Resources Top 5: Nickel and lithium fight for top billing, while a small REO player is landing punches

Pic via Getty Images

- Nimy Resources has received major investment funding to help advance its nickel and lithium drilling in WA.

- Western Yilgarn has identified multiple drilling targets for nickel, copper, gold and lithium, also in WA.

- Raiden Resources has pulled the trigger on its lithium-hunting expansion.

- Red Metal is surging on the back of the REO discovery it announced to market yesterday.

Here are the biggest small cap resources winners in early trade, Tuesday August 22.

NIMY RESOURCES (ASX:NIM)

Nimy has bagged itself $2.5 million as a major, cornerstone investment from New York-based Lind Partners, in order to get cracking on its nickel and lithium drilling programs at the Mons project, north-east of Perth, WA.

Lind is a manager of institutional funds focused on providing growth for promising small- and mid-cap companies publicly trading in the US, Australia, Canada and the UK.

The investment is a staged placement over a maximum 24-month period, with the price fixed at $0.208 cents in the first four months then at either the fixed price or a calculated VWAP subscription price.

NIM surged in June after the company intersected lithium-rich pegmatite rocks in eight holes, over 1.3km of strike, at the South Lake and Royale prospects within the Mons project.

It was a short-lived burst though, with the share price struggling through July and into the first few weeks of August.

This funding injection could be the boost the company needs to get things rocking.

Regarding its nickel and lithium operational updates – the Program of Works for RC drilling have been submitted for approval targeting, respectively: two “nickel massive sulphides” anomalies and high-grade lithium with the aforementioned fertile pegmatites confirmed.

Nimy Resources Executive Director Luke Hampson said, “ To date 2023 has seen Nimy progress significantly with our nickel and lithium targets. The funds invested by Lind will further our ability to drill highly prospective targets and propel our project to the next level.”

Lind Partners founder Jeff Easton meanwhile noted that his firm has been keeping an eye on both Nimy Resources and De Grey Mining (ASX:DEG) for some time, adding:

“We are confident both our interests are aligned given managements continued and significant shareholding in the company. Nimy is preparing a drill campaign on Priority One targets for Nickel and Lithium at The Mons Project and we are very excited to see what they yield.”

NIM share price

WESTERN YILGARN (ASX:WYX)

