Mongolian CBM foray could see Talon give Elixir a run for its money

Mining

Mining

Success in Mongolia’s emerging coal bed methane (CBM) industry could propel Talon closer to the likes of rising peer Elixir Energy.

Talon Petroleum (ASX:TPD) recently made its foray into the growing CBM industry in Mongolia with the securing of an option to take a stake in a soon-to-be-granted production sharing agreement (PSA).

The agreement was struck with Telmen Resource JSC and gives Talon the right to earn a 33 per cent stake in a PSA over the Gurvantes XXXV Field, located onshore Mongolia.

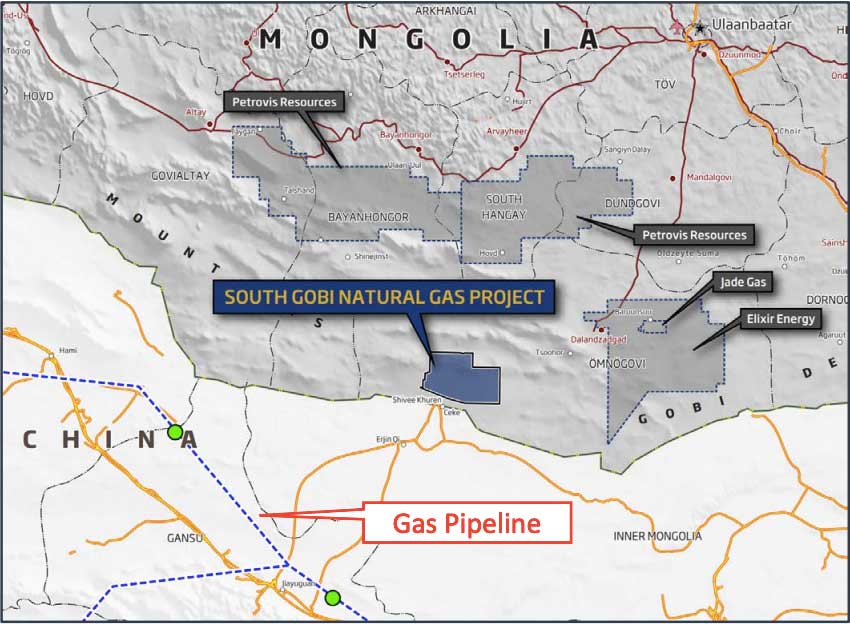

Elixir Energy (ASX:EXR) is also active in Mongolia, with a large 30,000sqkm CBM permit in the south of the country.

When Talon first announced it was entering the lucrative Mongolian CBM industry in February, Elixir had a market cap of around $130m. But shares have been on a tear in recent weeks and Elixir’s market value has rocketed to over $300m.

Elixir’s share price has spiked as much as nearly 230 per cent in that time, notching a new 52-week high of 51c – a good indicator that investors are definitely keeping a close eye on the Mongolian CBM players.

Talon has also witnessed strong investor interest with the addition of a Mongolian CBM play to its portfolio, with shares now double what they were before the news was announced.

Talon Petroleum (ASX:TPD) share price chart

But there’s still plenty of share price upside to come, with Talon having a number of advantages when it comes to its Mongolian CBM project.

The PSA that Talon can earn a 33 per cent stake in covers a significant area of 8,400sqkm in what is considered one of the most prospective basins for CBM globally.

Gurvantes XXXV is situated less than 20km from the Chinese-Mongolian border and close to the extensive Northern China gas transmission and distribution network.

Another plus for the project is it is the closest of Mongolia’s CBM projects to China’s West-East Gas Pipeline. It is also proximate to several large-scale mining operations with high energy needs.

This means Gurvantes XXXV is ideally placed for future gas sales to satisfy both local Mongolian, and Chinese, energy requirements.

Initial work program operations at Gurvantes XXXV are expected to begin as soon as possible following the granting of the PSA.

Work will include the drilling of at least four core holes where important data will be gathered to confirm gas contents and understand permeability — one of the last remaining technical parameters to be understood at the project.

The other differentiator is that Talon also has highly prospective assets in Western Australia’s gas rich Perth Basin and the UK’s North Sea, whereas Elixir is solely focused on Mongolian CBM.

The Perth Basin has become a hot bed of activity and is shaping up as Western Australia’s answer to a looming gas shortage with continued success by Strike Energy (ASX:STX) at West Erregulla.

Earlier in April, Strike delivered better-than-expected results from the drilling of the West Erregulla 4 well with its thickest intersection of the Kingia Sandstone in the Perth Basin to date at 155m.

Strike is also Talon’s partner in the Walyering prospect in the Perth Basin that is next on the agenda to be drilled later this year once Strike has finished its campaign at West Erregulla.

At the start of this year, Talon expanded its Perth Basin acreage with a deal to acquire a 100 per cent interest and operatorship in the area covering the Condor structure (formerly Muchea) with Macallum Group.

The structure of the transaction allows Talon to undertake low-cost initial exploration work to better define the potential at Condor while progressing towards and during drilling at Walyering.

Early indications are that Talon’s Condor prospect could deliver up to 10 times the gas resources the company is targeting at Walyering.

In mid-March, the company released initial estimates of the recoverable prospective resources at its Condor prospect, showing the potential for up to 710 billion cubic feet of conventional gas resources.

This means Condor could be the Perth Basin’s largest untested wet gas structure.

Things are also hotting up in the UK Central North Sea (UKCS), where Talon late last year won three new licences.

The North Sea is a marginal sea of the Atlantic Ocean located between the UK, Denmark, Norway, Sweden, Germany, the Netherlands, Belgium and France.

But the region is highly prospective for oil and gas, especially the UKCS.

Talon now holds interests in eight exploration and appraisal licences in the UKCS.

A key part of the company’s strategy is to acquire low-cost licences while it continues to field strong interest from potential farmout partners.

According to Wood Mackenzie, UK North Sea deals are booming, surpassing 2020 levels just two months into the year.

“The latest acquisitions continue what has been a blockbuster start to the year for UK M&A with buyers (and sellers) buoyed by the recent recovery in prices,” Wood Mackenzie analysts Neivan Boroujerdi and Lucy King said in early March.

“Just over two months into 2021 and UK disclosed deal spend has reached $US2.7 billion, already surpassing last year’s total, making it one of the hottest markets globally.

“We estimate up to another $US5 billion worth of assets could change hands this year.”

This article was developed in collaboration with Talon Petroleum, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.