Resources Top 4: Reward Minerals is coming up roses on $20m potash project deal

The American Beauty sequel just didn't seem as captivating. (Pic via Getty Images)

- You know it’s a slow resources news day on the bourse when… fertiliser compound sulphate of potash is headlining

- Nevertheless, well done RWD, for reaping SOP-related rewards

- In other news, a couple of small goldies are shining, because, well, so is gold in general right now

Here are the biggest resources winners in early trade, Tuesday December 5.

Reward Minerals (ASX:RWD)

Reward is back in the spotlight today. Earlier, it rose (then subsequently dipped*) on the news it’s entered into a binding share sale agreement with the receivers at Kalium Lakes, to acquire the $400m Beyondie sulphate of potash (SOP) project for $20 million.

That’s a WA project, about 160 km SE of Newman and SOP is a compound commonly used in agriculture – in fertilisers.

* (News just in, it just rose double digits again. This thing’s more volatile than magic internet money this morning. Ah look, just check the accompanying share price action on the chart below for the latest.)

We recently reported this acquisition was on the table as a potential outcome, after the company entered into an exclusivity deed with Kalium and its receivers.

This share sale agreement now represents the next step in an acquisition that’s looking pretty likely.

The company reports that the share sale will be on a “debt-free basis, free of encumbrances for total consideration of A$20 million, comprising a A$250,000 exclusivity payment previously made, upfront cash consideration of $14.75 million and deferred cash consideration of $5 million by 30 June 2025.”

Reward’s executive director, Dr Michael Ruane said: “Assuming that the proposed DOCA [deed of company arrangement] with creditors, shareholder approval and capital raising are completed, the Reward team are keen to move quickly on evaluation of the plant and flowsheet modifications and costs for potentially recommissioning the Beyondie project.”

RWD share price

Castile Resources (ASX:CST)

(Up on no news)

The NT minerals explorer is, for some reason, trending in a positive direction today.

There’s no news we’re seeing, because as far as we can tell, the company is taking a break at its Pathfinder 35 site until the “you move an inch, you sweat buckets” wet season up in the Territory has somewhat abated.

Pathfinder 35 is a drilling hole site at the iron oxide copper gold (IOCG) Rover project near Tennant Creek.

Here’s the company’s most recent social post…

Due to unexpected rain and mobility to the site, #Castile Resources Limited has decided to cancel the drilling at Pathfinder 35 until after the wet season and anticipates being back on the ground as soon as possible in early 2024.

View here: https://t.co/7h4YBiQrua #CST #ASX pic.twitter.com/OONNpCJhP4

— Castile Resources (@CastileRes) November 28, 2023

Other than that, here are some highlights from the company’s recent annual report:

- “Castile retains a strong cash position of $5.428M (as at 30 June 2023) to fund its ongoing activities over the ensuing year.”

- “Castile lists on the OTCQB in New York to provide US Retail investors the opportunity to invest in Castile shares.”

- “The Rover 1 Project Bankable Feasibility Study continued with metallurgical process studies, Green House Gas Emission estimates and the Environmental Impact Study nearing completion.”

