Hardey gets an ASX grilling over higher-than-expected costs

Mining

Mining

The ASX wants to know why Pilbara gold player Hardey Resources spent substantially more on its corporate costs in the December quarter than it estimated.

The junior explorer’s (ASX:HDY) administration and corporate costs came in just shy of $900,000.

However, at the end of the September quarter Hardey told the ASX it expected administration costs for the final quarter to be $150,000.

In its response to the Australian bourse, the company said it encountered multiple events — several of them unexpected.

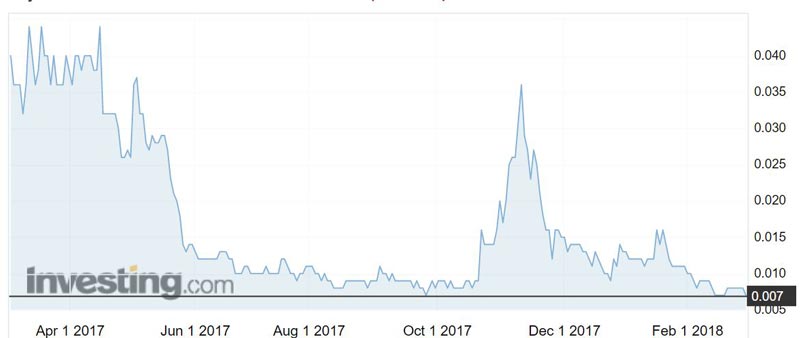

The shares slipped 12.5 per cent to 0.7c on Wednesday morning but recovered to 0.8c by 2.30pm AEDT.

Hardey’s share price has tumbled 86.5 per cent from a 52-week high of 5.2c in March 2017.

Among these events was a review by the NSW Mines Department that required additional consulting and legal advice and the reverse takeover of Perth-based Elysium Resources.

The ASX questioned the accuracy of Hardey’s budgets and accounting policies, but the company said it believes its current procedures are accurate.

“The company maintains a budget that is reviewed and updated periodically using historical financial information as a basis for projected expenditure, and forecasts for upcoming expenditure and outgoings known to the company at the time,” Hardey said.

The company had roughly $1.8 million in the bank at the end of December quarter and it plans to raise more cash.

Hardey wants to undertake new exploration at its Burraga copper project as part of its renewed focus on the project.

“The company believes it may be appropriate to undertake a capital raising in the near future on terms to be determined in consultation with corporate advisors,” Hardey noted.

Hardey’s portfolio of projects also includes four Pilbara conglomerate-hosted gold projects.