Resources Top 5: From the Pilbara to Nevada – Raiden and Astute own today’s lithium bragging rights

Mining

Mining

Here are the biggest small cap resources winners in early trade, Wednesday August 23.

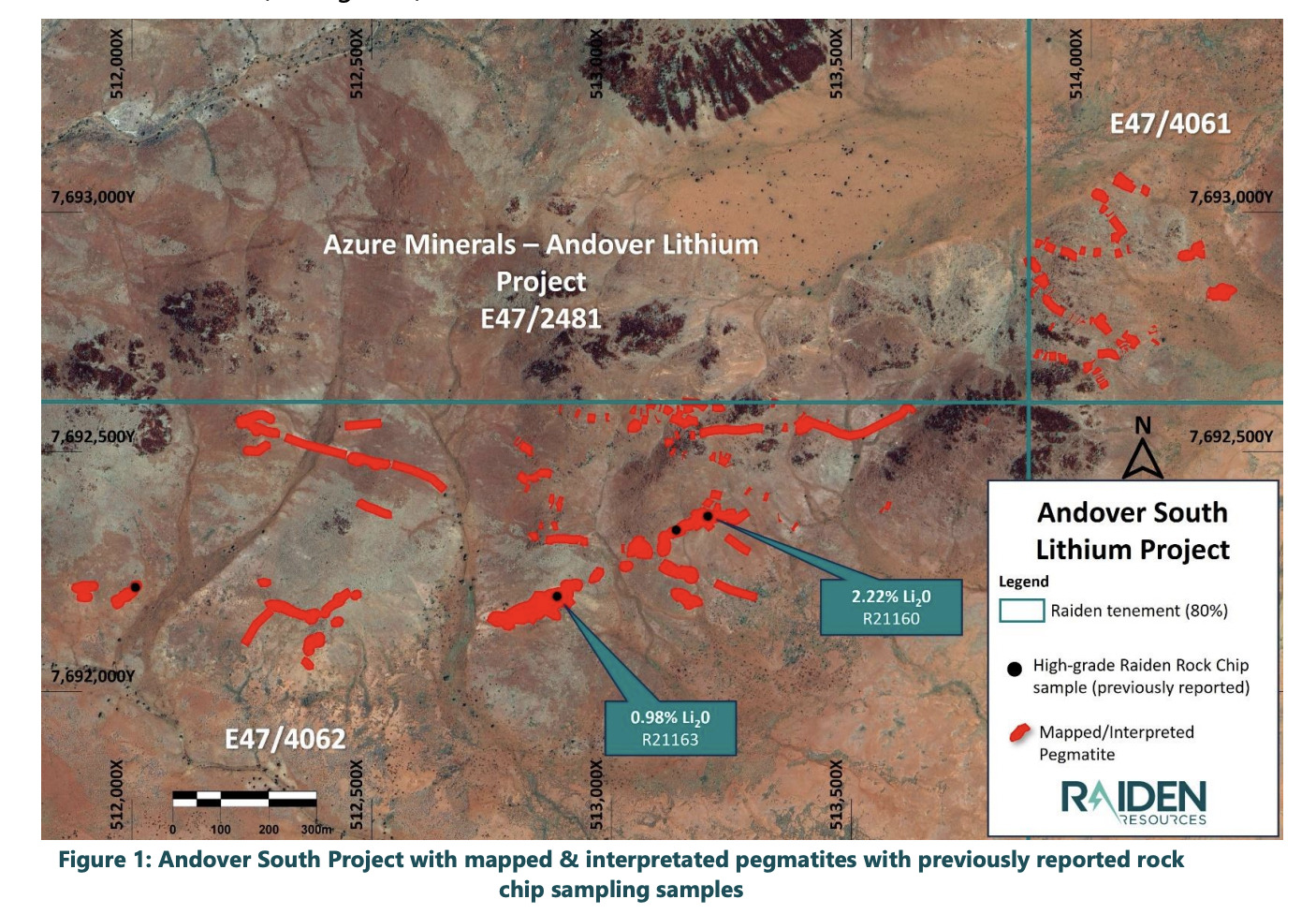

Raiden is having an ASX power surge so far today. RDN stock is up 37% at the time of writing on news that the company’s found a ~3.5km long, 600m wide pegmatite field at its Andover South tenements with individual pegmatites outcropping up to 30m widths.

