You might be interested in

Mining

Monsters of Rock: BHP's $60 billion Anglo American gambit far from a done deal

Mining

Fresh ASX-lister Litchfield Minerals has new options for critical minerals success

Mining

Mining

Some 15 years after father-and-son prospectors Michael and Matthew Pustahya first started piecing together various rock packages across parts of Northern Australia, one of their companies is set to debut on the ASX as early as next month.

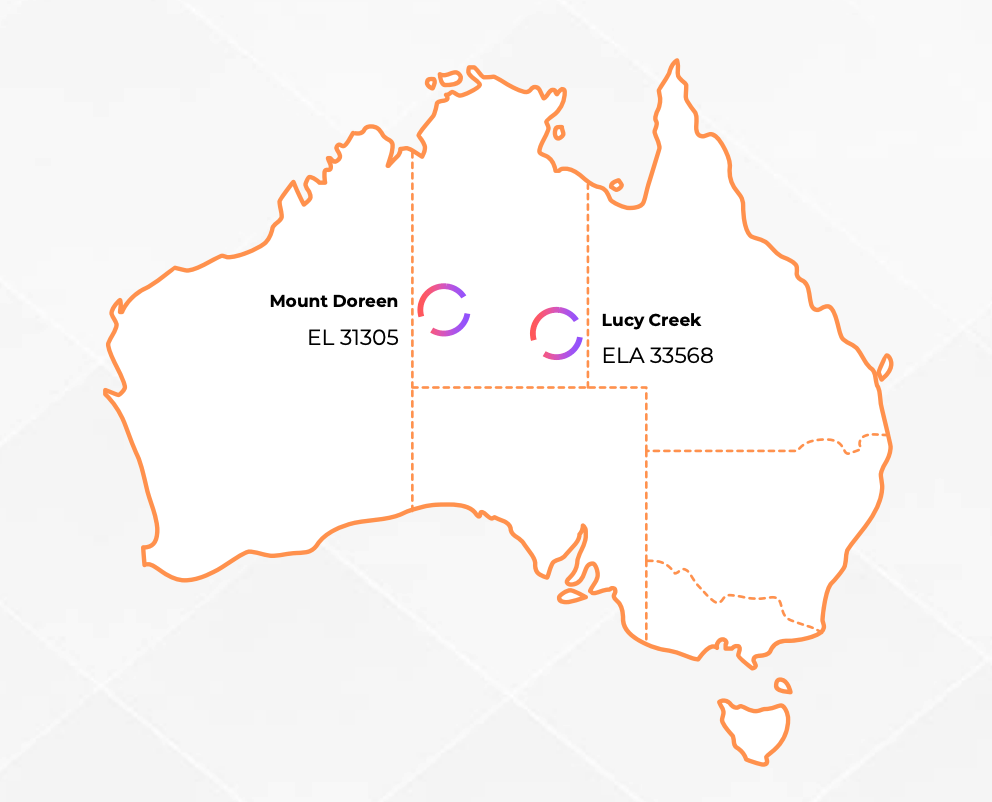

Litchfield Minerals (proposed ASX:LMS) is targeting a mid-March listing following an IPO between $4.5 million and $5.5 million at 20c per share. The critical minerals explorer is focused on two key projects in the Northern Territory which the Pustahyas have spent the best part of the last five years advancing out of their own pockets.

Matthew Pustahya, who is also Litchfield’s managing director, told Stockhead the two projects – Mount Doreen and Lucy Creek – now required a more detailed level of exploration than what he and his father have undertaken to date.

“We’ve been picking up tenements for years and trying to do as much work as we can to get them to a level where we’re comfortable to either exit or develop them further,” he says.

“We really love this package that we have, that’s why we decided to IPO it because we see the upside. This is one of the best packages we’ve ever had.”

Joining Pustahya on Litchfield’s four-person board is former Rio Tinto executive Peter Eaglen as chair, as well as non-executive directors Mark Noppe and Brent van Staden.

Phil Cawood of boutique advisory firm Alpine Capital is managing the company’s IPO.

The Litchfield IPO is the first time the Pustahyas have successfully progressed one of their private companies to the cusp of an ASX listing.

It is also a milestone arguably some three decades in the making.

“For my first show and tell, I took these gold specimens that I’d picked up from the Melbourne Goldfields with Dad when I was three or four, so we’ve always had a passion for rocks in us,” the now 37-year-old Matthew Pustahya recalls.

“Dad has always been really into his science, he can tell you everything there is to know about black holes in space. He’s not a geologist and neither am I, but we’re very well researched. Dad has always had an inkling for rocks and geology and he can piece things together really easily. He’s got a knowledge base of what I would call ‘natural geology’, he just understands how things work.”

