MinRex shares jump on strategic cobalt and scandium acquisition

Mining

Mining

Special Report: MinRex Resources is snapping up three cobalt, scandium, copper and nickel projects in prospective parts of Australia at a time when the specialty and base metals sectors are hotting up.

The company has struck a deal to acquire Clean Power Resources Pty Ltd – an explorer with three high-quality projects in NSW and WA.

The shares (ASX:MRR) jumped 29 per cent to 9.2c after the announcement. They closed at 8.8c — up 26 per cent.

While cobalt is becoming harder to get hold of, end users are finding it even more difficult to get their hands on scandium, with production estimated at just 15 tonnes each year.

The rapidly expanding electric vehicle market is pushing up demand for cobalt, while the need for stronger, lighter weight aircraft and vehicles makes scandium a highly sort after substance.

Scandium is added to aluminium products to make them stronger, more corrosion resistant and heat tolerant.

It is also used in solid oxide fuel cells – a clean, low-pollution technology that can generate electricity at high efficiencies.

The three projects MinRex (ASX:MRR) is acquiring are close to critical supporting infrastructure and suitably positioned near ports (Newcastle and Esperance) to ship product to key north Asian markets.

Prospective neighbourhood

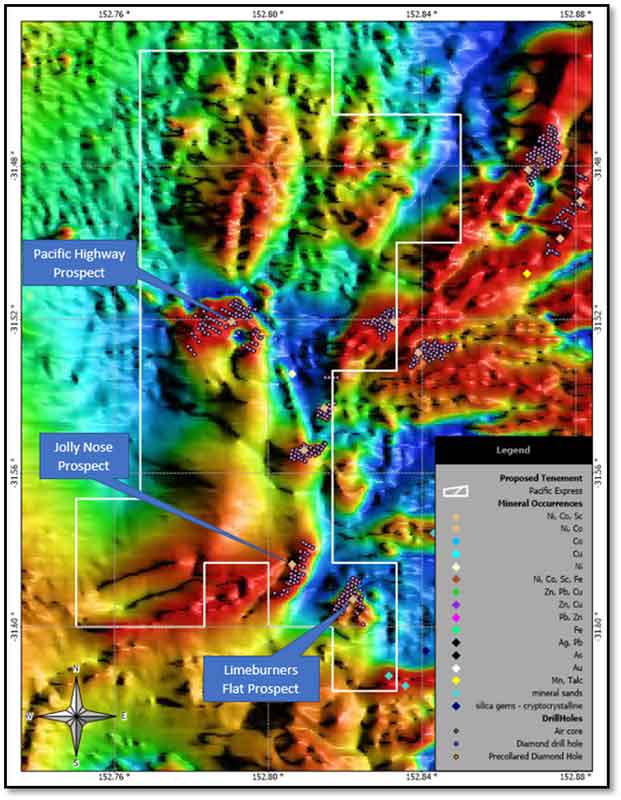

The Pacific Express project in NSW has a legacy JORC (1996) indicated resource of 4.6 million tonnes at 0.09 per cent cobalt, 40 grams per tonne (g/t) scandium and 0.61 per cent nickel that recent satellite imagery suggests can be expanded with additional exploration.

JORC refers to the mining industry’s official code for reporting exploration results, mineral resources and ore reserves, managed by the Australasian Joint Ore Reserves Committee.

Mineral resources are categorised in order of increasing geological confidence as inferred, indicated or measured.

> Bookmark this link for small cap breaking news

> Discuss small cap news in our Facebook group

> Follow us on Facebook or Twitter

> Subscribe to our daily newsletter

Previous owner of the Pacific Express project, Jervois Mining (ASX:JRV), drilled 506 holes in the region between 1996 and 1999.

This led to a JORC (1996) resource of 19.2 million tonnes at 0.1 per cent cobalt, 40 g/t scandium and 0.63 per cent nickel.

While the previous prolonged downturn in base metals saw Jervois let its tenements go, the recent uptick places MinRex in an ideal position to potentially leverage the legacy data to fast track a resource.

