You might be interested in

Mining

First lithium carbonate produced at Green River opens pathway for Anson’s success

Mining

Two of a pair: Anson confirms the target clastic zones at Green River are the same as those at its Paradox project

Mining

Mining

Anson plans to test 3 priority targets with a new drilling program at its recently acquired Green River project in an aim to establish a resource.

The 106.2km2 Green River project, about 50km northwest of the company’s flagship Paradox lithium project, was staked in January 2023.

The projects boast similar geological, metallurgical, and structural characteristics but, interestingly, drilling has resulted in brine flowing to the surface at Green River, which did not occur at Paradox.

This has the potential to reduce operating costs as it eliminates the need for mechanical pumping to extract brines from depth.

Notably for Anson Resources (ASX:ASN), Green River is a potentially large project with a conceptual Exploration Target of between 2Bt and 2.6Bt of brines grading 100 parts per million to 150ppm lithium and 2,000ppm to 3,000ppm bromine.

In September, Anson doubled down, acquiring a 56.8 hectare industrial zoned property less than 1km from the project.

For Anson, Green River is set to play a significant role in its development plans, with the company looking to build its proposed future lithium extraction and production facility at the site.

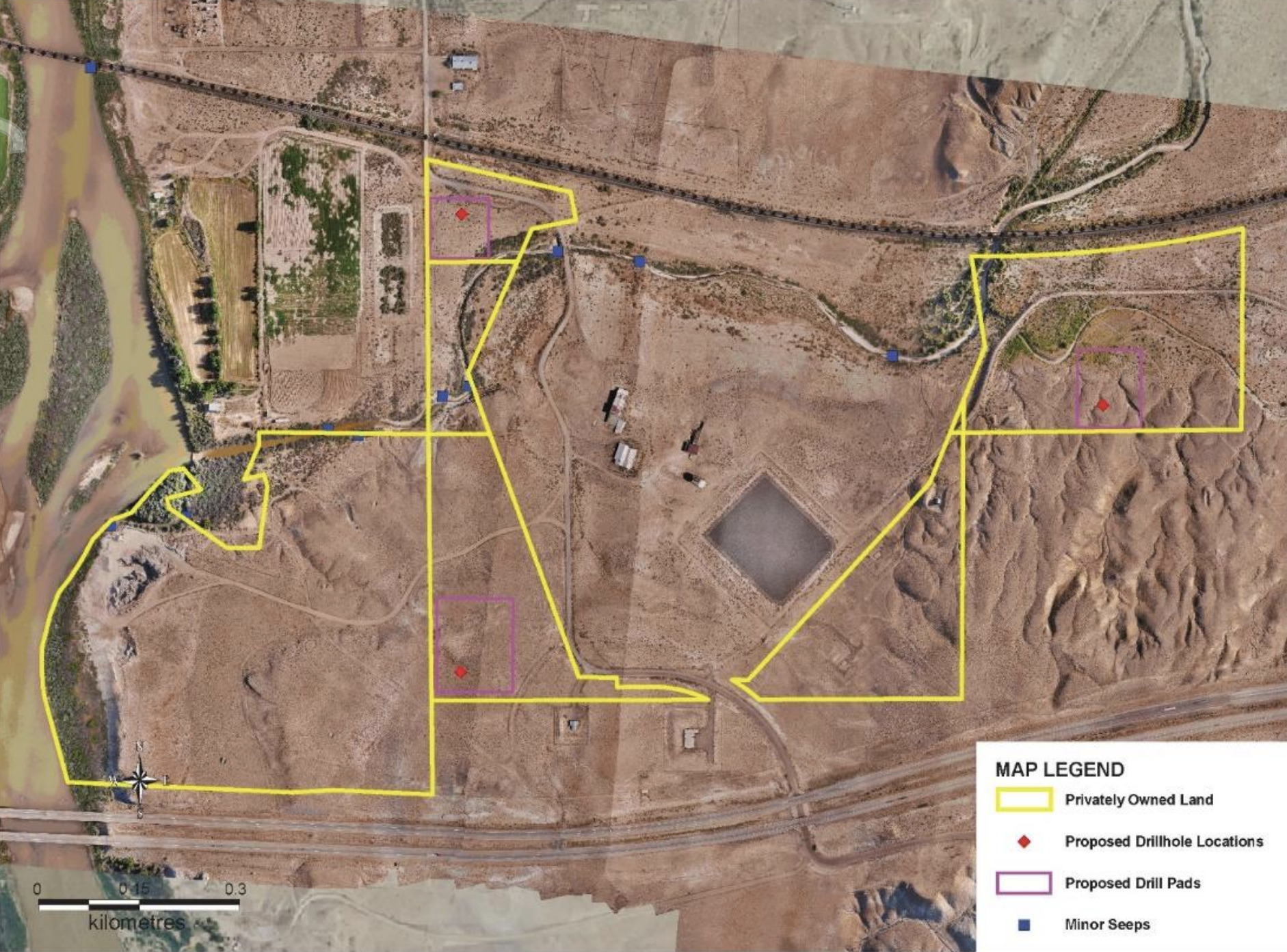

The ground is surrounded by existing infrastructure including the national rail network, interstate road system and gas and power, which ASN believes could provide major time and cost savings for project development.

Being privately owned, it also benefits from a less rigorous approval process for drilling, extraction, transportation and disposal.

Anson now plans to undertake resource drilling on this newly acquired area at Green River, which is Phase 2 of the company’s mineral resource definition strategy.

It is designed to add resources to those planned to be defined from the company’s proposed re-entry drilling program at existing oil and gas wells (Phase 1).

This second phase will hit three drill targets on flat, sparsely vegetated ground that will require very little earthworks and site preparation prior to drilling.

The explorer has submitted a requisite Application Permit to Drill to UDOGM due to the planned depths of the wells.

With all the regulatory environmental, cultural and land surveys complete, Anson plans to kick off drilling on receival of the UDOGM approval.

At this stage, drilling is planned to a total vertical depth of approximately 3,292m to sample both the Mississippian units and Clastic Zones.

It has been recorded that both the Clastic Zones and the Mississippian units contain supersaturated brines, but no assaying for lithium has been carried out to date.

The program is designed to target highly porous horizons within the project area, which have formed due to the geological structures in the region.

Green River’s high level of porosity is confirmed by observed ‘seeps’ in the area of the drill program.

Seeps are defined as slow and intermittent flow or leak-through porous material, and their presence indicates that the porosity of the deeper rock units in the region may have increased.

Meanwhile, Anson has ramped up lithium carbonate production from its demonstration plant in Florida to meet demand from potential US offtakers.

This is a significant milestone for the company as it has only just started producing battery-grade lithium carbonate using direct lithium extraction (DLE) technology provided by its partner Sunresin to process brines sourced from the Paradox lithium project in Utah.

Additionally, progress is being made on the approvals process to start production at Paradox with the company nabbing a key air quality approval in early August.

Completion of the detailed Front-End Engineering & Design study (FEED) is also expected soon.

This article was developed in collaboration with Anson Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.