CST share price

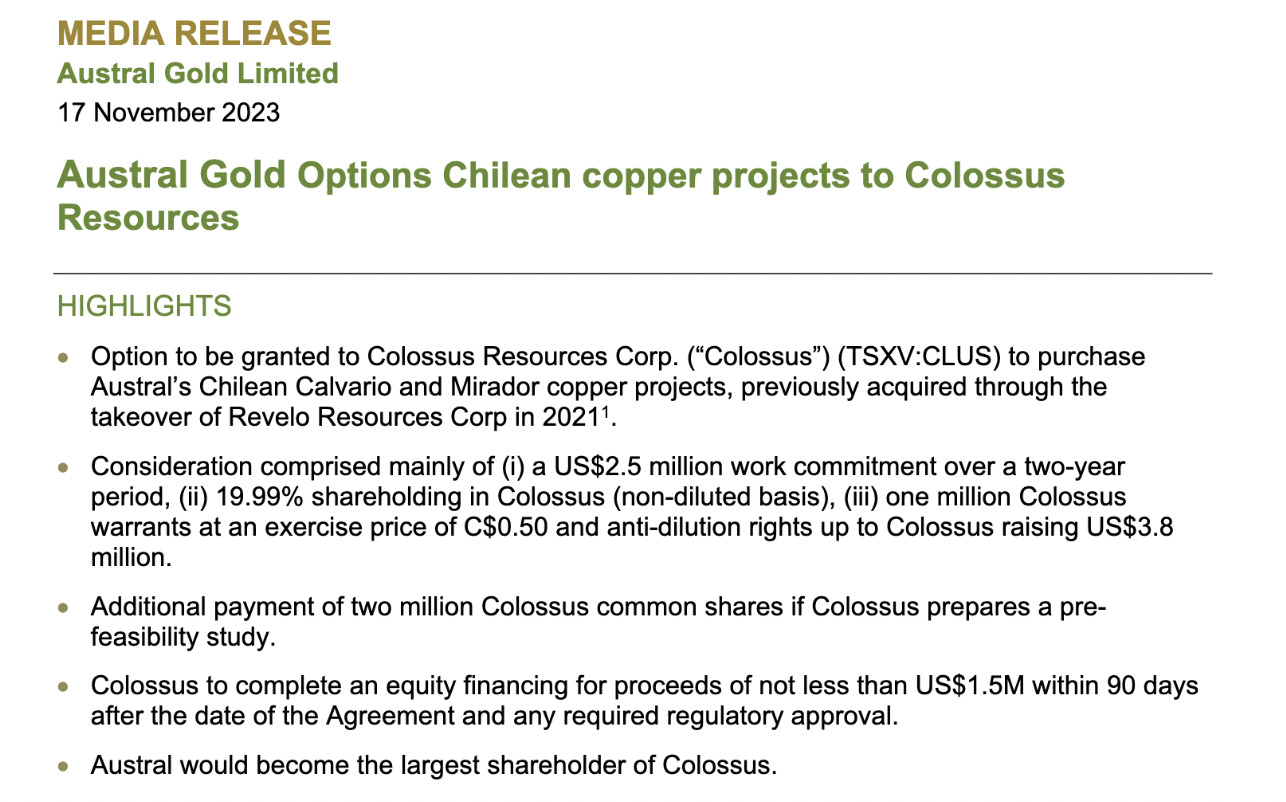

Austral Gold (ASX:AGD)

(Up on no news, although… gold)

It’s another slow news day in ASX resources land, but, thanks in part to bullion hitting all-time highs in the past week, you can pretty much count on at least one gold-focused stock to be among the gainers at the moment.

And right on cue, here’s small ($19.5m market capped) goldie Austral Gold (not to be confused with Austral Resources – AR1), with a double digit gain and enough to make today’s standouts.

Specific news? Not a lot that’s fresh so far this week although there was this media release, which hit the ASX on November 17…

In a nutshell, Colossus Resources, a Canadian-based explorer, has agreed to acquire an undivided 100% stake in Austral’s Calvario and Mirador copper projects in Chile.

This essentially means Austral can focus on its chief interest – gold.

Says Austral’s CEO Stabro Kasaneva:

“The agreement offers potential upside for the Company, enabling Austral to focus on its core gold assets across production and exploration, while still sharing in the potential success of the Calvario-Mirador copper projects in Chile as the largest shareholder of Colossus.”

And ah look, Austral Gold has reposted an article about gold’s November performance from a certain informative ASX-focused financial publication. Worth a read, we reckon…

Stockhead: Up, Up, Down, Down.

Winner: Gold

Gold prices have spent November edging closer to their all time high of US$2075/oz, a run that has been followed by a lift in ASX gold equities, which are up over 6% in the past four weeks.

Read here https://t.co/heF3Cx9088

— Austral Gold Limited (@AustralGold) December 4, 2023

AGD share price

Zuleika Gold (ASX:ZAG)

(Up on no news)

Zuleika is another small goldie, this one focused on four gold projects near Kalgoorlie. It’s seeing its share price move up today on… “Change in substantial holding”? Quite possibly. It’s up about 11% at the time of writing in any case.

The substantial holdings refer to those belonging to one Yandal Investments, which has increased its voting power at the table to 42.5% with the allotment of more than 213 million ZAG shares, see below.

Who is Yandal Investments, you ask? None other than Mark Creasy, the famous ‘everything i touch turns to billions’ prospector.

Zuleika recently entered into a subscription agreement with Yandal Investments for the raising of $3 million.

The company noted that the subscription price came in at a 28% premium to its prior closing price.

Proceeds from the private placement will be funnelled straight into the company’s ongoing exploration and development programs across multiple targets at its four Kalgoorlie projects – Zuleika, Credo, Menzies and Goongarrie.

ZAG share price

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.