Resources Top 4: Osmond and Sabre show ravenous appetite for yellowcake

Mining

Here are some of the biggest resources winners in early trade, Thursday January 18.

Yellowcake. Everyone wants it right now.

Osmond is an exploration minnow with a diverse metals (lithium, uranium, gold, boron, graphite ‘n’ more) portfoilo that takes it far and wide across Australia, USA and Spain.

It’s latest news, though, which shot it straight to the top of the ASX pops today (before Woomera made a strong recovery, that is), comes from local territory – the Fowler project in South Australia.

The $4.2m company has burst up the bourse with a +40% gain after announcing “exciting uranium potential” at Fowler, straddling part of the edge of the sediment-tastic Eucla Basin, which extends over 2,000km along the coast from WA into SA.

Osmond says that its reviewing of historical exploration at the site has identified potential uranium (U3O8) mineralisation right across 20km of the sands and clays within the Fowler project.

🔔 $OSM.ax $OSM Exciting Uranium Potential Discovered On Fowler Project, South Australia 🔗https://t.co/O0rl7Hw7wl#uranium #mining #exploration #ASX

“This discovery of uranium☢️potential is an exciting development for Osmond Resources," says Osmond Resources Executive… pic.twitter.com/uYsrkSKO9b

— Osmond Resources Ltd (ASX:OSM) (@OsmondResources) January 17, 2024

What happens next? This:

Osmond’s exploration manager, Charles Nesbitt, said:

“The recognition of the potential large-scale roll-front style of mineralisation is a crucial step in uranium exploration. It allows Osmond to predict mineralisation morphology based on sedimentary environments and vectors towards the higher grade ‘nose’ facies of the roll front mineralisation.

“I am excited, by not only the potential roll-front style mineralisation but also a number of other possible uranium deposit styles that may exist in the region.”

South Australia is host to three of Australia’s licensed and operating uranium mines – Olympic Dam (BHP), Beverley (Heathgate Resources) and Honeymoon (Boss Resources).

The Sabre is rattling again, showing some fight on the bourse today with a +24% gain at the time of day’s coffee.

