Sunk capital: Why Walta believes Panton will be the future king of PGMs

Future Metals has its sights set on becoming Australia's first PGM producer. Pic via Getty Images

- New Century Resources founder Patrick Walta has joined PGM hopeful Future Metals as executive chairman

- The Panton project in the East Kimberley is Australia’s highest-grade undeveloped PGM resource

- PGM prices are at 10-year lows but FME is advancing its flagship asset to be production-ready for the inevitable turn in the cycle

- Further exploration potential added to the company’s portfolio via the recent acquisition of Osprey Metals

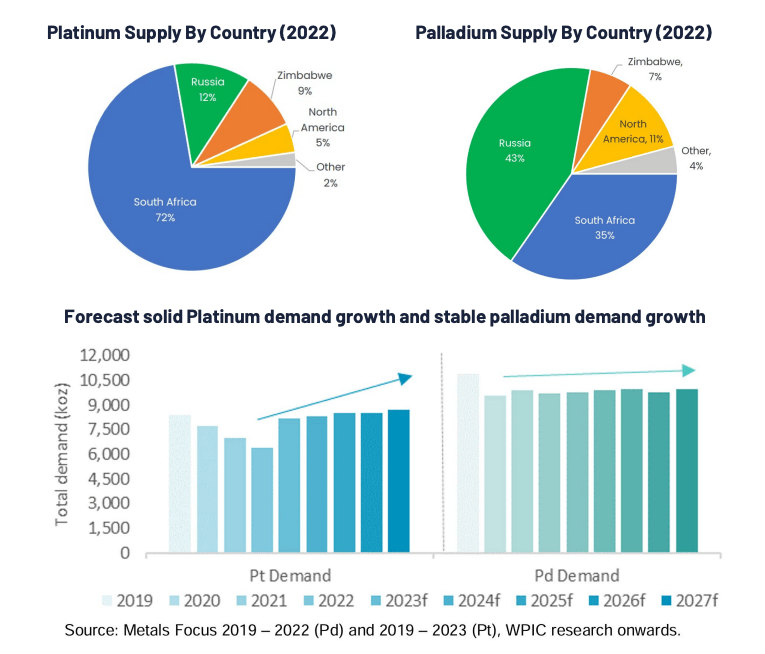

Platinum Group Metals (PGMs) prices have plummeted to 10-year lows, but new Future Metals boss Patrick Walta believes now is the perfect time to enter the niche and complex sector.

Walta emerged from a 12-month sabbatical late last year as executive chairman of Future Metals (ASX:FME) which remains one of the few ASX-listed players committed to finding and developing new sources of PGMs in Australia.

A seasoned metallurgist and mineral economist, Walta rose to prominence in his previous role as managing director of New Century Resources where he oversaw the strategic acquisition, subsequent restart and ongoing operation of the famed Century zinc mine in Queensland.

New Century was acquired last year by its largest shareholder, multinational PGM-gold producer Sibanye-Stillwater, via a ~$150 million off-market takeover.

The RIU Explorers conference in Perth earlier this month was Walta’s first major appearance in his new role since being elected chair in November, but it hasn’t taken him long to find immediate and promising comparisons between the Century mine and his new company’s flagship asset – Panton – Australia’s highest-grade PGM resource.

“One of the major benefits of Panton and Future Metals is the sunk capital,” Walta told Stockhead on the sidelines of the conference.

“This asset has been around for 20 years, it’s had $50 million spent on it, 45,000m of drilling, mining leases and an exploration decline in place, and we’ve just released a scoping study on it. There’s just so much development done on it already.

“If you have a traditional discovery, realistically you’re 10-15 years away from first production because of all the effort that still has go into it. For me, that just spells risk because there’s multiple price cycles you still have to go through and there’s a lot more luck required to get it into production.

“Sunk capital assets like Panton, which have gone through a lot of that development timeline already, we’re looking at a three-year development timeframe, so we can time the metal price cycle to get into production. That’s exactly what we did with Century – it was a big sunk capital asset, big infrastructure play with an existing deposit, albeit a tailings dam, which we were able to acquire, very quickly get it into operation and we were able to time our run into market in 2018 before zinc fell off a cliff. But, hey, we were able to survive the zinc downturn because we were already up and running.”

What is sunk capital and how do you play the market?

Century was a mothballed operation when Walta picked it up and vended the asset into the Atilla Resources shell back in 2017.

The opportunity that Walta and revered mining entrepreneur Tolga Kumova saw at the time was leveraging off +$2 billion of existing infrastructure at Century to restart operations, initially via the reprocessing of tailings before turning attention to the vast number of other in-situ resources on the project lease.

When first presented to investors, the strategy was an instant hit with New Century’s share price soaring above $2 prior to the operational restart in mid-2018.

“It’s a strategy for certain times in the market,” Walta explained.

