Closing Bell: ASX ends it like Beckham… lower and with a pretty whimper, which could still suggest good things ahead

Via Getty

- The ASX benchmark has closed slightly lower on Friday

- Losses across the Energy Sector weighed

- Small caps led ID8

The Aussie sharemarket has ended lower on Friday, driven to a small disgrace by the ongoing declines in oil prices – down for a fourth straight week and after a mixed-up effort from Wall Street overnight.

That hot-to-trot mood in New York lasted a good 15 minutes it seems, with uncertain local traders left to wonder what might’ve been as the energy majors sucked the fun out of Friday in Sydney.

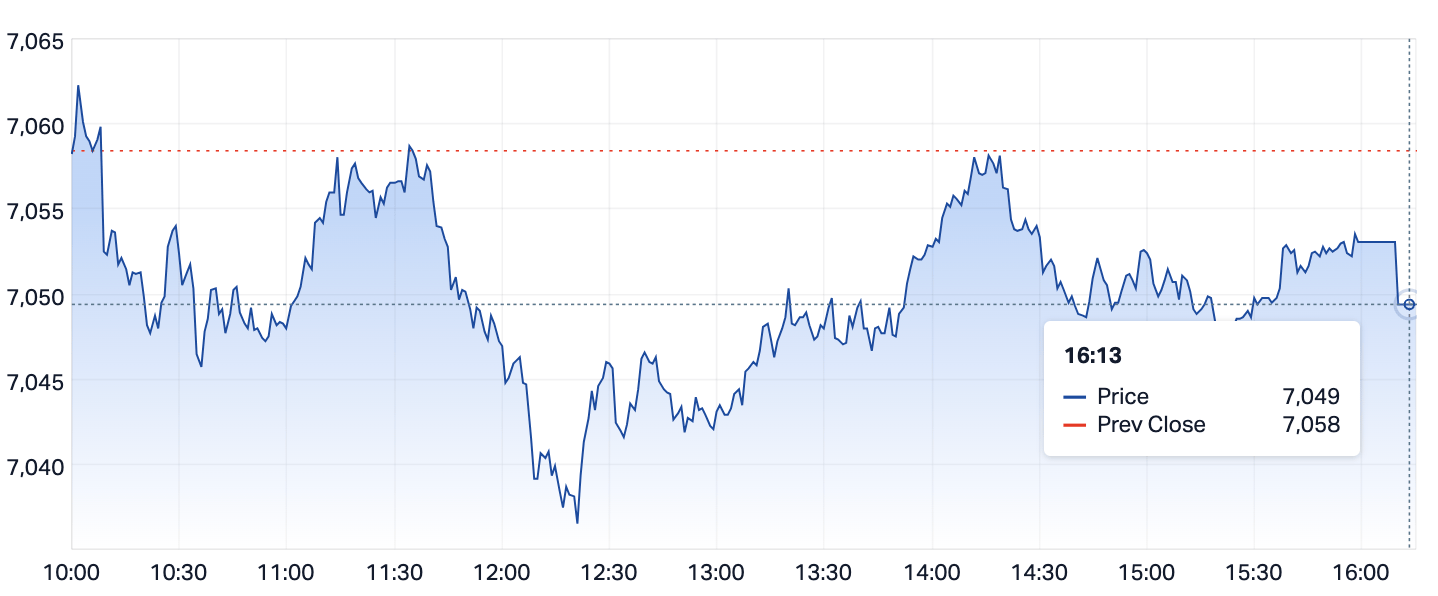

At match-out on Friday November 17, the S&P/ASX 200 (XJO) index was down about nine points, or -0.13% at 7,049:

