You might be interested in

Mining

Toubani propels DFS works at growing 2.4Moz Kobada gold project with $4m placement

Mining

Toubani unlocks high grade secrets of 2.4Moz Kobada gold project in spectacular drill hit

Mining

Mining

Here are some of the biggest resources winners in early trade, Tuesday March 5.

Like a hoarder at a garage sale, Chris Ellison’s plan to lift any lithium that isn’t nailed securely to God’s green earth is continuing unabated in spite of criticism of Mineral Resources’ (ASX:MIN) balance sheet.

To be fair those critiques are not too loud, but were amplified by MD and founder Ellison himself in an expletive rich presentation on the company’s financial results last month, where he seemed to blame nit-picky analysts for his decision to sell a portion of the haul road at his new Onslow Iron mine to paint a better picture of financial health.

But his free-spending ways continue in the lithium game, as Ellison’s ‘control the rock’ plan continues to evolve. There have been plenty of hints MinRes wants to set up some kind of tolling arrangement to service stranded lithium deposits across the Goldfields. That puts assets held by lithium and even gold and nickel juniors in the region in the crosshairs.

MinRes has stakes in the vast bulk of those participants, and its latest venture shows Ellison is not done dealing, not by a long shot.

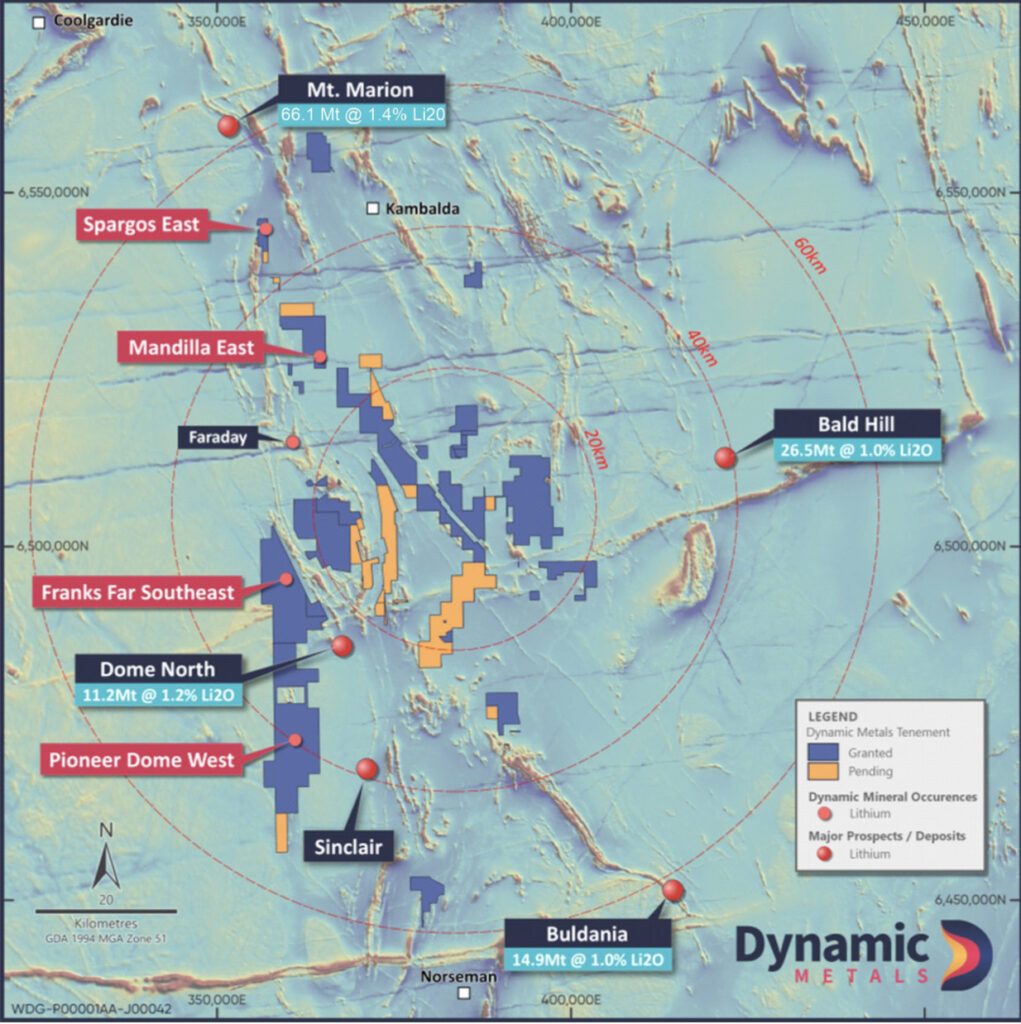

Dynamic Metals (ASX:DYM) is the latest beneficiary of MIN’s largesse, selling 40% of the lithium rights at its Widgiemooltha project for $5m. Cue a near 50% gain for the junior on over $1.5m of turnover.

MinRes will also be able to solely fund exploration to the tune of $15m over four years to up its share to 65% and go even further to 80% on an eventual decision to mine.

Dynamic will keep the rights to everything except the white stuff.

It boasts a massive ground position in the traditional nickel and gold heartland around Widgiemooltha — a nearly ghost town known for its nickel riches and as the home of the legendary Golden Eagle nugget.

It’s also surrounded by hard rockin’ lithium deposits like MinRes’ Mt Marion JV with Ganfeng, MinRes’ Bald Hill, MinRes backed Develop’s (ASX:DVP) Dome North and Liontown’s (ASX:LTR) Buldania.

“The Widgiemooltha Project is a regionally significant tenement package that has yet to be fully assessed for its lithium potential,” DYM managing director Karen Wellman said.

“Although we have had some encouraging results with our first pass exploration activities, the sheer size of the Project means that it would likely have taken Dynamic many years and considerable expenditure to assess its potential and realise value.

“We are excited by this transaction as MinRes is a leader in the lithium sector in Australia, with the technical expertise and financial capabilities to do the Project justice.

