EV production could send uranium nuclear. These ASX juniors are jumping all over it

Mining

Mining

Uranium is peaking right now on the dancefloor of our energy transition and there’s a bunch of ASX-listed juniors with tangible projects that have been waiting all too patiently to get their groove on.

Once-shuttered uranium mines are starting to come back online and new projects are in development, as demand is foreseen to exponentially outstrip supply to meet our energy needs.

Nuclear energy has definitely had a chequered past.

The horrors of Hiroshima and Nagasaki; reactor disasters of Chernobyl, 5-Mile Island, Fukushima, nuclear test sites and the fear of nuclear bombs going off throughout the Cold War era have instilled in our society uncomfortable feelings about producing nuclear energy.

While generational directing talent Chris Nolan’s cinematic masterpiece Oppenheimer might lend your mind to revisit the horrors of ~78 years ago. (You have to see it, it’s Nolan’s Magnum Opus.)

Those were horrific moments in time, however, nuclear power generation is now considered one of the cleanest, highest-output forms of energy production we have available, so there’s a real good argument to be had around its benefits and unlikelihood of future accidents.

Third-generation nuclear plants began operating in 1996, incorporating improved fuel tech, higher thermal efficiency, as well as significantly improved safety systems and standardised designs that reduce capex.

And so we need uranium. Governments around the world are waking up to the fact that we’re going to need a lot more stable, clean and cheap baseload energy supply – and quickly, as we transition from combustible to electric vehicles that will lean heavily on electricity grids.

U3O8 is now trading at ~US$56/lb, a much healthier point than in the recent past – and there’s still room for price improvement.

Yes, it’s costly to construct a nuclear power plant, but the metrics shown here speak for themselves when it comes to power output and nuclear’s clean energy bill.

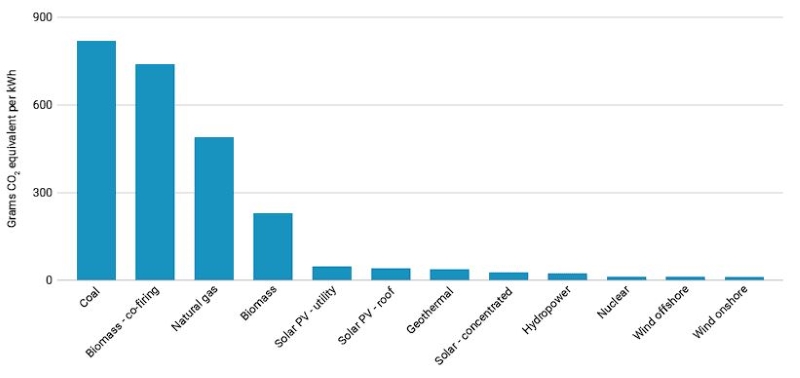

“On a life-cycle basis, nuclear power emits just a few grams of CO2 equivalent per kWh of electricity produced,” says the World Nuclear Association.

“A median value of 12g CO2 equivalent/kWh has been estimated for nuclear – similar to wind, and lower than all types of solar.”

Both the acidification and eutrophication potential of nuclear power are estimated to be among the lowest of all available generation technologies.

With the Russian-Ukraine war in full tilt and imposed sanctions on imports from Russia by the West, uranium is now fighting a scarcity issue and prices of the yellow cake are ready to jump.

Speaking to Stockhead, uranium boffin and Elevate Uranium (ASX:EL8) CEO Murray Hill lays down the necessity of baseload energy production for our transition to net-zero emissions.

Hill says the accelerating global adoption of EVs will weigh heavily on electricity grids and nations need to realise that the amount of juice required is going to skyrocket.

“We’re going to need an enormous amount of reliable, low emissions power. Where’s it going to come from? The world is going to need more reactors and more uranium,” he says.

“It’s very clear that the world is on its way to decarbonisation and electrification, and what gets lost in the conversation around batteries is that the energy obviously has to be charged into them and has to come from somewhere.

“Stable energy supply predominantly comes from fossil fuel extraction still, yet nuclear power is cleaner, cheaper and has a low carbon footprint.”

Hill says it’s a very exciting time to be in uranium because we know the push into carbon-free energy is increasing.

“We know that supply will have to increase. There’s only one way to go and that’s up,” Hill says.

“When utilities realise that supply will be increasingly tight, they’re going to jump over each other to get uranium.”

In UK-based Energy Institute’s recent Statistical Review of World Energy report, fossil fuels made up 82% of global energy production – and by 2030, analysts would like to see that figure drop with an increase from nuclear’s current 10% share rise to 25%, among other, cleaner power generation sources if we are to achieve our net-zero targets by then.

There are currently ~436 reactors in production (with 59 under construction), providing 391,669MWe for ~10% of the world’s electricity.