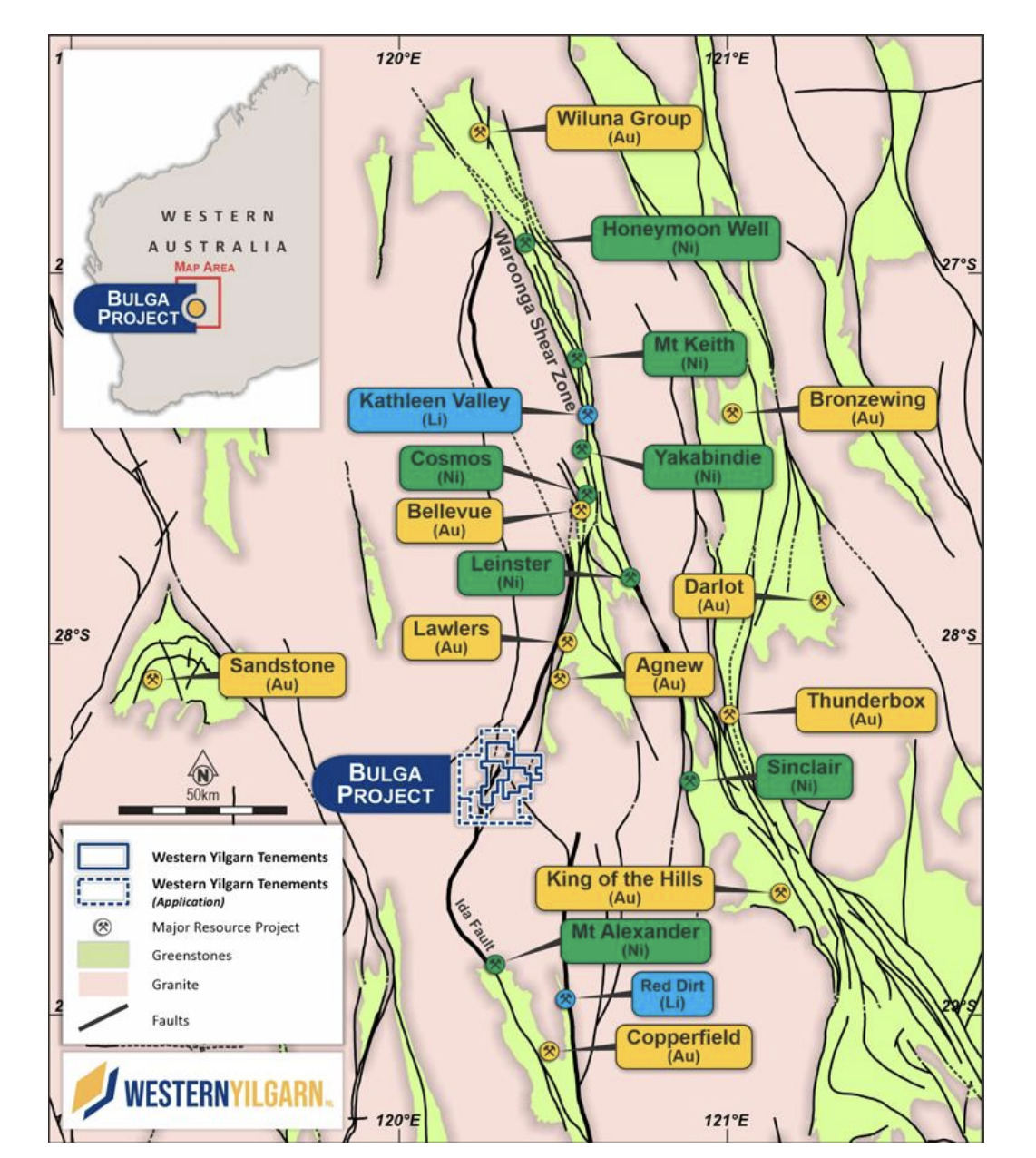

Explorer Western Yilgarn has identified multiple targets for drilling at its Bulga mining project in WA, where it’s going for a variety of minerals, including nickel, copper, gold and, yep, some lithium, too.

The Bulga project is situated in what appears to be a potentially advantageous position, near two Tier 1, world-class nickel projects operated by BHP (ASX:BHP) – the Leinster and Mt Keith operations – as well as several 2Moz+ gold operations including the renowned Agnew, Lawlers and Bellevue mining projects.

And throwing in some blue-sky lithium near-ish-ology for good measure, Bulga is also about 60km north of Delta Lithium (ASX:DLI)‘s Mt Ida Lithium Project and roughly 90km south of Liontown Resources (ASX:LTR)‘s huge Kathleen Valley Lithium Project.

Assay results from WYX, based on a high quality auger geochemistry program, have confirmed:

• 3 Lithium-Caesium-Tantalum (LCT) pegmatite targets

• 5 Nickel-Copper-Platinum-Palladium (Ni-Cu-PGE) targets

• 1 lower order Gold (Au) target

Peter Lewis, Chairman of Western Yilgarn said:

“With 9 targets identified, it is exciting to see Western Yilgarn’s first-principles, new-generation exploration strategy continuing to deliver results for the Bulga Project.

“The team is very keen to extend exploration efforts onto the incremental 275km2 of under-application tenements.”