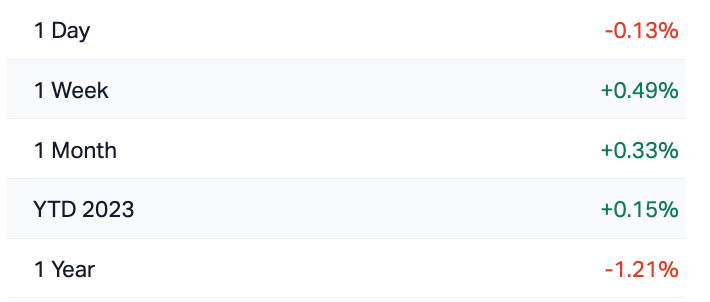

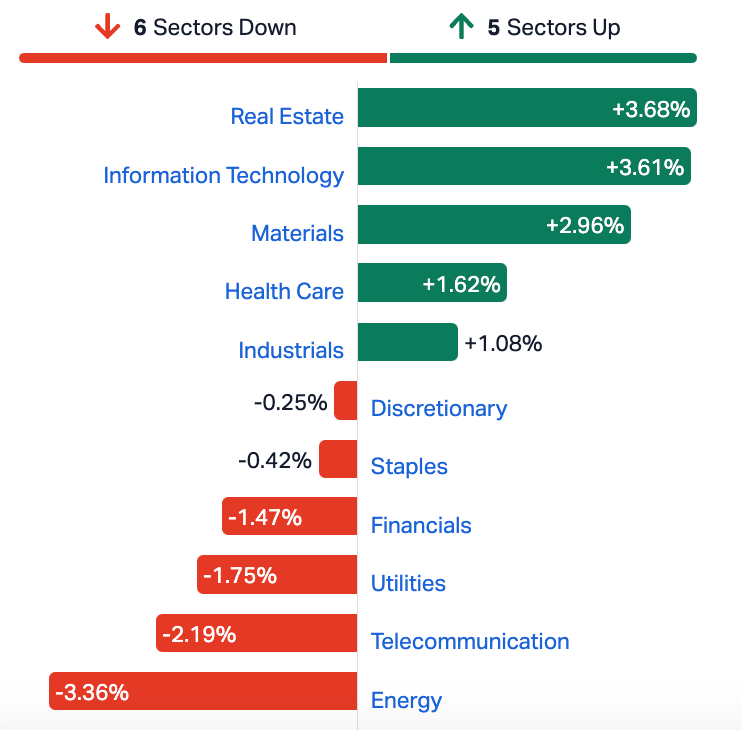

This is where Google says the XJO and the Small Ords (XSO) ended up over the last five sessions:

I’m not sure Google is right, so here’s the XJO’s numbers according to MarketIndex:

The ASX Sectors This Week

Wall Street closed overnight mixed, as US traders appear to now be stuck between the hard place of easing US inflation and the rock of looming US economic angst. It’s not quite a recession yet, but we’ll be back to talking about hard and soft landings for ages now.

The US central bank is widely reckoned to keep rates unchanged again in December, as US traders now give up on reality and choose instead to focus on when the Fed will start cutting rates.

This all started after Tuesday’s US (CPI) October consumer inflation read slowed more than expected, while US retail sales fell for the first time in seven months.

The number of Americans filing for unemployment benefit claims also increased to a three-month high last week.

The Dow Jones Industrial Average snapped a four-day winning streak, while both the S&P 500 and tech heavy Nasdaq Composite ended in the green.

The European Stoxx 600 index fell -0.75%, led by losses for oil and gas stocks – the sector down a further -2.5% after oil made it four weeks of price falls straight.

In chocolate news, the stock price of a company I’d like to meet called Hotel Chocolat went Tobleronishly high – up circa +160% after a company I know well – the US confectionary genius Mars offered to buy the British chocolate business for circa US$660 million.

The uncertainty around Chinese tech giant Alibaba just got an injection of pure uncertainty, after the company told investors that its big announcement about chopping itself into six neat pieces and listing its cloud division as a totally separate and publicly traded company, is now, in fact off.

The headline plan, declared back in May when the stank of ex-boss Jack Ma was finally purged from the corridors with a payout and kiss off the various boards, lay the blame at the feet of US Pres J Biden and his punitive microchip / semiconductor war vs China and the e-commerce giant.

The US-listed Alibaba stock fell 10% overnight.

