Notorious DLE: The lithium extraction technologies gunning for the crown

Mining

The strong demand and significant investment in lithium over the past few years has driven a wave of direct lithium extraction (DLE) technologies, designed to maximise the potential of lithium projects.

As it stands, the world is facing a lithium supply crunch that will see demand rising from 500,000t of lithium carbonate equivalent (LCE) in 2021 to 4Mt in 2030.

To help meet the shortfall, producers, miners and service providers are turning to a range of different DLE technologies to produce cheaper, higher quality, and more environmentally friendly lithium by tapping salty brine deposits that the US Geological Survey estimates to contain roughly 70% of the world’s lithium reserves.

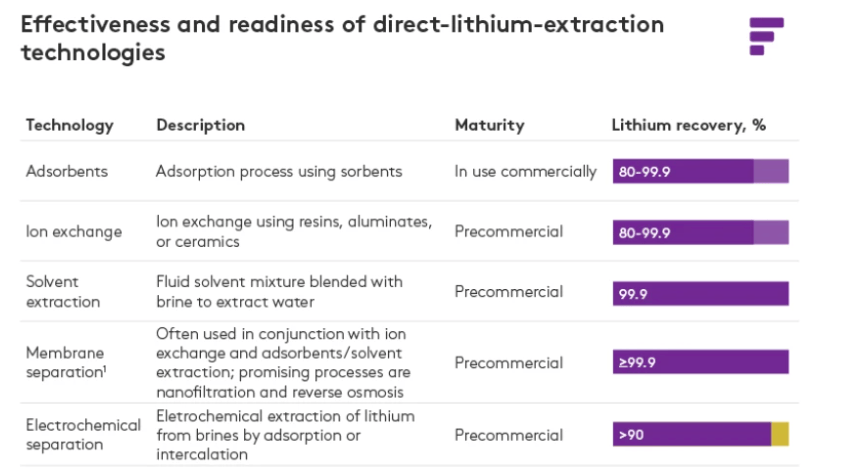

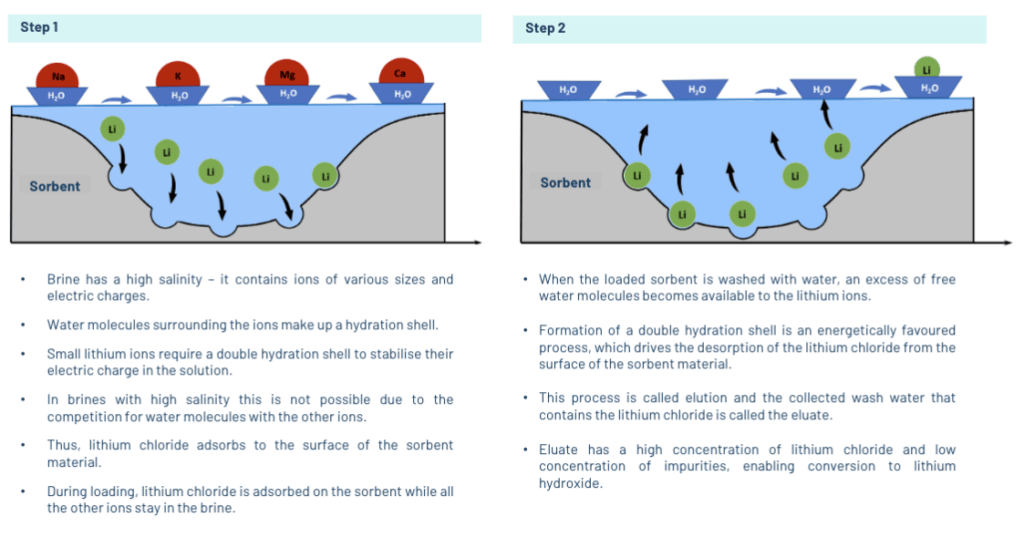

Instead of concentrating lithium by evaporating brine in large pools, DLE technologies aim to extract about 90% or more lithium through different methods, the most common of these being sorption (also known as adsorption), ion exchange, and solvent extraction.