The Andover South project, if you’ve been paying attention to Stockhead for a while now, is right next door to where Azure Minerals (ASX:AZS) has been drilling out lithium for fun just lately. Wake-riding and nearology a-go-go.

As we noted yesterday, Raiden has completed its latest fact-finding mission, confirming the go-ahead to acquire an 80% interest in five more lithium tenements – nearby the privately held Welcome Exploration project and adjoining the stupendously-hot-right-now Azure Minerals Andover lithium discovery in the Pilbara.

This is also covered in more detail in today’s special report on Raiden, which you can read here. But, a snippet, for means of some clarification:

“Raiden and vendor Welcome Exploration entered into a binding heads of agreement at the end of June to acquire an 80% equity interest in Welcome’s tenure surrounding Azure Minerals’ Andover project, which boasts a newly minted exploration target of between 100Mt and 240Mt grading 1% to 1.5% Li20 for Target Areas 1, 2, and 3.”

Raiden’s Managing Director, Dusko Ljubojevic, said:

“Our initial investigations on the Andover South projects are starting to yield positive results – the widths of the pegmatites defined to date, of up to 30 metres in outcrop, are providing encouragement that the pegmatite system may be of significant size.

“Furthermore, multiple swarms of pegmatites are being noted throughout the license area with further areas to be mapped and sampled.

“Our teams are now mapping and sampling the remaining tenements of the Andover South and Andover North project area and we hope to provide results to the market in the near term.”

RDN share price

Astute Metals, formerly known as Astro Resources and run by Pilbara Minerals (ASX:PLS) original Tony Leibowitz, has more announcements flooding the ASX in-tray today than the Poms have “moral” sporting victories.

They’ve banged out nine announcements to be precise.

