Nuclear power rises with shifting political tides

Mining

Mining

Uranium producers are back in the spotlight as both the US and UK look to nuclear power to fuel their transition to a zero emission economy.

In the US, pro-nuclear candidate Joe Biden’s nail-biting win over incumbent President Donald Trump is paving the way for the Democrats to introduce their US$2 trillion climate change plan.

That will see the economic superpower wean itself off fossil fuels with deep investment into both renewable and nuclear power, a move expected to do more to support the US nuclear industry than any of the past five administrations.

Meanwhile UK Prime Minister Boris Johnson is expected to release a 10-point plan for getting the country to net zero emissions by 2050, with nuclear widely reported to play a key role in the nation’s new energy mix.

Mr Johnson has been a vocal supporter of nuclear power throughout 2020, initially flagging his support for the sometimes controversial power source back in April.

Domestically there has been little change in energy policy, but Biden’s declared commitment to rejoin the Paris Climate Agreement – pledging to keep global temperatures from rising 2 degrees above industrial levels – is expected to put pressure on Australian politicians to step up their climate commitment.

Meanwhile small modular reactors – the same nuclear technology flagged by Biden – were outlined in the “watch brief” of Energy Minister Angus Taylor’s New Technology Investment Roadmap released in September.

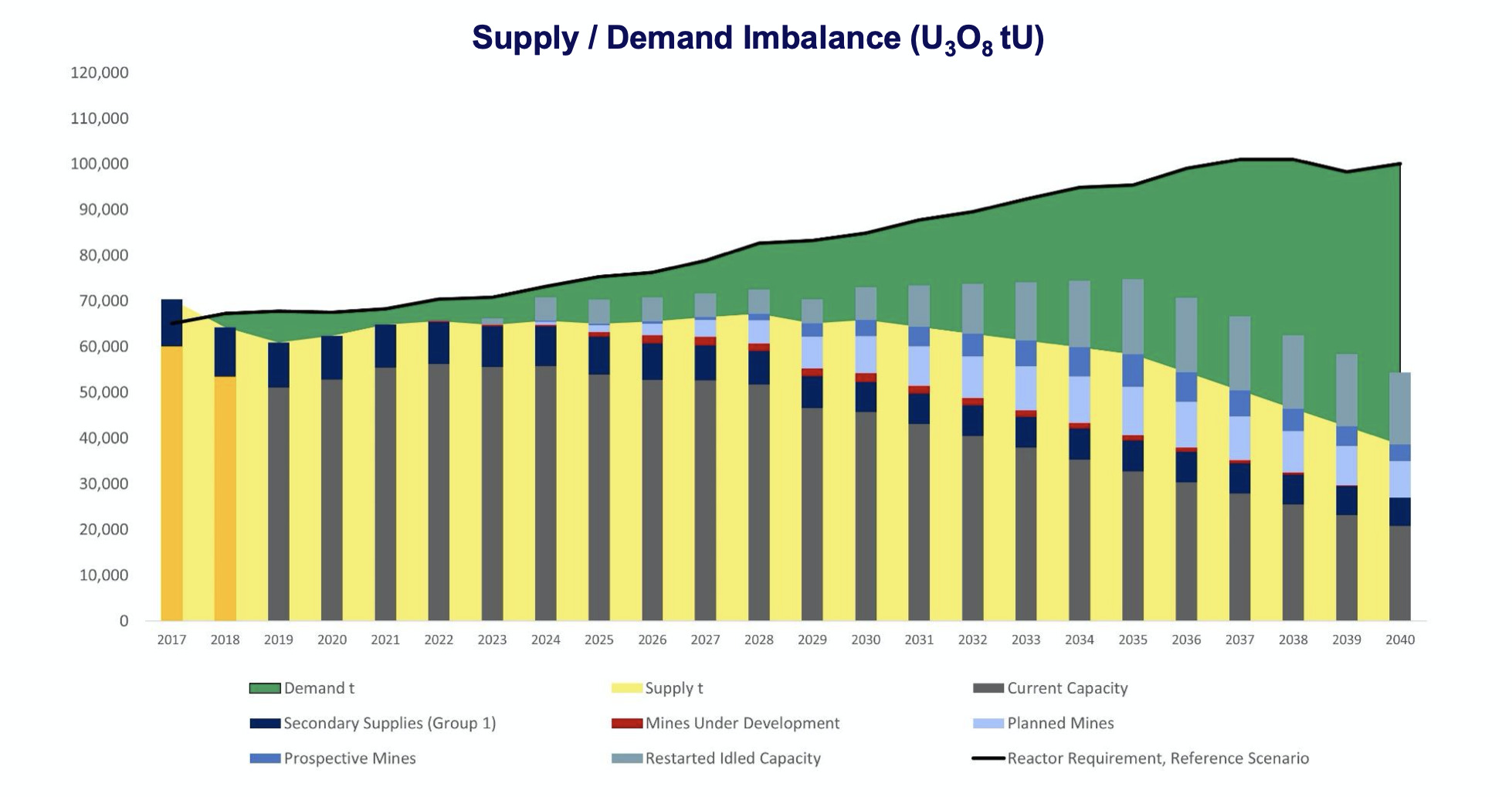

This political shift is unfolding against a backdrop of rising uranium prices (up from US$23.70 per pound in March to around US$30 today) as the growing demand for yellow cake outstrips supply.

