The sun, the sand and the stocks: South-West Connect brings resources stalwarts to the seaside

The South-West Connect ASX Showcase runs from October 18-19 at the Abbey Beach Resort. Pic via Getty Images.

South-West Connect is back, baby! Who can you expect to see at next week’s event?

Amid the topsy-turvy spring weather and the never-ending wait until December holidays, we could all do with some time at the beach.

Lucky for small-and mid-cap pundits across the west coast, Vertical Events is bringing the stocks (and the mimosas) to the seaside for this year’s South-West Connect conference.

Nestled in the heart of beautiful Abbey Bay, this jam-packed investor forum is a chance for ASX execs to get down to brass tacks and talk shop in a more relaxed format.

Now three years in the running, the two-day conference attracts some of the best in the biz, including those in the know from resources and energy stalwarts like Patriot Battery Metals (ASX:PMT) and Strike Energy (ASX:STX) .

Stockhead caught up with conference guru Jaxon Crabb to get the skinny on this year’s event and to find out who’s who in the South-West Connect zoo.

From boardroom to boardshorts

You’ll need to get your forty winks before the conference begins bright and early on Wednesday, October 18.

City of Busselton Mayor Grant Henley will be in town to kick off proceedings at 9:00 am, followed by a chok-a-blok schedule of investor presentations and a networking event from 5:00 pm.

Expect more of the same on Thursday, including a panel discussion and an abundance of morning tea.

“There’s a lot to like if you’re interested in the lithium space, but we’ve also got plenty of companies that are exploring for other commodities,” Crabb explained.

With more than 40 companies set to present, there’s sure to be something for everyone at this year’s conference. And while investors may go in with a couple of stocks on the watchlist, Crabb stresses it’s important to keep an open mind.

“Embrace the opportunity to engage with representatives from the companies that are presenting and hear their stories closely,” he said.

“Let’s make the most of the opportunity to be in the Southwest for a couple of days!”

Stocks to watch

Lithium Universe (ASX:LU7)

Well, well, well…if it isn’t Iggy Tan and his motley crew of lithium trailblazers.

This Canadian developer has its eye on James Bay, where the plan is to build a vertically-integrated mining and processing hub to support Quebec’s burgeoning lithium industry.

They’re grand plans for an ASX-lister who only joined the bourse in August, but non-executive chair Iggy Tan has found the talent to keep the dream alive — most notably from his days at Galaxy Resources (now lithium monolith Allkem following a merger with Orocobre in 2021).

With four new recruits added to the lithium dream team in September — and engineering behemoths Primero and Hatch tied to the company’s processing hub — there’ll be plenty to talk about at this year’s conference.

Altech Batteries (ASX:ATC)

Iggy Tan won’t just be flying the Lithium Universe flag at the conference, he’ll also be repping the Altech Batteries story as managing director next week.

For those new to the stock, ATC is focused on building “a game-changing alternative to lithium-ion batteries”, with a particular emphasis on the grid energy storage market.

What makes it stand out from the pack? For one, recent news that the company’s CERENERGY battery project in Germany will use no lithium, copper, cobalt or graphite, instead opting for humble table salt and ceramic solid-state tech to keep the wheels turning.

Expect more news on this pioneering technology (eight years in the making from the battery boffins at Fraunhofer IKTS) at next week’s event — but for now, you can hear Iggy’s two cents on the grid storage market in the vid below.

Brightstar Resources (ASX:BTR)

Soon to be a member of the lucrative gold producer club, Brightstar Resources’ Alex Rovira will be on deck from Wednesday.

The managing director will update pundits on mining endeavours at the Selkirk open pit — a JV project with BML Ventures that’s expected to mint its first gold bar early next year.

But that’s not all. A recent scoping study for Brightstar’s Laverton and Menzies projects has highlighted the company’s potential to become “a meaningful producer in the WA Goldfields”.