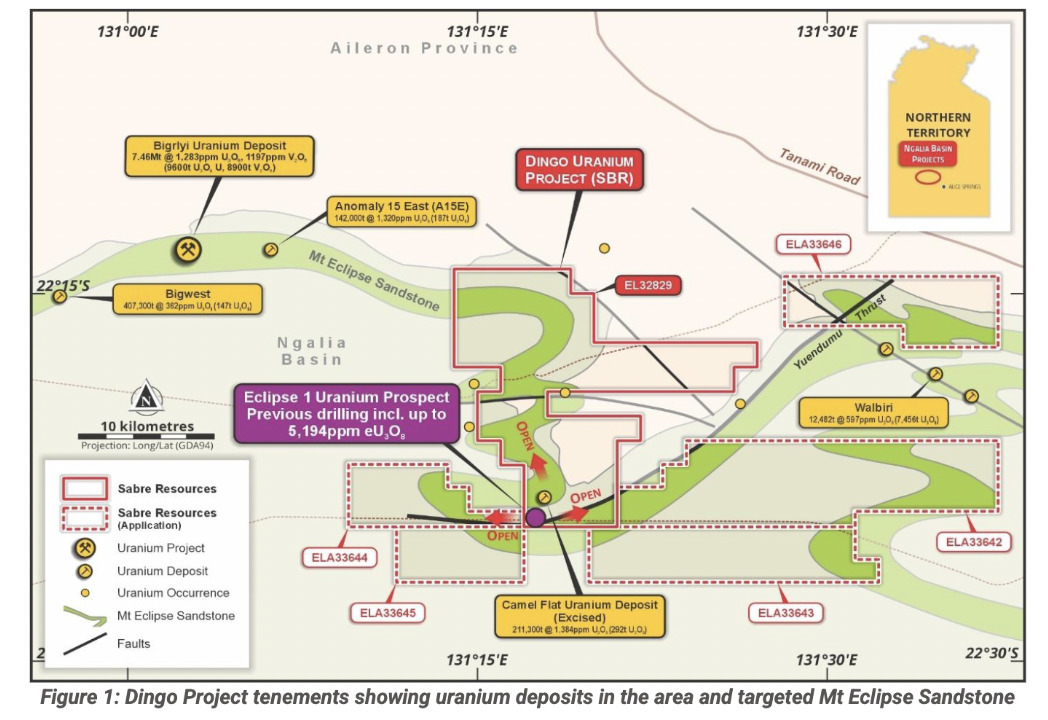

The diverse minerals-exploring junior (lithium, nickel sulphide, uranium) has announced it’s launched a new exploration program at the Dingo uranium project within its 1100km2 Ngalia Basin tenement package in the Northern Territory.

This follows up on high grade results identified in previous drilling at the tenements – up to 5,194ppm eU3O8.

The company will be going hard with geophysics and drilling high-grade sandstone-hosted uranium targets and resource extensions under shallow cover.

In particular, the Eclipse 1 prospect target is believed to continue for over 50km. All up, only 5km of the sandstone contact has been partially tested with the previous shallow drilling.

Sabre Resources CEO Jon Dugdale noted the uranium results in previous drilling at Dingo highlights the prospectivity of the Ngalia Basin projects for high-grade discoveries.

“Sabre’s 1,100km2 tenement package in the highly-prospective Ngalia Basin is surrounded by high-grade uranium deposits and remains largely un-explored due to shallow soil cover.

“Uranium exploration in the Ngalia Basin is actively encouraged by the Northern Territory Government and its location in an arid area 300km northwest of Alice Springs makes it one of Australia’s best regions for uranium development,” he added.

We mentioned Woomera earlier, which came off a trading halt it requested the day before, pending a further announcement.

The lithium stock took a hammering earlier this week, but is in the process of pulling some of that back today and is now currently sitting on a 50% intraday gain.

Yesterday, this $13.4m lithium stock announced the completion of a reverse circulation (RC) drilling program comprising 26 holes for 2813m at its Ravensthorpe project in south-east WA.

The drilling program was following up on historic pegmatite intersections at the Mt Short JV and lithium geochemical anomalies defined on the company’s wholly owned tenement at Mt Cattlin.

Those two tenements cover a combined area of 103km2 within the same greenstone belt as Allkem’s (ASX:AKE) Mt Cattlin lithium mine, not far to the south.

Woomera notes that pegmatites have been intersected in eight of 26 holes completed and samples are with a lab for assaying, with those results expected by late February.

Gateway seems to be in the middle of correcting what was at first looking an ordinary first couple of weeks of the year for the WA gold explorer, share-price wise.

Today’s announcement from the company has so far put paid to that.

It’s made a head-turning reveal at its flagship 526,000 oz Montague Gold Project, about 70km north of the township of Sandstone, Western Australia.

A new style of gold mineralisation (compared with anything previously identified at Montague) has reportedly been discovered at the project’s Duplex target, with RC intercepts up to 18m at 5g/t Au.

Gateway reports it’s a gabbro/dolerite-hosted mineralisation intersected 3.5km south of existing the company’s existing resources, along the margin of the Montague Granodiorite Dome. Anomalism in air-core drilling indicates a potential strike length of over 500m for the new zone of mineralisation.

Follow-up RC drilling is being planned as a priority, to commence during the first few months of this year.

Gateway’s MD Mark Cossom said: “This is a fantastic way to start the new year, with RC drilling completed late last year as a first test of the new Duplex Target returning some standout assay results, including an exceptional shallow intercept of 18m at 5.0g/t.

“Significantly, this is a completely new style of mineralisation to anything we’ve seen before at Montague –validating our systematic approach to unlockt he full value, through new discoveries, of what we believe is a major gold mineralised system.”