You might be interested in

Mining

Norfolk Metals is running the ruler over the Las Alteras uranium project in Argentina

Mining

Join the big wigs in Adelaide for Resources Rising Star’s inaugural Gather Round investor conference

Mining

Mining

Norfolk Metals is gearing up to list this week, and executive chair Ben Phillips says the company offers shareholders both uranium and gold exposure – with the Orroroo uranium project in South Australia and the Roger River gold project in Tasmania.

“We’re very different to some other micro-cap entries to the ASX; Norfolk has two projects with drill-ready targets prospective for gold and uranium,” he said.

“We’re in a trusted jurisdiction – being Australia – and we expect to have completed two consecutive programs within 12 months.”

It’s great timing to get into uranium. The spot price hit US$60/lb earlier this month, which is the magic number a lot of aspiring developers use to justify the profitability of their future operations.

It came as the US looks to ban its nuclear power plants from buying enriched uranium from Russia, but also off the back of broader sentiment shift to the role of nuclear power in helping the world reach net zero goals.

And the projected shortfall is massive. There’s been limited exploration over the past 10 years due to low commodity prices, and the largest exporter in Kazakhstan, Kazatomprom, is extending production cuts into 2023.

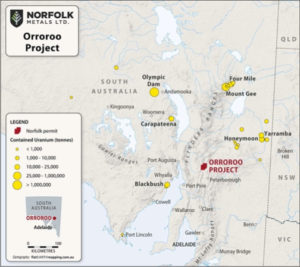

At the Orroroo project, exploration will kick off to further understand the Gamma anomalies identified within historical hydrocarbon drill holes by Linc Energy in 2010.

In fact, Norfolk Metals (ASX:NFL) is basing their exploration strategy on an emerging targeting model for roll-front uranium, which is amenable to low cost in-situ recovery methods.

“Similar to Kazakhstan proven exploration models and Alligator Energy’s (ASX:AGE) Big Lake asset in South Australia, it’s a model based on investigating known hydrocarbon, coal and oil basins,” Phillips said.

“The Orroroo projected is located in the Walloway Basin in an area with known hydrocarbon occurrences. The model is based on the region being a basin, hydrocarbons being an important chemical trap to mobile uranium combined with the historical Gamma readings.”

“Any findings that could lead towards potentially economical uranium within the permitted area would be an excellent outcome for the company.”

At Roger River, the company is planning 2,000-3,000m of diamond drilling at Roger River with the aim of identifying epithermal gold occurrences in targets defined from ground-based gravity and airborne aeromagnetic survey.

“The Roger River Project is 7km long, 26sqkm area, and the previous vendors spent over $500,000 drilling, doing IP lines, c-horizon soil sampling and mapping,” Phillips said.

And these vendors know what they’re doing when it comes to epithermal gold. They’re also founders and management of Medusa Mining (ASX:MML), which has the Co-O epithermal gold mine in the Philippines on track to produce 90,000 to 95,000 ounces for FY21.

“Our plan is to get a rig over to Tasmania and move straight into diamond drilling in Q2 of this year,” Phillips said.

“The new geophysics will allow targets to be defined and the drill bit will answer the query over the fault.”