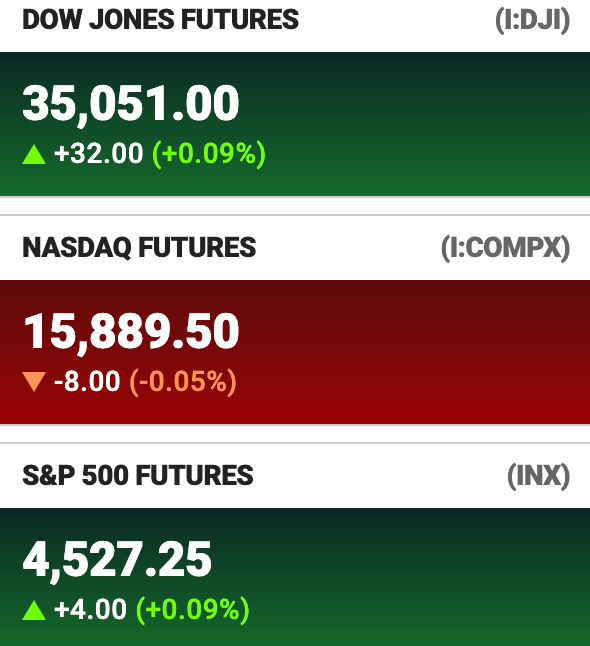

US Futures look pretty undecided on Thursday night in New York:

Ripped from the headlines

We’re watching gold

Gold is totally back. it’s the new yellow. And it’s settling into the weekend at around $1,980 an ounce, a gain of well over +2% since Monday.

Gold was at about US$1934 on Wednesday, so it’s been a fun few days, wrought by cooling inflation and economic contraction in the US. Both of which served to reinforce market bets that the Fed is done raising interest rates and that the greenback won’t be discarded so easily.

Elsewhere, gold got an additional boost this week after Moody’s lowered its US credit rating outlook from stable to negative, citing growing fiscal deficits and political standoffs in Washington.

We’re watching iron ore

prospect of more infrastructure spending, even with the longer timeframe for a turnaround in China’s property sector, likely means a pick-up in China’s commodity demand in H1 2024. That being said, we still think spot iron ore prices of $US132/t (62% Fe, CFR China) are too optimistic on China’s steel demand hopes, suggesting downside risks to prices.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| KNM | Kneomedia Limited | 0.003 | 50% | 2,794,383 | $3,009,571 |

