GT1’s vertically integrated lithium business is the vanguard of Ontario’s emerging battery ecosystem

Mining

Mining

Green Technology Metals will be the first of its kind when an ambitious vision for vertically integrated lithium production in Ontario, Canada comes to fruition.

While there’s a flurry of action in Quebec’s James Bay lithium precinct, Ontario is accelerating developments to become a highly robust, downstream lithium precinct in its own right.

Backed by Canada’s C$1.5 billion to support critical minerals exploration and development, there are a host of EV and battery manufacturers setting up shop in Ontario – well known for its manufacturing nous.

They include:

READ MORE: Canada’s sweet on Lady Lithium and Aussie explorers are sharing the love

This is the perfect ecosystem for a vertically integrated lithium business, from mining all the way through to battery grade chemical production.

Green Technology Metals (ASX:GT1) has big ambitions to be a major player in Canada’s hard rock lithium sector, where it has amassed a 22.5Mt and growing inventory across its project portfolio.

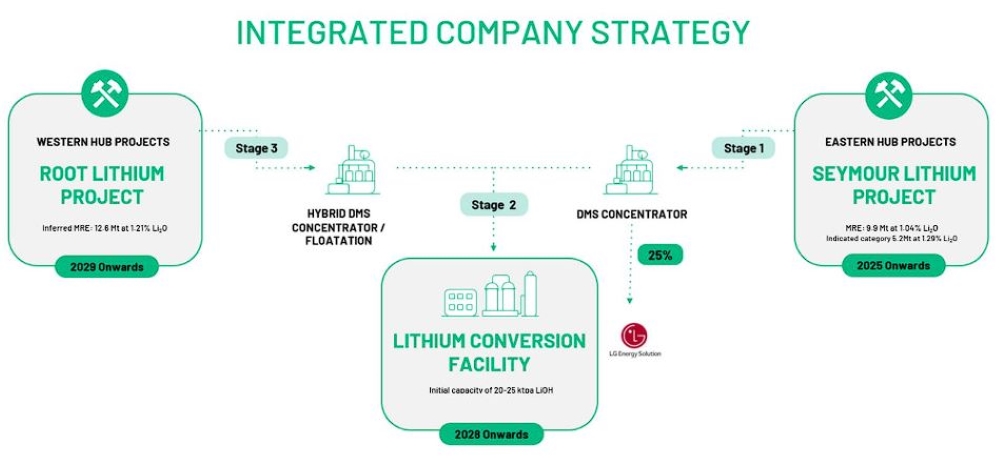

The Seymour Lake and Root Bay projects are two of the most advanced in the region, which the company is looking to complement with concentrators that will feed into a central lithium conversion facility to produce 20-25,000tpa of battery-grade lithium hydroxide.

While GT1 already has a strategic agreement in place with LG Energy Solution for 25% of its Seymour lithium offtake, it’s also in discussions with Canadian and foreign government agencies for funding options for the development of its concentrators and chemical conversion facility.

“As we move forward, we are evaluating various financing options, including government funding, and have submitted an application for Strategic Innovation Fund (SIF) where C$1.5 billion is allocated to critical minerals projects,” GT1 CEO Luke Cox says.

Stage 1 includes GT1’s Eastern Hub, for its Seymour mine and DMS concentrator.

The explorer is proceeding towards a definitive feasibility study (DFS) with an aim to deliver in Q2 2024 and final investment decision (FID) for development by the following quarter. First production will be in 2025.

Stage 2 is lithium hydroxide production in 2028, with the conversion facility to be located in Thunder Bay, Ontario – just south of the two main project areas.

Bench scale conversion test work has already commenced using Seymour concentrates from its pilot plant and preliminary permitting, emissions and environmental assessments are underway, as well as assessments for power, gas, water and waste.

A preliminary feasibility study will immediately commence and post-PEA with an aim to deliver during H2 2024.

Stage 3 is an expansion of production via a second DMS concentrator to be constructed at the Western Hub (Root Bay), with a PFS due out in Q4 2024.

A further resource upgrade incorporating an additional ~20,000m of drilling at the project is scheduled to be released this quarter and will form the basis of the PFS.

GT1 will be releasing a vertically integrated preliminary economic assessment (PEA) – the same as a scoping study — this quarter, incorporating a staged east-west mine and concentrator development strategy to feed into a conversion facility in Thunder Bay, Western Ontario.

It will be designed with scalable lithium conversion capacity, to highlight the advantages of vertical integration and its complete “lithium mine to chemical supply chain strategy” to produce battery-grade lithium hydroxide.

“We’re on a path to become Ontario’s first lithium concentrates and chemical producer with our integrated strategy that involves a strategic staged development plan positioning us to achieve crucial milestones and prepare for initial production by 2025,” Cox says.

“Our team has undertaken an extensive amount of work over the past 12 months to evaluate to advance GT1’s integrated supply chain strategy ready for the eagerly anticipated Integrated Preliminary Economic Assessment (PEA) set for release this quarter.”

“The PEA will offer insights into project specifics and timelines, emphasising cost-effectiveness, infrastructure advantages, and growth opportunities, that we are confident will enhance shareholder and stakeholder value.

“Progress at the Seymour lithium project is steadily advancing, and we are working towards a financial investment decision in 2024 to initiate development at Seymour in alignment with our integrated strategy.

This article was developed in collaboration with Green Technology Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.