Eye on Lithium: Volkswagen could leap above Tesla as global EV sales leader by 2024

Mining

Mining

All your ASX lithium news for Wednesday, June 15

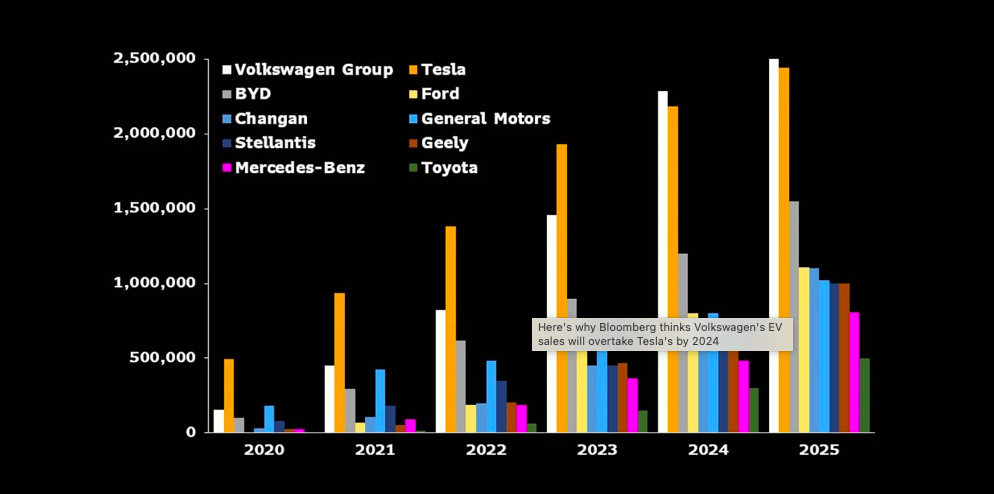

Bloomberg Intelligence believes that electric vehicle heavyweights Volkswagen and Tesla will race ahead of the rest of the industry and battle to become the leader in global EV sales – with VW just pulling ahead to beat out Tesla by 2024.

Which is interesting, because Tesla’s market cap is currently ~10x higher than VW’s. Will VW’s valuation go up, or Tesla’s go down? Or both?

VW has worked hard to move on from the reputation-trashing diesel cheating scandal of 2015, when it installed software in millions of diesel cars designed to cheat and show false emission results every time the vehicles were tested.

The company has really pushed its EV brand, which has a wider variety of models (and pricing options) under its umbrella compared to Tesla’s limited line-up.

Even if Volkswagen pushes Tesla to second place in global EV sales in 2024, the two automakers will hold a commanding lead over all other automakers, with each selling well over 2 million electric vehicles that year.

China’s BYD is expected to be a distant third, selling one million EVs in 2024.

By 2025, EVs are expected to account for 25% of all car sales in China and 20% in Europe, according to the report.

Volkswagen already has the lead in Europe, but in China it lags behind, only accounting for 3.5% of that market in 2021.

Compare that to Tesla’s 13% slice of the Chinese market, however its worth noting that Tesla has committed its Shanghai factory for manufacturing for export – which may cost it more market share in China.

Lithium stocks missing from our list? Shoot a friendly mail to [email protected]

