Resources Top 4: Forrestania double bags as gold stocks surge amid record high Au

Mining

Mining

Here are some of the biggest resources winners in early trade, Wednesday April 10.

There has been a clear breakout leader of the ressie gainers pack this morning, and it’s FRS, with a stonking, double-bagging 114% bourse burst at time of writing.

As Reubs flagged in our Top 10 at 10 earlier, the gold, lithium and nickel hunter has picked up dirt and rocks containing up to 49g/t gold at the Ada Ann prospect, part of the Eastern Goldfields project in WA.

Gold samples up to 49.0g/t Au from fieldwork at Ada Ann Prospect, Eastern Goldfields

🗞️ https://t.co/nbSLNLdLEA$FRS.ax #Lithium #Copper #Gold #Resources pic.twitter.com/Sm3li8mm2H

— Forrestania Resources Ltd ($FRS) (@ForrestaniaRes) April 10, 2024

Also found in recent “grab samples” from previously unrecorded historic drill spoils: 15.7g/t Au and 13.5g/t Au – in addition to the more impressive 49.0g/t Au mentioned above.

Forrestania Resources’ chairman John Hannaford said this:

“The developing gold story at this project can be quickly advanced to a potentially valuable asset for the company given the very favourable location nearby of several active mills and excellent logistics, with a haul road immediately adjacent to the project area.”

Want more gold stonk news? Of course you do. It’s the commodity du jour right now – partly/mostly thanks to surging, all-time-high levels of late.

Here’s Waratah, a $17m market-capping junior with a fresh high-grade gold and porphyry skarn discovery made at its Spur gold-copper project, in the Lachlan Fold Belt, of NSW.

We’re talking maiden drilling at Spur, which is just 5km west from big gun Newmont Corporation’s (ASX:NEM) flashy Cadia Valley project (>50Moz Au, 9.5Mt Cu 1). And Waratah’s Spur is also hosted in “equivalent Late Ordovician-aged geology” within the Molong Belt of mineralisation.

Drilling (sorry) further into the details, latest assay results revealed an open zone of shallow gold mineralisation including: 22m at 1.92g/t Au from 11m, inc 5m at 6.69g/t Au from 24m.

Waratah notes the identification of a gold-rich skarn mineralisation at the Spur East target “indicates potential for significant shallow gold resources and shows affinities with the nearby Cadia Valley gold-copper skarn deposits”.

Drilling has also identified stratabound porphyry mineralisation.

We're pleased to announce initial results from its maiden drilling program at the Spur Project, located in the Lachlan Fold Belt, New South Wales.

ASX Announcement: https://t.co/gMbcDUmSMZ#ASX $WTM #gold #graphite #mining #investment #waratah #minerals pic.twitter.com/eB70DcHcwT

— Waratah Minerals (@MineralsWaratah) April 10, 2024

Gold, GOLD, GOLD. Top 5 Resources is rolling in the stuff today. We’ll cover something else in a tick… possibly.

This WA goldie minnow has been making a few ASX-housed waves of late and it has more news sending it in a pleasing direction today.

S’up? This:

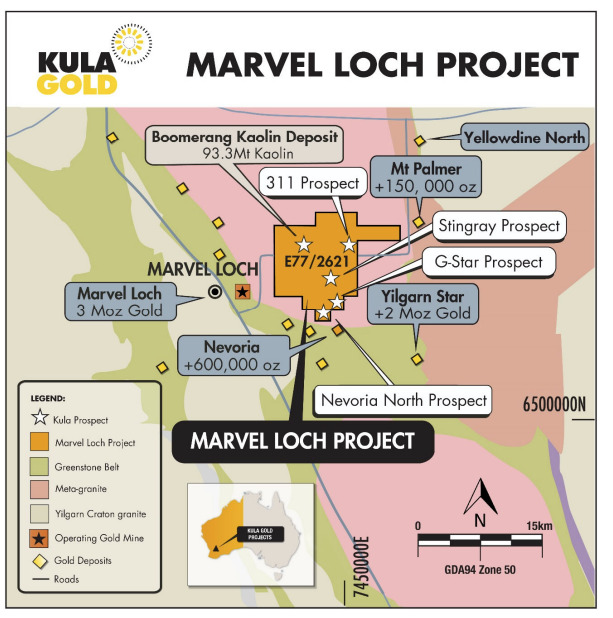

The company has discovered a new gold anomaly in soil sampling at the Boomerang project, which is a stone’s throw from the Marvel Loch gold plant in WA.

Boomerang is one of five gold prospects at the Marvel Loch project, which sits between several gold mines including the historical +600,000oz Nevoria mine and east of Barto Gold’s 3Moz Marvel Loch mine.

The company discovered the large 93.3Mt Boomerang kaolin deposit near the Southern Cross gold op owned by Barto in July 2021 and has since moved the project through to the economic and engineering study phase.

⛏️ Kula Gold reports geochemical sampling has defined a #Gold anomaly at $KGD's Boomerang Gold Prospect near Southern Cross WA.

“This is a very promising (drill ready) target in a proven mining district," $KGD.ax Managing Director Ric Dawson.

⚙️Details: https://t.co/GPJDm8nax2

— Kula Gold Limited (@KulaGold) April 9, 2024

Kula’s Marvel Loch project. Pic: Kula Gold

Discussion with potential acquirers and developers of the project continue with a view to monetising the asset while Kula narrows its focus on its gold potential.

Read more on this > here.

Also very recently, Kula identified significant gold prospectivity at its Brunswick project in WA near a historical production area after rock chipping and mapping returned assays of up to 11.19g/t gold.

Brunswick sits within the Donnybrook-Bridgetown Shear Zone just 35km from Greenbushes, the world’s largest hard rock lithium mine.

Moving on then, let’s talk rare earths. And Caspin Resources, which is double-digits to the good at time of wondering what gold-related pic to use for this article.

Caspin is actually a PGE, nickel, copper hunter targeting WA’s West Yilgarn. But here’s the REE news…

It’s announced the execution of an option agreement with Australian Strategic Materials (ASX:ASM) to form a Joint Venture in which Caspin will farmout and retain a 25% free carry (up to a decision to mine) of the REE rights on the Mount Squires project in the West Musgrave region of WA.

Caspin found heavy rare earths mineralisation at the greenfield-style gold and base metal project Mount Squires back in May last year.

The company says it has been steadily advancing its understanding of REE mineralisation and recognises the potential for further, similar discoveries at the project.

That said, Caspin is focused on nickel, copper and gold. ASM can do the heavy lifting on the REEs, while Caspin can still maintain some exposure there. A potential win/win for both companies.

‼️ $CPN has executed an Agreement with @ASM_aus $ASM to retain 25% free carried interest in the Mount Squires #REE potential & to receive milestone payments of up to A$1.5M

Read more: https://t.co/F1lZ1DvXrF#batterymetals #copper #nickel #gold #exploration #asxnews #Caspin pic.twitter.com/bJstQCzmgo

— Caspin Resources Limited (@CaspinRes) April 10, 2024

Caspin’s MD Greg Miles confirmed: “Caspin will retain exposure to the REE potential without any funding obligation and potentially receive milestone payments. This will allow Caspin to maintain its focus on the nickel, copper and gold potential at Mount Squires and other acquisition opportunities.”

At Stockhead we tell it like it is. While Kula Gold is a Stockhead advertiser at the time of writing, it did not sponsor this article.