Gold: Cardinal recovers from savage hit, unleashes big feasibility study on 5.1moz Namdini project

Mining

Mining

Cardinal Resources (ASX:CDV) has just released a solid feasibility study on the mammoth, 5.1-million-ounce Namdini gold development in Ghana. But it hasn’t all been smooth sailing for the explorer.

In 2012, Cardinal – then uranium-focused Ridge Resources – picked up some underexplored gold tenements in Ghana.

About three years later it discovered the flagship Namdini deposit, and the market got excited. This thing was shaping up to be a monster.

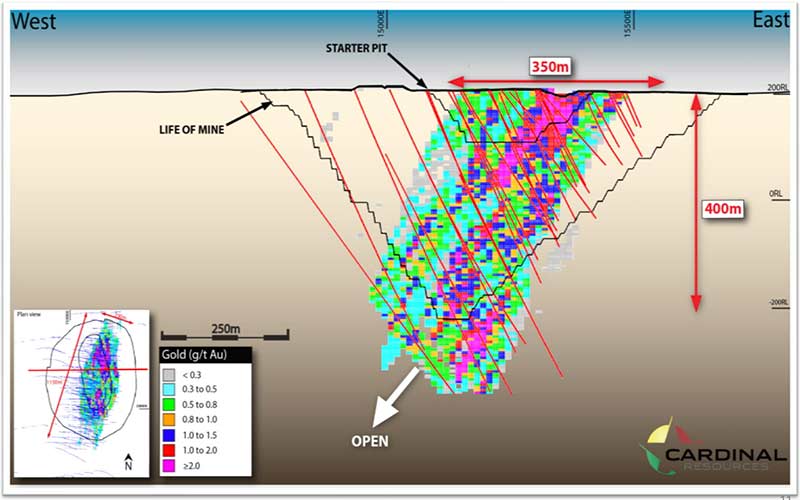

The share price really went for a run in 2016. At this point, Cardinal had delineated a large mineral system 1km long, 200-300m wide, and 350m deep. A maiden gold resource was due Q4 2016.

Then things went pear-shaped. The share price fell from highs of 77.5c to 63c just prior to the release of the maiden resource announcement. It kept going to lows of about 16c once the 4moz resource was announced.

That’s because initial metallurgical test work suggested it was going to be harder and more expensive for Cardinal to unlock the gold from the ore, potentially increasing project capital and operating costs.

But the company worked hard on its processing flowsheet and recovered. Heavy hitters like Gold Fields and Sprott soon jumped on the register.

Now with gold prices surging in 2019, today’s feasibility study naturally looks pretty good across a number of key metrics. Plus, this thing is huge and still growing.

“With over 1 million ounces slated for production in the first three years — 421,000 oz in year one alone — and an average annual gold production of 287,000 oz over a 15‐year mine life, Namdini ranks amongst the world’s largest known, financially robust, undeveloped gold projects,” Cardinal chief Archie Koimtsidis says.

Namdini’s 5.1-million-ounce ore reserve could generate $US1.46 billion ($2.1 billion) in pre‐tax free cashflow over the initial life on a gold price of $US1350 – significantly below the current spot gold price of about $US1500.

The all-in sustaining costs are aren’t bad either – just $US585/oz for the starter pit and $US895/oz over the life of the mine — while the development costs of $US390m are a big improvement on pre-feasibility study numbers. It will take about two years to pay that back.

Now it’s all about securing the project finance.

In early 2019, Cardinal kicked off financing discussions with a number of Australian and international banks — it has the Commonwealth bank on the register — from which the company received a number of preliminary (non‐binding) financing term sheets.

“Discussions with these interested financial institutions have progressed where financial and technical due diligence has commenced, with a data room prepared and accessed, with several technical site visits already conducted,” the company says.

“Review of financing options for the Namdini project will be completed in due course.”

Dacian’s recovery from that horror June quarter continues.

Executive chairman Rohan Williams says the miner has rebounded with an “excellent” September quarter.

“With production of over 42,000 ounces of gold for the quarter generating operational cash flows of over $20m, it has enabled the company to increase its cash and equivalents to $54m, and this is after paying $10.8m back to our banks in debt repayments,” he says.

“We remain very focused on delivering our stated production guidance of 150,000-170,000 oz of gold production at Mt Morgans at an all-in-cost of $1,400-$1,500/oz (which is inclusive of all capital) for FY2020.”

A couple of big drilling programs are about to get underway.

Proven mine-finder Talisman Mining (ASX:TLM) will drill five priority gold targets at the Lachlan project in NSW, starting later this month. The region has come under investor scrutiny following Alkane Resources’ (ASX:ALK) big discovery at Boda.

And Greenpower Energy — soon-to-be called Great Northern Minerals (ASX:GNM) — is planning a maiden drill program at three historic gold mines in Queensland.

“This drilling announcement marks a significant point in the transformation of this company and we believe the three projects will provide real opportunity to build on the known gold endowment that was uncovered here and mined up until the 1990s,” Greenpower’s Cameron McLean says.