WYX share price

RAIDEN RESOURCES (ASX:RDN)

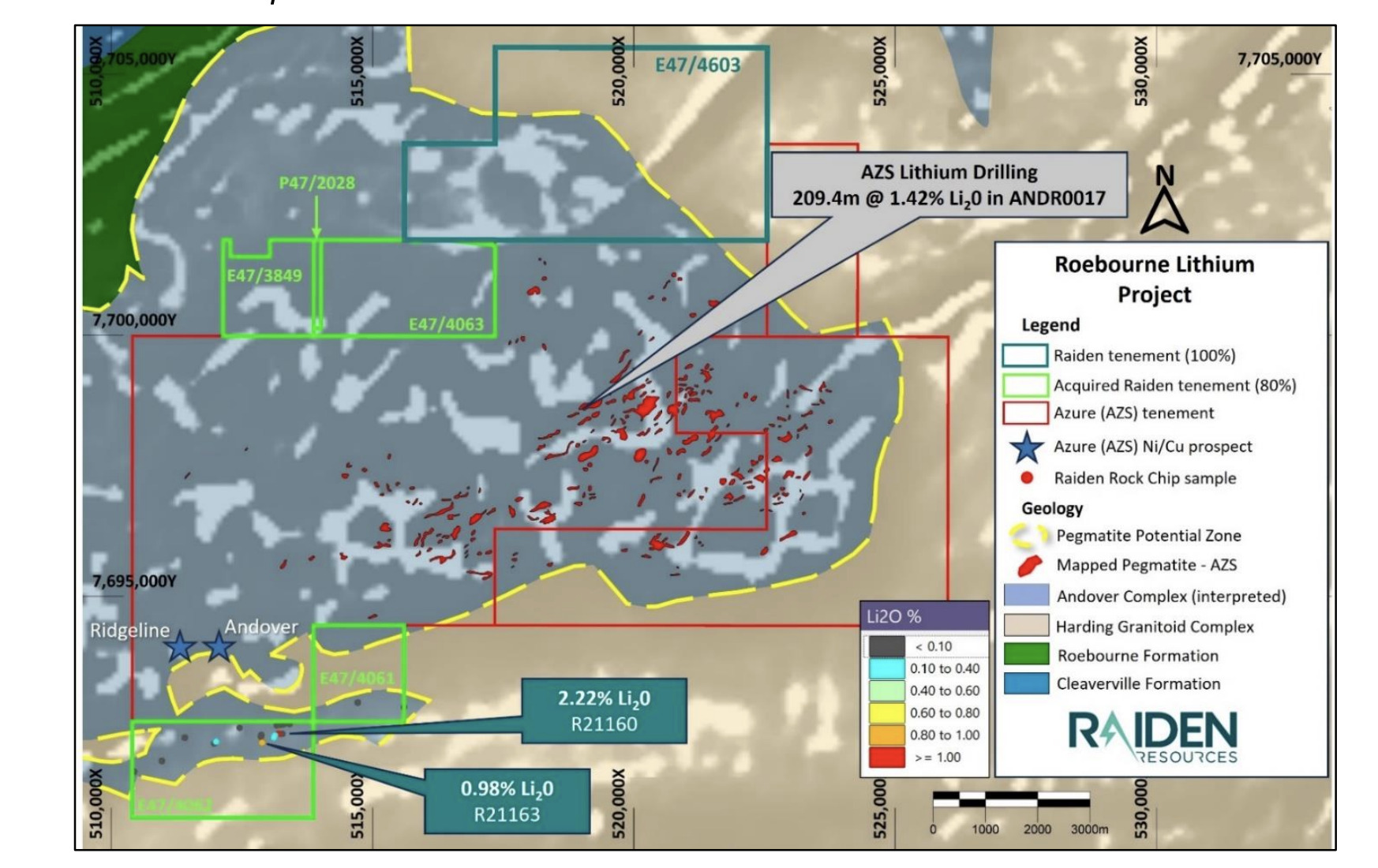

Having completed a due-diligence period, Raiden has announced this morning its decision to go ahead and nab more lithium locations in the Pilbara, WA.

