- American West Metals is surging on indium news

- Koonenberry Gold sees the yellow metal in its dreams, and in real life, too

- Battery Minerals also moving up at pace, on… not battery minerals, but gold

Here are some of the biggest resources winners in early trade, Wednesday December 13.

AW1 has some weighty news this morning – pertaining to 23.8 million ounces of indium and 119k ounces of gold, which are the highlights from the company’s updated JORC Mineral Resource for the West Desert deposit in Utah, US of A.

Indium. It’s a beaut ‘critical mineral’.

See that phone you’ll swipe once finished reading this article? Indium was used for some of that. It’s part of what makes tin oxide, a component for touchscreens, flat-screen tellies, solar panels and a host of other very useful things.

American West notes that West Desert is the only indium deposit in the US and one of the largest, highest-grade undeveloped deposits for the stuff on the planet.

At present, America imports 100% of its indium.

All up, the updated JORC MRE adds 23.8Moz of indium and 119koz of gold to the existing 1.3Mt zinc, 49Kt copper and 10Moz silver of contained metal at West Desert.

The company notes there is “considerable potential to significantly expand all metals within the West Desert resource”.

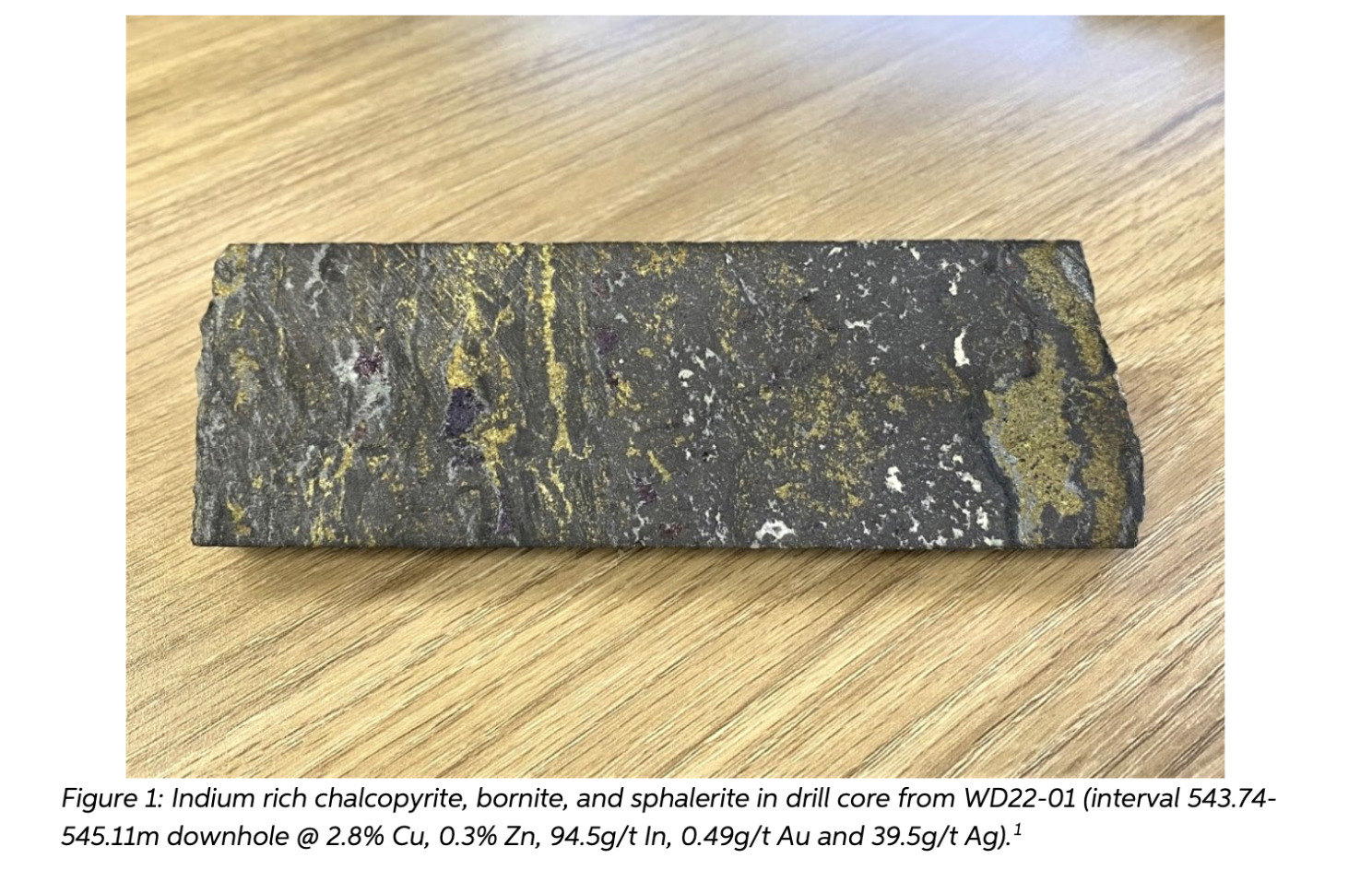

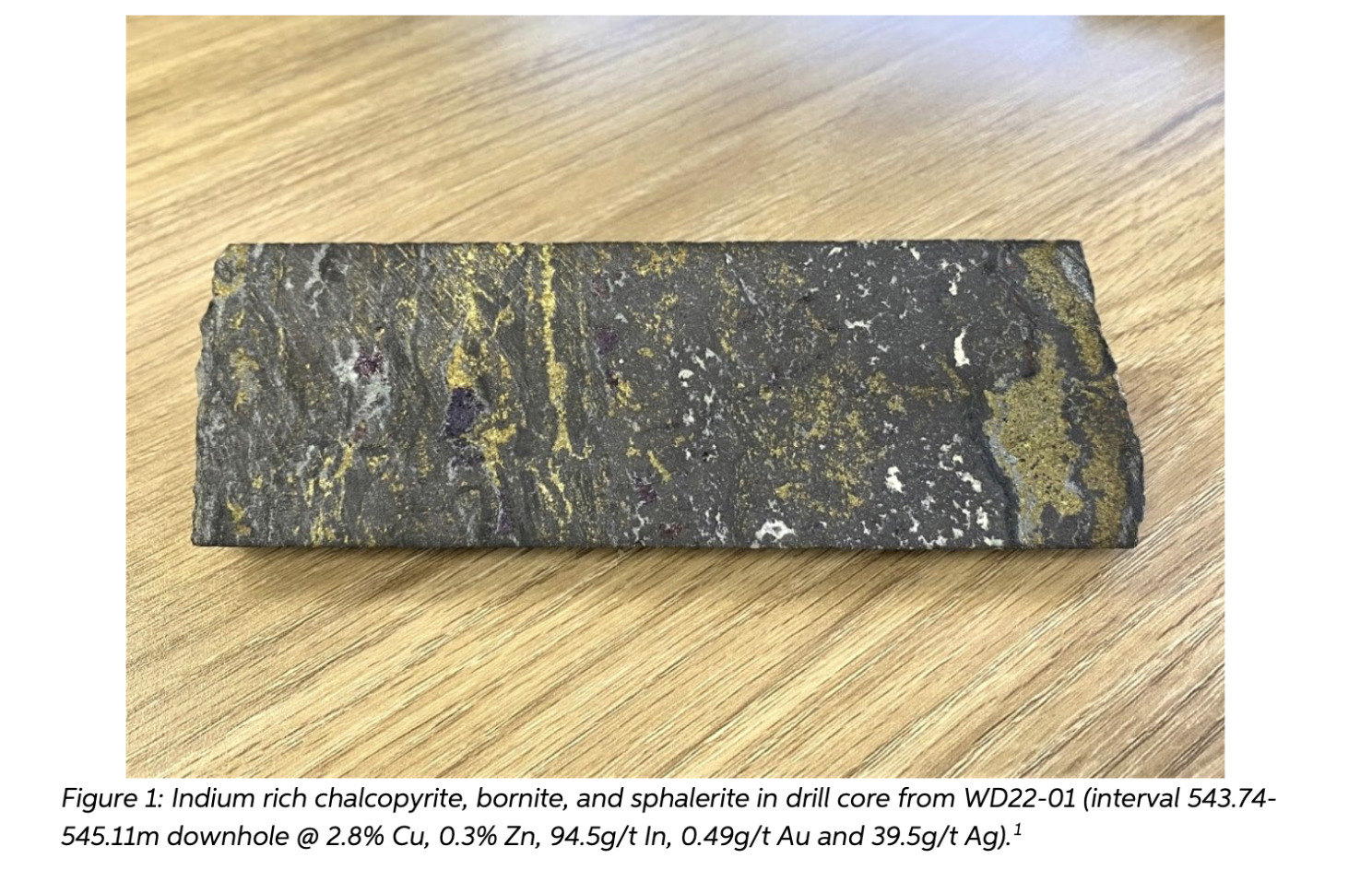

Here’s a nice-looking chunk of indium…

AW1 share price

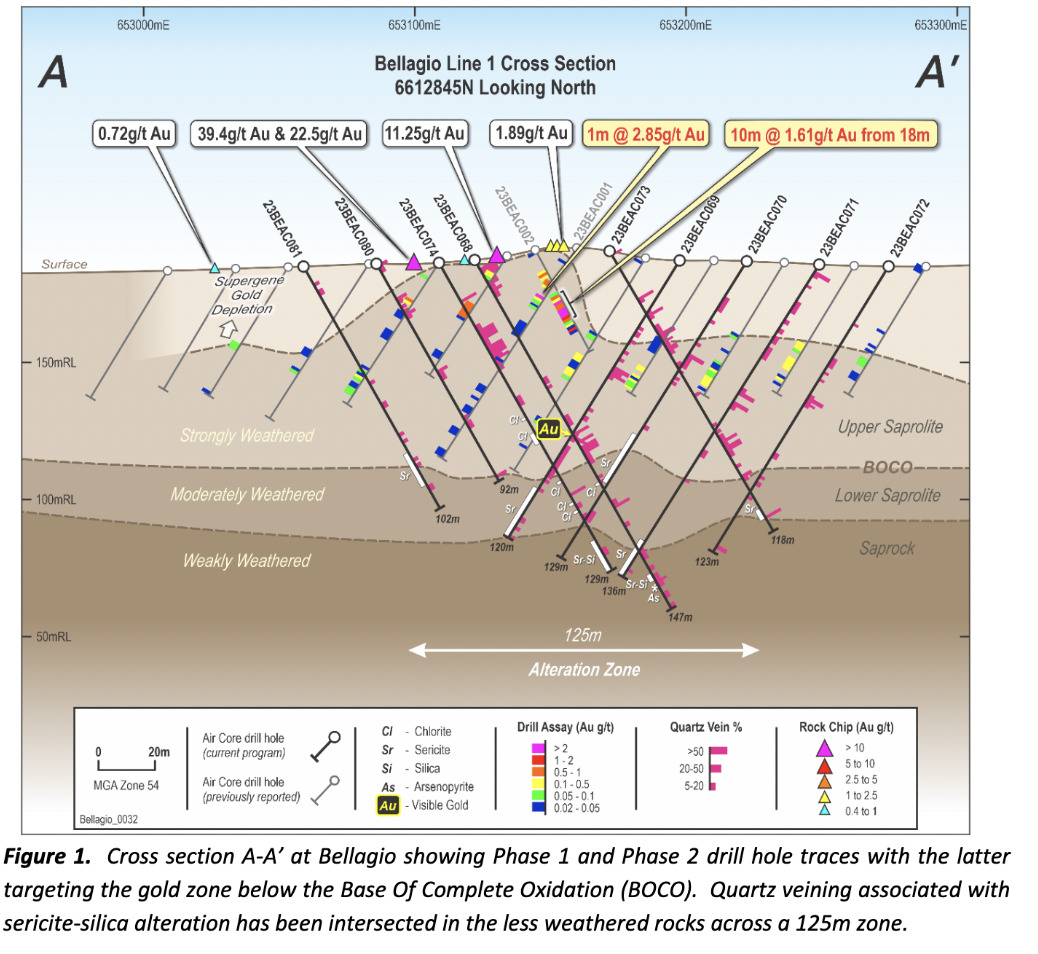

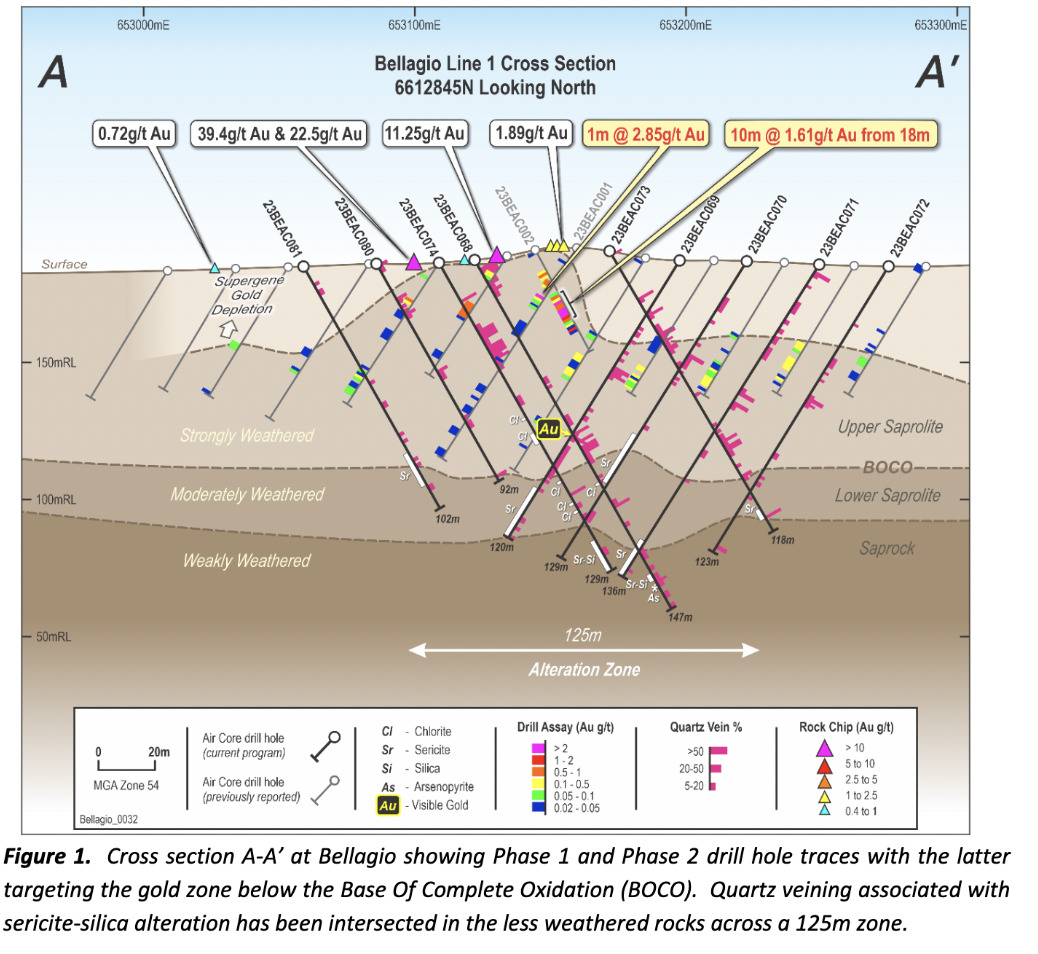

This goldie is up is up this morning, after dropping an announcement with two very exciting words in it: “visible gold”.

