Norfolk Metals is running the ruler over the Las Alteras uranium project in Argentina

Norfolk Metals has expanded its uranium portfolio. Pic: Getty Images

- Norfolk Metals to acquire the Las Alteras uranium project in Argentina

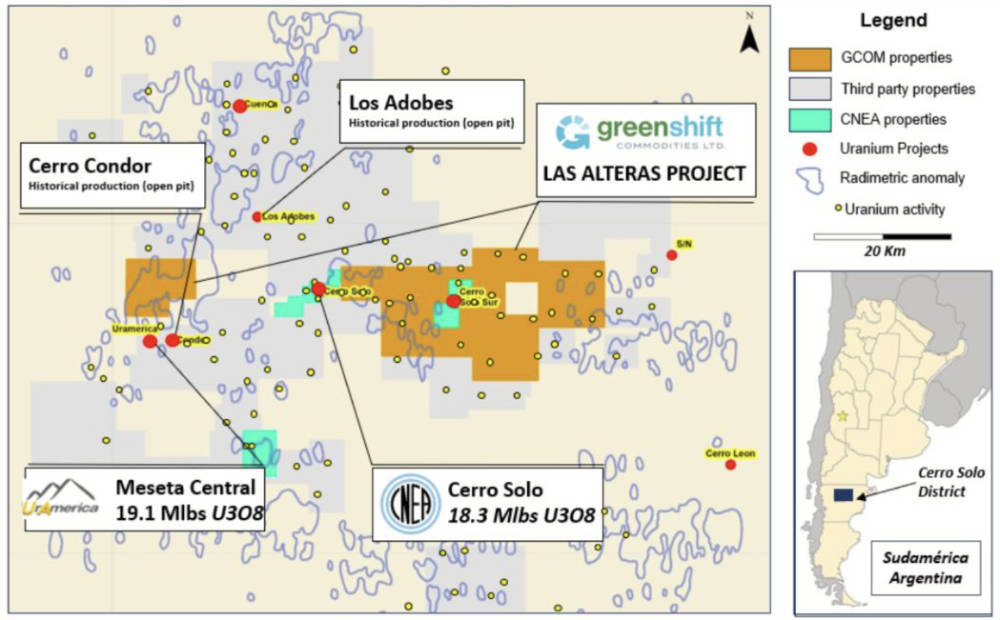

- Project is surrounded by uranium deposits such as the 19.1Mlbs Meseta Central and the 11.49Mlbs Cerro Solo

- Company has raised $415,746 through a share placement to strategic uranium investors

Special Report: Norfolk Metals is looking to bolster its uranium portfolio with the intriguing Las Alteras project, which is surrounded by several large +10Mlb deposits and historical mines in Argentina.

Keeping the ongoing structural uranium supply deficit in mind, NFL’s move to acquire the Las Alteras project makes excellent sense.

Las Alteras is surrounded by UR Americas’ Meseta Central deposit (19.1Mlbs eU308), CNEA’s Cerre Solo deposit (11.49Mlbs U308) and ISO Energy’s Laguna Salada deposit (10.1Mlbs U308 as well as the historical Cerro Condor and Los Aodobes uranium mines.

Norfolk’s takes a view that as the uranium market continues to evolve globally it is the Chubut region of the San Jorge Basin hosting the renowned government owned Cerro Solo deposit presents an exceptional opportunity to diversify and grow the Company.

The addition of the Las Alteras project suite will allow Norfolk to progress the appointment of Key Management Personnel and advisors.

Argentina is a growing uranium consumer

Argentina currently has no domestic uranium production despite having three operating nuclear reactors with small modular reactors currently under construction.

“Norfolk has exclusivity for an exceptional project in Argentina where we expect to see an increase in positive sentiment from government, uranium explorers and investors throughout 2024,” executive chairman Ben Phillips said.

“Las Alteras is surrounded by multiple uranium deposits to the east, west and south with historical mines located to the north and south.”

“It has been proven in previous uranium bull markets the sentiment towards Argentina increases exponentially as money is made in tier one jurisdictions not to mention the level of activity around nuclear power in Argentina and the fact they are importing pounds from Kazakhstan.”

Acquisition terms and placement

NFL has paid the vendor $30,000 for a 75-day exclusive right to complete technical, financial and legal due diligence as well as negotiate terms and conditions of a formal legally binding agreement for the proposed acquisition.

Under the indicative terms of the proposed acquisition, the company will pay Green Shift Commodities C$300,000 in cash and 6 million NFL shares to acquire Las Alteras.

It will grant the vendor a 1% net smelter royalty over all minerals extracted from the project.

Additionally, the company has received firm commitments from strategic professional and sophisticated investor for a placement of 2.77 million shares priced at 15c each to raise $415,546.45 before costs.

This represents a 2% premium to the company’s 10-day volume weighted average price prior to entering a trading halt on 12 April.

Orroroo Uranium Project in South Australia

The company is also exploring its Orroroo uranium project in South Australia, which consists of two granted exploration licences covering 723km2 in the Walloway Basin.

Orroroo is hosted in sediments of the same age as the Frome Embayment that hosts the third-party Honeymoon and Four Mile deposits.

Drilling by Norfolk Metals (ASX:NFL) at Orrorroo has delineated further uranium across broad scale targets, validating its paleochannel model of uranium mineralisation.

It also identified prospective uranium-bearing floodplains, which will guide future exploration.

This article was developed in collaboration with Norfolk Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.