Investors back Many Peaks’ West African gold pivot after mammoth share price increase

Pic: PMImages/DigitalVision via Getty Images

- Many Peaks Minerals up near 200% since acquiring a majority stake in three gold projects in Cote d’Ivoire last week

- A new $2m placement at 17c backed by existing shareholders

- Will bolster coffers to drill at the exciting Ferké and Odienné projects in the world class Birimian greenstone belt

- Additional options could be exercised to raise more capital if its share price rises above 25c

Special Report: Many Peaks Minerals has tapped its loyal crop of shareholders for $2 million to hit the ground running at its newly acquired Ferké and Odienné gold projects in Coté d’Ivoire.

The non-brokered placement was a vote of support for the explorer’s opportunitypaired with tapping the vast West African discovery experience of executive chairman Travis Schwertfeger, who previously enjoyed success in the region with Newmont and Exore Resources.

The latter was acquired by Perseus Mining (ASX:PRU) in a $64m deal in 2020.

Many Peaks Minerals (ASX:MPK) last week announced a deal involving the issue of over 5.6 million shares to Turaco Gold (ASX:TCG) and Predictive Discovery (ASX:PDI) for 100% of their holdings in the Ferké, Oumé and Odienné projects, where Many Peaks can now earn up to an 85% interest.

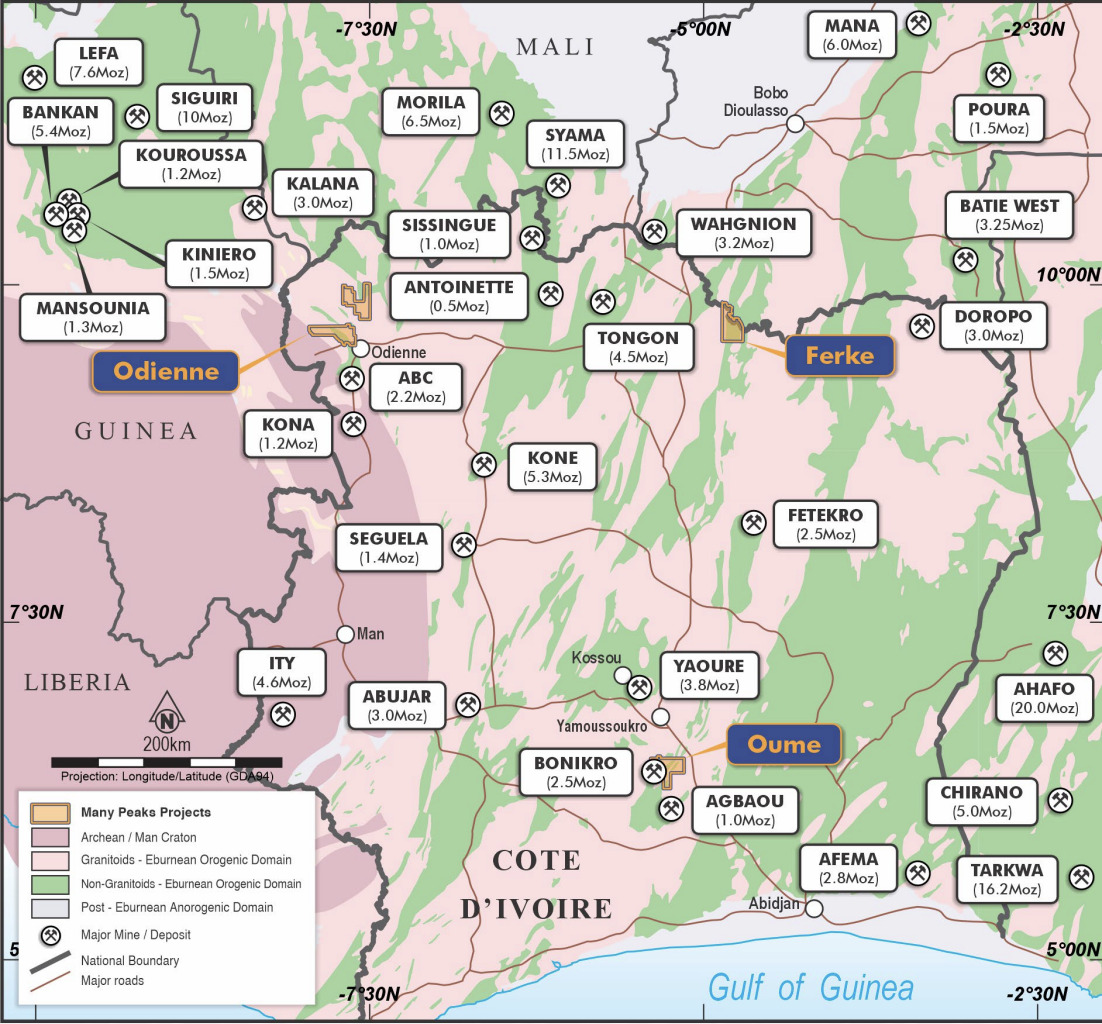

Formerly part of Resolute Mining (ASX:RSG), the projects contain 1275km2 located adjacent to some of West Africa’s biggest gold deposits.

Since announcing the deal ––MPK’s shares have stormed almost 200% higher, climbing from 7.3c before the acquisition to 20.5c before the placement.

Conducted at 17c, MPK will issue 11.76m new shares on firm commitments in a two-tranche placement to raise $2m.

That was a 17.1% discount to its last closing price and 19.1% discount to the company’s 15-day VWAP before the market close last Wednesday.

