You might be interested in

Mining

Galan just got the government agreement it needs to start commercialising its Argentinian lithium

Mining

Galan starts filling Pond 2 at its US$2bn Hombre Muerto West lithium brine project in Argentina

Mining

Mining

Special Report: New data has been incorporated to upgrade Galan Lithium’s total resource once again up to 8.6Mt contained lithium carbonate equivalent (LCE) at 859mg/L Li – one of the highest grades declared for Argentina brines.

HMW covers a total estimated area 18km long, up to 8km wide and 730m deep, adjacent to projects owned by Arcadium Lithium (ASX:LTM) and POSCO.

Last year’s definitive feasibility study (DFS) update earmarked a four-phase ramp-up to full production, with Phase 2 production set for 21,000tpa LCE in 2026, 40,000tpa by 2028 for Phase 3 and 60,000tpa LCE for Phase 4, which will then include Galan Lithium’s (ASX:GLN) other brine project at Candelas.

Pond 2 is currently being filled as part of the company’s 5,400tpa lithium carbonate equivalent (LCE) Phase 1 target. Pond 1 already contains 500t of LCE, and Pond 3 construction work is also well under way.

With lithium sentiment on the upswing, GLN is well placed to feed the market when it comes online in H1 2025.

GLN says ~20% resources boost to 8.6Mt LCE @ 859mg/L Li across its HMW and Candelas projects, with the inclusion of the Catalina tenements, “adds flexibility, optionality and leverage to any lithium price upswing”.

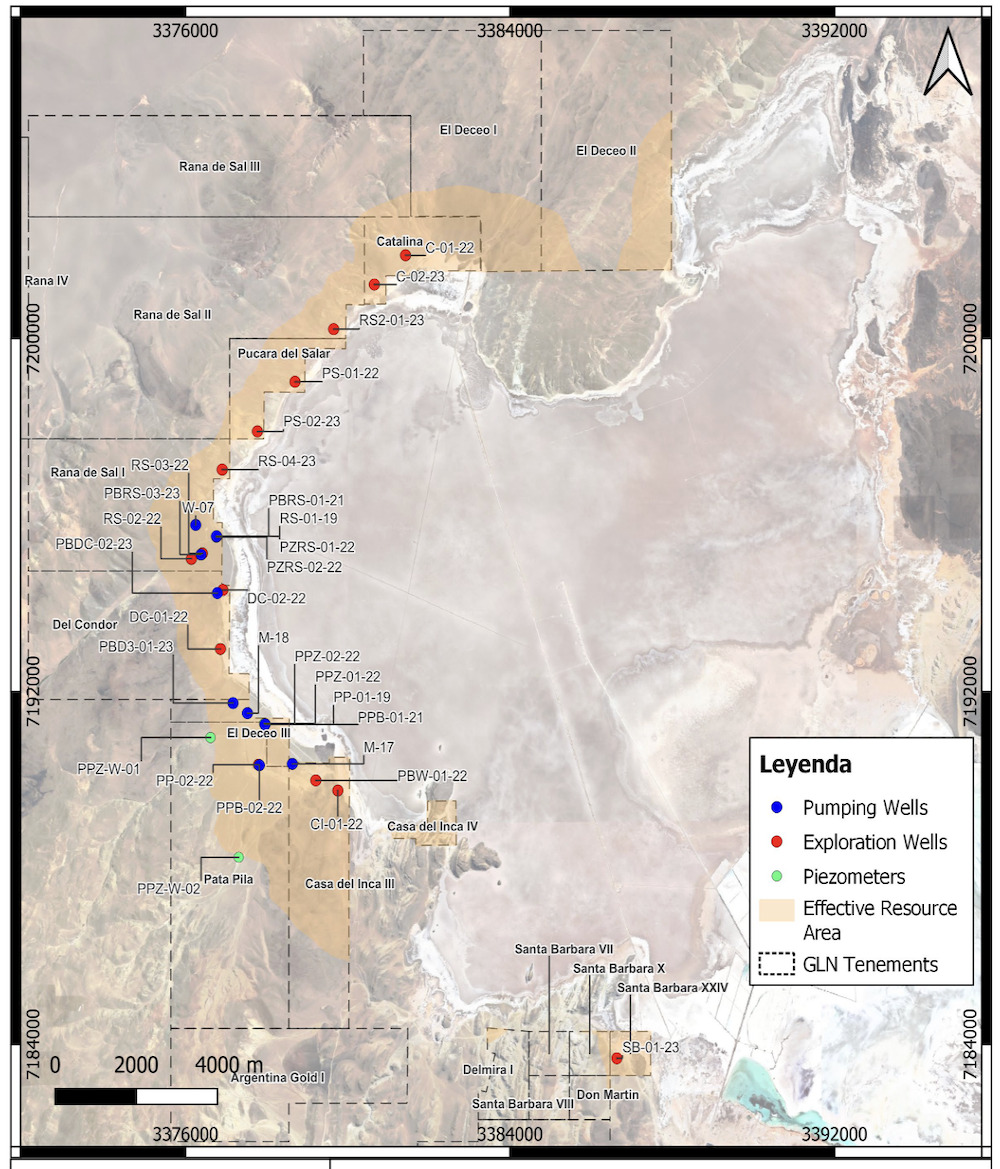

The updated MRE incorporates geological and geochemical information from 31 drillholes for 9,043m and upgrades the previous resource of 6.6Mt LCE @ 880mg/L Li.

A significant enhancement from previous MRE was the inclusion of the north project area in the Rana de Sal II, Rana de Sal III, Catalina, El Deceo I and El Deceo II areas which make up the Catalina tenements.

The Catalina tenements incorporated into the latest MRE upgrade at HMW. Pic supplied: (GLN)

“This latest significant upgrade in the high grade, low impurity HMW resource highlights the potential enormity of the brine resource that sits within Galan’s tenements,” GLN MD Juan Pablo (JP) Vargas de la Vega says.

“Coupled with our Candelas resource, Galan has a very solid foundation, and more importantly has delivered a further validation that its Hombre Muerto Salar resources fully support our four-stage lithium production target of up to 60ktpa LCE.

“The HMW project is robust and underpinned by strong financial metrics as illustrated in its Stage 1 and Stage 2 DFS results.

“We constantly evaluate opportunities to increase the value of the HMW project in parallel with continuing to construct Stage 1 as we look forward to first commercial production in 1H 2025.”

This article was developed in collaboration with Galan Lithium, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.