Hardey moves closer to re-opening its Nelly vanadium mine

Mining

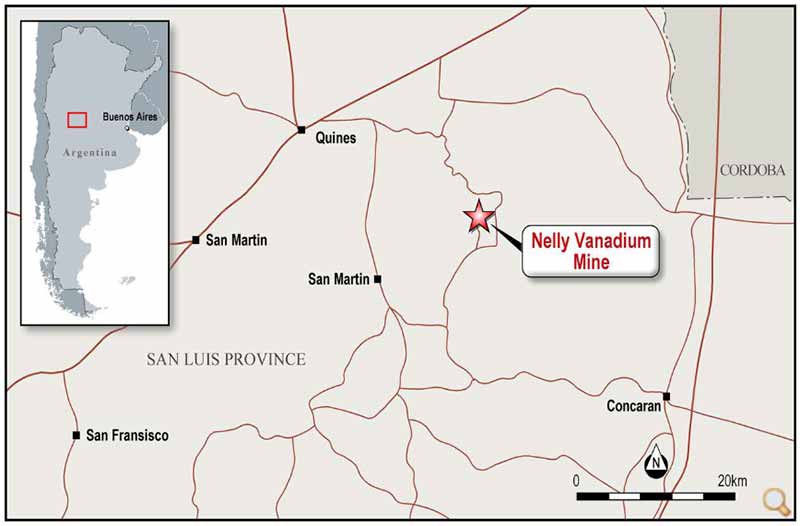

Special report: Hardey Resources is moving quickly on plans to re-open the Nelly vanadium mine in Argentina.

The company (ASX:HDY) announced today that team members will travel to Argentina to meet with the San Luis’ Mining Department in the hopes of expediting the process.

It is setting up a liaison office to progress securing of the exploration approval and mining right, which have already been lodged.

A report by SRK Consulting has found that the Nelly mine is likely a medium-size, high-grade deposit.

SRK confirmed that historic operators only extracted a minor portion of the mineralised central vein, while the average grade from channel sampling was 0.8 per cent up to 1.9 per cent V2O5 – one of the highest globally.

Once exploration permit, the geology team can begin verifying the extent of mineralisation within the mine and bulk sample legacy stockpiles.

Hardey executive chairman Terence Clee says once the mining right reactivation is approved, the stockpiles can then be monetised, while the technical team works to optimise mining operations.

The company says Argentina’s favourable regulations allow for a legacy mining right to be reactivated more quickly compared to other mining countries and that re-opening the Nelly mine will enable Hardey to create shareholder value at a much faster rate.

It told investors today that while it typically takes three to five years to transform a greenfield project into a viable mining operation in Argentina, the relative timeframe to reactivate the Nelly vanadium mine’s mining right is potentially under 12 months.

This special report is brought to you by Hardey Resources.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.