Resources Top 5: Austral GOLD pumps… but are investors buying the right one? BOA up as Aussies ramp up the battle for Bald Hill

Mining

Mining

Here are the biggest small cap resources winners in early trade, Wednesday September 6.

(Up on no news)

AGD is actually leading the resources pumpers pack this morning with a current 41% gain, but we’re not exactly sure why at the time of writing.

We can tell you the following, though:

• Gold and silver miner Austral Gold is dual-listed on the ASX and the Toronto Stock Exchange (TSXV). So, hats off to them for that.

• Austral Gold‘s last piece of news of any significance regarded its latest half-year report (gross profit: 12.4% among other positive data).

• Austral Gold made headlines about this time last year when armed bandits absconded with ~500oz of gold from AGD’s Guanaco and Amancaya mine complex operation in Chile.

• And finally, perhaps crucially, when looking to invest in Austral Resources (ASX:AR1), a profitable copper-cathode producer which has good news out today (continuing to grow its McLeod Hill lease with fresh significant near-surface copper intervals)… be sure not to confuse that with Austral Gold.

Which, as the second part of its name suggests, is focused on gold, and not necessarily copper. Just sayin’.

AGD share price

(Up on… nearology)

Also up on no fresh announcements is Boadicea, which is an exploration company with tenements in four of Australia’s mining hotspots – the Charters Towers region and Drummond Basin of North Queensland, the Fraser Range, Paterson Province, and the Eastern Goldfields of Western Australia.

It’s the latter region mentioned there that probably matters most today, because the Bald Hill lithium mine in the area has been making some big headlines so far this week.

Bald Hill, as Stockhead‘s Reuben Adams details in one of his latest deep-delving reports, is seeing a sudden revival and great interest as one of Australia’s only producing lithium mines.

The big news is that Aussie mining exploration major Mineral Resources (ASX:MIN) has lobbed in a bid for the Bald Hill lithium mine and snare it from Chinese interests alleged to have been selling at a rate that stooged the State on royalties, with Glencore also reported to have put forth a $1.8bn proposal with Sagex Capital.

Yep, we’re talking another nearology narrative here.

To the immediate north-west of the mine, Torque Metals (ASX:TOR) is settling in with, among other tenements (forming a larger aggregated project dubbed Penzance), its New Dawn project. That’s an unmined lithium and tantalum occurrence on granted mining leases, 600m along strike of the established Bald Hill operation.

On the other side is Boadicea Resources (ASX:BOA), which acquired a 17.6sqkm Bald Hill East tenement in December 2021 for just $300k.

Reubs writes:

Maiden drilling in September the following year failed to hit paydirt but the best part of the tenement – which “is closer to [and along strike from] the existing Bald Hill deposit and mine and considered more prospective” — still requires heritage clearance.

“Boadicea will continue to work with our native title partners to arrange land access at the earliest opportunity,” the company said late July.

Stay tuned, because Stockhead is following up.