By the time Matthew was in his early 20s, he and his father were prospecting together “more professionally”, picking up and exploring tenements around the vanadium-rich Julia Creek and Mt Isa quartz district in Queensland.

The Pustahyas held various parts of East and West Isa over the next decade before sensing an opportunity was emerging over the border in the Northern Territory.

“We saw an opportunity around five years ago that the Northern Territory was ripe – ripe as in there was every likelihood that good infrastructure was going to start opening up places where no one had really been able to go and have a proper look because it’s just so remote up there,” Pustahya says.

“So we went hunting and we found Mount Doreen. Traditionally it was always pretty hard to get to in terms of you’d have to drive up to the Tanami Road, which at that stage would take five or six hours from Alice Springs, and it was just rough country.

“We’re lucky enough now to have a two-lane sealed road right up past our tenement, plus a mining camp, an airstrip and everything else an exploration geologist needs to be able to do their job.”

Having been locked out for 2.5 years due to COVID-related travel restrictions, the Pustahyas were not about to waste any time continuing their hunt for a major mineral discovery at Mount Doreen, about 350km northwest of Alice Springs.

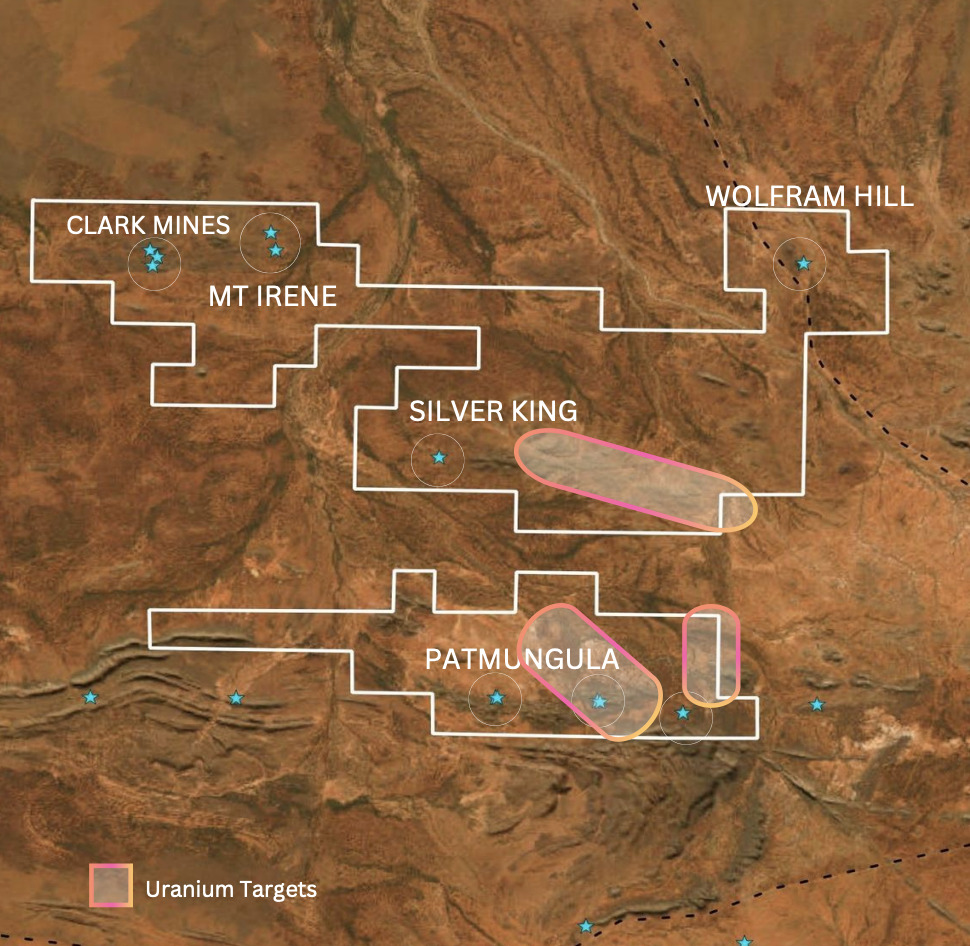

An induced polarisation survey over the 388km2 tenement package identified targets declared “highly prospective” for a range of minerals, including uranium, copper, lead, zinc, silver, gold, tungsten and rare earths.

Litchfield is particularly interested in the Silver King, Clark Mine and Mount Irene prospects which are approved for drilling post a successful ASX listing.

“We’re champing at the bit to get out there and drill,” Pustahya says.

“From a compliance perspective, we’ve got our mining management plans all approved, so we’re ready to go and drill 10 holes across each of Silver King, Mount Irene and Clarke once the IPO is away.”

Expect Litchfield to quickly work to prove up the uranium potential at Mount Doreen once listed as the energy metal continues to captivate investors thanks to the spot price recently breaking through US$100/lb for the first time in 15 years.

