From explorer to producer: Mining begins at Brightstar’s Menzies gold project

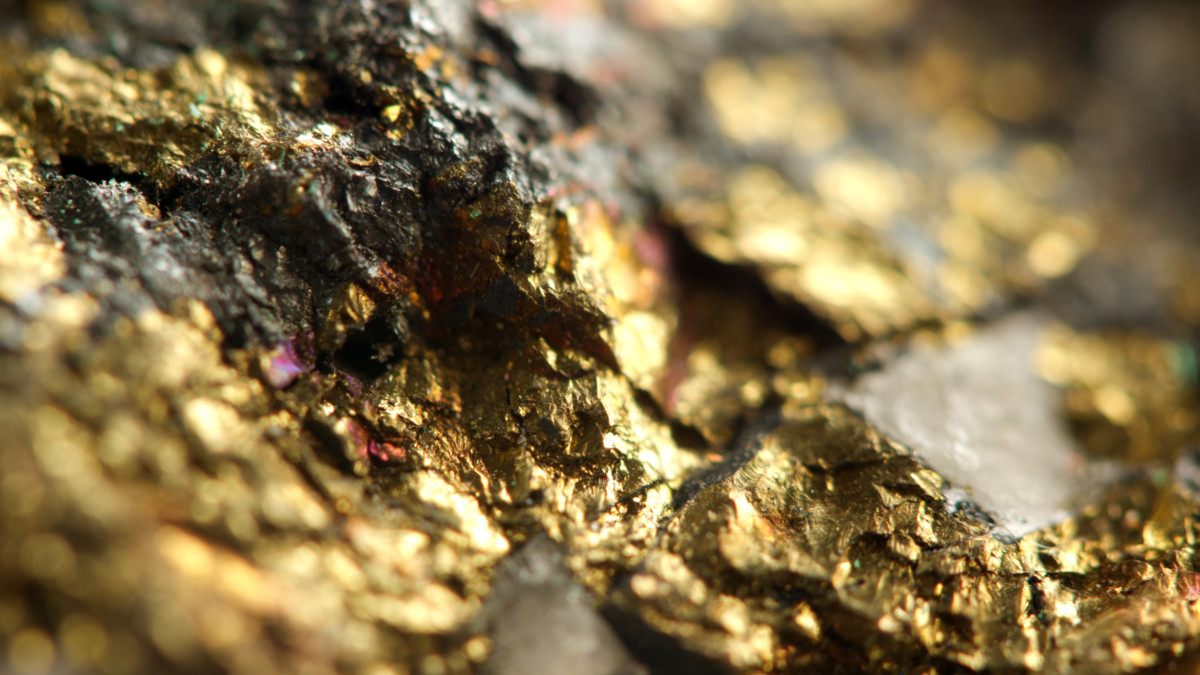

The maiden blast at Selkirk that signifies the commencement of production at the Menzies gold project. Pic via Getty Images

- Mining begins at the Selkirk deposit at Menzies

- JV partner BML Ventures completes first blast of open pit

- Five-month mining campaign underway, with cashflows expected in February

Mining has started at the Selkirk open pit, a JV between Brightstar Resources and BML Ventures, with maiden gold pour and cashflows expected Q1 next year.

The maiden mining campaign represents Brightstar Resources’ (ASX:BTR) transition from junior explorer to producer.

Brightstar Resources’ (ASX:BTR) ultimate goal is to be large, long life gold miner.

In May, it acquired the Menzies Gold Project via its takeover of Kingwest Resources (ASX:KWR) to complement its Laverton goldfields assets.

The deal creates a gold company of scale with a resource of +1Moz in the Leonora-Laverton district, which is undergoing consolidation by $1.5bn capped Genesis Minerals (ASX:GMD).

Menzies includes the high-grade gold field which historically produced 787,200oz at an eyewatering 18.9g/t between 1895-1995.

According to Brightstar, the deal would ultimately leverage Brightstar’s infrastructure mothballed plant – yes, it has a plant – to unlock the development potential of Menzies and Laverton.

Selkirk is anticipated to be a profitable ‘proof of concept’ operation whereby mining, hauling and processing activities will support future planned mining activities at the projects.

First blast done, with mining to come

Joint venture partner BML Ventures — which is responsible for all capital, mining, and haulage costs — has safely completed the first blast of the open pit cutback and has mobilised the mining fleet after agreement was reached on the final budget and schedule.

Gold ore will now be stockpiled at Menzies for the duration of a 5-month mining campaign, then hauled to Genesis Minerals’ (ASX:GMD) Gwalia Processing facility in February 2024 for processing in a single parcel.

First gold pour is expected in the first quarter of 2024 with cashflows to split evenly between Brightstar and BML.

The JV parties have budgeted for a conservative gold price of $2,850 per ounce which is intended to provide sufficient risk protection in the event of gold price fluctuations and upside to the current spot price of ~$2,950 per ounce.

More mining opportunities being assessed

“We are pleased to see the maiden blast at Selkirk that signifies the commencement of production at the Menzies gold project,” managing director Alex Rovira said.

“Encouragingly, the project is budgeted on a gold price of A$2,850 per ounce, compared to the current spot price more than A$2,950 per ounce which presents potential upside in the forecast economics for the joint venture.

“We remain impressed with the detailed technical and operational work BML is undertaking for the Selkirk Mining JV, and we continue to assess further opportunities at Menzies for exploitation,” he continued.

“Future mining opportunities at Menzies will be assessed to unlock the bigger-scale ambitions of Brightstar to continue as a gold explorer, developer and ultimately as a long-term producer via our wholly-owned processing plant in Laverton.”

Following a $3.5m post-quarter capital raising, Brightstar is well funded to provide sufficient working capital until anticipated organic cash flow from the Selkirk mining JV begins in Q1 2024.

This article was developed in collaboration with Brightstar Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.