You might be interested in

Mining

Venture Minerals’ Jupiter serves up some of the best rare earths to date with +2,000ppm drill hits

Mining

REE Survival Guide Part 4 – These Aussie projects aim to be ready to supply refineries... and soon

Mining

Mining

It’s been a while since Australian clay rare earths deposits really shifted the market, with the focus all falling onto Brazil where ionic clay discoveries larger than those that have dominated the rare earths market in southern China have seen staggering gains for explorers like Meteoric Resources (ASX:MEI).

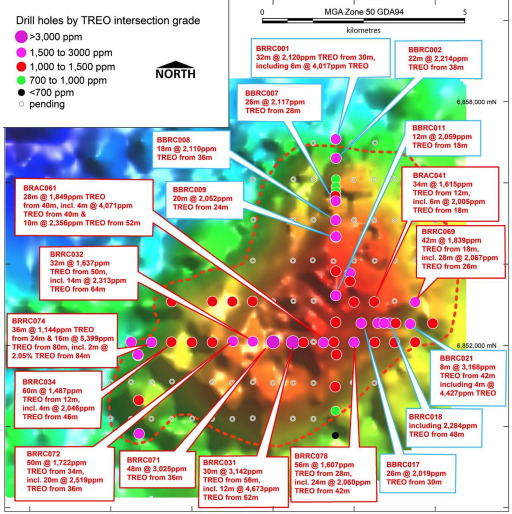

But the spotlight has been shone back onto WA this morning as kaleidoscopic explorer Venture Minerals (ASX:VMS) revealed a record intersection of 48m at 3025ppm total rare earths oxides from the first stage of reverse circulation drilling at its Jupiter prospect in the Mid-West.

READ: Venture Minerals produces super-high grade rare earth grades at… hang on, Jupiter? Yep

It’s part of the larger Brothers REE project, which sits close by to its Golden Grove North JV with SensOre, home to the Vulcan REE target, and midway between Lynas Rare Earths’ (ASX:LYC) Mt Weld mine and Iluka Resources’ (ASX:ILU) new +$1.5b Eneabba rare earths refinery.

That result, Venture claims, is the highest grade clay hosted rare earths intersection reported in Australia. Cue a 50% gain this morning.

It is one of a number of `cough` ventures the junior has embarked on. It briefly operated the Riley iron ore mine in Tasmania, where high prices have led to a strategic review that could see the project restarted.

Venture also owns the Mt Linsday tin and tungsten project over in the Apple Isle and a nickel-copper-PGE project in WA’s South-West where Chalice Mining (ASX:CHN) is exploring for Julimar style prospects.

But today’s result is almost certain to shift the focus more intensely onto its rare earths find at Jupiter, its namesake gas giant now making a photoshopped cameo on Venture’s ASX plugs.

Other high grade portions in holes 031 and 074 included 2m intercepts grading 10,266ppm and 20,538ppm, with 20-30m widths of over 2000ppm TREO in 96% of the holes drilled in the program.

Among those were individual magnet rare earths grades topping out at 3288ppm neodiumium oxide, 788ppm praseodymium, 674ppm dysprosium and 101ppm terbium.

Those magnet metals are regarded as the highest value products among the rare earths suite, used in permanent magnets in EV motors, wind turbines and defence applications.

“These record breaking ultra-high grade REE clay results, for Jupiter, place us well above our peers in terms of both grade and scale. What’s incredible is that these results are not isolated. They confirm consistent grades over 2,000 ppm TREO in broad widths of 20-30 meters in 96% of the holes and that is sitting within zones of around 60 m over 1,000 ppm TREO,” MD Andrew Radonjic said.

“We have lots of news flow to come, with further results pending for our Maiden Resource drill program. This drilling is widely spaced and down the track we will be working on infill drilling with the potential to uncover more impressive grades. Most drilling will be shallow aircore and RC, so it’s highly cost-effective. Keep in mind that these results cover a small area of our enormous, 40km2 target and you can certainly understand that Jupiter is shaping up to be an incredibly impressive project.”

The graphite players were in the bad books with investors last year, recording massive losses across the sector as prices for the flake graphite largely used in batteries cooled and sent ex-China players into loss-making territory.

It also halted some of the (probably over-)exuberance that had emerged around anode materials developers. Due to ample supplies of natural and synthetic graphite in China, pricing never surged in the way it did for other battery commodities like lithium, nickel and cobalt.

When the market was hot in 2021, the focus fell firmly on downstream developments, with a number of graphite hopefuls looking further downstream into Western anode materials developments.

Novonix rose amidst that wave, though unlike the natural graphite producers its focus has been on its GX-23 grade synthetic graphite product.

It says life cycle assessments have shown that product would hold a 60% decrease in global warming potential against anode grade synthetic graphite in Inner Mongolia and 30% decrease against natural graphite in HeilongJiang Province in China.

The $360 million firm is up ~161% over the past five years but down ~57% in the last 12 months.

But it’s seen another reversal of fortune today, climbing 18.7% at the time of writing.

