Miners benefit from budget tax cuts to the tune of billions of dollars

Mining

Mining

Capital-intensive mining and mining services companies are clear winners in Treasurer Josh Frydenberg’s budget as they will benefit from billions of dollars in instant tax write-offs for new equipment and tax offsets for business losses.

The Treasurer’s budget measures aim to encourage massive business investment to support job creation through generous tax relief.

“In our focus areas, we see clear winners among construction and mining services businesses, particularly those with greater capital intensity,” said stockbroker Argonaut Securities in a research note.

Two budget measures are beneficial to mining companies and those providing mining services; tax deductions for new capital investment, and the ability to offset losses against previous years’ profits for tax purposes.

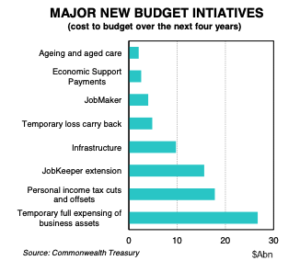

Together both measures will cost the government $31.6bn over the next four years, twice the cost of extending JobKeeper scheme payments for another six months to March 2021 for 3.5 million people.

Businesses with a turnover of up to $5bn will be allowed to claim the full cost of depreciable assets – without any limit on their value – for tax purposes until June 30, 2022.

“Which will encourage and be of immediate benefit to capital intensive businesses and, or those considering investment in property, plant and equipment,” said Argonaut Securities.

This measure will apply to $200bn of potential asset investment and cover 3.5 million businesses that employ 11.5 million workers, said the government in its budget papers.

Full expensing reduces the after-tax cost of assets purchased for a business, providing increased cashflow, and incentivises companies to bring forward investment.

“The government is expecting this initiative to reduce business tax by $26.7bn over the next four years,” said Commonwealth Bank of Australia analysts in a briefing note on the budget.

There are approximately 700 resource companies listed on the ASX, and some larger miners will be ineligible for the tax incentives as their turnover or revenue is too high.

BHP (ASX:BHP) had earnings before tax, interest and depreciation of $US22bn in the 2020 financial year, and its spending on capital and exploration was $US7.6bn, for example.

Some mining services firms such as Emeco Holdings (ASX:EHL) and Perenti Global (ASX:PRN) would meet the tax relief criteria for asset purchases as their annual revenue was below the $5bn cut-off figure.

Emeco’s revenue for the 2020 financial year was $540m, and for Perenti it was $2bn.

Mining services companies with civil engineering divisions also benefit from the government’s increased spending on infrastructure.

Companies with a turnover of up to $5bn will also be able to offset tax losses against previous years’ profits on which tax has already been paid to generate a tax refund.

Called a loss carry-back initiative, this will allow losses incurred by companies in the 2021 and 2022 financial years to count these against profits made in the 2018 and 2019 FYs.

Allowing companies to access their losses earlier by way of a cash refund will increase business cashflow and enable firms to invest with confidence in the future.

“This policy is expected to cost $4.9bn over the forward estimates,” said Commonwealth Bank of Australia in its budget note.

Some good news for mining companies was contained in the budget in terms of the Australian government’s forecasts for commodity prices in the next few years.

“We think that the government’s forecasts for Australia’s key mining and energy commodities in the coming years are too conservative,” said Commonwealth Bank of Australia analysts.

Specifically, the bank’s analysts zeroed in on the government’s forecasts for iron ore and coking coal prices in 2021 and 2022, and for thermal coal and oil prices in years after.

The Treasurer’s budget assumes iron ore will decline in price to $US55 per tonne ($77/tonne), and coking coal prices are forecast at $US108 per tonne ($151/tonne), in the second half of 2021.

“Spot prices are trading well above long-term projections as markets face strong demand from China’s infrastructure-heavy stimulus support. Supply issues in Brazil have also supported prices,” said the bank.

Traded prices for Australian coking coal used in steelmaking have surged to $US140 per tonne, “as demand has increased on the back of rising steel output outside China.”

Currently, iron ore cargoes arriving at Chinese ports are trading at $US123.50 per tonne, according to price assessment company Metal Bulletin.