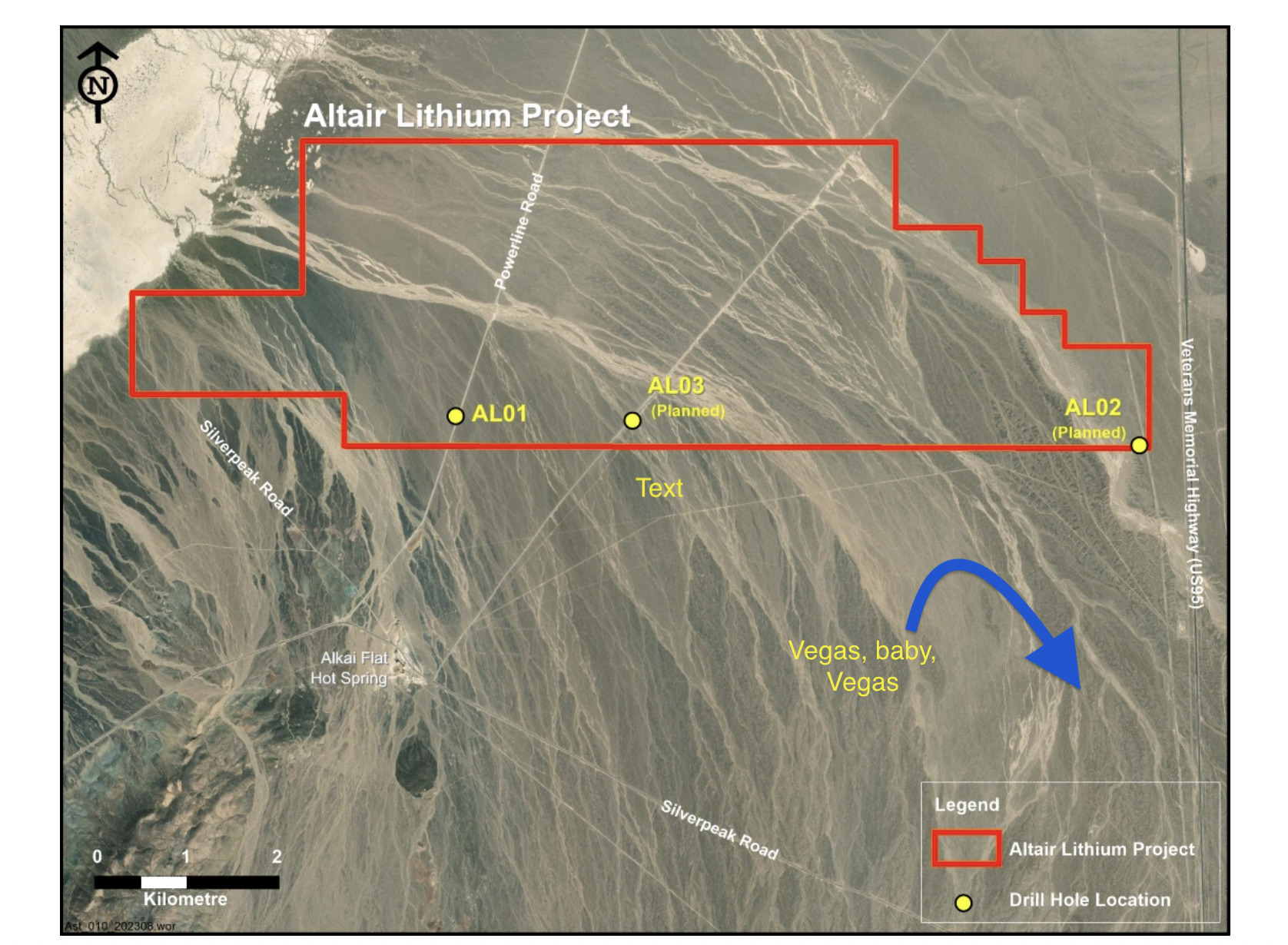

Let’s start with its first, and most eye-catching, one titled: ‘Broad Lithium Hits in First Altair Drill Hole‘.

That references the company’s maiden drilling campaign going on at the Altair lithium project in Nevada – up the road from where Leisure Suit Larry is probably still wandering about looking to get lucky in the Land of the Lounge Lizards.

Perhaps it’s time he switched from the one-armed bandit and got into battery metal stocks.

Astute reports that wide zones of lithium mineralisation have been intersected in the first hole drilled at Altair, with assay results in, indicating 109.7m of Siebert Formation claystone, confirming “the significant potential of the project”.

Two significant zones of lithium mineralisation have been found at drill-hole AL01:

• 33.5m at 481ppm Li from 80.8m (265ft);

• and 33.5m at 508ppm Li from 147.8m (485ft) to End-of-Hole (181.4m/595ft).

The other notable news gleanable from all those announcements is the fact the company has successfully completed the final stage (“Tranche 2”) of a capital raising initiative, raising $1.35 million from sophisticated investors. Which counts out Leisure Suit Larry. And probably most of Stockhead’s writers.

The issue price was 5.3c per share and the company notes that the funds will be used to expand Astute’s lithium strategy in the USA, where it has ambitions to be a major lithium player.

It will also be used, however, to “fund the delivery of the Mineral Resource upgrade for the Governor Broome Mineral Sands Project”, which is in Western Australia.

Regarding the Altair hit, though, Leibowitz said: “This is a tremendous result for our first hole which provides clear evidence of the significant potential of the Altair Project.

“The fact that we have significant lithium mineralisation over broad intervals has given us the confidence to push ahead with further drilling in this proven lithium district.