The sauce? A deal with Japanese electronics giant Panasonic to supply synthetic graphite from its planned Riverside Facility in Chattanooga, Tennessee.

Panasonic Energy has said it will purchase at least 10,000t for use in its US EV battery manufacturing plants from 2025-2028, with NVX saying it will use its ‘best efforts to deliver the increased volumes’ if Panasonic requests them.

It all helps Panasonic and its EV producing customers hit guidelines for incentives under the Inflation Reduction Act, which provides production credits for manufacturers who use raw materials sourced from the US or free trade agreement nations like Australia.

NVX is planning to have its Riverside plant in production by late 2024 with plans to scale up to 20,000tpa over time to meet future demand. It was awarded a US$100m US Department of Energy grant to fund the expansion of the plant in November.

“We are excited to announce the finalization of a binding off-take agreement with Panasonic Energy to become a supplier of key anode material for its North American based facilities,” NVX CEO Chris Burns said.

“Off-take agreements with high-quality partners such as Panasonic Energy solidify NOVONIX’s position as a leader in onshoring the supply chain of synthetic graphite and accelerating the adoption of clean energy in the industry. We look forward to expanding our long-standing relationship with Panasonic Energy to support its growth efforts in North America.”

It comes after Novonix signed a joint development and investment agreement with Korea’s LG Energy Solutions last year.

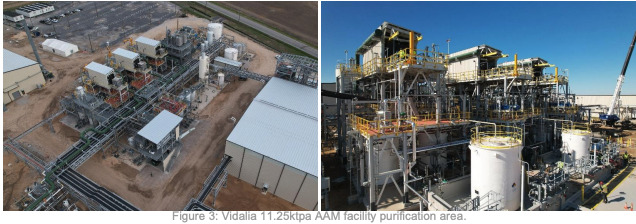

NVX was not the only graphite play on a winning run today, with $380 million capped Syrah Resources (ASX:SYR) also up 5% after announcing it had begun to produce active anode material production at its 11,250tpa Vidalia plant in Louisiana.

It makes Syrah, which curiously rose around 20% yesterday, the first vertically integrated natural graphite anode material supplier outside of the Chinese market, leveraging its ownership of the large Balama deposit in Mozambique.

Around 8000t each year is expected to go to Elon Musk’s EV giant Tesla, with plans to expand the plant further to 45,000tpa currently under the microscope. The company has applied to extend its loan commitments from the US DoE’s Advanced Technology Vehicles Manufacturing loan program by US$350m to support its expansion, which will carry a capital cost of US$539m according to a DFS released last year.

Syrah plans to hit 80% of its 11,250tpa rate within six months and a full capacity runrate within 18.

MD Shaun Verner said the production of Vidalia’s first pitch coated spherical graphite followed a seven-year process to go from miner to a downstream integrated supplier to the EV supply chain.

“Our 11.25ktpa AAM Vidalia operation is strategic for both Syrah and the North American battery supply chain and is the foundation of our downstream growth strategy,” he said.

“This strategy is supported by strong EV-driven demand globally, recognition of the importance of independent natural graphite AAM critical mineral supply, and differentiation in terms of emissions intensity of production and provenance of supply.

“The importance of Vidalia is reinforced by China’s recent introduction of export controls on natural and synthetic graphite and its products, and US guidance on the definition of foreign entity of concern governing qualification for the Section 30D tax credit for new electric vehicles.”

(Up on no news)

Today’s ‘what on Earth is going on here’ pick is Theta Gold Mines, the South African gold developer up over 75% on no news whatsoever.

Surely ASX investors aren’t that in tune with the fortunes of its women’s cricket team — which recorded a shock 84 run ODI win over the historically dominant Australian XI — or Bafana Bafana, its men’s soccer team whose shock run to the semi-finals of the African Cup of Nations has restored pride in a national team more recently regarded as a lost cause.

But it has been working the booths at the Mining Indaba Conference in Cape Town, describing its strategy to revive mining in one of South Africa’s first gold rush locales the Kirkland Lake strategy.

Kirkland Lake famously uncovered the uber-high grade Swan Zone at Fosterville, reviving the fortunes of the Victorian gold sector in Australia in the mid-2010s.

Theta controls 43 historic gold mines in the Eastern Transvaal Gold Fields, the original site of the South African gold rush 130 years back.

Boasting 6.1Moz of gold at 4.17g/t, it claims just US$107 million of capital will be needed to develop a project utilising four historic underground operations known as Beta, Rietfontein, Frankfort and CDM to produce 1.1Moz over 12.9 years.

Running at an underground mining rate of 540,000tpa, the $113 million explorer says it will produce between 80,000-100,000ozpa over its first three years and as much as 160,000ozpa after five years of operations.

If realised in practice, all in sustaining costs of US$834/oz would place TGM firmly in the bottom quartile of gold producers globally.

It notably received the backing of Sprott’s gold streaming business, which has pledged to provide US$70m of cash for the return of up to 100,000oz over the life of mine at 10% of the prevailing gold price, according to a term sheet announced in October 2022.