| ID8 | Identitii Limited | 0.027 | 42% | 1,480,600 | $8,117,522 |

| MGT | Magnetite Mines | 0.47 | 36% | 361,591 | $26,483,942 |

| CXU | Cauldron Energy Ltd | 0.016 | 33% | 14,242,713 | $13,585,961 |

| M4M | Macro Metals Limited | 0.004 | 33% | 9,206,769 | $5,961,233 |

| PNX | PNX Metals Limited | 0.004 | 33% | 2,100,000 | $16,141,874 |

| MRR | Minrex Resources Ltd | 0.021 | 31% | 52,655,002 | $17,357,880 |

| CZN | Corazon Ltd | 0.023 | 28% | 2,565,485 | $11,080,762 |

| OMX | Orangeminerals | 0.046 | 28% | 291,600 | $1,822,506 |

| LVH | Livehire Limited | 0.051 | 28% | 408,347 | $14,645,729 |

| GTG | Genetic Technologies | 0.0025 | 25% | 2,525,236 | $23,083,316 |

| NES | Nelson Resources. | 0.005 | 25% | 3,665,329 | $2,454,377 |

| AZL | Arizona Lithium Ltd | 0.046 | 24% | 68,203,343 | $122,795,083 |

| CMP | Compumedics Limited | 0.195 | 22% | 39,900 | $28,346,072 |

| 14D | 1414 Degrees Limited | 0.054 | 20% | 185,439 | $10,717,583 |

| BMM | Balkanminingandmin | 0.18 | 20% | 90,342 | $10,321,076 |

| AUH | Austchina Holdings | 0.003 | 20% | 31,666 | $5,194,709 |

| CCO | The Calmer Co Int | 0.006 | 20% | 650,058 | $4,085,596 |

| RLC | Reedy Lagoon Corp. | 0.006 | 20% | 1,697,966 | $3,083,418 |

| RMI | Resource Mining Corp | 0.038 | 19% | 168,815 | $17,995,130 |

| TRT | Todd River Res Ltd | 0.0095 | 19% | 11,619,770 | $7,502,780 |

| RON | Roninresourcesltd | 0.225 | 18% | 37,683 | $6,497,638 |

| ACW | Actinogen Medical | 0.026 | 18% | 2,492,277 | $49,589,322 |

| RHT | Resonance Health | 0.06 | 18% | 76,000 | $23,811,539 |

| ACP | Audalia Res Ltd | 0.014 | 17% | 300,001 | $8,305,634 |

Spidey-sense is tingling on Friday regarding the absolutely flying share price of the Aussie regtech play Identitii (ASX:ID8), which – while not exactly in crisis – has no idea who or why or how it’s surged so nicely late on Friday in the arvo.

Ah. I’m not the only one – the ASX speeding cops have issued (at 3.35pm) a price query… A quick peek under the hood shows there’s not much official happening in the life of ID8, but a bunch of well-directed hack attacks (which we’ve been watching of late) could quickly change all that for this security software provider…

It’s certainly not this – from Wed:

And they can’t have used it to buy ID8 stock because the company also says after the receipt of the R&DTI refund, it instantly repaid its R&D Loan of $980k, leaving ID8 net funds of $514,150, which are available to fund future operating activities.

A quick recap for those unfamiliar with the Aussie software company – iD8 works inside financial services helping banks and stuff collect and share sensitive information – safely.

They’ve a client list of old and new school players like HSBC, Mastercard and Standard Chartered and digital payments companies ie: Novatti.

Incredibly, both traditional institutions and new digital payment companies rely on people, emails and spreadsheets to collect and share sensitive information, which is needed to keep payments moving and meet Anti Money Laundering and Counter Terrorism Financing (AML/CTF) laws.

With cyber-attacks, financial crime and fines from regulators all on the rise, pressure on industry to automate manual processes is tremendous. The cost of getting it wrong is ginormous, (remember AUSTRAC fined Crown $450 million in 2023 and Westpac $1.3 billion in 2020.

So… maybe people just cottoned on. I’m sure that happens all the time late on Friday’s in the financial services security sector…

Also on Friday, we’re enjoying the adventures of Aussie edu-SaaS play, KNeoMedia (ASX:KNM) which booked a +50% rocket this morning.

KNM says it’s in receipt of a 2nd tranche of cash, paid out by the New York Department of Education, which is deploying KNM’s ‘Connect All Kids’ education initiative.

The $700k from New York is part 2 of a 3 part series.

KNeoMedia says that it is in talks with the New York DOE around expanding its current offering, both through growing existing usage of the company’s tech and through the development of other complementary products, and as such it anticipates further payments from the US in due course.

Tasfoods (ASX:TFL) meanwhile, has received ACCC approval to sell its Betta Milk and Meander Valley Dairy businesses to Bega Cheese (ASX:BGA), for a cool $11 million.

It’s a sweet deal for both sides – Tasfoods pockets the cash, Bega gets the businesses as well as a perpetual, royalty free licence to use the Pyengana Dairy brand for milk and cream products in Australia.

Now with the offiicial ACCC nod, TFL expects all the paperwork and glad-handing to be done by the end of the calendar year.

Among the diggers, MinRex Resources (ASX:MRR) is surging +33% moments from the close of trade.

Rob Badman via email: There’s nothing to report as yet, but we’ve made calls and will let you know as soon as we have more.

And he does:

It’s on the hunt up near Global Lithium Resources’ (ASX:GL1) renowned spod-bearing-pegmatite swarming Archer deposit.

Rising like the price of magnetite in late trade, Magnetite Mines (ASX:MGT) on Wednesday signed a non-binding Memorandum of Understanding (MoU) with Pacific Partnerships, which is a subsidiary of the giant CIMIC Group

MGT says the MoU is to support the development, and – potentially – financing of the Razorback Iron Ore Project, and to establish a foundation for Early Contractor Involvement.