A big part of that strategy is reviving a shuttered processing plant — parts of which are brand new and may never have seen gold before today.

With maiden gold just around the corner and two more assets in the wings, BTR has plenty to keep itself busy heading into the silly season.

Belararox (ASX:BRX)

While all eyes are on South America’s famed Lithium Triangle, Belararox’s Arvind Misra is chasing a different kind of payday in that corner of the Earth.

The BRX chief is on the hunt for epithermal gold and porphyry copper systems at the company’s Toro-Malambo-Tambo (MTM) project in Argentina, where 11 prospective targets are waiting in the wings.

A little closer to home, Belararox is also putting plans in action at its 5Mt Belara base metals asset in NSW, where emerging, high-priority targets have charted the course for further resource growth.

“These developments significantly bolster our outlook for exploration,” Misra told the market late last month.

“We eagerly anticipate the opportunities that these projects bring and are dedicated to delivering enduring value to our esteemed shareholders.”

DevEx Resources (ASX:DEV)

There’ll be plenty of news to recap from DevEx Resources at this year’s South-West Connect conference.

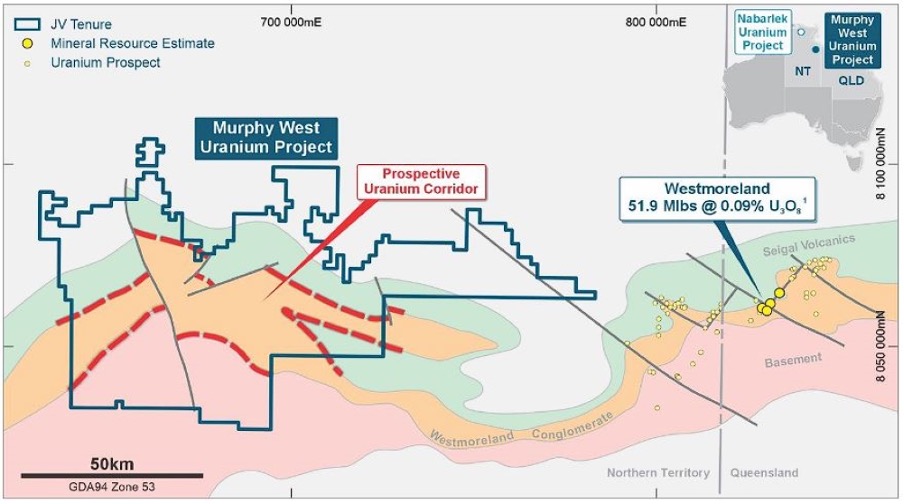

The yellowcake stock has just bolstered its uranium portfolio, landing an agreement that will see it secure up to 75% of the uranium rights at the province-scale Murphy West tenements in the NT.

Of course, DevEx also has its fingers in the rare earths pie — the latest assays from the Kennedy ionic clay-hosted REE project in Queensland point to extensive rare earths in the surface clay.

Announcements aside, recent uranium mania is sure to set tongue’s wagging, particularly after Managing Director Brendan Bradley gives his presentation on Wednesday.

Uranium prices in the spot market have managed to rocket past US$70/lb this past year – a valuation last seen in 2011.

James Bay Minerals (ASX:JBY)

I can remember James Bay’s listing like it was yesterday — because it pretty much was.

This lithium-focused newcomer hit the boards in September following an oversubscribed $6m IPO, giving it a nice chunk of change to support future drilling at its La Grande asset in — you guessed it — Quebec’s James Bay region.

First-pass fieldwork has already paid off, pinpointing a massive outcropping pegmatite and a 3km corridor at the Aero property — enticing finds so early in the discovery journey.

If that wasn’t enough to whet your appetite, take a gander at the board and management team, which boasts alumni from resources bigwigs like Pilbara Minerals, Nemaska and Primero.

Expect to hear the latest updates from Executive Director Andrew Dornan as the company’s field program remains firmly under way.