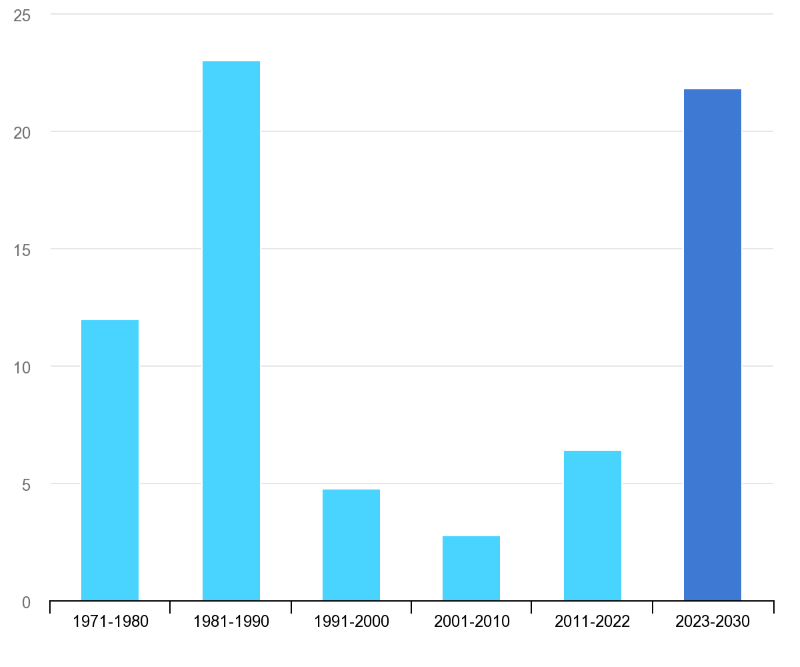

Uranium production, as well as the market price, stagnated over the decades – but that’s changing. Fast.

With countries around the world continue to announce plans to increase or upgrade nuclear generation capacity, ASX-listed explorers and mine developers dotted across the globe are looking to prove up uranium to feed nuclear energy producers.

Elevate’s Hill says the company’s “blue sky” potential in Namibia is enormous and already hosts Rio Tinto’s Rössing – the largest uranium mine in the world.

It owns the Koppies, Hirabeb, Marenica and Namib IV projects where the company is undergoing extensive drilling.

“We hold a large land position in a Tier 1 jurisdiction and have three rigs spinning at the moment drilling 75-80 holes a week.

“We’ve got great optionality in Namibia, where infrastructure around uranium production and processing is robust and comes with lower capex than other jurisdictions.”

Elevate also has tenements in Australia, owning 48Mlbs of high-grade uranium mineral resources in Australia at an average grade of 859ppm U3O8, including the Angela, Thatcher Soak, Minerva and Oobagooma projects and JV interests in the Bigrlyi, Malawiri, Walbiri and Areva projects.

Peninsula Energy (ASX:PEN) is another near-term uranium producer at its flagship Lance project, which has a JORC resource of 53.7Mlbs U308 aiming to be the first commercial US uranium project to utilise low-pH in-situ Recovery (ISR) processing methods.

At Nabarlek in the NT, DevEx Resources (ASX:DEV) holds a dominant 4,700km2 tenement package in the Alligator Rivers Uranium Province.

Bannerman Energys’ (ASX:BMN) Etango-8 project is continuing towards development and production with FEED work and is targeting a final investment decision in the first half of next year.

In the doldrums for years, Paladin Energy (ASX:PDN) is finally making huge headway at its flagship Langer Heinrich project and is close to production, pegged for early next year.

Critical plant and equipment has been delivered to site with over 1,000 contractors working towards the restart of the Namibian mine.

Looking to reopen its Honeymoon mine in South Australia is Boss Energy (ASX:BOE), which is close to achieving first uranium in Q4 this year and has spent 79% of its $105m budget on the mine’s restart, which will make it Australia’s third active uranium producer.

A gravity survey was recently completed by Norfolk Metals (ASX:NFL) at the Orroroo project, also in South Australia where sandstone-hosted uranium mineralisation develops.

In Canada, Valor Resources (ASX:VAL) has recently staked the Beatty River REE and uranium project and plans for drilling are underway at Hidden Bay – near Cameco’s historic Rabbit Lake mine.

Explorer Uvre (ASX:UVA) is in uranium-rich Utah where it recently completed a magnetic and radiometric survey across its entire East Canyon project located in the highly-prospective Uravan mineral belt.

Moab Minerals (ASX:MOM) is also interested in the Uravan belt and currently drilling an initial three holes of a targeted 21-hole program at its Colorado REX uranium-vanadium project to test eastward extensions of known mineralisation.

Basin Energy (ASX:BSN) is progressing its Geikie project in the Athabasca Basin, advancing drill targets deemed prospective for high-grade uranium mineralisation.

In Sweden and Mauritania, Aura Energy (ASX:AEE) is exploring its Häggån and Tiris projects respectively.