“The nearby location of the Bald Hill mine, operated by MinRes, may offer a pathway to production for any discoveries on the Widgiemooltha Project.”

An interesting tidbit for lithium lovers as well we’ll throw in for free. Fastmarkets price reports suggest spodumene has lifted $75 in the past week to $925/t. Have we seen the bottom or just a dead cat bounce?

There’s plenty of appetite from investors to get into producing copper stocks, even if that stock happens to be mining in … Oman.

While other ASX copper plays have their sights set on Mt Isa, Cobar and the Kalahari, Alara Resources has gone the path less travelled, quietly building its 51% owned Al Wash-hi Majaza copper and gold mine and copper-concentrate plant.

It’s expected to produce almost 80,000t of copper and 22,000oz of gold over its 10-year life, processing around 1Mt of ore a year.

Those numbers are fairly old. The project began construction in 2021 and its feasibility study is now seven years old. Its last NPV update came in April 2021, suggesting that at current prices the operation held an NPV of US$104m and IRR of 36%, generating US$306m in EBITDA across its life.

Located 160km southwest of Muscat, the sultanate’s capital, Alara announced today that it had started copper concentrate production after the successful commissioning of its plant — around 12 years from the start of work on the project.

Full capacity will be hit in 2-3 months, with the inaugural shipment of around 1000dmt of copper concentrate to ship to trading giant Trafigura in April.

“The commencement of concentrate production is a momentous occasion for Alara and its shareholders. This represents the culmination of 12

years’ hard work, from project site identification through resource definition, detailed engineering studies, debt and equity financing and the construction phase just completed,” Alara MD Atmavireshwar Sthapak said.

“This great achievement would not have been possible without the enormous efforts of Alara’s joint venture partners in AHRL – Omani conglomerates Al Naba Services and Al Tasnim Enterprises, for which we are extremely grateful. Their local experience, networks and contracting capabilities made an invaluable contribution to bringing this mine to production.

“Alara looks forward to the next stage of its journey to become a mid-tier mining production company, involving a shift of focus to developing existing exploration projects and new acquisitions. I would like to thank our shareholders for their support over this period and into the future.”

Alara was up almost 46% before 12pm AEDT.

(Up on no news)

At a market cap of around $18m, few could argue Malian gold hunter Toubani Resources is not wearing the infamous African discount often lamented by explorers on the continent.

