Could a reboot of the historic +1Moz Menzies and Laverton gold projects be the start of something big for Brightstar Resources?

Brightstar’s scoping study has unlocked the viability of its Menzies-Laverton gold project. Pic via Getty Images.

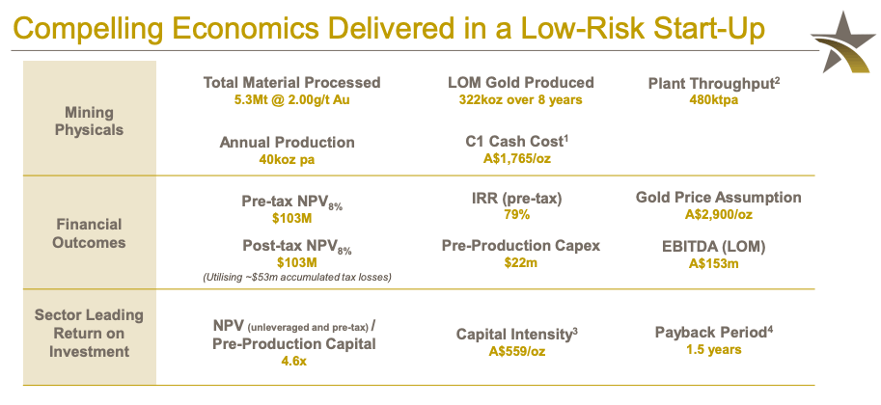

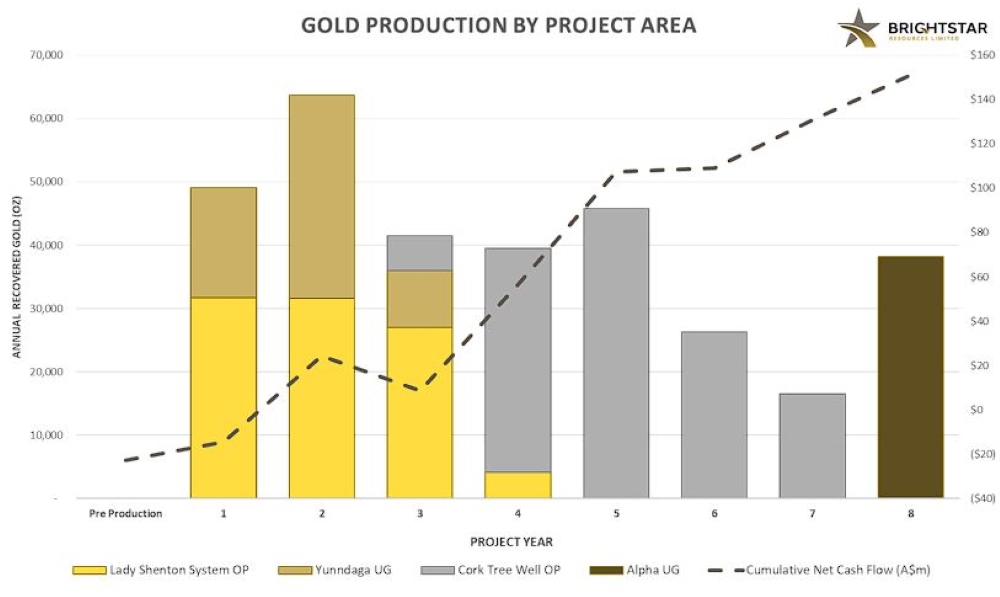

- Scoping study envisages ~40,000ozpa over initial 8 years at Menzies and Laverton gold projects with “strong potential to increase production profile and mine life”

- Low cost $22m development

- Revenue of ~$935m with robust operating cashflow (after all capital and before tax) of $153m

- Pre-feasibility study has commenced

- Exploration ongoing to prove up further resources

A positive Scoping Study highlights the strong economic case for recommencing mining operations at the historic Laverton and Menzies projects, ultimately resulting in Brightstar Resources “becoming a meaningful gold producer in the WA Goldfields”.

A staged ramp up is part of Brightstar Resources’ (ASX:BTR) ultimate goal is to be large, long life gold miner.

In May, it acquired the Menzies project via its takeover of Kingwest Resources (ASX:KWR) to complement its Laverton goldfields assets and create a gold company of scale in the Leonora-Laverton district.

Menzies includes the high-grade gold field which historically produced 787,200oz at an eyewatering 18.9g/t between 1895-1995.

Brightstar says the deal would ultimately leverage Brightstar’s infrastructure mothballed plant to unlock the development potential of the +1Moz Menzies and Laverton assets.

The Scoping study released today highlights a “compelling” low capital, low risk pathway to production leveraging existing infrastructure.

It would cost just $22m to get underway, with early capital requirements for the project to partially flow from the company’s Selkirk open pit mining JV with BML Ventures.

The road to development

The study highlights a robust project with a low capital hurdle, capable of being substantially self-funded by this early-stage toll-treatment of ore from Menzies.

It estimates ~40,000ozpa production over an initial 8 years, resulting in post-tax NPV (thanks to ~$53m in accumulated tax losses) of $103m –4.6x preproduction capital — and a massive IRR (pre-tax) of 79%.

This is based on a gold price of $2900/oz, which is +$100/oz below current Aussie spot of $3,022/oz.

Low capital pathway

Brightstar MD Alex Rovira says the results of our scoping study outline a low-capital pathway to production from the miner’s assets.

“We have delineated four key deposits within our Menzies and Laverton Gold projects which will deliver an executable >8 year LOM plan and result in Brightstar becoming a meaningful gold producer in the WA Goldfields,” Rovira says.

“The staged mined development has been optimised to minimise up-front capital costs, utilising operational cash flow to organically fund the refurbishment of the Laverton processing facility to minimise equity dilution and limit onerous debt and/or hedging exposure associated with large capex builds magnifying commissioning risks.”

The mine plan has been designed to minimise risks associated with ramp up and deliver a profitable gold producer in WA with significant upside to expand on the production profile and mine life.

“More importantly, when assessing key financial metrics for the return on investment in a challenging capital environment, the development of these gold projects is peer-leading in the WA gold development sector,” he says.

PFS underway alongside hunt for more ounces

Pre-feasibility study work has commenced in parallel with infill drilling at Menzies and Laverton to convert inferred resources to higher confidence indicated resources, as well as ongoing extensional exploration and resource growth.

Brightstar has received interest from various backers for the project, with ongoing preliminary discussions for securing debt financing for a large portion of the pre-production capital requirements.

“Whilst we’re pleased to release the results of our scoping study and are progressing with a pre-feasibility study, we continue to advance exploration efforts across the portfolio with the intent of finding additional ounces to add to the mine plan,” Rovira says.

“We look forward to continuing our dual focus of development and exploration in the Goldfields and building WA’s next gold producer.”

Register here for a Brightstar webinar where Managing Director, Alex Rovira will be providing an investor update for the restart of the Menzies and Laverton Gold projects on Thursday 7 September at 12pm AWST.

This article was developed in collaboration with Brightstar Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.