BOA share price

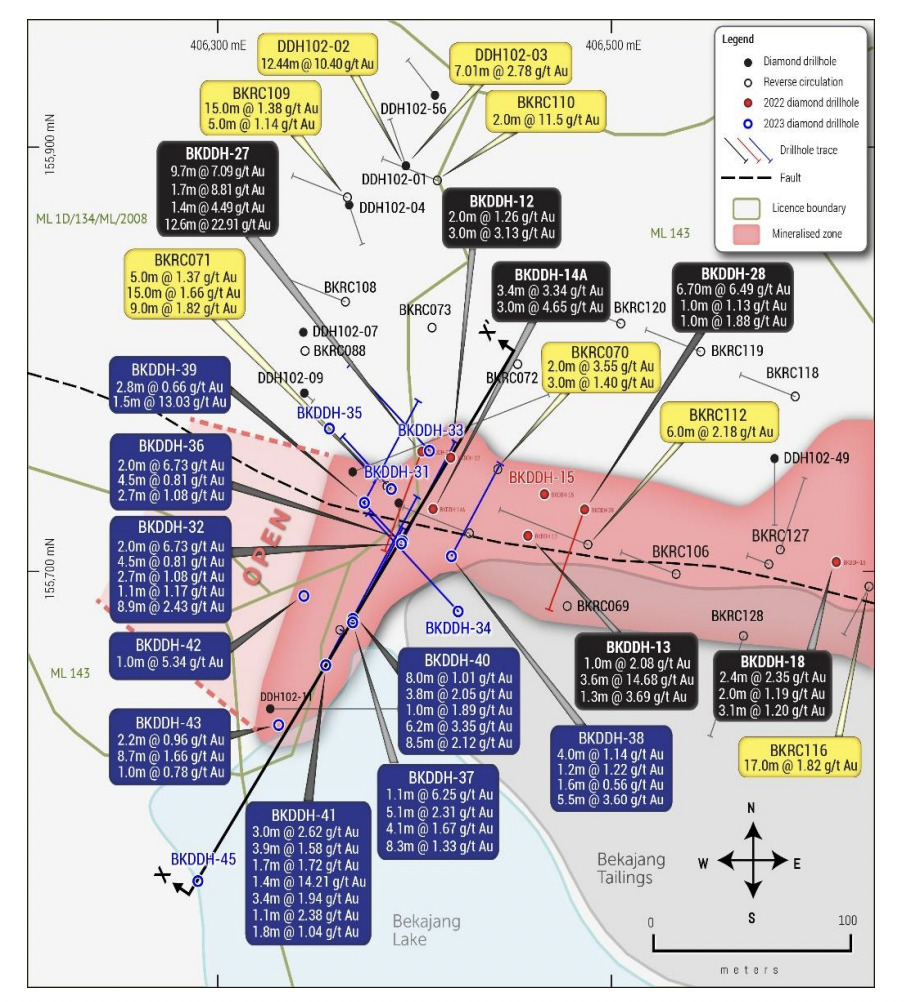

Besra Gold is double-figures up this morning on news that drilling at its Bekajang project has revealed it to be a “multi-storey” deposit, with a discrete high-grade gold zone below the initial find reported in 2022.

The Bekajang project is south of the township of Bau, a gold mining town in the Kuching Division of Sarawak, Malaysia.

It’s within what’s known as the Bau Gold Field corridor, located at the western end of an curved metalliferous belt extending through the island of Borneo.

The company reports the newly discovered zone is defined by “intense exoskarn development and hydrothermal alteration with highest gold grades, in excess of 10g/t Au, associated with brecciated and veined limestone, cemented by fine grained silica, sulphides and jasperoid replacement”.

And we’re talking shallow dipping, too – between about ~30m-60m depth.

Besra’s Interim Chairman, John Seton, said:

“During 2022, we discovered exceptional and bonanza grade gold below the traditional LSC target at Bekajang. Following this up has been the focus of our exploration in 2023 and we are very pleased to report the confirmation of our earlier success, and then some.

“Assays from this 14-hole program indicate the presence of a potentially very significant understorey of mineral endowment, separate and distinct from that at the overlying LSC level and it remains open along strike.”

BEZ share price

ERW is trading in the right direction, around 15% at the time of writing, on news that it had to close a heavily-oversubscribed placement early, after receiving commitments for $4.25 million from sophisticated investors to fund and accelerate its exploration.

This comes through a placement of shares through clients of CPS Capital Group.

We are pleased to have acted as Lead Manager and Broker to the @errawarra $ERW $4.25M heavily oversubscribed placement at $0.12.

Funds raised will be used for upcoming exploration programmes at the Pilbara Andover West projects in close proximity to $AZS $RDN $GRE $ARV. pic.twitter.com/PxzDhhsW1k

— CPS Capital (@cpscapitalgroup) September 6, 2023

And said exploration activities include the company’s lithium hunt at the Andover West projects in the Pilbara and further exploration at the gold, nickel, graphite focused Errabiddy project.

The Pilbara region, though, has been a chief focus of late for ERW, thanks to the lithium exploration success there of Azure Minerals (ASX:AZS), Raiden Resources (ASX:RDN) and Greentech Metals (ASX:GRE).

ERW share price

Buxton, which recently announced “exceptional” assay results from its maiden diamond drill hole at its Copper Wolf project in Arizona, is surging up as we type.

This morning, it reckons “it’s time to wake the giant“, delivering fresh news dug up from another beaut hole in the ground – the second diamond drillhole at Copper Wolf.

The company reports that CPW0002D penetrated the cover sequence at 527.61 metres and “immediately” intersected visual copper and molybdenum mineralisation.

“This hole was terminated in mineralised rocks at 1,174.40 metres for a total of 646.79 metres of basement diamond drilling,” Buxton adds, further clarifying that the basement interval in the hole consists of 626.88 metres of porphyry-style chalcopyrite-molybdenite mineralisation.

Buxton Resources CEO Marty Moloney enthused:

“The intersection of significant thicknesses of continuous alteration, veining and mineralisation in CPW0002DD establishes Copper Wolf as a porphyry copper-molybdenum project of global relevance.

“Our second drillhole shows that historical drilling has barely scratched the surface. It’s time to wake the giant which has been lying low at Copper Wolf for the last 74 million years.”

BUX share price

At Stockhead, we tell it like it is. While Austral Resources (not Gold) and Besra (definitely Gold) are Stockhead advertisers at the time of writing, they did not sponsor this article.