“When metal prices are flying and everything’s at its peak and anything with a sniff of copper or gold in the ground is trading at huge market caps, you don’t need to do anything. All ships rise on a rising tide and all that. But when times are tough and you need to be able to think innovatively about acquisitions, about how you develop assets, you need every advantage you can get.

“The reality is if someone else has spent the effort and someone else has paid the money to get you that little bit further along the road, it’s such a big advantage because, ultimately, that first tonne or that first ounce is the hardest one to produce. The second one is so much easier because of all the effort that’s gone into the first one.

“Our goal with Century – and now with Future – is to be as close as possible to that first tonne because that means you’re just so much closer to the second tonne.”

Why PGMs and why Panton?

Until Chalice Mining (ASX:CHN) light a fire – and a massive one at that – under Australia’s nascent PGM industry with its Julimar discovery in early 2020, Panton was essentially the country’s only asset containing a notable amount of platinum and palladium.

At the time, Panton was majority-owned by nickel miner Panoramic Resources (ASX:PAN) but was in the process of offloading it to a privately-held company. The listed vehicle now known as FME eventually took control of the project in March 2021.

The market love for PGMs has steadily declined alongside the drop in prices to the decade lows they are currently commanding.

For Walta, the current pricing troughs – when coupled with Panton’s status as one of the world’s highest-grade undeveloped PGM assets – present a perfect storm for investors.

“We’re right at the bottom of the cycle, PGMs couldn’t be lower than where they are now,” he says.

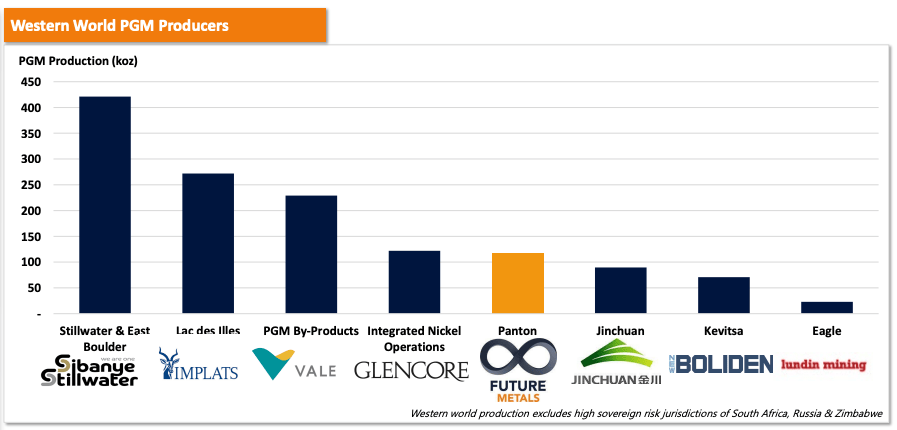

“The last thing you want to be is a PGM producer right now, we’re at about the 60th percentile on the cost curve, so there’s a lot of producers now that are just haemorrhaging cash.

“We’re seeing supply getting stripped out of the market and, ultimately, that’s going to lead to a price turn. Our strategy with Future is to be production-ready as soon as the price starts moving. We will rise first and we will rise fast. That’s our play, it’s a massive option on PGM prices.”

Walta has nothing but praise and admiration for what Chalice has done to educate the Australian market about PGMs and says the gauntlet has now been passed to the likes of FME to build on that interest and momentum.

“Two years ago, poor old Future Metals was fighting for oxygen versus Chalice, which was just this massive story, but now the market has realised that you need grade – and we’ve got the highest-grade, undeveloped PGM resource in the Western world – and you need to be near-term so you can a part of the next rise in the market,” Walta says.

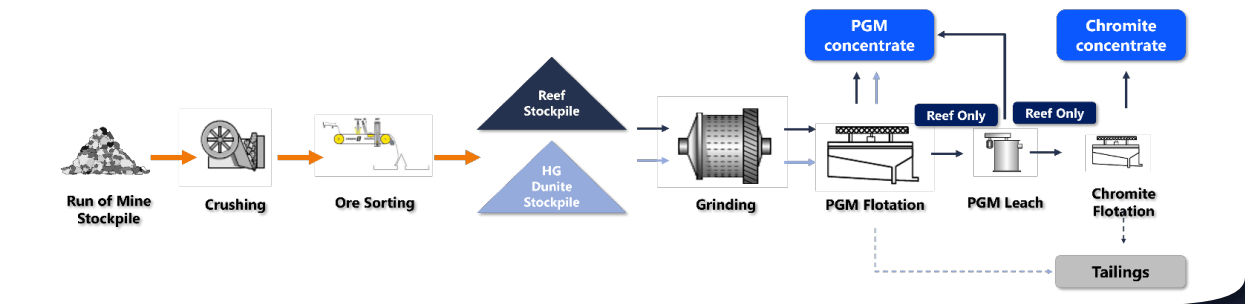

“You also need simple flowsheets, and our flowsheet is literally crush, grind, float, put it on a truck, three hours up the highway and then export it around the world. We’ve got a $250 million capex, it’s 1Mtpa float plant at the end of the day, so we’re kind of the antithesis to the big Chalice story.