Drilling encountered said gold and a widespread alteration at KNB’s Bellagio prospect, with quartz veins also in sight, 75-76m deep.

The company notes that the quartz veins are widespread and” importantly have also been intersected below the strongly weathered zone where better gold grades and widths might be expected”.

Assay results are expected mid January, followed by an additional drilling campaign.

MD Dan Power expressed excitement for the Bellagio find, adding:

“This high impact air core drilling program has met its objectives and we have been able to penetrate below the strongly weathered upper saprolite where better gold grades might be expected.

“To see visible gold in quartz veins in air core drill chips is extremely rare in my experience and therefore extremely exciting. We know we have potential for high grade gold at the Bellagio because we have a previous rock chip sample which returned 39.4g/t Au.”

KNB share price

This small gold-copper mineral explorer is up decently today – about 16% at the time of writing.

The company recently picked up the Spur gold project near Cadia in the Lachlan Fold Belt of NSW.

Of note, too, turning up as substantial holders in ASX announcements this week are:

• Tim Goyder – 7.29%, Lotaka Pty Ltd

• Stuart Tonkin – 9.9%, Gladstone Mining.

Goyder needs no introduction. Tonkin is the MD of $14.1bn capped gold producer Northern Star Resources (ASX:NST).

BAT is now up 84% this week and 66% for the month.

BAT share price

(Up on no news)

Potash poker Highfield is up on not much today. But potash fertiliser has been back in the news of late and HFR investors want their slice of the action, sending the stock up double digits at the time of writing.

In early November, HFR updated its feasibility study for the Muga-Vipasca potash project in northern Spain near the town of Pamplona, which is famous for the Running of the Bulls festival. Handy omen, that.

We could go into it all in detail per the company’s last report, but let’s just hear from the company’s CEO Ignacio Salazar and move on. He said:

“We are delighted to announce the updated Feasibility Study for the Muga project. After significant progress, now fully permitted and construction ready, with access to all the project land anda much higher level of confidence in the Capex estimate, the Muga Potash mine stands out with a value of €1.8 billion.

“The difficult global geopolitical backdrop reinforces the importance of Muga, and the strategic nature of the project for Europe.”

HFR share price

(Up on no news)

Copper Search pretty much does what it says on the tin copper lid – it’s on the hunt for IOCG-style mineralisation in South Australia.

And lifting that lid today, we can’t see any fresh news, so we’ll revert back to the company’s last drilling update at the Peake project in SA, which was revealed late November and highlighted:

• A six-hole reverse circulation drilling program at the Peake project testing the Paradise Dam Prospect has been completed (1,791m total) with samples dispatched to the laboratory.

• The overall location of Targets AC23 and AC24 was renamed the Paradise Dam Prospect for ease of reference.

• A diamond core tail was completed to 651m depth on hole 23PK11,to test the promising chargeability anomaly on the southwest corner of the prospect.

• Assays are expected in January.

CUS share price

(Up on no news)

Another sub-$10m market-capped copper hunter, KCC is travelling well today also on nothing of notable import.

The last announcement of note the company made was mid November – it’s Q3 2023 financial report.

Highlights from that? Here are a few:

• KCC is a “pure play explorer in one of the most significant gold rich porphyry regions in the world, the Macquarie Arc within the Lachlan Fold Belt (“LFB”),located in the Central West of New South Wales.”

• An extensive multiple system porphyry complex expanded at the Trundle gold-copper project.

• Maiden Kincora drilling programs completed at the Condobolin and Nevertire projects.

• The company’s working capital was A$2,078,413 at the end of Q3 2023.

What else? There’s a lot more to be gleaned from its report, of course, but we’re not here to repeat that verbatim, so let’s end with the following:

KCC recently reposted this neat Visual Capitalist chart the other day, which might interest copper heads, considering the estimated boom in demand for the commodity in a net-zero world…

KCC share price

At Stockhead we tell it like it is. While Koonenberry Gold is a Stockhead advertiser at the time of writing, it did not sponsor this article.

You might be interested in