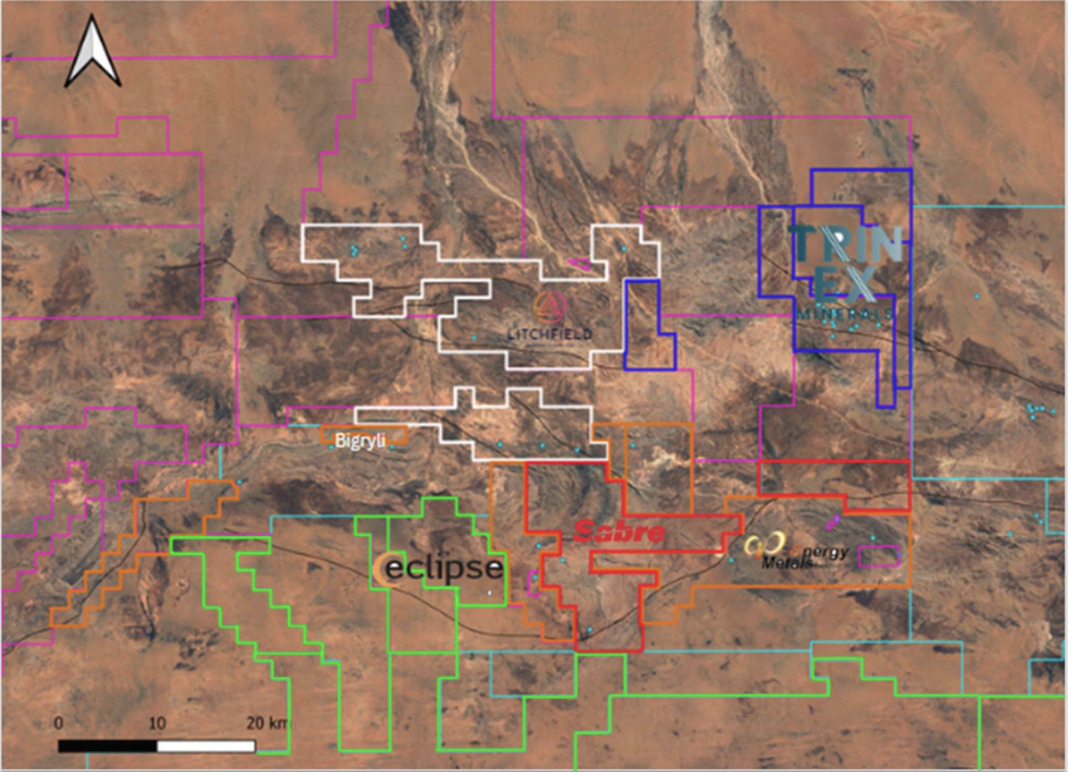

The company is already surrounded by a number of existing uranium explorers in the Aileron province, including Energy Metals (ASX:EME), Sabre Resources (ASX:SBR) and Eclipse Metals (ASX:EPM).

“We’ve never been afraid of the uranium story, it was actually part of the reason why we picked these tenements up,” Pustahya says.

“We always knew the uranium potential was there. Interestingly enough, the granites behind Silver King seem to be quite rich in uranium, at least from a radiometric perspective. One of the rock chip samples from Rio Tinto returned 0.255% uranium, so we really need to investigate those.

“We’ve got two other areas, Area 2 and Area 4, that are most likely a different style of mineralisation, it probably won’t be within the granites, it might be in the sandstones or the sediments. But we do think that Area 3’s granites, which are about 8km of strike, appear to be very elevated in uranium, according to radiometric data and some rock chip sampling, and that’s probably been remobilised into the other areas on our tenement over millions of years.”

While uranium, copper and tungsten are expected to be the main game for Litchfield at Mount Doreen, Pustahya also has high hopes for the delineation of another critical mineral – bismuth.

“The interesting part about our bismuth is it appears to be very high grade,” he says.

“Bismuth is as rare as silver and gold on the parts per million crust. Some of our assays are up 0.8% bismuth – and that appears to be native bismuth. That would be equivalent to 8,000g/t gold.

“It’s kind of unheard of so we’re very excited about looking further into that opportunity.”

