In 2021, Galan Lithium (ASX:GLN) is enhancing its already world-class Hombre Muerto West (HMW) project in South America’s Lithium Triangle. This project optimisation is progressing well into March.

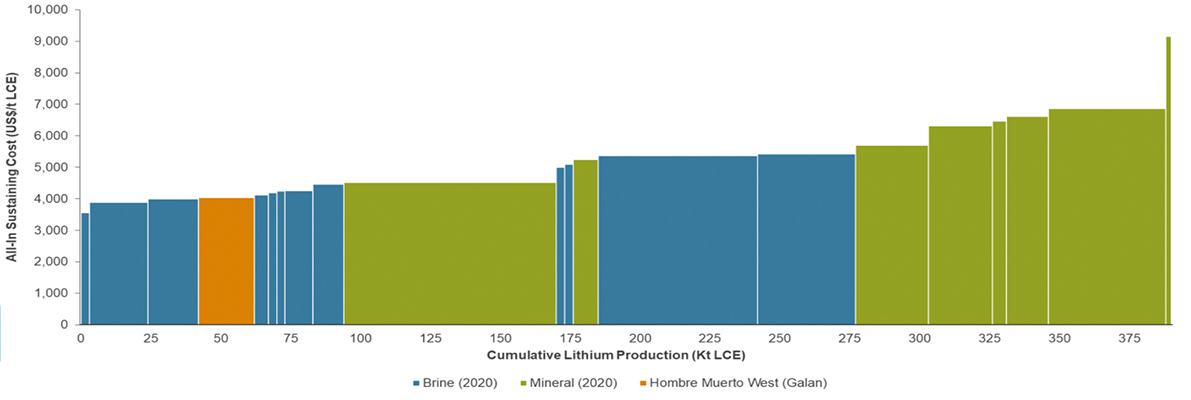

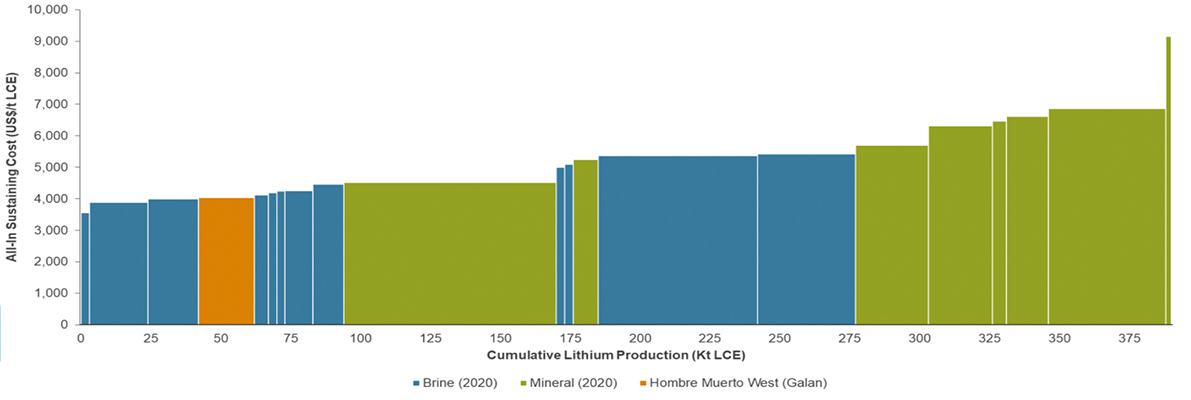

A recent study shows the project (orange, below) in Argentina would produce lithium at about $US3518 per tonne – already one of the lowest cash cost points in the industry — against Roskill’s average long-term lithium carbonate price (2020-2040) of $US11,687/t:

Envisioned to produce 20,000t per annum for more than 40 years using just 60 per cent of the current HMW resource, the capital costs for the project are estimated at $US439 million – inclusive of a 30 per cent ‘contingency’ (in case of unforeseen cost blowouts) which could be reduced through further improvements.

This improvement (or optimisation), as well as a broader understanding of the best way to mine HMW, is expected to be Galan’s focus over the next 12 months.

The company says project optimisation is progressing well into March, with chemical laboratory work for the HMW project now 85 per cent complete.

The brine concentration model prediction shows a sound correlation between actual lab results and the predictive brine evaporation model, the company says.

Furthermore, these results can be seen across the prediction of the concentration of lithium and impurities.

In parallel, the company is optimising evaporation route options by testing different reagents in the evaporation process to produce high grade lithium chloride concentrate.

Final lab results are expected by the end of this month.

Meanwhile at the project site, prep for future study activities continues.

A new site for the HMW camp and pilot areas has been located, which will provide better support to the crew while reducing travelling time, currently 40km east of Candelas.

Galan managing director Juan Pablo (JP) Vargas de la Vega says interim results showing great progress despite the COVID challenges in South America.

“Our team has done a fantastic job to provide solutions in this current environment,” he says.

“Galan has a unique setting of high grade and low impurities (with one of the lowest studied OPEX in the industry) that gives us significant more flexibility to test many ideas.

“Last year we took a 20 cubic metre sample of brine to Chile with the objective of continuing our testing and to provide enough samples to assay several evaporation trains to look beyond our initial PEA/Scoping Study plan.

“2021 it is an exciting year for Galan, and we remain fully funded to execute all studies required at HMW.”

This article was developed in collaboration with Galan, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

You might be interested in