These explorers are right next door to Alkane’s massive copper-gold discovery

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Gold producer Alkane (ASX:ALK) has just discovered something very, very big at its Northern Molong porphyry project (NMPP), in the same neighbourhood as Newcrest Mining’s (ASX:NCM) mammoth 50moz Cadia operations in NSW.

On Monday, Alkane unveiled this incredible hit at the Boda prospect — 502m at 0.48 grams per tonne (g/t) gold and 0.2 per cent copper, 211m from surface.

It might seem low grade, but because of their easy-mining large volumes, porphyry orebodies can be economic from copper concentrations as low as 0.15 per cent.

Alkane says there’s “several apparent similarities” between Boda and the upper sections of Newcrest’s nearby Cadia East deposit.

Basically, they’re saying this could be Cadia 2.0. The stock went for a run and is now up about 50 per cent.

But who’s holding ground around this massive discovery? ( This is not an exhaustive list — if we’re missing someone let us know.)

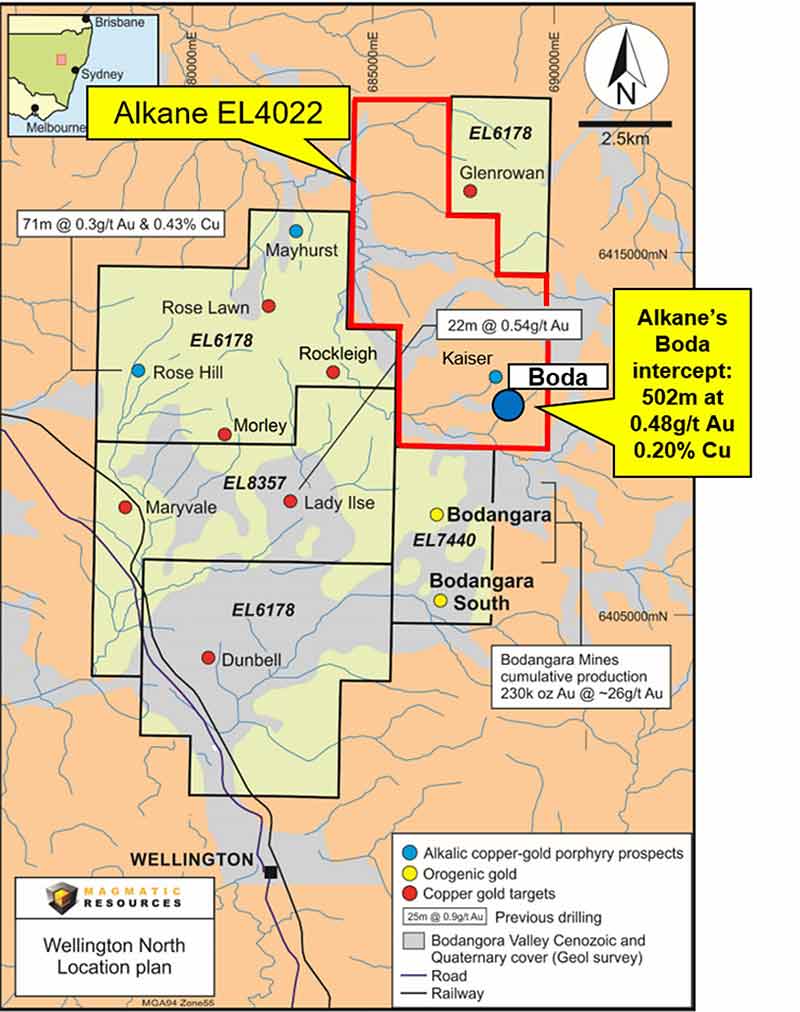

Magmatic Resources (ASX:MAG)

Market Cap: $5.3m

Magmatic’s ground literally encircles Alkane’s Boda prospect. This saw the share price jump from 1.8c to about 4.3c on nearology.

Magmatic holds a big chunk of the northern section of the Molong Volcanic Belt where it is exploring for porphyry copper-gold at Lady Ilse (22m at 0.54g/t gold) and Rose Hill (71m at 0.3g/t gold and 0.43 per cent copper).

Both of these prospects are considered possible porphyry targets with further work required, the explorer says.

Managing director David Richardson says the company has always been a huge believer in the region — given that Cadia Valley and Northparkes are the only two copper-gold porphyry mines in Australia.

“Porphyries, which supply up 60 per cent of the worlds copper, are in the East Lachlan; it’s a matter of finding them,” Richarson told Stockhead.

“The USGS (US Geological Service) has done work on the East Lachlan — they believe there is between four and 10 porphyries still to be found.”

And in the past year exploration activity in the region has really ramped up.

“In the last 12 months Newmont and Freeport have both pegged ground. FMG came in two years ago, while Sandfire had been there for years,” Richardson says.

For Magmatic, drilling at Lady Ilsa is a priority, he says.

“But we are looking to do JVs, because porphyries are a different beast. It takes a lot of money to explore – you really need $20m to throw at it.”

