Independent study finds Hardey’s Nelly vanadium mine can be globally competitive

Ready, set Pic: Getty Images

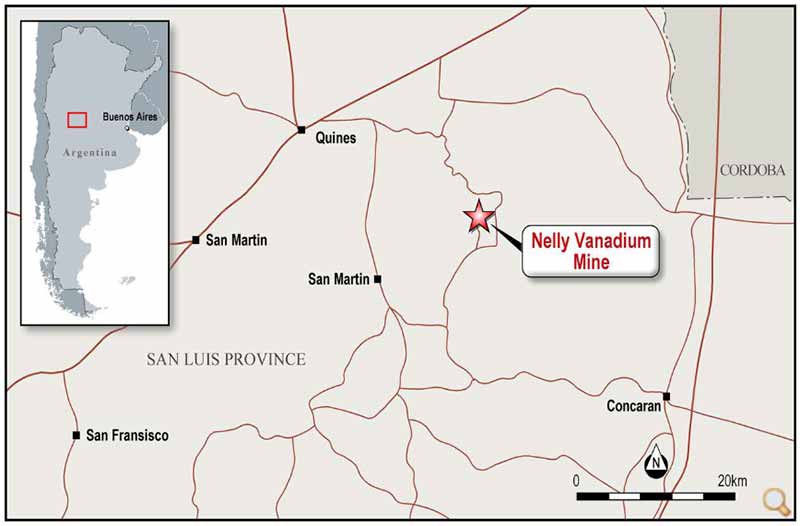

Special report: A report by SRK Consulting has found that the Nelly vanadium mine in Argentina being acquired by Hardey Resources is likely a medium-size, high-grade deposit.

SRK confirmed that historic operators only extracted a minor portion of the mineralised central vein, while the average grade from channel sampling was 0.8 per cent up to 1.9 per cent V2O5 – one of the highest globally.

This compares favourably to mines like Maracas in Brazil, which has an average grade of 1.2 per cent V2O5 and is the largest operating vanadium mine in South America with a resource of 256,000 tonnes.

The Nelly mine could also potentially rank alongside or higher than the Pandora mine in Utah, US, which has an average grade of 0.91 per cent V2O5.

“Confirmation from SRK Consulting there is potentially four untapped, highly mineralised veins at Nelly vanadium mine and 10 historic stockpiles, reflects the project’s significant potential upside,” executive chairman Terence Clee said.

“The board has accepted all SRK Consulting’s recommendations to expedite a high-level exploration program, with re-opening the mine as soon as possible the core priority.”

The Nelly deposit hosts a 1km mineralised trend, possibly longer, with five quartz-rich hydrothermal polymetallic veins, including one partially mined, with relatively high contents of vanadium, lead, zinc and copper.

The dimensions are up to 5.5m wide and from 12m to potentially 40m deep.

The SRK Consulting team recommended a high-level exploration program be undertaken to determine the extent of mineralisation within the system.

A key priority was verifying the V2O5 grade and ore continuity, particularly from a depth of 15m to 40m along the mineralised trend, since this would determine the projects scalability.

Potential for early cash flow

Hardey fast-tracked due diligence on the once-operating mine, after announcing a plan to buy it in July.

Shareholders backed the acquisition at last week’s extraordinary general meeting and the company can now complete the acquisition.

A priority for Hardey will be to bulk sample the stockpiles to determine if they are viable as a potential direct shipping ore (DSO) product to generate early cashflow from the Nelly mine.

DSO requires only simple crushing before it is exported, which keeps costs low.

Hardey is progressing the application to reactivate the mining licence for Nelly and studying the process to monetise the legacy stockpiles.

This special report is brought to you by Hardey Resources.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.