MPK’s acquisitions are in the heart of one of the world’s great gold fields. Pic: MPK

Discovery potential

That the rights to 65% and up to 85% of Ferké, Oumé and Odienné are coming to MPK is a fillip for the explorer given the rich exploration potential they possess.

The projects sit among some of West Africa’s biggest gold mines.

Oumé is directly adjacent to the 2.5Moz Bonikro mine operated by Allied Gold Corporation.

Ferké sits on the Burkina Faso border not far from Barrick’s 4.5Moz Tongon (183,000oz produced in 2023) and Lillium’s 3.2Moz Wahgnion (~150,000ozpa).

Odienné is located directly north of Centamin’s 2.2Moz greenfields ABC project and not far from Perseus’ Sissingue and Antoinette deposits, the latter the main prize traded in the Exore deal.

Located within the rich Birimian greenstone belt, one of the world’s great gold fields, over US$4m has already been spent to prove up targets on the tenements.

Ferké currently contains high grade gold mineralisation from surface and Odienné hosts a more than 1.2km long gold anomaly identified in shallow aircore drilling.

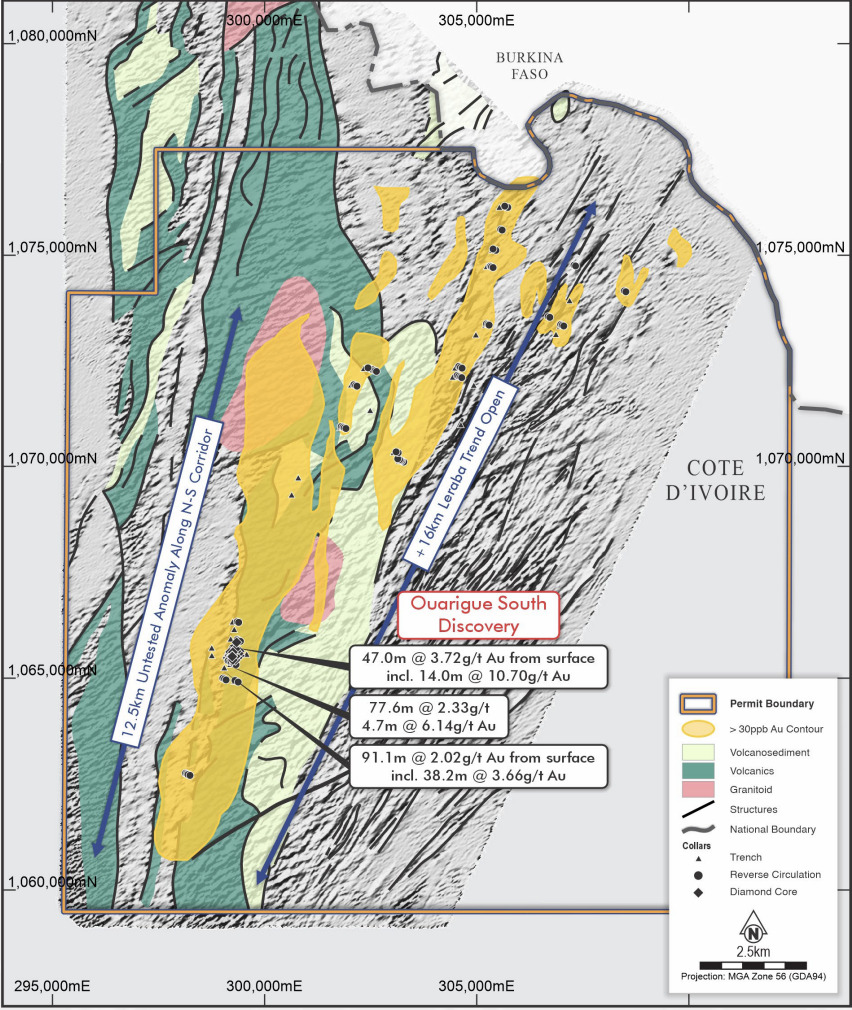

A closer look at results from Ferké shows why investors are excited about the potential.

RC drilling previously carried out includes 25m at 3.06g/t gold from 64m, impressive width and grades at that shallow a depth.

Trenching identified results of to 34m at 5.29g/t Au and 92m at 1.76g/t Au, also within the 16km Leraba gold in soil anomaly.

Drilling there comprised an 80 hole reconnaissance RC program, which unearthed the Ouarigue discovery followed by only 18 diamond holes, leaving much of the 12.5km long anomalous corridor untested.

Drill results from the limited diamond follow-up work – from surface no less – include 91.1m at 2.02g/t Au, 47m at 3.72g/t and 15m at 2.06g/t followed by 116.5m at 0.98g/t. Under 1.5km of this north-south corridor has been drill tested to date.

Did someone say underexplored? Check out those early hits at Ferké. Pic: MPK

Funds put to use

MPK says funds collected in the raising will be used to fund exploration in West Africa, cover the costs of the offer, provide working capital and assist with corporate and admin costs.

The first $733,802.96 tranche will be issued under MPK’s existing placement capacity, with the balance along with almost 4 million free attaching options to be voted on in a meeting to be held in May.

Those 1 for three options will have an exercise price of 25c, expiring on June 30 2026, leveraging the company to future exploration success in Cote d’Ivoire, Queensland and North America.

MPK will also issue options to corporate advisors and as incentives to key personnel and employees in a bid to retain and attract staff and keep directors’ skin in the game.

Over 8 million new options will be listed, providing MPK the potential to raise additional capital when its share price rises above 25c.

MPK had $1.82m in the bank at December 31 last year, but will use the new cash to progress exploration at its newly acquired African assets.

This article was developed in collaboration with Many Peaks Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.