You might be interested in

Mining

Resources Top 4: Another junior drawn to the yellowcake, Richmond preps for vanadium bull market

Mining

‘Opportunity worth exploring’: Power Minerals investigates uranium prospectivity in South Australia

Mining

Mining

Special Report: Power Minerals is the latest exploration company to reignite its interest in South Australia’s uranium sector.

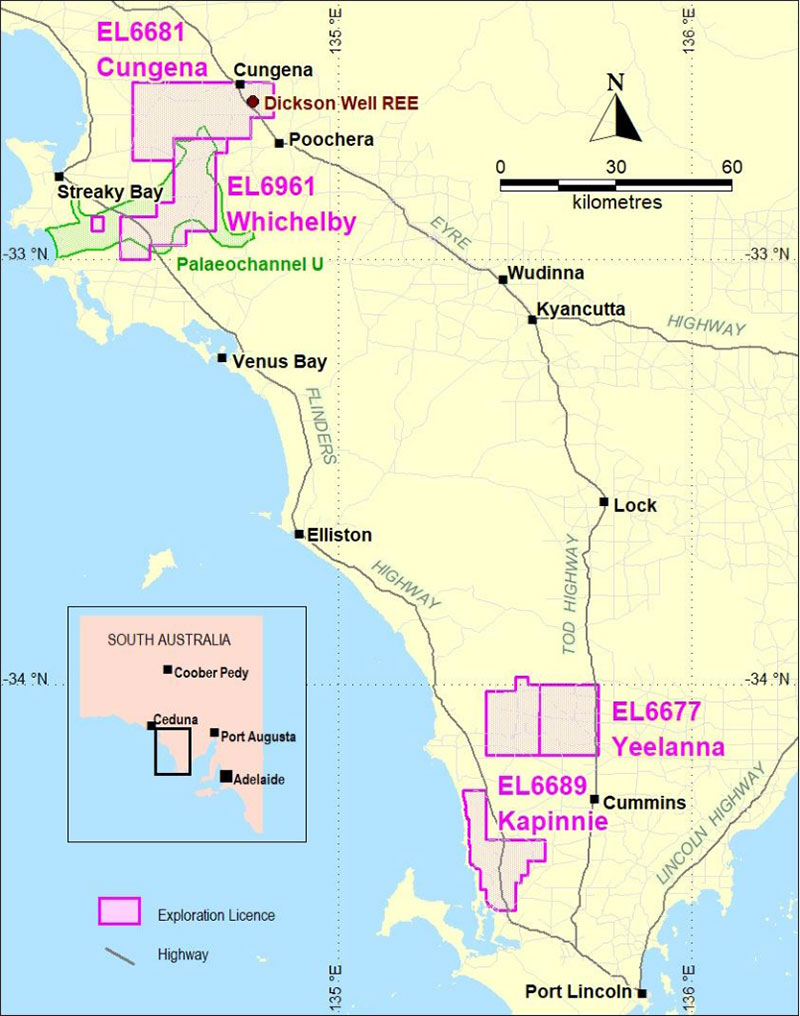

Power Minerals (ASX: PNN) has dedicated most of its resources towards exploring and developing the Salta lithium brine project in Argentina in recent years, but the resurgence of the yellowcake sector has enticed the company to review the potential for its uranium projects on South Australia’s Eyre Peninsula.

Those plans received a shot in the arm last September when geochemical pXRF analysis of historical drill intervals detected possible anomalous uranium concentrations.

PNN has now significantly expanded its uranium footprint on the Eyre Peninsula with the company granted the Whichelby licence (EL6961) which sits adjacent to its existing Cugenea licence (EL6681).

The Eyre Peninsula is currently a hive of uranium exploration activity with the likes of Argonaut Resources (ASX: ARE), Alligator Energy (ASX: AGE) and Pinnacle Minerals (ASX: PIM) all establishing significant ground positions in the region.

South Australia is also widely recognised as the most advanced uranium jurisdiction in the country with five mines approved to date – including BHP’s massive Olympic Dam operation – providing a proven pathway for yellowcake hopefuls such as PNN to follow.

The palaeo-valley within PNN’s newly acquired Whichelby licence is yet to be extensively tested despite CRA Exploration (now Rio Tinto) previously undertaking uranium exploration in the area during the early 1980s.

At the time, the rotary mud style of drilling completed by CRA was largely considered ineffective for measuring uranium concentration.

PNN believes recent drilling for kaolin as well as the testing of basement targets has helped to better define the edges of the channel below its new licence area.

The company is now planning to deploy modern aircore drilling and will use advanced Vanta pXRF analysis to obtain real-time, on-site uranium values (along with those of other metals) in its upcoming maiden campaign at Whichelby.

Different organic facies will also be mapped to better target the uranium prospectivity and demarcate the stratigraphic intervals where the best potential uranium reductant has developed.

While PNN is permitted to drill at Cungena, it must seek the requisite approvals (including environmental and land holder agreements) for such activity on the neighbouring Whichelby licence.

First-pass drilling is tentatively planned for Q2 2024 pending grant of those approvals.

PNN managing director Mena Habib is confident the uranium potential of the company’s Eyre Peninsula licences can be fully exploited.

“While we continue to develop the Salta lithium project in Argentina as our flagship project, the company is keen to further explore the uranium potential of its Eyre Peninsula project area, and the strategic addition of the Whichelby licence substantially expands our contiguous uranium prospective ground position,” he said.

“South Australia is very proactive in uranium exploration and mining, as demonstrated via the multiple uranium mines and projects in development within the state.

“We aim to uncover the uranium potential of our project area, which would add significant value to the project, at a time when demand for uranium continues to grow and there is appetite to bring new projects to market.”

This article was developed in collaboration with Power Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.