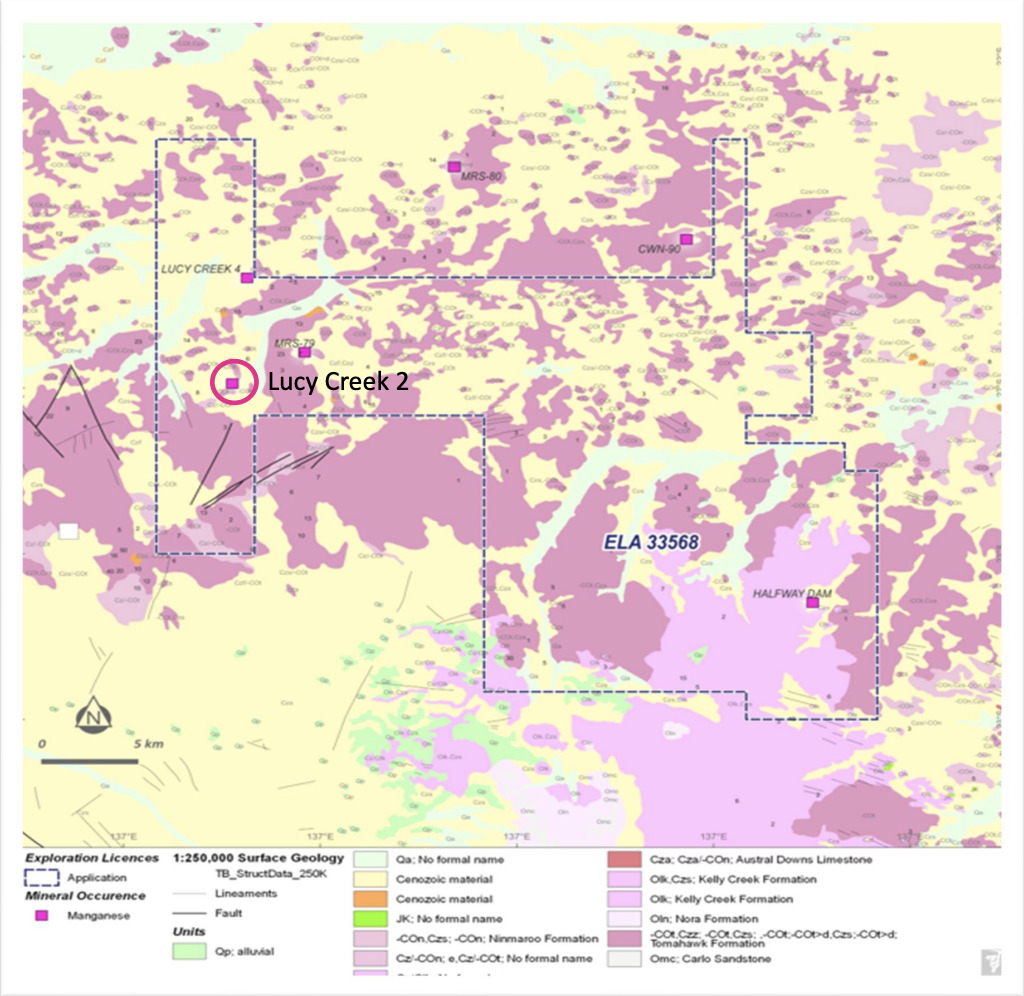

Located about 400km northeast of Alice Springs is the company’s second project, Lucy Creek, which hosts potential for manganese, sedimentary base metals and rare earths over a large 790km2 ground holding.

Even though it is still early days, Litchfield is ultimately seeking to join majors such as Rio Tinto (ASX:RIO) and Newmont (ASX:NEM) as an established name in the burgeoning Northern Territory resources sector, which has become one of Australia’s hottest exploration spots.

Mid-tier miners including IGO (ASX:IGO) and Sandfire Resources (ASX:SFR) have also staked sizeable footprints in the Northern Territory in recent years.

“There’s nowhere to peg anymore in the NT and that’s really only happened over the last year and a half,” Pustahya says.

“The Northern Territory had their biggest quarter on record for exploration in the [September 20230 quarter, nearly $75 million, so I think it’s fair to say we’re not the only ones that are bullish on the NT. And the government up there are really supportive of exploration.

“We see it as the final frontier. It’s one of the only places in Australia that just hasn’t had a fine-tooth comb run through it, and where tenements aren’t being as recycled as much. We think some major discoveries will be made in the NT, especially where we’re sitting, in that Arunta complex.”

Just two resources IPOs have hit the ASX this year, but pleasingly for Litchfield’s prospects, both Kali Metals (ASX:KM1) and Infini Resources (ASX:I88) are respectively trading 56% and 40% above their listing prices, as of market close on February 6.

According to Pustahya, Litchfield could be drilling at Mount Doreen within two weeks of its stock debuting on the bourse.

“I would like to be drilling day one, but I don’t think logistically we’ll be able to do that, but I think two weeks after is quite a reasonable timeframe,” he says.

“We’re in a challenging market, obviously, at the moment but there’s still a lot of money sitting on the sidelines and we’ve got a really good team of people behind us to make it all work.”

At Stockhead, we tell it like it is. While Litchfield Minerals is a Stockhead advertiser, it did not sponsor this article.