“Chalice is still a great story and an important story. I believe it will get developed, but it will probably take 10-15 years to tinker and get right, I’m guessing, whereas Future is here and now and so investors can see it’s real. As soon as prices move, it’s your value proposition for getting exposure to PGMs.

“The market knowledge is growing in Australia compared to overseas where it’s already quite strong. There’s a lot more brokers covering the sector in the UK and the US. We might even an anticipate a bit of a spread in investors over time as we tell the Future story.”

But what about the Panton process?

One of Walta’s first assignments upon joining FME was to sign off on the Panton scoping study which forecast average annual mine production of 117,000oz PGM 3E (platinum plus palladium and gold), 134,00t chromite concentrate and 1,200t nickel over an initial nine years.

The scoping study estimated lowest-quartile all-in sustaining costs of just US$789/oz and modest capex of $267 million (including a $32 million contingency). Other key financial metrics included pre-tax NPV of $250 million and IRR of 26%, with payback achieved inside 4.1 years of first production.

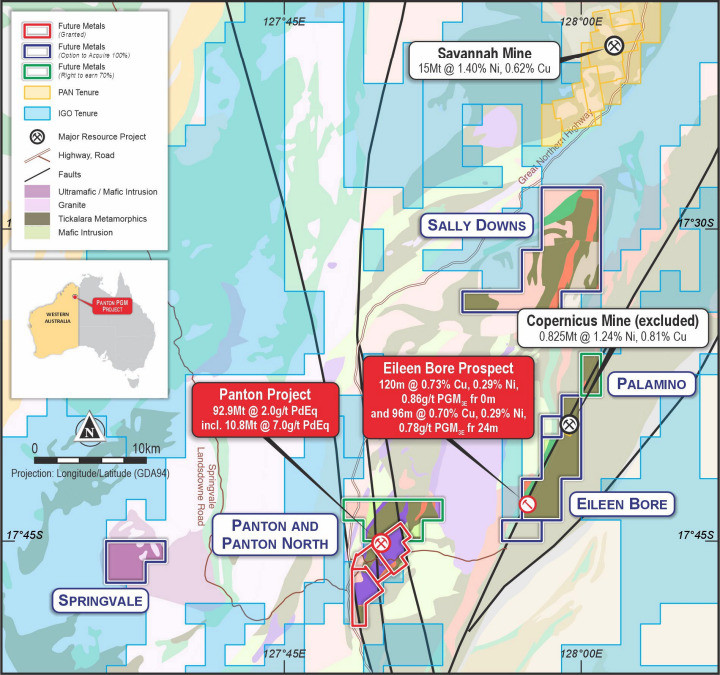

Walta intends to spend the next few months educating investors about the advancements that have been made at Panton – about 60km north of Halls Creek in the East Kimberley region of Western Australia – since the project first came to public prominence two decades ago when under the ownership of Platinum Australia.

“As part of my DD that I did on the project, I was giving it the sniff test and asking people what they thought about it and a lot of people would say, ‘oh Panton, that’s the thing with the difficult metallurgy, right?,” Walta recalled.

“I’d say, ‘no, it’s actually just crush, grind, float’ and then they would ask, ‘what about the Panton process?’ but that was 20 years ago, the flowsheet has completely changed. Almost verbatim that kept happening and you realise that the market is anchored on 20-year-old information, but the reality is it’s been completely de-risked between then and now.

“Panoramic were actually the ones who cracked the metallurgical nut on it. They did that by copying the Mt Keith nickel flowsheet and were able to upgrade the ore in the ground. Before that, Platinum Australia developed this massive hydromet flowsheet but weren’t able to upgrade the ore into a saleable concentrate.

“Future Metals has been de-risking it even further, all the while PGM prices have halved and Chalice has sucked all the oxygen out of the market. So I looked at that and said there’s a massive value arbitrage in terms of the de-risking of the project versus the market cap of the company. It’s borderline shell value.”

With that market education ongoing in the background, Walta says the company will continue “spit-polishing” the Panton resource and study numbers while also undertaking exploration over the rest of the project area.

This includes further work on the recently acquired Eileen Bore target which is now FME property following its takeover of the unlisted Osprey Metals.

“It’s only 10km away from the Panton asset, which eventually will be a mine,” Walta says.

“We’re already hitting some big, big drill bits – like 100m @ 0.9% PGM with some nickel-copper credits in there as well. When you roll that all up, it’s got potential to be 2% copper equivalent type stuff.

“Strategically, this ground has so much value because we know we can truck it 10km and just put it straight into the plant at Panton. So there’s lots of exploration upside on what is already a mature story. Every tonne we find there has such high value because there’s going to be an operating plant nearby.”

At Stockhead, we tell it like it is. While Future Metals is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.