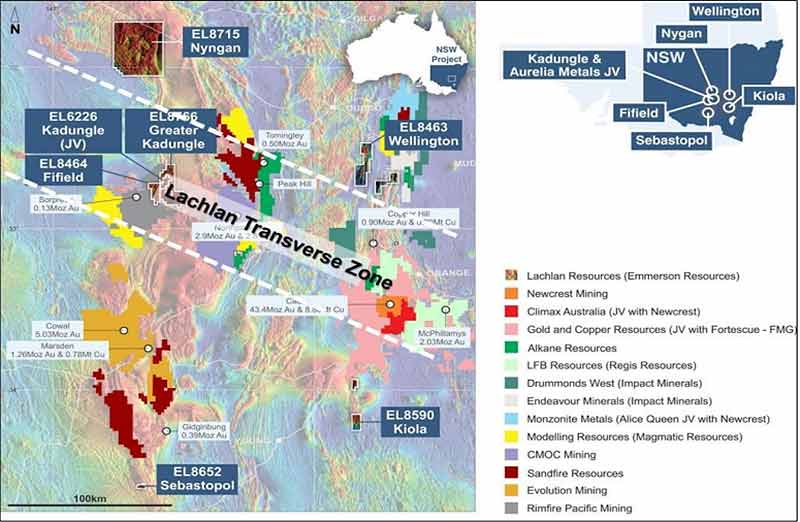

Emmerson Resources (ASX:ERM)

Market Cap: $59.5m

This explorer has five projects – some of them along strike from Alkane’s ground.

Emmerson’s first pass drilling earlier this year at Fifield, which contains the Whatling Hill project, intersected the outer zone of a porphyry copper system in an area with very little historical exploration.

Best results from this program were 8m at 0.4 per cent copper, including 1m at 1.4 per cent copper.

“We are still in the early discovery stage, but like Alkane, our project at Fifield has all the same geology and hallmarks as Cadia Ridgeway,” managing director Rob Bills told Stockhead.

“We will be drilling early next month so fingers crossed.”

Alice Queen (ASX:AQX)

Market Cap: $15.2m

Alice Queen is hunting large scale porphyry targets at Mendooran and Yarindury, also along strike from Cadia.

In early August, the explorer was preparing to drill six high quality porphyry targets under shallow cover at Yarindury.

These completely undrilled targets were generated by Alice Queen’s technical advisor John Holliday — who actually co-discovered Cadia Valley. What a guy to have in your corner.

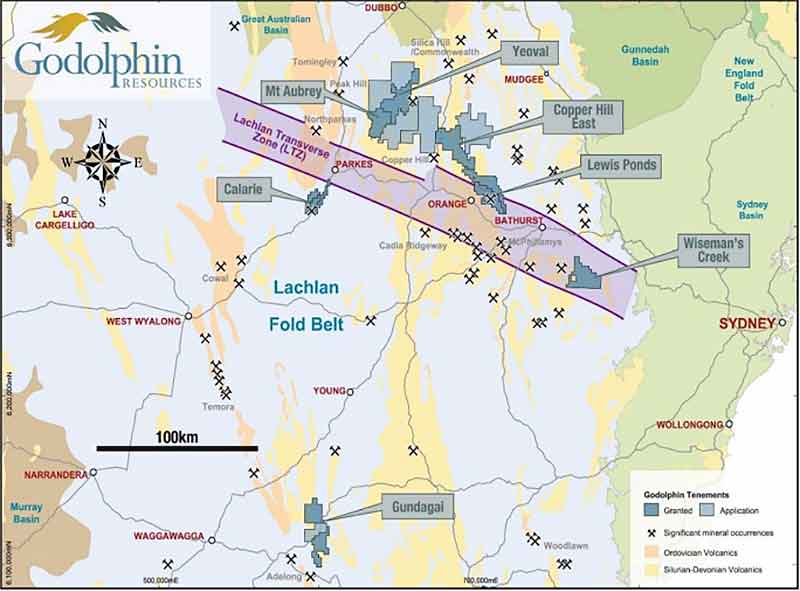

Ardea Resources (ASX:ARL)

Market Cap: $75.25m

Nickel-focused Ardea is planning to spin out its NSW copper-gold assets into a new IPO called Godolphin Resources.

The timing could be very good if the region heats up, because it has 3,216sqkm within the Lachlan Fold Belt of NSW, about 25km from Alkane’s Boda discovery.

Ardea’s Yeoval porphyry project currently contains 48,500 tonnes of copper, 58,000 oz of gold, 911,000 oz of silver and 1,500 tonnes of molybdenum metal – with the mineralisation remaining open in all directions.

“The Boda discovery result of 502m at 0.48g/t gold and 0.2 per cent copper is outstanding and the type of result every company dreams about receiving,” Ardea chief executive Andrew Penkethman told Stockhead.

“Additional exploration and resource definition work has the potential to define a large gold-copper porphyry mineral system that could be amenable to bulk scale underground mining, such as the Cadia Ridgeway operation.”

“These early results suggest that this is a significant discovery for NSW and all of Australia.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.