While many of these DLE technologies are so far unproven, adsorption-DLE has a 50-year development and implementation history with the technology being used at commercial scale by global top three lithium producer, Livent, for 26 years at the Fenix lithium mine in the Salar del Hombre Muerto in Argentina, South America.

Livent, set to merge with Allkem (ASX:AKE) later this year, is currently in the process of increasing lithium carbonate production by over 400% at Fenix.

It developed its adsorbent DLE tech in-house during the 1990s based on intellectual property adapted from Dow Chemical.

Their sorbent is used to extract lithium chloride from brine before evaporation ponds remove water from the lithium concentrate produced by the DLE process.

Lithium is then shipped to Livent’s chemical plant for conversion into other lithium chemicals.

Currently ~10% of global lithium production comes from DLE projects in China and South America but commodity price provider, Fastmarkets, sees this number jumping 30% by 2030.

The world needs abundant, low-cost lithium to have an energy transition and experts believe DLE could help in meeting that goal.

As well as international mining companies, the potential game-changing technology has found its way into the hands of a handful of ASX companies, some of which hold ambitious plans to begin production between 2024–2026.

Dual Australian and Frankfurt listed Vulcan Energy Resources’ (ASX:VUL) promises to use its own proprietary alumina-based adsorbent, VULSORB, at its zero carbon lithium project in Germany’s Upper Rhine Valley.

The project, which has been in development since 2018, is now heading into the execution phase with its Phase One commercial operation targeting 24,000tpa of lithium hydroxide production to supply its offtakers including automakers Stellantis, Volkswagen and Renault.

While current DLE producers use gas to heat the brine, Vulcan’s project – and major point of difference – uses geothermal brine that is already naturally heated, with excess heat used to generate renewable energy.

Vulcan also uses process equipment to concentrate lithium, instead of concentration ponds to speed up the production time and reduce water usage.

$166b market cap company Rio Tinto (ASX:RIO) is also using a proprietary adsorbent at its Rincon lithium brine project in Argentina.

RIO, which has an MOU with Ford, acquired the project in 2022 for US$825m and has started construction on a 3,000t per year plant to produce lithium carbonate beginning in 2024.

Over in Utah, Anson Resources (ASX:ASN) has completed a DFS using the Sunresin patented adsorption DLE method and has tested the purity of lithium battery material at the Paradox lithium project at 99.95%, indicating longer battery lifespan.

Sunresin’s DLE technology has been commercialised with four operating projects and a further six under construction or under contract in China and South America with a total production capacity of 73,000tpa.

ASN is also operating a sample demonstration plant at its lithium innovation centre in the US, which is already producing lithium carbonate.

At this stage, Anson’s DLE process can recover 91.5% of lithium from the brine but the company believes it can improve that further before going into production in 2025.

And Lithium Energy (ASX:LEL) could be producing lithium by early 2025 – albeit in limited quantities – under an agreement it reached with China’s Xi’an Lanshen New Material Technology.

Under the deal, Lanshen will construct a demonstration plant using its proprietary sorbent-based direct lithium extraction to produce up to 3,000tpa of battery grade lithium carbonate at the company’s Solaroz lithium brine project, which is next to Allkem’s (ASX:AKE) lithium production facility in Argentina’s Salar de Olaroz basin.

Lanshen will fund at their sole cost, the engineering and design, construction, transportation, assembly, commissioning and initial operation of the plant.

Commissioning is targeted for the second half of 2024 subject to the receipt of all local approvals and permits.

DLE technologies vary but VUL executive chairman Francis Wedin says adsorption-type DLE has similarities to legacy oil and gas projects in that they include piping networks, as well as both ‘upstream’ and ‘downstream’ integration and a chemical refining and water treatment step.

“All of this lends itself to oil and gas expertise rather than mining expertise, which is why we employ former Shell, Santos, and Woodside people who have worked on large scale LNG or oil and gas projects,” he says.

