Resources Top 5: Drilling ‘accidental’ rare earths discoveries and a fistful of lithium, cobalt and gold acquisitions

Mining

Mining

Here are the biggest small cap resources winners in early trade, Tuesday May 2.

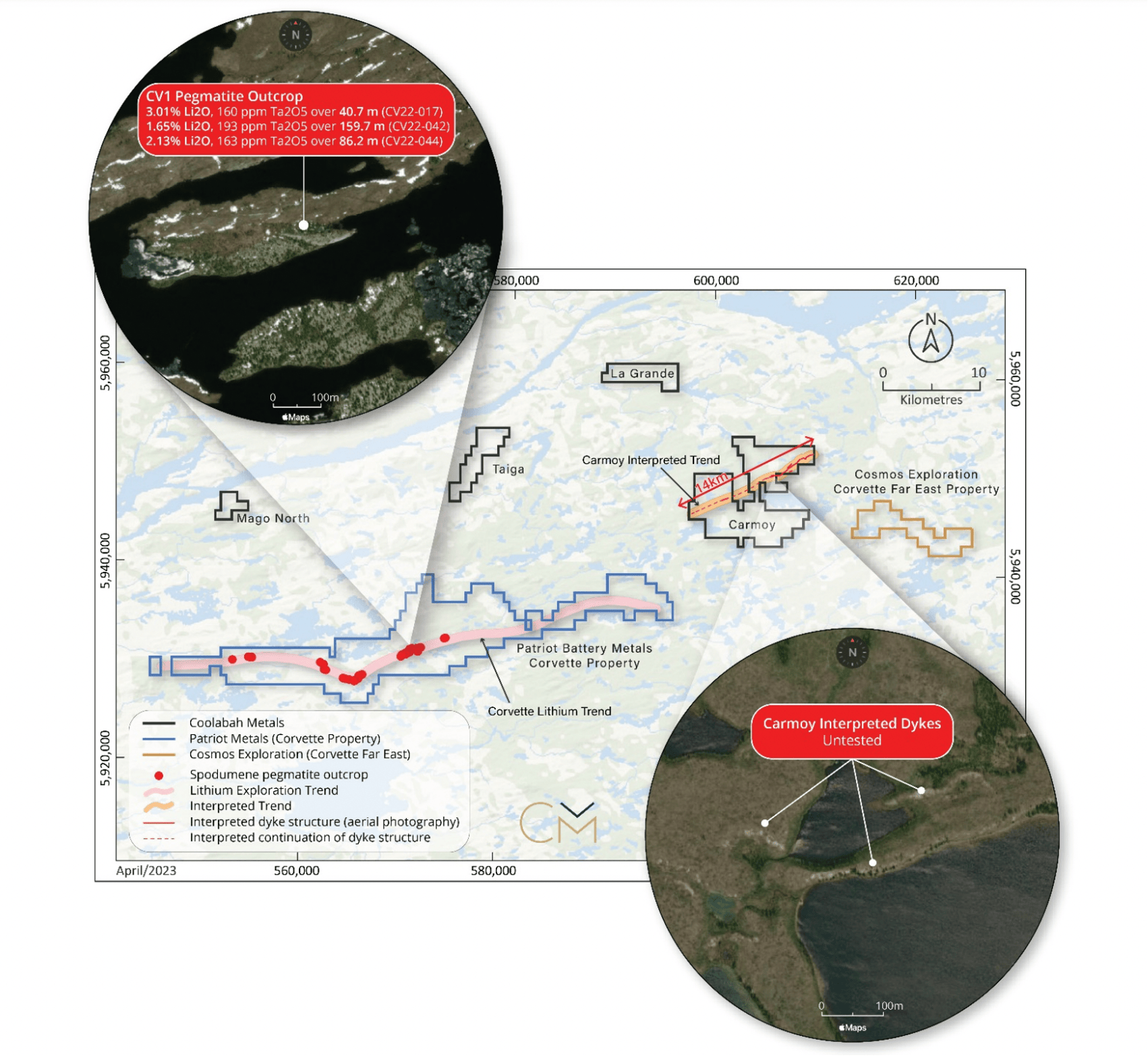

The latest in a long line of junior ASX exploration stocks to snap up lithium ground in the popular James Bay region of Quebec, Canada.

The four properties are ~20km from Patriot Battery Metals’ (ASX:PMT, TSX-V:PMET) Corvette project, where PMT is drilling into remarkably thick high grades like 83.7m at 3.13% Li2O.

“We can already see in publicly available satellite images, structures that appear to be intrusive dykes about 10km along strike from Patriot’s Corvette Project,” CBH MD Cam Provost says.

“Early focus for Coolabah’s field work will be determining if these dykes contain lithium.”

