Infinity director appointed lithium expert for the EU’s upcoming critical raw materials assessment

Mining

Mining

Special Report: Infinity Lithium (ASX:INF) Executive Director Vincent Ledoux-Pedailles will be the European Commission’s lithium expert in an upcoming EU Critical Raw Materials assessment that is due to evaluate the merits of adding lithium to the list in 2020.

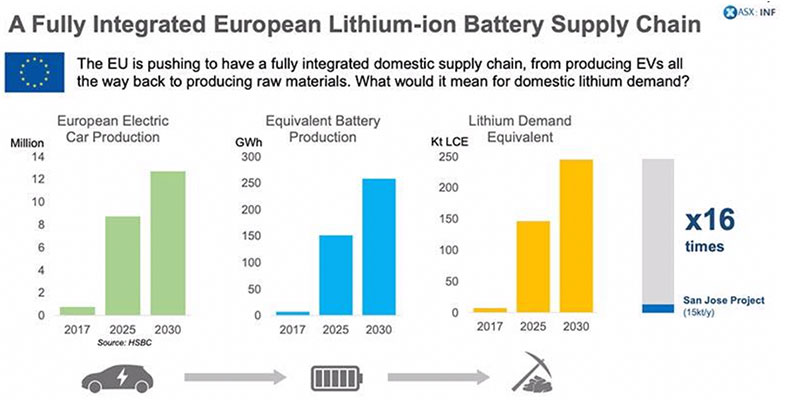

Car manufacturing giant Europe, increasingly concerned that it is over-reliant on China, is intent on supercharging its own battery supply chains.

The EU’s upcoming raw materials assessment will result in a list of Critical Raw Materials (CRMs) in 2020, and right now, lithium is not on this list.

The burgeoning EU battery sector will need an enormous amount of locally produced lithium and lithium chemicals as it ramps up over the next few years.

>> Learn more about Infinity Lithium (ASX: INF)

In June, a meeting between the European Commission and the Board of the European Investment Bank (EIB) called for the prioritisation of EU battery raw material projects, focussing on lithium extraction and in particular the conversion to essential lithium chemicals.

Right now, about 80 per cent of crucial lithium chemicals are sourced from Chinese conversion plants.

Infinity Managing Director Ryan Parkin says Europe is really starting to recognise just how exposed they are to Chinese supply.

“Our low-cost San Jose project in Spain is one of only a few preparing to produce battery grade lithium chemicals within the European Union,” Parkin told Stockhead.

“We aren’t just digging up ore, producing a concentrate and then shipping it off to China for processing.”

READ: Infinity hits key milestones at San José lithium hydroxide project as EV boom approaches

This sets Infinity apart from other EU-focussed lithium plays like London-listed Savannah Resources, which is currently completing a definitive feasibility study (DFS) on its project in Portugal.

“They have a substantial market cap but they are focused on producing a spodumene concentrate, which must be shipped elsewhere for conversion. Our model differs from this approach and is aligned to recent activity in the Western Australian hard rock space, where producers are increasingly participating further downstream,” says Parkin.

“The availability of lithium chemicals within Europe is far more advantageous than simply shipping our concentrate to other markets. We are encouraged that the European Commission, the European Investment Bank and other major stakeholders are increasingly focusing on the EU supply chain.”