“At the same time, these oil and gas companies are now heavily investing into adsorption type DLE technology in North America and other places around the world.”

Exxon Mobil has acquired an adsorption type project in the Smackover Formation of Arkansas, Koch Industries has invested into adsorption type DLE with Compass Minerals International (CMP.N) and Chevron has also announced its exploring opportunities to enter the space.

“It’s an interesting area, the lithium industry is evolving rapidly and while hard rock has had a good run, going forward you’ll see a dramatic increase in market share from these sustainable lithium projects.”

But investors still have a lot to learn when it comes to DLE, with the term commonly used to capture technologies that are still in the R&D phase.

“What’s happened so far is there has been a lot of juniors entering the space slapping a ‘DLE’ badge on their projects and expecting to get a market uplift on that basis,” he says.

“Usually these companies don’t differentiate either, they just say they are using ‘DLE’ technology, which is hard for investors to understand.

“It’s also not helpful because then you get articles claiming the technology isn’t proven.

“And that’s not the case – roughly 10% of global lithium production comes from DLE projects in China and South America.

“There’s about five or six commercially producing projects in China alone, accounting for 80,000 tonnes of production.

“The lithium market is still really small, we’re up to 1 million tonnes of global lithium production, and it takes longer to build these projects than it does a hard rock mine.

“But a lot more are being built so there will be an exponential rise in the production from these projects in years to come.”

Other forms of the tech include ion exchange systems which separate ionic contaminants from a solution through a physicochemical process where undesirable ions are replaced by other ions of the same electrical charge in order to recover pure lithium.

And solvent extraction, which is where lithium is captured either chemically or physically to transform it into lithium chloride or pure lithium.

AZL’s acquisition at the end of 2022 also came with its own proprietary DLE tech, the Prairie Lithium Ion Exchange, which selectively extracts lithium from brine, using equipment which is anticipated to be readily available at commercial scale.

AZL managing director Paul Lloyd says the company is moving forward with Phase 3 and the installation of a larger, third party DLE pilot plant in Saskatchewan, planned for November 2023.

“This third phase aims to provide valuable information on the potential functioning of a commercial DLE facility at the Prairie project and follows on the first two highly encouraging phases of offsite testing using the selected DLE technology.”

Earlier this year, Lake Resources (ASX:LKE) and DLE tech partner, Lilac Solutions, announced the production of 2,500kg of lithium carbonate equivalent (LCE) at the Kachi project in Argentina’s Catamarca province.

Based on this result, Lilac increased its ownership of Kachi from 10% to 20%.

The company has been working hard at proving up its ion exchange DLE technology through field testing which processed 4Mt of brine and 20,000l of eluate.

“This work supports the phased approach to first commercial lithium production from 2H 2027, with a targeted plant capacity of 25,000 TPA of battery grade LCE by 2028, and targeted plant capacity of 50,000 TPA battery grade LCE from 2030,” LKE CEO David Dickson says.

QXR recently raised $3m to carry out drilling activities at the Liberty lithium project, where it holds a 75% stake.

It is one of the largest project areas in the US and is analogous to Albermarle’s nearby Silver Peak deposit, currently the only significant lithium producer in the country.

Like Silver Peak, QXR says Liberty could be a large-scale, producing lithium brine asset.

The company has an indicative development plan involving drilling, sampling, and testwork starting with two permitted drillholes in the main part of the surface lithium anomaly in November-December.

Large volumes of lithium brines, if encountered, will be submitted for testwork with various DLE providers.

Pantera Minerals has a foot in one of the world’s hottest lithium brine regions, Smackover in the US, after securing a 35% stake in the Superbird project.

Pantera will invest $2m in private Australian company Daytona Lithium for a 35% stake in Superbird, which contains 5,325 acres of brine prospective ground within the Smackover Formation, with a further 7,000 acres currently under negotiation.

This is supported by a two-tranche placement of 28,571,429 shares at 7c per share to raise the $2m to fund the stake in Daytona.

DLE ASX stocks share price today: