New IPO Litchfield to list on the ASX with some giant uranium targets

- Litchfield Minerals is looking to list with uranium, copper and manganese exploration projects in the Northern Territory

- It is looking to raise up to $5.5 through an IPO led by broker Alpine Capital

- The initial focus is drilling and sampling the historical Mount Doreen project

- Manganese, base metals and REEs exploration will also start later this year at Lucy Creek

Special Report: Northern Territory-focused Litchfield Minerals is gearing up to list on the ASX with a smorgasbord of uranium and critical minerals exploration assets.

These include drill-ready copper and uranium targets at the Mount Doreen tenement in the Arunta region, about 350km from Alice Springs, and the highly prospective Lucy Creek manganese project in the Georgina Basin.

Uranium is currently running hot, thanks to a parabolic move through a US$100/lb spot price over the past year.

New sources of supply are now being sought by explorers and miners alike as stockpiles deplete and a new multi-year contracting cycle begins.

Longer term expectations are that demand will soar as countries adopt nuclear power as a key route to zero emissions energy.

Meanwhile, copper’s prospects remain bright in 2024, while interest in manganese has been building due to its use as a stabilising component in the cathodes of nickel-manganese-cobalt (NMC) lithium-ion batteries used in electric vehicles.

That is without considering the potential for Lucy Creek to contain rare earths, which is valued for a range of applications including in the manufacturing of permanent magnets used in EV motors and wind turbines.

Backed by a team of Rio Tinto and AngloAmerican alumni, Litchfield is looking to raise $4.5-5.5m through an initial public offering priced at 20c per share, giving it a market cap on listing of between $6.6-7.6m.

Once listed, it plans to hit the ground running with a multi-target drilling and sampling program at Mount Doreen.

A uranium hotspot

Mount Doreen is in an emerging uranium province. Right next door is Energy Metals’ (ASX:EME) 7.46Mt Bigrlyi deposits, where resource expansion drilling is due to kick off soon.

Also nearby are early-stage explorers Sabre Resources (ASX:SBR) and Eclipse Metals (ASX:EPM).

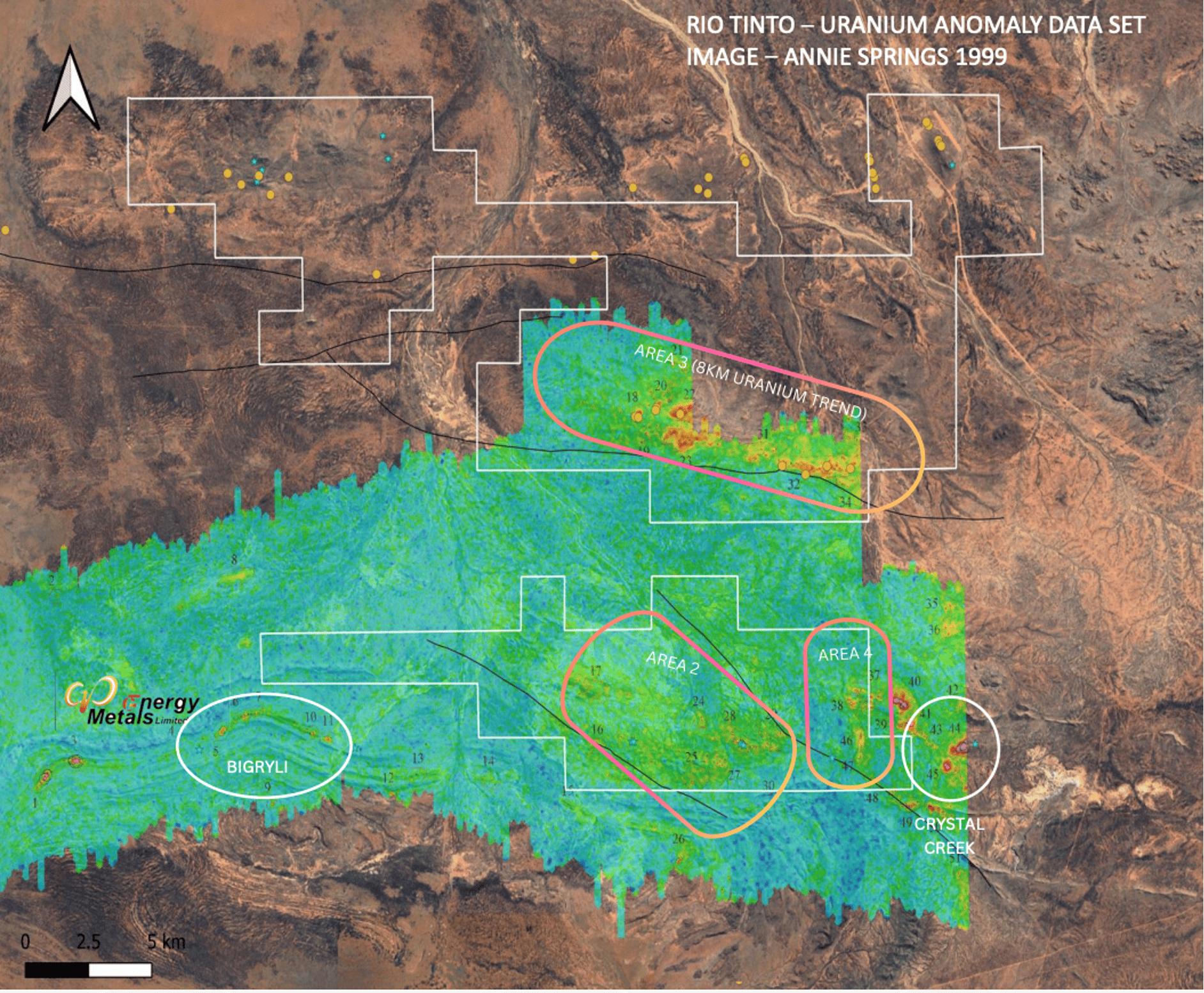

In the mid-1990s, Rio Tinto conducted an exploration program over EL 9413, which includes some of the current area of EL 31305.

