Boss Energy’s Honeymoon restart is a signpost for South Australian uranium hopefuls

Boss Energy has painted a clear path for uranium juniors to follow. Pic: Getty Images

Uranium sentiment remains positive with the energy metal trading close to US$90 per pound in April thanks to expectations that long-term demand will remain strong and concern about near-term supply.

This has fuelled a flurry of activity in every location known to have uranium mineralisation, such as South Australia, which hosts nearly a quarter of the world’s uranium resources and major deposits such as Olympic Dam – the world’s largest uranium deposit, Four Mile and Yarramba.

However, all this activity – be it exploration, appraisal or studies – pales in comparison to actually producing yellowcake, which is exactly the pivotal milestone that Boss Energy (ASX:BOE) achieved earlier in April when it produced the first drum of uranium from its Honeymoon project following a successful commissioning process.

This is a key part of the successful commissioning process at the project, which will see production ramp up to ~2.45 million pounds (Mlbs) of U3O8 per annum.

To top it off, project metrics such as recoveries of loaded resin in the IX column are already exceeding feasibility study forecasts, proving that BOE’s decision to adopt the new processing technology was the right one.

BOE’s restart of Honeymoon will focus on the 36Mlb U3O8 resource at the main mining centre and the high-grade Jason’s satellite deposit that hosts a resource of 10.7Mlb at 790ppm U3O8.

An encouragement for juniors

For the host of uranium juniors in South Australia, BOE’s re-entry into production provides a clear signal that moving from exploration to production is entirely within reach.

Speaking to Stockhead, Adavale Resources (ASX:ADD) executive director David Riekie said BOE’s achievement was not only a milestone for the larger company, it also served as a positive signal and clear pathway for junior uranium explorers to both explore and mine uranium in this region.

“The entry of Boss Energy into production serves as a first signal and you should expect a noticeable uptick in exploration activity over the coming months and beyond. The favourable uranium price environment driven by supply deficits, provide an additional tailwind,” he added.

“Adavale with its ~2000 sqkm licence holding is well positioned to capitalise on these trends”

Riekie noted that South Australia has long been a preferred destination for uranium mining and that there is now limited availability of exploration ground available over paleochannels that are expected to host uranium mineralisation.

He also touched on the use of in situ leach techniques for mining uranium, noting that it is a lower cost mining method that targets the uranium-rich, buried paleochannels.

“Boss and our neighbours at Heathgate (Beverly/Beverly 4 Mile) have successfully used ISL and importantly this method, has been recently approved and is supported by the South Australian government,” he added.

South Australian uranium juniors

So just who are some of the juniors that are hoping to be the next to make the transition towards uranium production?