In Kobada, Toubani has an impressive 2.4Moz in mineral resources, 77% of it within 150m of surface, 64% of it indicated and all ore types in the ground considered ‘free milling’.

That means gold can be liberated largely through gravity and cyanide leaching without the need for expensive refractory processing techniques like roasting or pressure oxidation.

TRE is certainly working hard to present the narrative that it is undervalued. Compared to its peers, a recent presentation suggests, Toubani is valued at just US$5/oz of resources against US$10/oz for its peers.

Recent M&A in West Africa has valued ounces in the ground at US$53 a pop.

There’s nothing new floating around on Toubani, but plenty of work going on.

A drill program has begun in recent weeks, targeting up to 10,000m of RC drilling to update the Kobada mineral resource and prepare for ore reserve studies as part of its DFS update.

That revision of the 2021 DFS was announced mid-last year. The original DFS suggested the mine would be in the order of 100,000ozpa over a 10-year horizon.

A final investment decision is planned for 2025, with first gold targeted — if all goes to plan — for the second half of 2026.

From solar salt in the Pilbara to lithium in Canada, Fin has searched enterprisingly down a number of rabbit holes in the past couple of years.

Up 90% in the past six months, the micro cap has had some degree of success in the land of moose and Mounties, reporting rock chip samples of over 6.5% and 70cm long spodumene crystals at White Bear, a discovery near Winsome Resources’ emerging Cancet project in Quebec.

An ‘aggressive advance’ to maiden drilling at White Bear is still on, according to Fin director Jason Bontempo, with funding in place for an initial phase of 1500m representing the first drill down into Cancet West.

The eye-catcher though is the headline that Fin has identified uranium bearing pegmatite in historic soil samples at the Ross project hitting grades of up to 1486ppm uranium oxide.

While lithium prices are in the figurative toilet right now, uranium is soaring, hitting a 16 year high of US$107/lb on spot markets in January.

It’s fallen since to US$93.50/lb, according to Numerco. But considering the energy fuel was worth around US$18/lb as late as 2018, that’s not a bad place for uranium explorers to find it trading.

The historical sampling was conducted by Landmark Minerals at the Rupert River Uranium Project back in 2007 at the tail-end of a uranium boom which saw prices peak at a record of US$149/lb before their GFC and Fukushima inspired collapse.

“This historical data combined with anomalous pathfinder elements including Total Rare Earth Oxides (TREO) and Th levels in pegmatite samples 138203, 138204 and 138227 previously reported by FIN, is potentially indicative of U-Th-REE bearing pegmatites that can show geochemical overlap with LCT (Lithium- Caesium-Tantalum) pegmatites,” FIN said.

An exciting time for the company, Bontempo exclaims. We’ll have to see how this washes up, but it certainly seems to be the era to be hunting for uranium, with a massive new nuclear power build program ongoing and the oft-maligned sector likely to obtain a growing share of the global electricity market as fossil fuel generators are phased out.

On top of the uranium samples, FIN also plans to follow up areas with high helium penetration it thinks may have resulted from the radioactive decay of uranium.

(Up on no news)

Penny dreadful Prodigy Gold (ASX:PRX) is up 66.7% on just $8500 of trading activity today.

No vroom tickets as yet, but we’ll wait and see.

The most recent news for holders to digest came with its decision to trade the Reynolds Range project north of Alice Springs to a subsidiary of iTech Minerals (ASX:ITM) in a bid to reduce tenement holding costs.

It leaves PRX to focus squarely on its gold prospects in the Tanami North project, where millions of ounces have been found and mined, largely from Newmont’s Callie discovery.

PRX also has JVs in the region with Newmont (ASX:NEM) at Tobruk and Monza and with IGO (ASX:IGO) at Lake Mackay.

But the most curious tidbit on the less than $5m player was the circulation of a strange rumour online suggesting it was planning to pay an 87c per share dividend — 174x its current share price.

Believe none of what you hear, even if it’s spat by me, quoth Jay-Z.

PRX, which finished the December quarter with just $2.8m in the bank, promptly corrected the record on February 15 after doubling over a handful of days to 0.8c.

At Stockhead, we tell it like it is. While Dynamic Metals, Fin Resources and Toubani Resources are Stockhead advertisers, they did not sponsor this article.