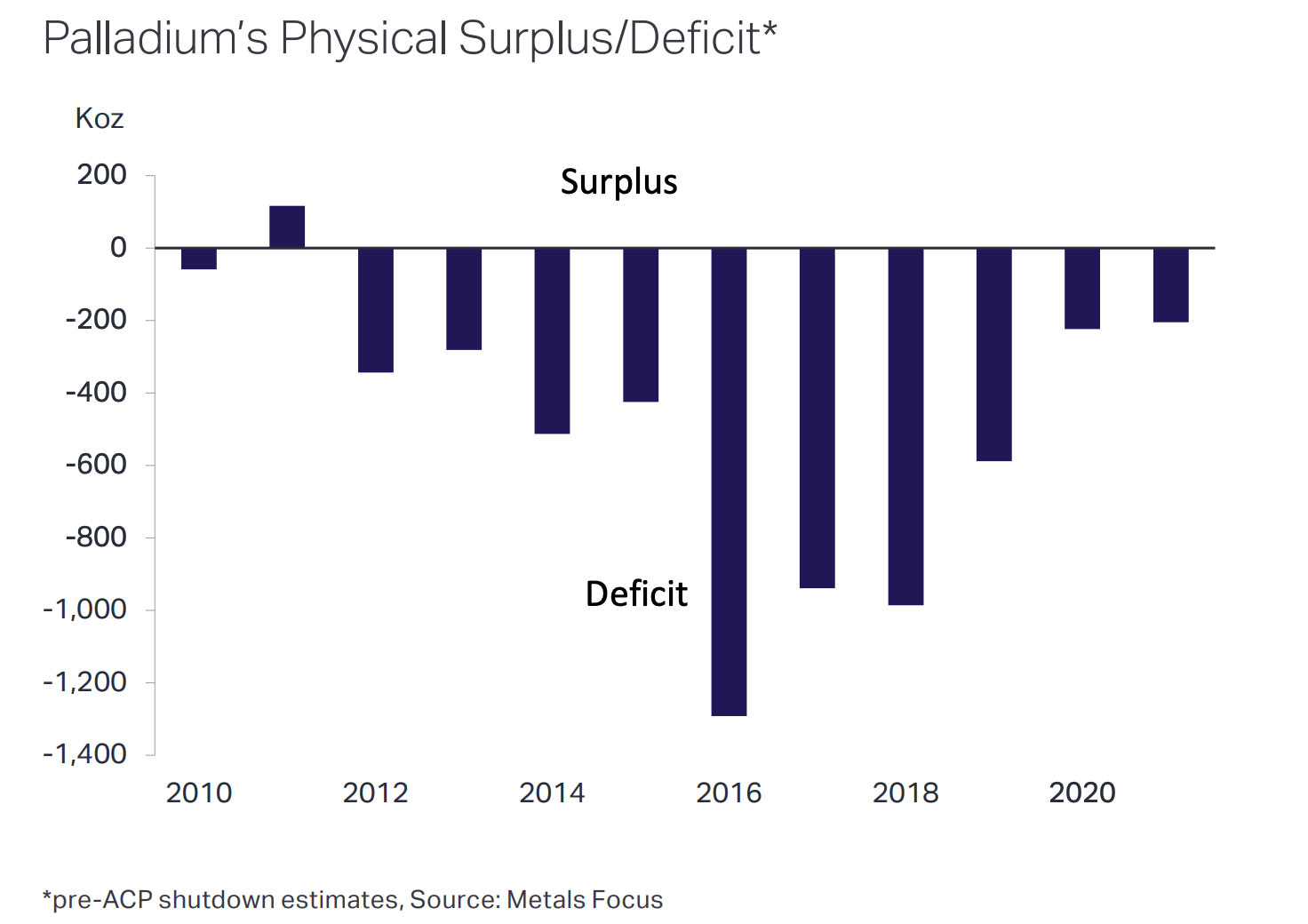

The answer is an ever-increasing, decade-long supply deficit:

Producer stock sales, higher recycling and heavy liquidation from physical ETFs have not been enough to balance out the long term discrepancy between primary mine production and consumption.

This deficit has only widened in 2020.

Its recent strength has been fuelled by renewed supply concerns in South Africa – one of the world’s largest producers, alongside Russia — where operational issues saw Anglo American Platinum downgrade palladium production by about ~250,000oz for the remainder of 2020.

Prior to the latest Amplats announcement, Metals Focus estimated that global palladium mine supply would fall by 10 per cent in 2020 and then recover by 11 per cent next year.

But beyond near-term challenges, the outlook for palladium autocatalyst offtake is “quite favourable”, with volumes forecast to almost return to pre-pandemic levels in 2021, Metals Focus says.

“An ongoing recovery in vehicle sales and tightening emission standards will continue to boost palladium offtake,” it says.

“As such, our current projection still sees palladium remain in a structural deficit in 2021.

“This, along with falling above-ground stocks, bodes well for palladium prices, with the metal projected to hit new all-time highs during 2021.”

Chalice Gold Mines (ASX:CHN) calls Julimar “Australia’s first major palladium discovery”.

In March, the very first hole at the Julimar project, right near Perth in WA, hit 19m at 8.4g/t palladium, 2.6 per cent nickel and 1 per cent copper.

Five rigs are turning right now as Chalice aims for a maiden resource in mid-2021.

Chalice’s discovery sparked a pegging rush, and now numerous explorers are looking for a Julimar of their own.

They include Cassini/ Caspin Resources (which was, to be fair, already hunting nickel-PGE deposits in the region), DevEx Resources (ASX:DEV), Liontown Resources (ASX:LTR), Mandrake Resources (ASX:MAN), Anson Resources (ASX:ASN), Australian Vanadium (ASX:AVL), Lachlan Star (ASX:LSA) and Lithium Australia (ASX:LIT) … just to name a few.

Further north in WA is Podium Minerals (ASX:POD), which is currently finalising a resource upgrade for the Parks Reef project near Cue.

The current resource stands at 1.14Moz of combined platinum, palladium and gold (plus a handy 37,000 tonnes of copper).

In NSW, Impact Minerals (ASX:IPT) is dialling in on a major discovery at the Broken Hill palladium-platinum group metal project.

A major drill program is in progress to test three priority prospects — Red Hill, Platinum Springs and Little Broken Hill Gabbro — with assays pending from all three.