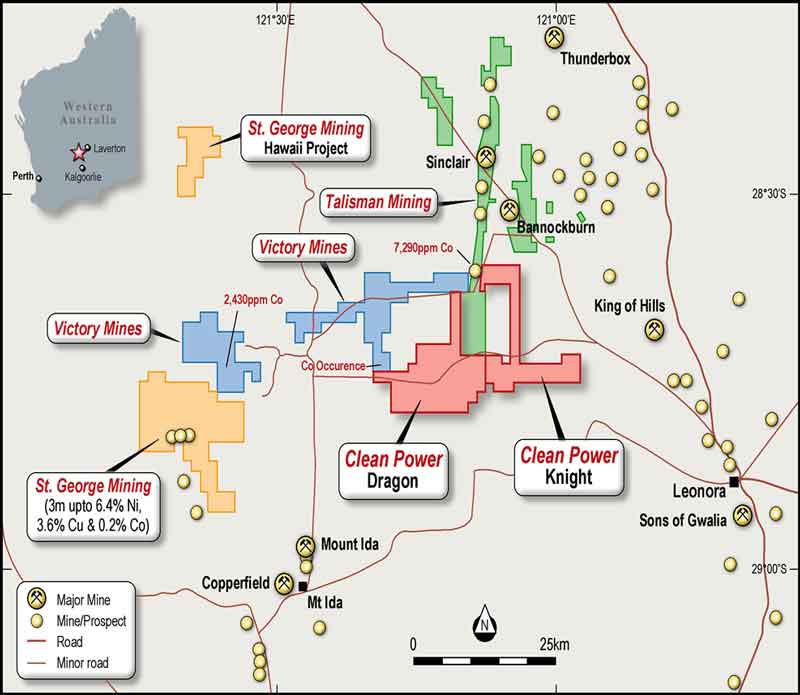

The WA assets, Knight and Dragon, are located near St George Mining’s (ASX: SGQ) tenure, which delivered solid drilling results of 3m at up to 6.4 per cent nickel, 3.6 per cent copper and 0.2 per cent cobalt.

The two WA tenements are pending grant, expected in the next couple of weeks. An offer of grant has been received for the flagship asset, Pacific Express – also expected to be granted in the coming weeks.

To settle the deal, MinRex will issue shares and options accounting for about 24.65 per cent of the expanded issued capital of the company, and a small amount of cash.

The region is highly prospective for massive cobalt, copper and nickel sulphide mineralisation, which St George confirmed in its 2017 drilling program.

While cobalt exploration has lagged materially behind base metals in recent years, there have been some significant occurrences across the region.

Legacy data indicates significant cobalt assays that range from 2430 parts per million (ppm) to 7290ppm. The 7290ppm significant cobalt drill intercept occurs adjacent to the boundary of the Knight project.

Meanwhile, Talisman Mining (ASX:TLM), which has ground adjoining the Knight and Dragon projects, produced 1.6 million tonnes at an average grade of 2.44 per cent nickel (38,500 tonnes) between 2008 and 2013.

A recent review of available geophysical evidence suggests that Knight and Dragon’s geological sequences are similar to St George’s and Talisman’s deposits.

High-demand commodities

“The opportunistic acquisition of these highly prospective assets delivers exposure to in-demand specialty metals cobalt and scandium in the first instance, then nickel and copper,” executive director Simon Durack said.

Cobalt is used in making rechargeable batteries for electric cars.

Electric or hybrid cars and buses are expected to reach 27 million by 2027, up from 3 million last year. Demand for electric car batteries is expected to drive demand for cobalt eight-fold by 2025.

With cobalt recently reaching a decade-high of $US95,000 ($123,118) per tonne on the London Metal Exchange, MinRex has made understanding the extent of cobalt mineralisation across the Knight and Dragon projects a priority.

Meanwhile, although scandium is one of the more abundant minerals not much is produced each year, which makes it a very valuable commodity that sells for a large premium.

Copper and nickel are also witnessing growing demand due to the electric vehicle uprising.

On the fast track to resource upgrade

On completion of the deal, MinRex plans to fast-track undertaking a desktop review and re-assessing the legacy data to the JORC (2012) code to potentially deliver a bigger resource.

The Pacific Express project has significant exploration upside for nickel, cobalt and scandium laterite mineralisation.

Following a review of recent magnetic intensity data, MinRex believes the indicated resource can be expanded with incremental exploration.

MinRex has already identified three prospective drill targets at the Pacific Express project that it will follow up once the acquisition is completed.

“The board was highly encouraged by the geology across all three assets, noting the indicated resource for Pacific Express in NSW can be reassessed under the JORC (2012) code then potentially deliver an upgrade, as well as the high level of sulphide mineralisation apparent near Knight and Dragon in WA,” Mr Durack said.

“There is clearly material potential to create value for shareholders from these new assets as their geology is further understood during the pre-acquisition due diligence period.”

This special report is brought to you by MinRex Resources.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.