‘Live long and prosper’: Vulcan has slashed capex, opex costs for its tier 1 Zero Carbon lithium project

Mining

Mining

Special Report: Most lithium project developments are suffering CAPEX blowouts but not Vulcan’s, which now expects lower start-up costs at its Zero Carbon Lithium project with the same production capacity.

China’s move last month to introduce export permits for some graphite products from December has exposed the vulnerability of the ambitious energy transition with much of the world relying on Chinese supply across a range of commodities and products.

To guarantee a secured ecosystem for its battery industry, Europe is going all-in on building its own domestic supply chain of critical battery raw materials with lithium front and centre.

As it stands, the continent boasts zero domestic production of battery-quality lithium hydroxide chemicals. In fact, about 80% of current supply today comes from China.

Vulcan Energy Resources (ASX:VUL) is on a mission to bring the world’s first zero carbon lithium operation online in 2025 to feed Europe’s electric vehicle battery needs, where demand is more than five times the volume of currently confirmed projects.

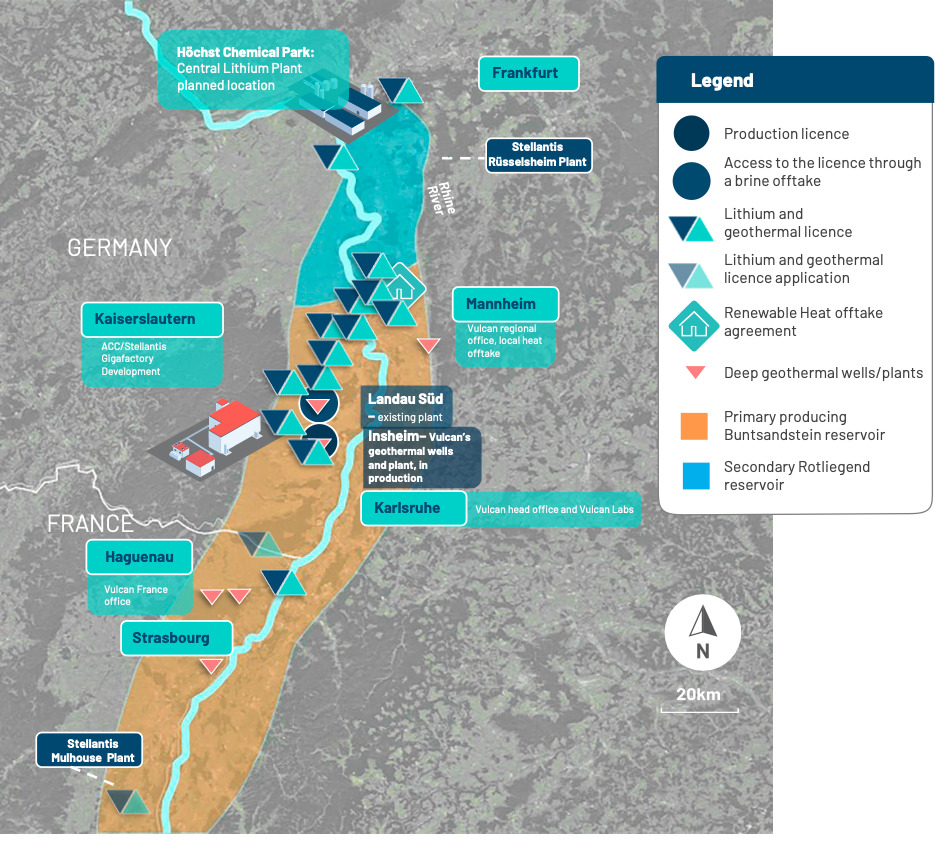

Vulcan’s unique geothermal project – home to Europe’s largest lithium resource at 27.7Mt contained lithium carbon equivalent at 175 mg/L – will produce renewable heat and power as well as enough lithium hydroxide for ~500,000 battery electric vehicles each year in Germany’s Upper Rhine Valley.

A bridging study is a higher-level engineering study and in VUL’s case, designed to secure an engineering, procurement, and construction management (EPCM) contractor for Phase one development, which is targeting 24,000tpa of lithium hydroxide production.

