Venture Minerals’ land grab secures priority clay-hosted REE targets near its Jupiter discovery

Venture has secured the remaining priority clay-hosted REE targets within the immediate vicinity of its Jupiter discovery. Pic via Getty Images

- Venture Minerals expands scale of Jupiter clay-hosted REE discovery with new acreage

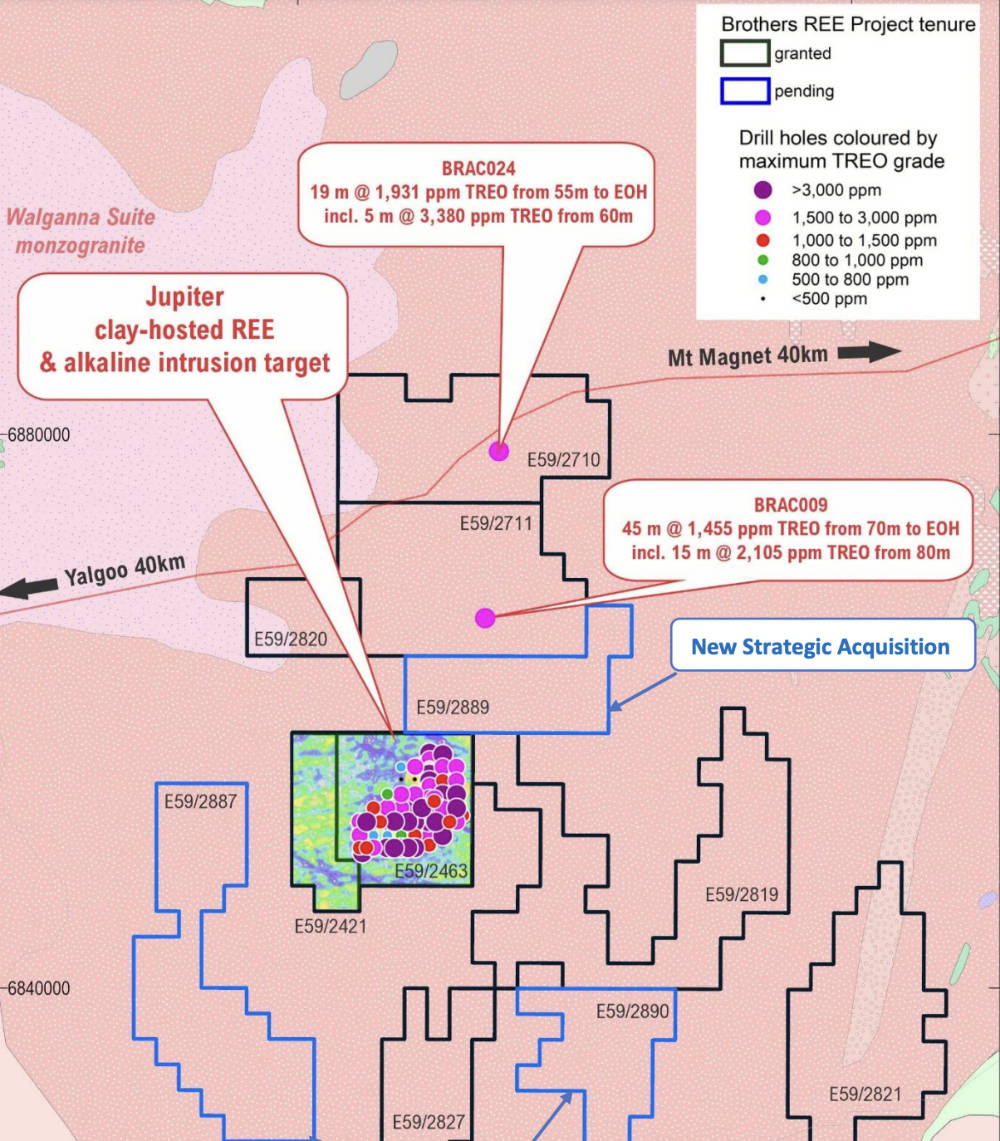

- New land acquisition is between Jupiter and recent new REE intersection 10km to the north

- It secures the remaining priority clay-hosted REE targets within the immediate vicinity of the Jupiter discovery

Special Report: Venture Minerals has expanded the scale of its Jupiter rare earths discovery with the acquisition of a key landholding as part of a broader 361km² strategic tenement package.

The large Jupiter clay-hosted REE discovery has delivered plenty of excitement with recent assays returning an outstanding intersection of 5,056ppm of just neodymium and praseodymium oxides within a 2m interval @ 13,906ppm total rare earth oxides (TREO).

It follows on Venture Minerals (ASX:VMS) reporting an eye-watering 48m intersection grading 3,025ppm TREO, which is believed to be the highest clay-hosted REE intersection ever for an Australian project.

Part of the Brothers REE discovery in WA’s Mid-West region, Jupiter is located close to Lynas Rare Earths’ (ASX:LYC) Mt Weld concentrator and Iluka Resources’ (ASX:ILU) Eneabba refinery that is currently in development.

More recently, the company embarked on an extensive 300 hole aircore drill program to bring in the drill density across the 40km2 Jupiter target to a 500m by 250m spacing to obtain the data necessary for a planned maiden resource estimate.

Securing ground

The new ground acquired by VMS sits between Jupiter and additional REE mineralisation about 10km to the north where first pass reconnaissance drilling had returned up to 45m @ 1,455ppm TREO.

It is part of a strategic 361km² tenement package the company is acquiring through the tenement application process to complement its existing acreage and expands the project by 36% to 1,353km².

This effectively secures the remaining priority clay hosted REE targets within the immediate vicinity of the Jupiter discovery.

“This strategic acquisition strengthens the company’s land position around Jupiter and facilitates unencumbered access across the project,” managing director Andrew Radonjic said.

“It provides a potential extension of high-grade, clay-hosted rare earth mineralisation to the north of Jupiter and secures the remaining priority clay-hosted rare earth targets around the discovery.

“Jupiter is emerging as a major, rare earths discovery that is ideally located between Lynas’s existing plant and Iluka’s planned rare earth processing facilities in the Tier One jurisdiction of the Mid-West region of Western Australia.”

This article was developed in collaboration with Venture Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.