“The scale of some of the large resources in the region, such as Tonopah Flats, provides an indication of the size of the prize that we are pursuing.”

ASE share price

We may as well call this column Eye on Lithium today, because here’s another Li-tastic piece of news tantalisingly outcropping on the local bourse.

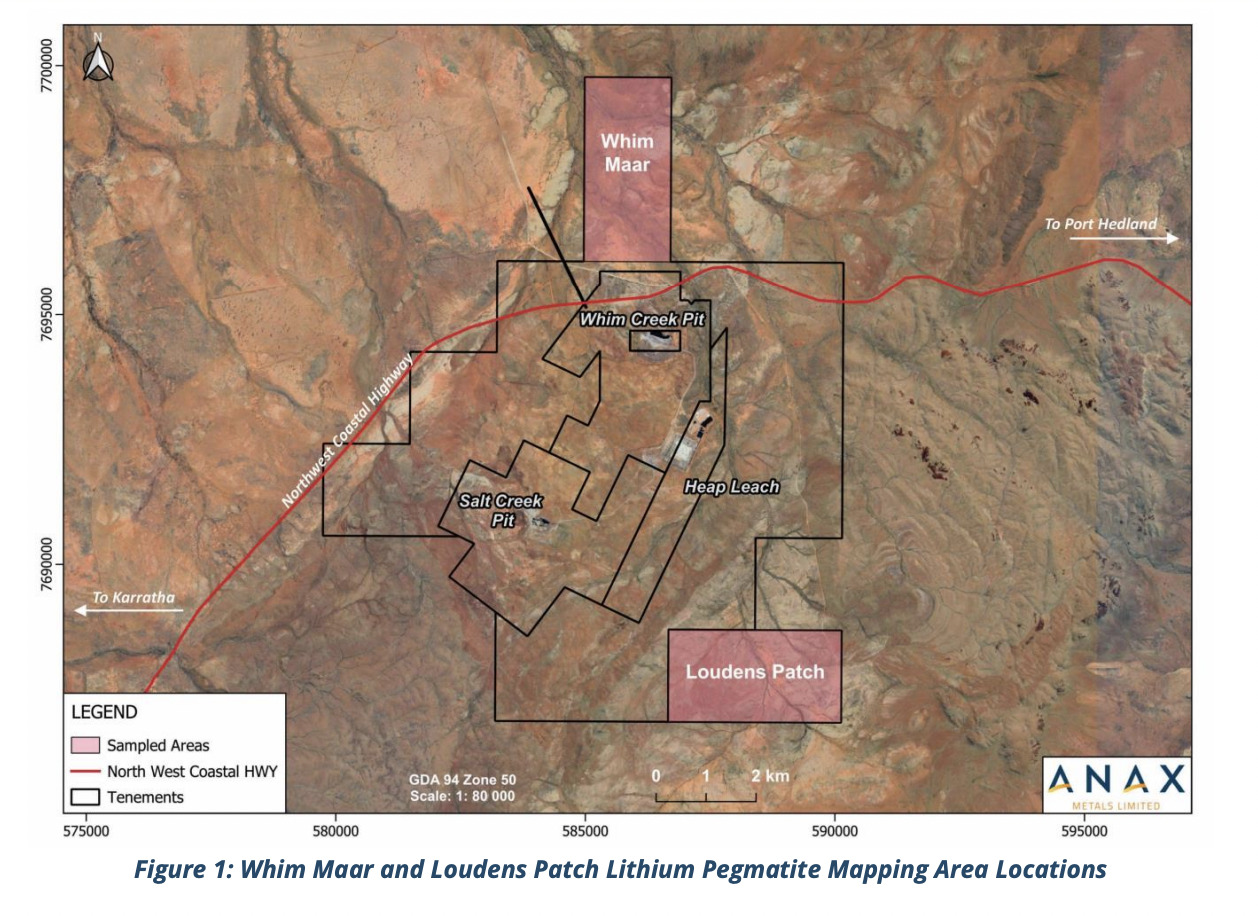

ANX has climbed on news that the company (Anax Metals) has discovered extensive pegmatites at its Whim Maar and Loudens Patch prospects – located in the Pilbara in WA.