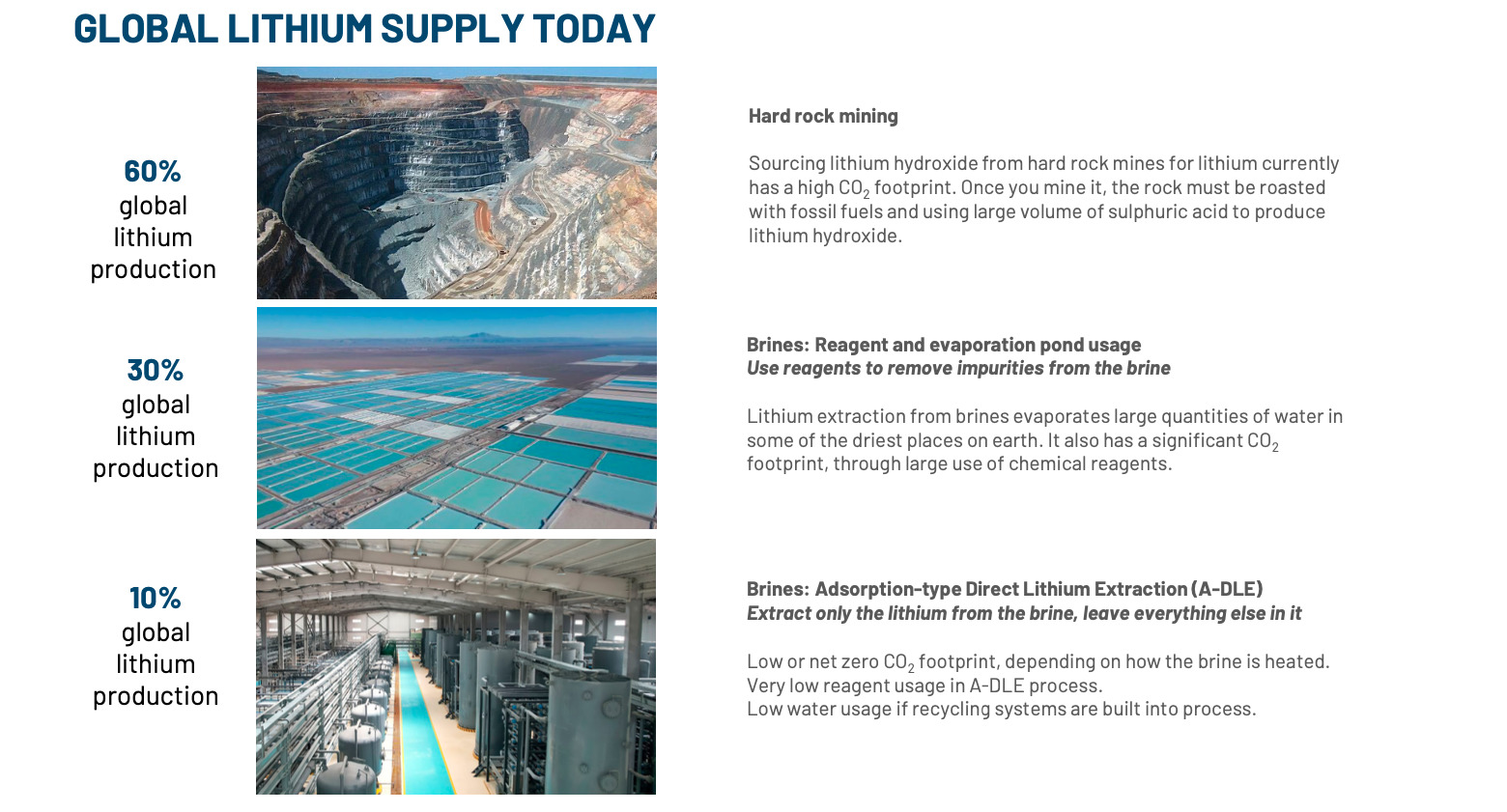

Current DLE producers use gas to heat the brine, but Vulcan’s project uses geothermal brine that is already naturally heated.

The company is targeting the co-production of up to 560 GWh/a4 of baseload renewable heat and the co-production of up to 275 GWh/a of baseload renewable power, which will be sold to grid at Feed-in Tariff rates.

The study has also identified several key value improvements not included in the DFS from February, such as the amalgamation of two planned lithium extraction plants and two geothermal plants into one central plant that is already commercially producing brine.

Not only does this remove the risk factor, but it reduces CAPEX by ~€100m to an estimated €1,399m, VUL says.

A decline in OPEX to an estimated €4,022/t LHM has also been reflected in the study and represents one of the lowest on the industry cost curve, while maintaining green credentials.

“Most projects have CAPEX going up, but we are likely to see ours go down through these value improvements and with the same production capacity,” VUL executive chairman Francis Wedin tells Stockhead.

“We also have one of the lowest OPEX’s in the industry, which means we will be producing at the lowest cost quartiles with stable pricing mechanisms through binding lithium hydroxide offtakes.

“This means the market has discounted us with the rest of the lithium equities when the spot price has been falling.”

It also means there is deep value in Vulcan that has been missed or overlooked, Wedin says.

While the frothiness of the lithium sector in recent times has centred around hard rock plays, there’s an enormous amount of value and upside potential to be found across the sector, especially in the lithium brine space.

Extracting pegmatite lithium from hard-rock ore is expensive, meaning that such deposits are arguably at a disadvantage compared to brine deposits.

The top-20 lithium chemical producers who use hard rock sources all have higher carbon emissions than those using brine sources due to it being a more energy-intensive process.