Airborne geophysics identified 51 radiometric anomalies in four distinct areas and a cluster of eight dipole anomalies. Three of the anomalous areas are partially located within the Mount Doreen project.

Area 3 alone is 8km long:

Upon listing, Litchfield plans to conduct sampling and mapping to assess this potential.

What else makes Litchfield’s projects attractive to investors?

Mount Doreen is a historically mined polymetallic project which comes with a mountain of data.

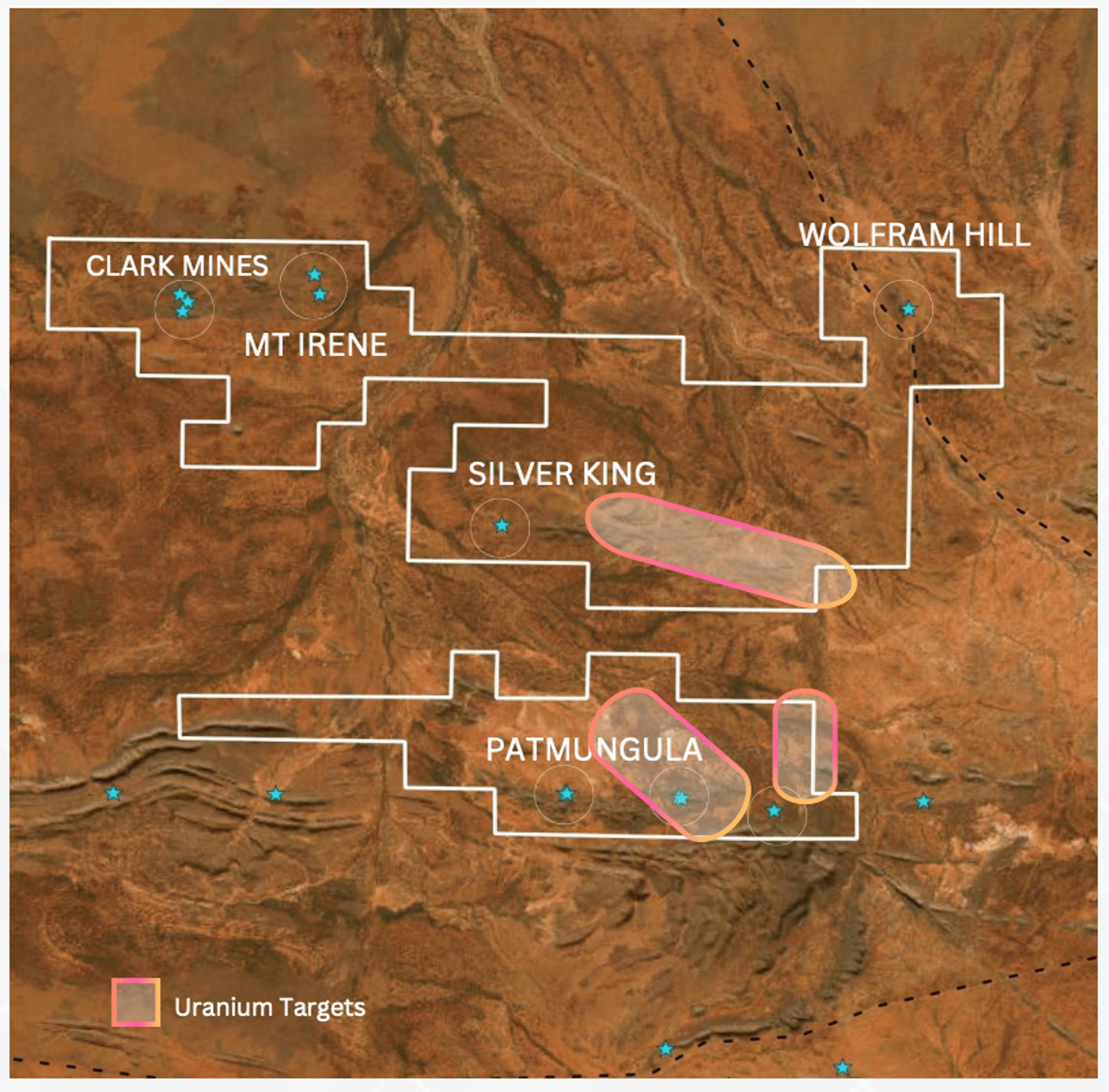

A 30-hole drill program is expected to commence at the precious-base metals targets Silver King, Clark Mine and Mount Irene following a successful listing on the ASX.

Six holes will go into Silver King, where historic rock chip samples returned values up to 55% lead, 31% copper, and 884ppm silver.

Also mined by the old timers was Mount Irene, where rock chips from working returned hits like 35.8ppm silver, 24.2% copper, 2,930ppm lead, 1.3% zinc and 0.56 ppm gold.

Underneath these old mines is a large, highly chargeable body beginning at a depth of 50m, Litchfield says.

Its core is situated around 150m deep and stretches over 400m in length.

The Clark Mines include three old pits, where exploration by Homestake Gold in 1997 outlined a 1.5km anomaly 1.5km over the Clark workings, and a 500m long anomaly, 1km south. Rock chip sampling returned up to 1.52 g/t gold and 19.7% copper.

This article was developed in collaboration with Litchfield Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.