Since the 2011 Fukushima quake and tsunami destroyed a Japanese nuclear facility and forced the closure of the rest of the country’s fleet, a glut of excess fuel has kept a lid on prices.

Canadian firm Cameco – one of the largest uranium producers globally – even resorted to buying uranium from other miners as it was more economical than digging it out of the ground themselves.

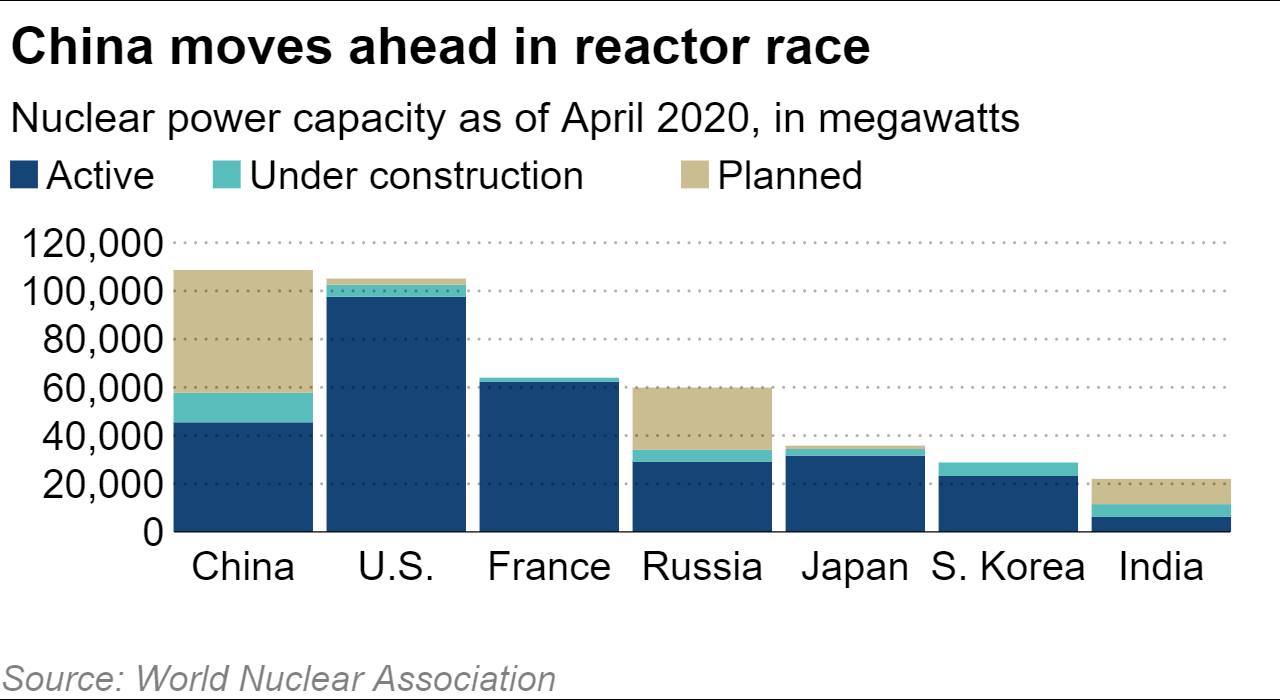

But in the nine years since, India and China have both ramped up their use of nuclear power, with the latter presently building 15 more generators (placing it on track to overtake the US as the leading user of nuclear power).

Both the UK and the US are now poised to join this surging demand for fissile material, at the same time that leading Kazakhstan producer KazAtomProm has announced a 20 per cent cut in production until 2022 in the wake of COVID-19.

This confluence of factors means a market which has long been in oversupply is likely about to fall rapidly into undersupply, according to Arnott Capital portfolio manager Kenny Arnott, which he says will create extreme changes in the uranium price.

“If you just think about it intuitively what happens when a commodity market goes into oversupply, you have a whole number of producers that ultimately end up at an operating cost well above where they’re selling, so they go out of business or they go into care and maintenance,” he said.

“And you get a whole lot of buyers, in this case utilities purchasing uranium, who get very comfortable buying very cheaply.”

Arnott said this presents an asymmetric investment opportunity, where the upside potential, on paper, appears to outweigh the downside risks.

While the past decade has been difficult for uranium explorers, Biden’s victory in last week’s ballot box battle does hold promise for a handful of locally-listed businesses, as previously reported.

The shift in political attitudes comes as Australian explorers look to further advance their projects, with Marenica Energy (ASX: MEY) currently mapping a 30km stretch of mineralisation in Namibia.

The recently discovered site is part of the company’s 94.4 million pound resource holdings across Australia and Namibia; the company is the largest exploration rights holder by land size in the latter.

The company also recently completed proof-of-concept testing on a new beneficiation process – developed in conjunction with the CSIRO – at its Angela project in the Northern Territory.

Those tests indicated a reduction in acid consumption in the uranium extraction process of up to 77 per cent, down from 104kg of acid per tonne of ore, to 24kg.

This article was developed in collaboration with Marenica Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.