| Code | Company | Price | % Month | % Week | % Today | Market Cap |

|---|---|---|---|---|---|---|

| LPM | Lithium Plus | 0.375 | -40% | -1% | 27% | $13,162,369.00 |

| LSR | Lodestar Minerals | 0.007 | -30% | -13% | 17% | $10,430,624.09 |

| TYX | Tyranna Res Ltd | 0.015 | 150% | -6% | 15% | $19,920,688.67 |

| SRI | Sipa Resources Ltd | 0.04 | 3% | -5% | 14% | $7,175,868.11 |

| M2R | Miramar | 0.105 | -13% | 0% | 14% | $5,905,173.00 |

| XTC | Xantippe Res Ltd | 0.009 | -10% | -10% | 13% | $61,544,455.19 |

| SRZ | Stellar Resources | 0.019 | -10% | -21% | 12% | $14,268,144.64 |

| NWM | Norwest Minerals | 0.034 | -26% | -15% | 10% | $5,598,829.00 |

| MTM | Mtmongerresources | 0.12 | -20% | -35% | 9% | $3,988,603.63 |

| EMS | Eastern Metals | 0.13 | -16% | -24% | 8% | $4,272,000.00 |

| KGD | Kula Gold Limited | 0.027 | -25% | -10% | 8% | $5,379,390.80 |

| KTA | Krakatoa Resources | 0.057 | -32% | -22% | 8% | $18,269,625.60 |

| ALY | Alchemy Resource Ltd | 0.017 | -15% | -19% | 6% | $15,249,184.91 |

| DAF | Discovery Alaska Ltd | 0.051 | 31% | -6% | 6% | $10,763,265.50 |

| WML | Woomera Mining Ltd | 0.019 | 6% | -14% | 6% | $12,362,995.19 |

| DAL | Dalaroometalsltd | 0.095 | -24% | 0% | 6% | $2,688,750.00 |

| JRL | Jindalee Resources | 2.95 | -15% | -19% | 5% | $160,661,104.80 |

| ZNC | Zenith Minerals Ltd | 0.335 | -9% | -9% | 5% | $110,049,329.60 |

| LRV | Larvotto Resources | 0.225 | -31% | -18% | 5% | $8,929,487.50 |

| GSM | Golden State Mining | 0.047 | -27% | -22% | 4% | $5,238,959.36 |

| INF | Infinity Lithium | 0.125 | -11% | -7% | 4% | $49,801,567.92 |

| WC8 | Wildcat Resources | 0.029 | -3% | -15% | 4% | $18,067,636.36 |

| PAM | Pan Asia Metals | 0.45 | 1% | -15% | 3% | $32,041,510.14 |

| WCN | White Cliff Min Ltd | 0.0155 | -30% | -9% | 3% | $9,804,050.43 |

| BMM | Balkanminingandmin | 0.19 | -42% | -24% | 3% | $6,058,750.00 |

| TEM | Tempest Minerals | 0.039 | -40% | -20% | 3% | $19,181,114.69 |

| CAI | Calidus Resources | 0.65 | -24% | -18% | 1% | $260,079,259.41 |

| RIO | Rio Tinto Limited | 111.68 | 6% | -4% | 1% | $41,223,560,564.70 |

| 1MC | Morella Corporation | 0.017 | -35% | -19% | 0% | $87,995,637.76 |

| AVZ | AVZ Minerals Ltd | 0.78 | 0% | 0% | 0% | $2,752,409,203.44 |

| LPD | Lepidico Ltd | 0.026 | 0% | -13% | 0% | $169,186,459.86 |

| TKL | Traka Resources | 0.008 | -11% | 0% | 0% | $5,510,196.49 |

| AAJ | Aruma Resources Ltd | 0.07 | -9% | -5% | 0% | $10,987,305.21 |

| AX8 | Accelerate Resources | 0.031 | -21% | -11% | 0% | $8,167,225.87 |

| AM7 | Arcadia Minerals | 0.19 | -12% | -19% | 0% | $6,648,575.00 |

| FRS | Forrestaniaresources | 0.135 | -50% | -23% | 0% | $3,793,338.54 |

| MMC | Mitremining | 0.12 | -17% | -8% | 0% | $3,250,212.00 |

| SHH | Shree Minerals Ltd | 0.007 | -30% | -22% | 0% | $8,555,658.24 |

| TSC | Twenty Seven Co. Ltd | 0.003 | -25% | 0% | 0% | $7,982,441.72 |

| CRR | Critical Resources | 0.054 | -26% | -13% | 0% | $80,337,305.68 |

| KZR | Kalamazoo Resources | 0.25 | -24% | -19% | 0% | $36,298,593.50 |

| QXR | Qx Resources Limited | 0.03 | -43% | -25% | 0% | $25,780,869.63 |

| ENT | Enterprise Metals | 0.012 | -14% | -14% | 0% | $7,735,762.26 |

