You might be interested in

Mining

Monsters of Rock: MinRes has 'seen the bottom' in lithium prices, Lynas tightens the screws on rare earths supply

Mining

Sunk capital: Why Walta believes Panton will be the future king of PGMs

Mining

Mining

Gold prices are struggling to recapture lost ground after slipping to $US1,860 ($2,638) per ounce with a stronger US dollar the culprit.

The US dollar index which reflects the currency’s buying power touched a two-month high of 94.50 and is putting a cap on gold prices, said market analysts.

“On the retail side, we are seeing a lot more clients coming in and buying gold because they are still bullish on gold, so every time there is a correction or pullback many clients are buying,” GoldSilver Central of Singapore managing director, Brian Lan, told Reuters.

Later this week the US Congress considers a proposed $US2.4 trillion economic stimulus package which if passed could provide some propulsion for gold prices.

S&P Global Ratings has revised higher to $US1,900/oz its price forecast for gold for the rest of 2020, from $US1,650/oz previously.

For 2021, S&P Global Ratings expects gold to trade around $US1,700/oz, up from $US1,400/oz.

“Abnormal gold prices could push more companies to increase their capacity, in turn leading to more sustainable price levels,” it said.

The price of silver has tumbled back to July levels, trading at $US23/oz ($32.68/oz), Monday.

Emu NL (ASX:EMU) has re-focused its gold exploration activities on WA, with the purchase of the Gnows Nest project, after winding down its Elevado gold project in Chile.

“Following our exit from Chile and subsequent travel restrictions imposed by the COVID-19 pandemic, the board made the strategic decision to focus on WA, where it is expected our activities can continue largely unaffected by the pandemic,” chairman Peter Thomas said.

Gnows Nest, located 32km west of Yalgoo in WA, has historic gold production of 27,925 ounces at a recovered grade of 22 grams per tonne (g/t) gold before the Second World War.

The company has also acquired three copper-nickel-pge projects in WA, Sunfire, Graceland and Viper, all within the south and mid-west of WA and near Emu’s 8 Mile Dam project.

The Sunfire project adjoins Venture Minerals (ASX:VMS) South West project in which Chalice Gold Mines (ASX:CHN) has committed $3.7m of exploration spending to earn a 70 per cent interest.

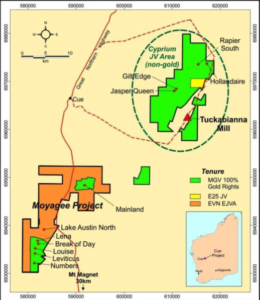

Musgrave Minerals (ASX:MGV) has extended the mineralisation for its White Light and Starlight discoveries below 260m which remains open down plunge at its Cue gold project in WA.

Drilling hits at the White Light lode include 2m at 17.7 g/t gold from 198m, and for Starlight at 2m at 13.7 g/t from 178m, at its Break of Day prospect in WA’s Murchison district.

“These are further excellent drill results from White Light lode which is continuing to grow,” said managing director, Rob Waugh.

Lachlan Fold Belt gold explorer Thomson Resources (ASX:TMZ) has lodged an application for a new exploration licence in the NSW goldfield adjacent to existing company projects.

The application includes the Buddigower tin field which has reported high grades of silver at 169 ounces per tonne and significant gold in surface rock chips of up to 4.8 g/t.