Lithium brine plays like VUL are undoubtedly trying to get their projects moving as quickly as possible in order to catch the next lithium wave.

Oil and gas players such as Exxon Mobil have also shown an interest lithium alternatives to hard rock deposits, including kicking off drilling of a lithium well in Arkansas with the goal of becoming a leading supplier for EVs by next decade.

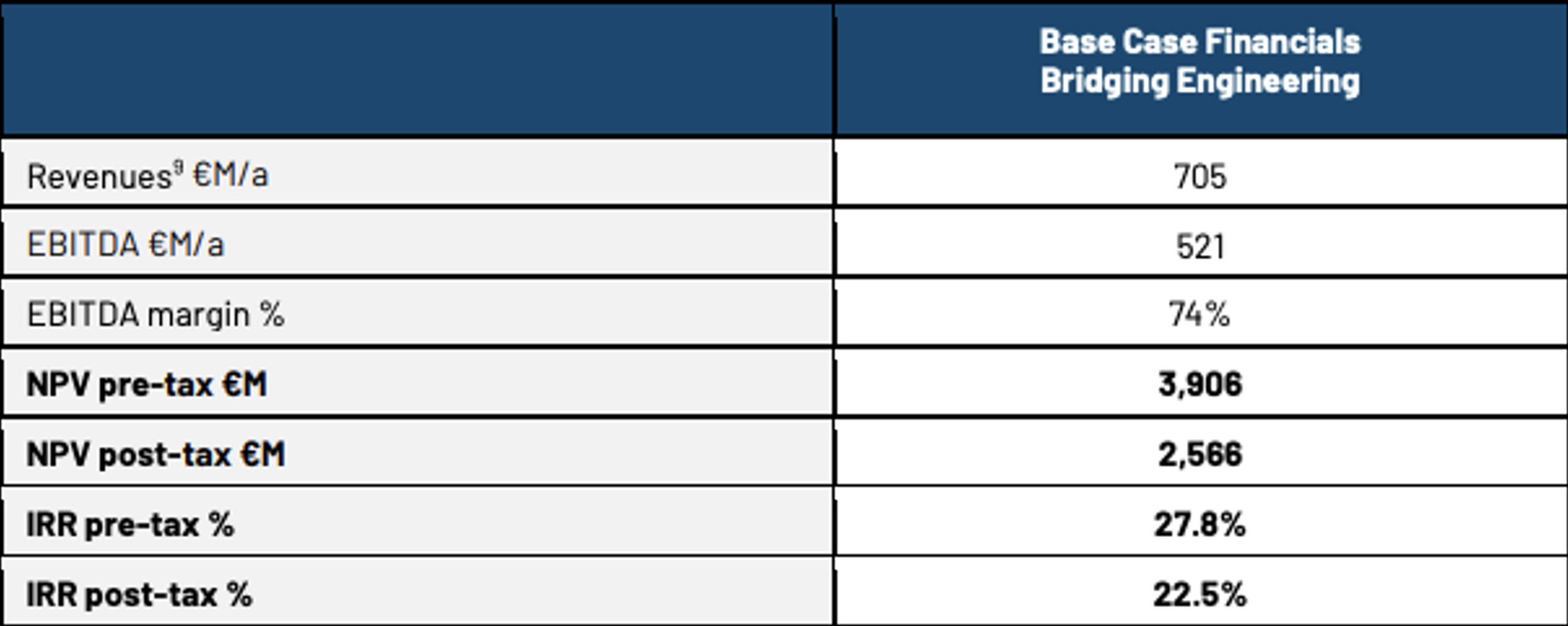

With reduced CAPEX and OPEX estimates comes a better NPV/IRR outcome, which includes an estimated pre-tax NPV of €3.9Bn (A$6.5Bn) and a post-tax NPV of €2.6Bn (A$4.3Bn), despite a cyclical drop in lithium prices.

“Our financials are robust as we have maintained our low-cost position and along with our binding lithium offtake agreements, represent a compelling case in volatile times,” Wedin says.

“Next week, we will formally open our first Lithium Extraction Optimisation Plant, which once in production, will represent the first tonnes of domestically produced lithium chemicals in Europe.

“We now move into debt and project-level equity financing, supported by BNP Paribas, after strong support from commercial banks, development banks and government-backed export credit agencies.”

The Lithium Extraction Optimisation Plant (LEOP) is in final stages of commissioning with opening scheduled for next week.

The opening of the plant will mark the first occasion of tonnes of domestically produced lithium chemicals in Europe.

The central lithium electrolysis optimisation plant is also progressing smoothly.

Together, these represent a €50m investment by the company, towards optimisation, operational training and product qualification facilities to enable commercial operational readiness.

In a broader sense, the role lithium brines will continue to play in the ever-evolving industry will be one to watch.

This article was developed in collaboration with Vulcan Energy Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.