| KAI | Kairos Minerals Ltd | 0.02 | -26% | -17% | 0% | $39,241,869.82 |

| PGD | Peregrine Gold | 0.38 | -14% | -17% | 0% | $14,548,934.22 |

| AVW | Avira Resources Ltd | 0.004 | -20% | 0% | 0% | $8,475,160.00 |

| EFE | Eastern Resources | 0.025 | -29% | -11% | 0% | $24,860,915.78 |

| AOA | Ausmon Resorces | 0.006 | -25% | -14% | 0% | $5,143,736.06 |

| VKA | Viking Mines Ltd | 0.007 | -22% | -13% | 0% | $7,176,809.02 |

| G88 | Golden Mile Res Ltd | 0.041 | -21% | -16% | 0% | $8,353,037.17 |

| THR | Thor Mining PLC | 0.01 | -17% | -17% | 0% | $10,673,009.73 |

| CZL | Cons Zinc Ltd | 0.02 | 0% | -9% | 0% | $7,267,156.26 |

| MXR | Maximus Resources | 0.049 | -33% | -22% | 0% | $15,577,382.63 |

| DRE | Dreadnought Resources Ltd | 0.037 | -3% | -3% | 0% | $105,031,291.39 |

| WMC | Wiluna Mining Corp | 0.48251 | 0% | 0% | 0% | $101,961,574.11 |

| GW1 | Greenwing Resources | 0.22 | -28% | -20% | 0% | $27,114,416.78 |

| IR1 | Irismetals | 0.28 | -56% | -13% | 0% | $15,575,000.00 |

| LNR | Lanthanein Resources | 0.017 | -35% | -11% | 0% | $14,243,034.69 |

| CY5 | Cygnus Gold Limited | 0.17 | 17% | 0% | 0% | $20,057,503.55 |

| NVA | Nova Minerals Ltd | 0.565 | -10% | -4% | -1% | $102,715,302.45 |

| PSC | Prospect Res Ltd | 0.945 | -1% | -3% | -2% | $427,839,925.44 |

| AKE | Allkem Limited | 10.1 | -9% | -14% | -2% | $6,548,748,543.22 |

| IGO | IGO Limited | 10.77 | 2% | -9% | -2% | $8,299,655,230.48 |

| AS2 | Askarimetalslimited | 0.275 | -43% | -27% | -2% | $11,646,395.60 |

| AZI | Altamin Limited | 0.095 | -4% | -4% | -2% | $37,996,524.94 |

| VUL | Vulcan Energy | 5.66 | -20% | -21% | -2% | $762,225,071.10 |

| RAG | Ragnar Metals Ltd | 0.04 | 8% | 0% | -2% | $15,546,580.45 |

| MRR | Minrex Resources Ltd | 0.035 | -34% | -19% | -3% | $36,313,758.32 |

| TKM | Trek Metals Ltd | 0.069 | -9% | -21% | -3% | $22,053,320.65 |

| MIN | Mineral Resources. | 53.91 | 0% | -9% | -3% | $10,512,022,394.52 |

| INR | Ioneer Ltd | 0.3675 | -24% | -24% | -3% | $794,693,779.60 |

| LTR | Liontown Resources | 1.015 | -16% | -16% | -3% | $2,301,836,457.90 |

| DTM | Dart Mining NL | 0.058 | -12% | -13% | -3% | $8,115,609.60 |

| GLN | Galan Lithium Ltd | 1.11 | -20% | -14% | -3% | $350,059,266.30 |

| EVR | Ev Resources Ltd | 0.026 | -28% | -21% | -4% | $25,001,569.92 |

| AUN | Aurumin | 0.13 | -30% | -19% | -4% | $14,745,139.02 |

| ZEO | Zeotech Limited | 0.052 | -5% | -16% | -4% | $82,345,435.38 |

| MLS | Metals Australia | 0.05 | -41% | -29% | -4% | $26,891,510.10 |

| SCN | Scorpion Minerals | 0.075 | -14% | -14% | -4% | $25,882,832.98 |

| BNR | Bulletin Res Ltd | 0.125 | -24% | -17% | -4% | $37,711,843.00 |

| MNS | Magnis Energy Tech | 0.3025 | -24% | -16% | -4% | $304,442,878.64 |

| AOU | Auroch Minerals Ltd | 0.07 | -21% | -11% | -4% | $26,969,981.33 |

| PLS | Pilbara Min Ltd | 2.07 | -16% | -15% | -4% | $6,429,992,509.44 |

| QPM | Queensland Pacific | 0.115 | -21% | -15% | -4% | $187,633,575.72 |

| WR1 | Winsome Resources | 0.23 | -43% | -34% | -4% | $32,427,358.56 |

| MQR | Marquee Resource Ltd | 0.069 | -24% | -26% | -4% | $22,460,290.92 |