Anax’s Whim Maar lithium operation is an 80-20 joint venture with Develop Global (ASX:DVP), with ANX owning and operating 80% of the pie.

Loudens Patch, meanwhile, is 100% Anax owned and adjacent to the east of the Whim Creek Pit – see below. The Whim Creek operation, by the way, is the company’s flagship copper-zinc project.

More than 200 pegmatite rock samples have been sent by Anax for geochemical analysis, while soil sampling is progressing and initial rock chip results received for assessing lithium fertility.

Anax MD Geoff Laing noted:

“Pegmatite swarms at Whim Maar and Loudens Patch are far more extensive than were initially identified by historical mapping or recent reconnaissance sampling.

“This work provides further encouragement of potential lithium fertility based on field observations.”

ANX share price

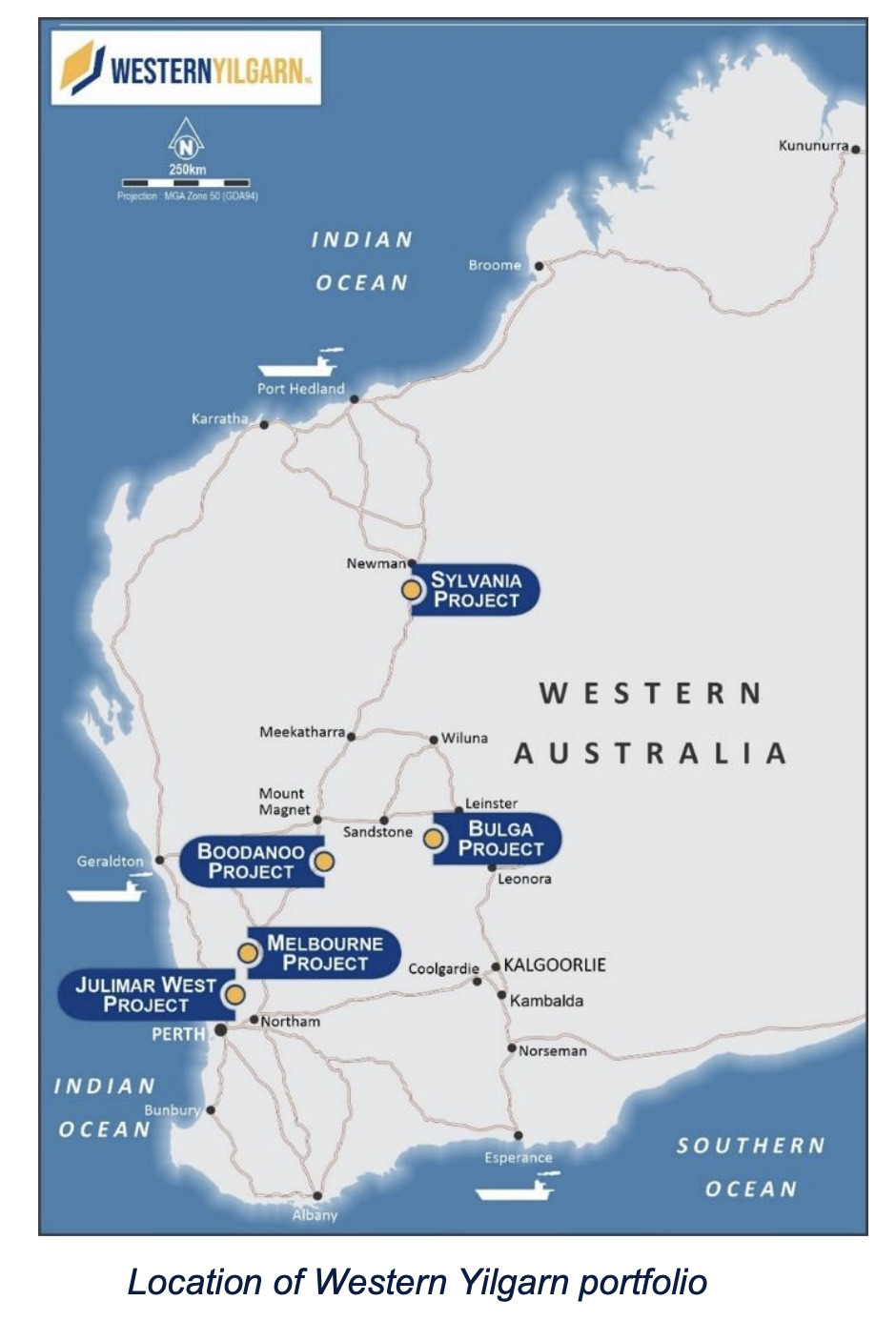

Yesterday, WA explorer Western Yilgarn pumped on the back of multiple targets identified for drilling at its Bulga mining project, where it’s going for a variety of minerals, including nickel, copper, gold and… yes, yes – lithium, too.

Today’s news, pushing up the WYX share price, however, is centred around the company’s Sylvania project, which is a little south of Newman in the Pilbara region.

It’s a site-access-mobilisation update that has been in the works pending negotiations with the Karlka Nyiyaparli Aboriginal Corporation (KNAC), the Aboriginal custodians of the land underlying the Sylvania Project leases.

A collaborative partnership has been formed between the two entities, allowing the comapny to undertake “low impact exploration activities” in the area and within the agreed leases.

The first such campaign is set to begin in October and will last 10 days. Western Yilgarn notes:

“Together, WYX and KNAC may identify not only areas of geological significance but areas or items of cultural significance across the Sylvania tenements.”