Specifically it’s acquiring an 80% interest in five tenements by the privately held Welcome Exploration project, adjoining the stupendously-hot-right-now Azure Minerals (ASX:AZS) lithium project.

The tenements cover a four-kilometre-long section of recurring high-grade lithium pegmatite outcrop on the Roebourne South project, with individual Li2O bearing pegmatites outcropping over a strike of 200 metres and up to 6 metres wide at surface.

During its fact-finding mission, Raiden turned up significant rock chip results including: 2.22% Li2O – sample R21160; 0.98% Li2O – sample R21163; 0.37% Li2O – sample R21168.

RDN’s lithium hunt is well underway now at the Roebourne, Arrow and Mt Sholl projects.

The company’s managing director, Dusko Ljubojevic, said: “With the due diligence exercise completed to our satisfaction, we are looking forward to progressing more detailed work programs and evaluating the entire Roebourne project area.

“With the confirmation of high-grade Li2O mineralisation within the mapped pegmatites, management will focus on mapping out in detail the outcropping areas and progress the projects to drill stage as soon as we can.

“Furthermore, our teams are currently in the field evaluating the entire portfolio for pegmatite/lithium potential and we are hopeful this will lead to definition of further anomalies and areas of interest.”

RDN share price

RED METAL (ASX:RDM)

The RDM share price is surging into lunchtime today, and there’s good reason for that – yesterday’s still-fresh news.

The company has made what it believes is a world-first rare earths discovery at its Sybella project in North West Queensland.

The discovery follows assay results from proof-of-concept drilling regarding 19 percussion holes (for 2,280m) across a large tranche of granite, which highlighted the quality of grade and substantial widths of the find.

Importantly, Red Metal is talking near-surface REO mineralisation that “should be recoverable by the application of a weak acid solution”.

The rare earths in question are neodymium and praseodymium (NdPr) as well as yttrium (Y) and dysprosium (Dy). These play into the EV (electric vehicle) use-case narrative via the production of high-performance magnets.

Having spoken to Red Metal’s MD Rob Rutherford yesterday about it all, we gather the company is quietly excited about the find, which shows scope for “vast tonnages of weak-acid soluble rare-earth oxide (REO) mineralisation hosted in low-acid consuming granite rock”.

Rutherford and his team is comparing the minerals’ solubility factor and the weathered, low-acid-consuming host-rock granite to conditions at massively successful projects elsewhere – such as the Rossing and Husab soluble uranium deposits in Namibia and the Morenci soluble copper deposits in the USA.

Those projects show favourable conditions for large and cost-efficient mining enterprises, and the Sybella project, believes Red Metal, is the rare earths equivalent.

We’ll bring you that exclusive Red Metal interview tomorrow.

RDM share price

LARAMIDE RESOURCES (ASX:LAM)

(Up on no news)

Uranium explorer Laramide is focusing its efforts of late on the Amphitheatre uranium prospect at the Westmoreland project in Queensland.

As it notes in a recent tweet, it plans to embark on an aggressive exploration program there over the next 12 months or so, in order to expand its resource.

Laramide Resources (#ASX: $LAM) plans to embark on an ‘aggressive’ exploration program this year to expand its uranium resource at the Westmoreland Projecthttps://t.co/i0Moe3RSOF#miningnews @LaramideRes

— Mining.com.au (@miningcomau) July 20, 2023

The company’s last significant announcement, in late July, was several more words to this effect, explaining that the drilling has commenced at Amphitheatre, with resource drilling then set to proceed at the nearby Long Pocket and Huarabagoo deposits.

“Concurrently, fieldwork on strategic, historically known targets at the Murphy Project in Northern Territory are also underway,” noted the company.

And the purpose of that is to investigate the potential for “historically reported and strategic critical metals”.

At Stockhead we tell it like it is. While Raiden Resources and Western Yilgarn are Stockhead advertisers at the time of writing, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.