| EPM | Eclipse Metals | 0.023 | -12% | -8% | -4% | $46,107,033.91 |

| LEL | Lithenergy | 0.8 | -28% | -24% | -4% | $37,700,250.00 |

| LIS | Lisenergylimited | 0.445 | -22% | -11% | -4% | $77,150,096.96 |

| CXO | Core Lithium | 1.16 | 1% | -6% | -5% | $2,104,809,045.66 |

| LRS | Latin Resources Ltd | 0.063 | -43% | -25% | -5% | $127,377,606.71 |

| PLL | Piedmont Lithium Inc | 0.6775 | -2% | -15% | -5% | $374,575,268.00 |

| FTL | Firetail Resources | 0.31 | -2% | -15% | -5% | $20,079,312.50 |

| RDT | Red Dirt Metals Ltd | 0.385 | -11% | -15% | -5% | $123,344,542.53 |

| LRD | Lordresourceslimited | 0.19 | -27% | -22% | -5% | $6,156,924.20 |

| RAS | Ragusa Minerals Ltd | 0.094 | 25% | -6% | -5% | $12,447,879.44 |

| GT1 | Greentechnology | 0.73 | -8% | -20% | -5% | $104,898,640.00 |

| LKE | Lake Resources | 1.505 | 8% | 3% | -5% | $2,140,879,283.22 |

| ADV | Ardiden Ltd | 0.0085 | -29% | -15% | -6% | $24,015,018.20 |

| LIT | Lithium Australia | 0.068 | -21% | -17% | -6% | $74,549,179.51 |

| LPI | Lithium Pwr Int Ltd | 0.3625 | -37% | -19% | -6% | $134,420,766.48 |

| AZL | Arizona Lithium Ltd | 0.094 | -33% | -25% | -6% | $223,271,921.20 |

| BYH | Bryah Resources Ltd | 0.031 | -33% | -26% | -6% | $7,464,836.78 |

| RGL | Riversgold | 0.031 | -23% | -18% | -6% | $24,960,407.97 |

| AGY | Argosy Minerals Ltd | 0.3425 | -6% | -21% | -6% | $494,932,179.51 |

| RLC | Reedy Lagoon Corp. | 0.015 | -40% | -32% | -6% | $8,918,830.59 |

| ARN | Aldoro Resources | 0.15 | -35% | -29% | -6% | $15,874,174.24 |

| VMC | Venus Metals Cor Ltd | 0.15 | -17% | -19% | -6% | $24,172,589.28 |

| ASN | Anson Resources Ltd | 0.1075 | -2% | -23% | -7% | $118,209,918.53 |

| EMH | European Metals Hldg | 0.7 | -30% | -24% | -7% | $105,582,723.75 |

| A8G | Australasian Metals | 0.205 | -42% | -43% | -7% | $9,057,508.68 |

| GL1 | Global Lithium | 1.22 | -23% | -20% | -7% | $208,688,206.64 |

| NMT | Neometals Ltd | 0.93 | -34% | -22% | -7% | $551,118,277.98 |

| ESS | Essential Metals Ltd | 0.36 | -28% | -27% | -8% | $96,115,397.04 |

| RMX | Red Mount Min Ltd | 0.006 | -25% | -14% | -8% | $10,675,365.08 |

| CHR | Charger Metals | 0.405 | -28% | -15% | -8% | $14,335,655.40 |

| PNN | PepinNini Minerals | 0.39 | -32% | -14% | -8% | $26,138,985.80 |

| FG1 | Flynngold | 0.11 | -19% | -12% | -8% | $7,687,326.00 |

| MMG | Monger Gold Ltd | 0.225 | -24% | -21% | -10% | $10,010,000.00 |

| SYA | Sayona Mining Ltd | 0.125 | -48% | -24% | -11% | $1,153,947,221.84 |

| EUR | European Lithium Ltd | 0.056 | -29% | -16% | -11% | $87,123,559.07 |

| TMB | Tambourahmetals | 0.16 | -24% | -22% | -11% | $7,414,667.64 |

| IPT | Impact Minerals | 0.008 | -24% | -11% | -11% | $22,332,335.00 |

| MM1 | Midasmineralsltd | 0.195 | -28% | -29% | -11% | $11,976,387.50 |

| AML | Aeon Metals Ltd. | 0.023 | -39% | -18% | -12% | $25,769,414.40 |

| FFX | Firefinch Ltd | 0.22 | -74% | -32% | -12% | $295,310,805.25 |

| STM | Sunstone Metals Ltd | 0.042 | -26% | -13% | -13% | $123,573,428.06 |

| TON | Triton Min Ltd | 0.023 | -8% | -15% | -15% | $33,987,172.78 |

| IMI | Infinitymining | 0.11 | -31% | -24% | -15% | $7,475,000.00 |