Regarding the minerals exploration potential, it’s a nickel, copper, REE, Lithium and gold hunt – all have been identified to varying degrees.

Western Yilgarn, by the way, has five exploration projects with a total area of 1,540km2 (including application areas) located across Western Australia.

The projects are prospective for Ni-Cu-Co-PGE, Au and Li and include: Julimar West; Bulga; Boodanoo; Sylvania and Melbourne… which is nowhere near the other Melbourne.

WYX share price

(Up on no news)

Perhaps investors know something we’re not seeing today regarding R3D, because there’s no fresh update for the small copper/gold hunter that we’re immediately spying.

We do know that it’s probably busting to reveal some news about its first production from its 45,000t Tartana copper ‘heap leach’ project in Queensland, which follows recent completion of a plant refurbishment.

R3D Resources (ASX: R3D) firing up Tartana plant in Chillagoe, Queensland to produce Copper Sulphate pic.twitter.com/FNf95981TC

— Michael Thirnbeck (@MangiWau) July 27, 2023

As Stockhead’s Reuben Adams recently explained, “Heap leaching involves piling ore on a pad then irrigating it with chemicals to dissolve the metal into a solution.

You can see the ore pile and irrigation lines in the foreground here:

“Originally pencilled in for December 2022, first production at Tartana has been steadily pushed back, probably due to delays in the plant refurb,” wrote Reubs.

Managing director Stephen Bartrop commented recently: “Cash flows from copper sulphate pentahydrate sales are expected to be a ‘game changer’ for the company and allow it to achieve its desired self-funding status,” managing director Stephen Bartrop says.

“It also enables the company to turn its attention to expanding existing copper resources in the Tartana open pit.”

r3D share price

At Stockhead, we tell it like it is. While Raiden Resources and Western Yilgarn are Stockhead advertisers at the time of writing, neither companies sponsored this article.