You might be interested in

Mining

Resources Top 5: Is this well-located explorer ready to catch up to its potential?

Mining

Resources Top 5: Does this stonker copper hit bring back the Sandfire days for you as well?

Mining

Mining

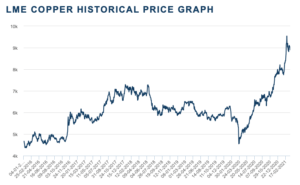

Chinese economic stimulus measures and growing investment in copper-intensive electrification and green energy initiatives are expected to carry the copper price to a fresh high this year.

The red metal hit a 10-year high of $US9,550 per tonne ($12,350/tonne) in late February, and the London Metal Exchange’s three-month copper futures contract touched $US9,017 per tonne Friday.

“Copper steadied as investors shrugged off recent concerns that China intends to trim spending on stimulus measures,” said analysts at ANZ bank in a research note.

China’s government has supported its economy through the COVID-19 pandemic with huge infrastructure spending that has boosted demand for metals including copper.

Beijing is expected to gradually wind back some of its economic stimulus spending, which may temper some Chinese demand for copper products, although new demand is emerging.

“The outlook for the copper market remains strong. Demand from new growth sectors, such as renewable energy and EVs continues to rise. Supply side issues are also ramping up,” said the ANZ analysts.

Another bullish sign for the copper market is that copper smelters in China have lowered their treatment charges to process cargoes of ore into copper metal.

“Reports emerged this week that a Chinese smelter paid $US10 per tonne for a spot cargo of copper concentrate. This is compared with current long term contract terms of $US53 per tonne,” the ANZ analysts said.

Other market analysts agree that demand for industrial metals such as copper will remain robust in the years ahead.

Beijing last week released its latest five-year economic plan which included a goal of cutting China’s consumption of fossil fuels as it strives to decarbonise its economy by 2060.

The Asian country is committed to increasing the electrification of its economy as shown by its plans to build more high-speed railways, airports and roads for electric vehicles.

Metals producer and trading giant Glencore has forecast a two-fold expansion in copper demand by mid-century as new mine production is outpaced by soaring demand.

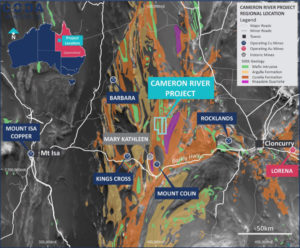

Coda Minerals (ASX:COD) has expanded its portfolio of Australian copper projects with its planned acquisition of a project for copper and gold in Queensland near Mount Isa.

The company has entered into a farm-in and joint venture agreement to pick up an 80 per cent stake in the Cameron River project which has peak grades of 22 per cent copper.

Coda Minerals said the Cameron River project is an “excellent strategic fit” with its flagship Elizabeth Creek copper project in South Australia.

“While we remain resolutely focused on our work in Elizabeth Creek, particularly the ongoing resource definition drilling at Emma Bluff and the exciting IOGC work, this was simply an opportunity that was too good to pass up,” chief executive, Chris Stevens, said.

The project in Queensland also provides the company with additional exposure to copper-gold exploration assets.

“We see this [project] as a logical and complementary addition to our existing portfolio of copper projects in South Australia that will open up a second platform for discovery, exploration success and, ultimately resource growth for Coda in a tier-one copper province,” added Stevens.

Coda Minerals is to spend $2m on the project over a three-year period to earn an 80 per cent stake in Cameron River which covers 35sqkm of copper and gold tenements.

The company also released assay results for two holes in its 17-hole drilling program for its Emmie Bluff prospect within its Elizabeth Creek copper-cobalt project.

The results included a new intercept of 7.58m at 1.51 per cent copper equivalent. Coda Minerals has a 70 per cent stake in Elizabeth Creek and Torrens Mining (ASX:TRN) 30 per cent.

Copper explorer Cobre (ASX:CBE) has signed an investment agreement with Armada Exploration, the owner of two exploration licences for nickel-copper sulphide in Gabon.

The exploration licences cover a total of 3,000sqkm of tenements in the west African country and present Cobre with a “frontier district-scale exploration opportunity”.

Cobre is paying $US750,000 for the exploration tenements via a promissory note and has subscribed for 5 million shares in Armada at 15 US cents each.

Armada Exploration’s management team include executives responsible for Ivanhoe Mines’ discovery of the world-class Kamoa deposit in the Democratic Republic of the Congo.

Armada has already spent $US10m on targeted exploration of the Gabon copper tenements and is gearing up to drill some identified magmatic nickel-copper sulphide targets in the Nyanga area in southern Gabon.

“With examples such as Noril’sk in Russia and Voisey’s Bay in Canada, along with Nova-Bollinger and Nebo-Babel deposits in Western Australia, Magmatic nickel-copper sulphide deposits represent some of the world’s most significant sources of base metals,” executive chairman and managing director, Martin Holland, said.

South Africa-focused explorer Orion Minerals (ASX:ORN) has intercepted some shallow high-grade nickel-copper-cobalt and platinum group elements at its Jacomynspan project.

Drilling at the project hit a massive sulphide zone at 31.5m at 0.72 per cent nickel, 0.34 per cent copper, 0.05 per cent cobalt, and 0.45 grams per tonne PGE and gold from 100.6m.

The intercept lies within a mineralised ultramafic body extending over a strike length of more than 3km, representing an outstanding shallow, open pit drill target.

“This is the best intersection ever achieved at Jacomynspan and confirms our view that there is a significant open pit opportunity at this project,” managing director and chief executive, Errol Smart, said.