Only 28 stocks were in the green, 31 flatlined and 70 were in the red.

The company has processed recent airborne radiometric, magnetic and DEM survey data for its Greenbushes South JV project, flagging 18 new key target zones for lithium pegmatites.

Plus, mapping and sampling of the first target site (GS11) discovered an approximately 200m x 40m outcropping pegmatite lens with similar mineralogy to the pegmatites at the Tier 1 Greenbushes Lithium Mine just 15kms away.

Soil samples and rock chips from GS11 have been sent for geochemical assay, and Galan says further fieldwork on that site and other key targets is scheduled from July.

Rockchip sampling at the Tambourah project has returned up to 3.14% lithium at surface at the Lion prospect, and CEO Julian Ford says the company has just scraped the surface.

“Grade is king, and the results from our Lion Prospect at Tambourah, with an average grade of 2.24% Li2O and a maximum of 3.14% Li2O, are outstanding,” he said.

“We are encouraged by the scale of the Tambourah Project, as the Lion, Ragdoll and a new prospect to the north extend now for over 800 metres along the granite contact.

“Our understanding of the lithium mineralisation is improving with each site visit, and we are encouraged by MinRex Resources’ (ASX:MRR) success next door.

“The lithium mineralisation discovered to date represents just a very small part of the overall tenement potential, with the majority of the tenement still to be explored over the coming months.

“Our focus to date has been around the western granite/greenstone contact and we see great potential for our pegmatites to extend further along approximately 34km of contact – west and east – and to extend well into and under the greenstones.”

The company has wrapped up its acquisition of the South Dakota lithium project – making it the second ASX-listed US hard rock lithium explorer behind Piedmont Lithium (ASX:PLL).

Chairman Simon Lill says its transformational for IRIS.

“It diversifies the Company geographically and by commodity, providing shareholders with exposure into the highly strategic battery metals space,” he said.

“The US in general and South Dakota specifically present a supportive environment for the development of battery metals assets; leaving IRIS ideally positioned to leverage from exploration success.”

Pegmatite mapping and rock chip sampling is currently underway, with the company planning its initial exploration program.

LITHIUM PLUS MINERALS (ASX:LPM)

The Northern Territory Department of Industry, Tourism and Trade has approved the company’s Mining Management Plan (MMP) for its flagship Bynoe Lithium Project.

An initial program of around 10,000 metres of Reverse Circulation (RC) drilling is planned to kick off in early July and will be designed to target the Lei and Cai Prospects.

“Our initial focus is the Lei and Cai Prospects, where we believe there is strong potential to delineate a maiden high-grade lithium resource at Bynoe,” executive chairman Dr Bin Guo says.

At Stockhead we tell it like it is. While Galan Lithium and Iris Metals are Stockhead advertisers, they did not sponsor this article.