“The MoU contemplates a consortium-based approach to the development of green iron hubs in the Upper Spencer Gulf in line with emerging South Australian Government strategy,” the company added.

Finally, up circa 15% after lunch, another local Conspiring-in-Canada lithium stock – Battery Age Minerals (ASX:BM8) – says it’s been green lit by Ontario’s Ministry of Mines to continue Phase 2 exploration drilling across the entire 5km prospective corridor at its Falcon Lake lithium project.

Earlier drilling in said spot returned an intercept of 19.1m at 1.34% Li2O – and there’s more than 30 new targets identified through its summer field work program.

Formerly the company known as Pathfinder Resources (ASX:PF1), BM8 is smack bang in the heart of another of Canada’s prime lithium exploration spots (Green Technology Metals (ASX:GT1) is a neighbour), the company says Falcon Lake is a consistently prospective lithium address.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the day’s worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CHK | Cohiba Min Ltd | 0.002 | -33% | 16,000 | $6,639,733 |

| GMR | Golden Rim Resources | 0.013 | -28% | 1,798,289 | $10,648,591 |

| BEX | Bikeexchange Ltd | 0.006 | -25% | 3,710,921 | $11,461,038 |

| GBZ | GBM Rsources Ltd | 0.012 | -25% | 4,481,448 | $9,925,149 |

| MCT | Metalicity Limited | 0.0015 | -25% | 1,000,000 | $8,502,172 |

| 8VI | 8Vi Holdings Limited | 0.06 | -25% | 16,945 | $3,352,914 |

| NAG | Nagambie Resources | 0.029 | -22% | 1,008,300 | $21,523,874 |

| ASV | Assetvisonco | 0.008 | -20% | 3,690,000 | $7,208,366 |

| MIO | Macarthur Minerals | 0.125 | -19% | 100,000 | $25,738,291 |

| MXC | Mgc Pharmaceuticals | 0.94 | -19% | 67,707 | $41,099,370 |

| EVZ | EVZ Limited | 0.13 | -19% | 116,382 | $19,374,707 |

| OZM | Ozaurum Resources | 0.165 | -18% | 8,877,833 | $31,750,000 |

| FHS | Freehill Mining Ltd. | 0.0025 | -17% | 4,230,000 | $8,534,403 |

| GSR | Greenstone Resources | 0.005 | -17% | 5,353,108 | $8,192,498 |

| LVT | Livetiles Limited | 0.005 | -17% | 42,650 | $7,062,664 |

| ME1 | Melodiol Glb Health | 0.0025 | -17% | 64,662,889 | $11,547,311 |

| RNX | Renegade Exploration | 0.005 | -17% | 80,008 | $5,718,743 |

| TNC | True North Copper | 0.13 | -16% | 1,483,302 | $40,275,425 |

| NGY | Nuenergy Gas Ltd | 0.021 | -16% | 60,000 | $37,023,887 |

| ASR | Asra Minerals Ltd | 0.012 | -14% | 4,951,044 | $20,386,879 |

| AYT | Austin Metals Ltd | 0.006 | -14% | 145,000 | $7,111,123 |

| OAU | Ora Gold Limited | 0.006 | -14% | 583,696 | $39,355,173 |

| TMR | Tempus Resources Ltd | 0.006 | -14% | 911,749 | $2,400,460 |

| VRC | Volt Resources Ltd | 0.006 | -14% | 1,020,890 | $28,507,967 |

| IMI | Infinitymining | 0.13 | -13% | 131,631 | $11,678,958 |

TRADING HALTS

Aurora Labs (ASX:A3D) – Pending an announcement regarding a capital raising.

Bryah Resources (ASX:BYH) – Pending an announcement regarding a capital raising.

VDM Group (ASX:VMG) – Pending the outcome of an announcement relating to the outcome of a submission by the Company relating to its compliance with Listing Rules 12.1 and 12.2. Oops.

Turaco Gold (ASX:TCG) – Pending an announcement in relation to a potential material purchase.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.