Green Technology Metals (ASX:GT1)

Those across the James Bay lithium story will have likely heard the name Green Technology Metals before now.

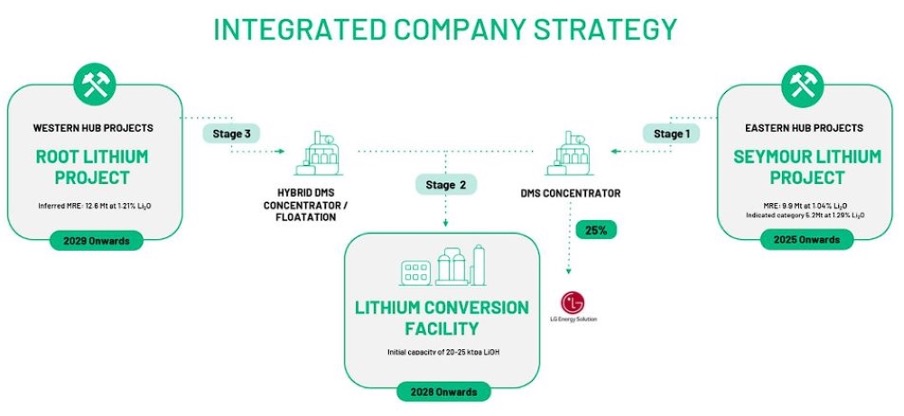

At this year’s South-West Connect, CEO Luke Cox will take investors through a spate of recent announcements, including news that the company is digging deeper at its 8.1Mt Root Bay deposit and the 9.9Mt Seymour Lake property.

The ASX-lister has also laid plans for Root Bay and Seymour Lake to form part of a vertically integrated lithium business that’s targeting first production for 2025.

“We’re on a path to become Ontario’s first lithium concentrates and chemical producer,” Cox told investors in early October.

Future Battery Minerals (ASX:FBM)

Future Battery Minerals has hit the double whammy with lithium assets in Nevada and Australia.

The explorer is onto Phase 3 resource drilling at its Nevada lithium project – work that is expected to bear fruit in to form of a maiden resource early next year.

And closer to home – in one of Australia’s hottest lithium addresses – the company’s Kangaroo Hills project is shaping up as a potential Kathleen Valley look-a-like.

CEO and Managing Director Nick Rathjen will be in the hot seat come Wednesday to give the business case for this in-demand critical mineral, as well as the company’s nickel sulphide assets.

Galan Lithium (ASX:GLN)

Galan Lithium is keepin’ on keepin’ on at its Hombre Muerto West property in Argentina, where development continues apace.

CFO Graeme Fox is ready to share findings from the HMW Phase 2 definitive feasibility study, which builds on an initial development phase that’s currently under construction.

Galan is also one of the newest members of the James Bay lithium contingent: The explorer recently struck a JV with fellow ASX-lister Redstone Resources, gaining ground next to Patriot Battery Metals’ CV8 pegmatite discovery.

A lot of news to fit into 15 minutes – you’ll want to stay awake for this one.

Fin Resources (ASX:FIN)

Rounding out the lithium crew is Canada-focused Fin Resources, which just announced that maiden fieldwork has revealed five outcropping pegmatites at the Cancet West project in James Bay.

Just a stone’s throw from Patriot Battery Metal’s world-class Corvette deposit — boasting a resource of more than 109Mt at 1.42% Li2O — Fin believes these pegmatite finds are just the start for Cancet West.

Attention is also on the Ross lithium prospect: sister to Cancet West and the second half of Fin’s Mt Tremblant lithium portfolio, which covers 150km2 near a smattering of iconic lithium fields.

“Following this initial spodumene discovery, the company is optimistic that additional lithium mineralisation will be discovered at Cancet West through further field work, detailed sampling and drilling,” Fin Resources chairman Jason Bontempo told the market in early October.

This article was developed in collaboration with Vertical Events a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.