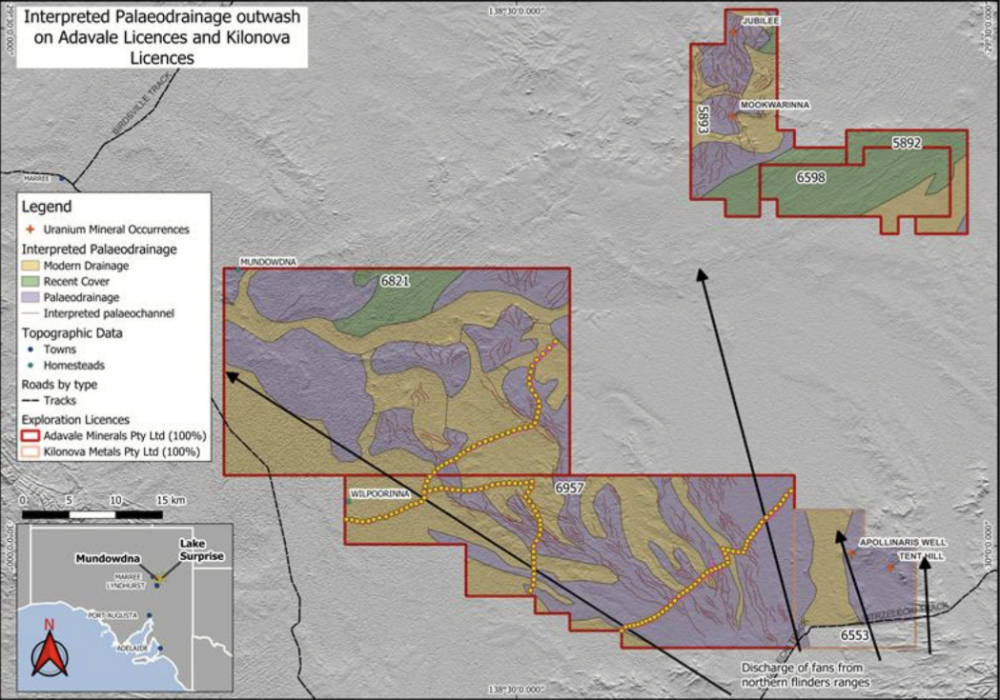

Riekie’s Adavale has a package of six licences covering 2058km2 in the northern Flinders Ranges, a region that has seen a lot of interest due to being covered extensively by the much sought after paleochannels and paleovalleys that are known to host significant sandstone-uranium deposits.

The company recently completed maiden uranium exploration at its Mundowdna (EL6821) and Mundowdna South (EL6957) uranium licences where historical airborne electromagnetic survey data had already interpreted as hosting an extensive series of covered paleochannels.

ADD’s exploration program, which came in ahead of schedule and under budget, had included gravity surveying to map subtle density contrasts that potentially reflect buried palaeochannel systems and a gamma spectrometer survey to quantify surface radiation levels.

It also included soil sampling, which can measure very low levels of uranium and other indicator metals at surface, and rock chip sampling to quantify uranium levels within known regional anomalies.

Geophysical data is being processed and assays from sampling are expected in early June.

The company will identify and rank correlating anomalies before starting the process to secure clearances for targeted drilling across multiple areas.

Koba Resources (ASX:KOB) has an 80% interest in the 5100km2 Yarramba project that is 120km southeast of the longstanding Beverley mine and immediately north of BOE’s high-grade Jason deposit.

Between 2005 and 2012, the previous owner drilled more than 100,000m into the project and delineated a JORC 2004 resource of 8.2Mt at 260ppm U3O8 for 4.6Mlb at the flagship Oban deposit.

Curnamona was subsequently acquired by Havilah Resources (ASX:HAV), which left the project largely untouched – a state of affairs that KOB intends to change once it completes its transaction with Havilah, which will see it issue 25 million shares as consideration for the 80% stake in the project.

It has appointed well-known uranium geologist Mark Couzens as its new exploration manager to oversee planned drilling later this year into both Oban and the Mt John prospects and has submitted applications for a heritage survey to be completed soon.

Also close to the Jason deposit is Marmota’s (ASX:MEU) Junction Dam uranium project which already hosts a 5.4Mlb resource at an average grade of 557ppm U3O8 at the Saffron deposit.

Earlier stages of a four-part review led by Couzens had highlighted two Namba Formation paleochannels with uranium mineralisation at the base of the channel, similar to Heathgate Resources’ Beverly uranium mine, as well as two Eyre Formation paleochannels while identifying an extensive and intriguing paleochannel at the Yolanda prospect.

The final stage that focused on the northwest corner of Junction Dam identified a new high-priority uranium exploration target immediately adjacent to Jason.

State gravity imagery was used to identify potential extensions of the uranium-carrying Jason paleochannel while the review also found the depression that Jason and Jason South sit in continues into the Marmota tenement.

Norfolk Metals (ASX:NFL) holds the 659km2 Orrorro project about 274km northwest of Adelaide that contains the same age sediments that host Honeymoon and Four Mile, giving it the same potential for ISR uranium mining.

Recent Phase 2 drilling validated its paleochannel model of uranium mineralisation by identifying prospective uranium-bearing floodplain, which could guide future exploration.

It also indicated that a close spatial relationship appears to exist between the intensity and thickness of the limonite units and the gamma anomalies as the company gets closer to a possible uranium bearing paleochannel, providing it with a very important vector for exploration.

Additionally, the drilling indicated the primary target model remains a Beverley-type uranium model where the highest grades of uranium are expected to be located at the base of the incising part of the palaeochannel with lower uranium grades seen in the floodplains.

Meanwhile, Power Minerals (ASX:PNN) recently expanded the uranium footprint of its Eyre Peninsula project by picking up the Whichelby (EL6961) licence that covers a large portion of the palaeo-drainage that flows west.

The company plans to use modern aircore drilling in combination with advanced Vanta pXRF analysis to obtain real-time, on-site uranium values at the new licence where the required approvals are already been sought.

First pass drilling will also be carried out at the existing Cungena licence (EL6681).

At Stockhead we tell it like it is. While Adavale Resources, Koba Resources, Marmota and Norfolk Minerals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.