CBH also scores a 70sqkm project in neighbouring Ontario as part of the deal, ~70km from Frontier Lithium’s (TSX-V:FL) 58.4Mt @ 1.50% Li2O project.

It will cost 10m CBH shares, plus 5m performance rights when the explorer picks up rock chip samples from any of the projects grading at least 1% Li2O.

That’s worth about $1.5m at the current share price.

CBH is now raising $1m via placement at 10c/sh, a small premium to the last traded price of 9.6c.

The former gold explorer listed in June 2022 with two projects in the Lachlan Fold Belt (NSW) and one in Mount Isa (QLD).

The $4.5m capped stock is up 40% year-to-date but remains substantially down on its listing price of 20c per share.

Last month PIM, which listed May 2022 as a kaolin play, accidentally discovered rare earths at the Great Southern project in WA.

A hole drilled into the Disruptor target to test historical elevated nickel geochemical results hit REEs in the bottom 40m, including a maximum value of 626.3ppm TREO.

Given the geochemistry of the rock and the overlaying clay regolith, this opens the potential for both hard rock and clay hosted rare earth deposits, PIM says.

Based upon these results PIM has approved a drilling program to further test Disruptor, which abuts ground held by Chalice Mining (ASX:CHN) and Fortescue (ASX:FMG).

That 15-hole program is now due to kick off mid-May.

The $4m capped, tightly held minnow is up 70% year-to-date. It had $3m in the bank at the end of March.

The acquisitive junior will buy the Yarrol and Mt Steadman gold-cobalt projects in QLD from $300m capped EMX Royalty Corp (TSX-V:EMX) for a mix of cash, shares and future royalties.

EMX has been reporting thick, high-grade drill hits like 17.8m at 4.01g/t, 2m at 110g/t, and 12m at 20g/t from Yarrol and Mt Steadman as recently as Feb this year.

Results are pending on 2023 soil survey and air core drilling campaigns at the projects, which surround Evolution Mining’s (ASX:EVN) Rawdon gold mine.

“The Yarrol and Mt Steadman projects are a key acquisition for Many Peaks; expanding the company’s footprint in Queensland with advanced stage gold exploration targets confirmed by recent exciting drill results and ready for immediate follow-up drilling,” exec chair Trav Schwertfeger says.

The explorer says there are also rock chip samples averaging 1% cobalt and 12.8% manganese across a large 2km by 4km target at Yarrol.

“Recently discovered high grade cobalt mineralisation at surface in the Yarrol project further complements the company’s current strategies of increasing exposure to the growing critical mineral sector and establishing a pipeline of highly prospective projects,” Schwertfeger says.

“Our team considers the cobalt discovery at Yarrol an exciting exploration opportunity.”

The explorer – which listed on the ASX March last year – recently acquired a Canadian rare earths project with up to 9.3% total rare earth oxide (TREO) assay results, at surface.

It has an early-stage lithium project, also in Canada.

$15m capped MPG hit all-time highs in early trade to be up 100% year-to-date. It had $3.75m in the bank at the end of March.

First results from a “high impact” drilling program at KLI’s Ravenswood North gold project in Queensland are due in the next 6-8 weeks, the company said yesterday.

The Rocky prospect has two targets with a similar ‘signature’ to big gold deposits 43km along strike (Mt Wright and Ravenswood).

A first-ever drill program late 2022 returned hints of the good stuff, including highlights like 1m @ 3.22g/t Au from 105m, 2m @ 1.58g/t Au from 177m and 7m @ 0.77g/t from 177m.

Five RC holes plus two diamond tails are planned for ~1,300m to effectively test the intrusive targets.

To keep momentum up KLI is also raising $1.4m via entitlement offer at 5.5c/sh, fully underwritten by Canaccord Genuity and sub-underwritten by the explorer’s directors and CEO.

The $2.5m capped minnow – which also owns a REE project next to Northern Minerals’ (ASX:NTU) Browns Range in the WA Kimberley — is down 50% year-to-date.

(Up on no news)

PXX was certified flavour of the month in December-January after major miner Northern Star (ASX:NST) snapped up a 10% stake.

PXX has two flagship assets: the Humboldt Range gold-silver project in Nevada, and the Alaska Range copper-gold project in south-central Alaska.

The junior scored one of the biggest gold hits of 2022 – which you can read about here – at Humboldt Range’s Star Canyon prospect, which is just ~3km from the currently operating 5Moz Florida Canyon mine.

Some less than stellar follow-up drilling results at Star Canyon announced in February saw the share price fall just as fast.

But this is early days, and PXX is still figuring stuff out. An IP survey will commence in May to identify sulphides as gold pathfinders prior to more drilling.

They also have a bunch of other undrilled targets to test.

A resurgent $27m capped PXX is now up 50% over the past month. It had $1.6m in the bank at the end of December.