Bargain Barrel: Experts think copper can hit new records as soon as 2025. These 10 stocks under a $20m MC are ready to run with the bulls

Mining

Mining

Is it finally happening? The copper boom propelled by the energy transition has been longer in its gestation than bullish market commentators had hoped.

Stalled by a general macroeconomic bloodbath, it’s now almost three years since the red metal hit all time highs of around US$10,700/t in May 2021.

That came amid calls the commodity could become the ‘new oil’ thanks to its centrality to the rollout of renewables and electric vehicles.

To summarise, cars were once a marginal source of demand for copper. But EVs require a lot more wiring than internal combustion engine cars, and that means there’s four times as much copper per automobile.

Renewables are great at providing cheap electricity when the sun is shining and the wind is blowing. But unlike the large centralised thermal generators around which most electricity grids have been designed, renewables are smaller in scale and need to be built where the resource is best captured.`

That means a rerouting of electricity grids requiring a massive roll out in interconnectors, poles and wires to connect dispersed generators to homes and businesses. You know what that means? More copper baby.

We’re someway from the exuberant mood that saw Goldman’s copper obsessed commodities lead Nicholas Snowdon say in 2022 that even US$100,000/t copper could be possible (his previous ultra-bullish projections had suggested prices could rise to US$15,000/t).

But there has been a string of supply traumas — highlighting the tenuous position of an industry facing a doubling of demand to 50Mtpa by 2050 yet stumped by its struggles to lift supply as mines get deeper and lower in grade – and both government approvals and social licence are getting harder to obtain.

The unexpected shuttering of First Quantum’s Cobre Panama mine late last year — around 3.5% of global supply — has flung what was going to be an oversupplied 2024 market into a significant deficit.

And last week we got the first sniff of the potential as copper rose 6% to more than US$9000/t after Chinese refineries, losing money due to overcapacity, agreed to production caps in the face of decade low treatment and refining charges. Prices slid 1.2% to US$8977/t on Tuesday.

That has analysts tipping big price rises. Goldman is less bullish than it was a couple years ago, having called the copper boom a tad early. It sees a healthy US$10,000/t in 12 months.

Australia’s Shaw and Partners, meanwhile, thinks the commodity will surge to US$11,000/t by 2025, having ratcheted up its expectations in February.

Bank of America has floated the idea copper could hit US$15,000/t, having flagged in December that new renewable energy targets could boost demand by an additional 4.2Mt to 2030.

This is all great for the current producers like Sandfire Resources (ASX:SFR), but the real gains will be made as money flows to the juniors at the bottom end of the market.

We’ve scoured the ASX for 10 juniors cheaper than $20m with the potential to fire if copper prices hit a record.

Market cap: $10 million

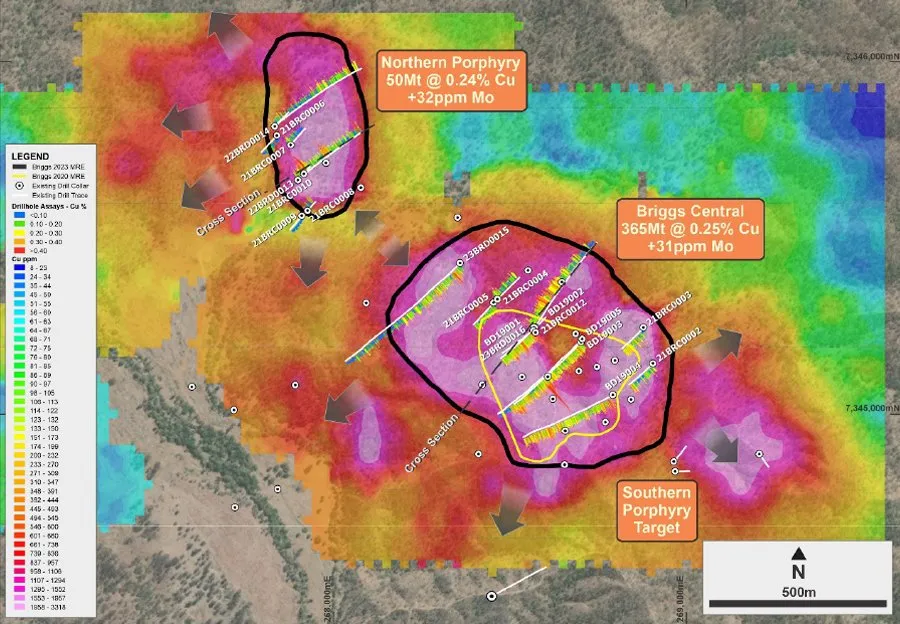

Alma’s Briggs copper deposit is an outlier compared to the sort of mine you would typically think of when you consider Queensland’s copper scene, which has in recent times been dominated by high grade iron-oxide copper gold finds like Evolution Mining’s (ASX:EVN) Ernest Henry.

It is, obviously, much lower in grade. But the porphyry hosted Briggs, Mannersley and Fig Tree Hill project makes up for that in scale, with an inferred resource containing upwards of 1Mt of copper metal and one of Australia’s largest deposits of molybdenum at 28.6Mlb.

Covering an area of around 245km2, inferred JORC resources at the site, just 50km inland from the port of Gladstone, clock in at 415Mt at 0.25% Cu and 31ppm Mo.

Drilling has only outlined the quartz hosted stockwork-style mineralisation to 500m below surface, with future drilling planned to target prospects thought to host the highest copper grades at greater density in a bid to provide a sweetener for future resource upgrades.

The final assays from a 2023 campaign at Briggs extended this higher grade contact zone, hitting intervals upwards of 10m and up to 161m long at above the resource grade, including a hit of 161m at 0.29% Cu, 12m at 0.5% Cu and 94.5m at 0.33% Cu.

A scoping study for the project, where Alma is earning in from a 30% JV interest to 70% in a deal with Canterbury Resources (ASX:CBY), is due to take place later this year after June quarter drilling to evaluate this intrusive contact zone and upgrade Alma’s resource confidence.

Some of the drill hits announced in January will help as well, including a 136.3m hit from surface at 0.36% Cu and 90ppm Mo which included a 32.8m intersection from just 16.2m deep at 0.78% Cu.

Market cap: $18.5m

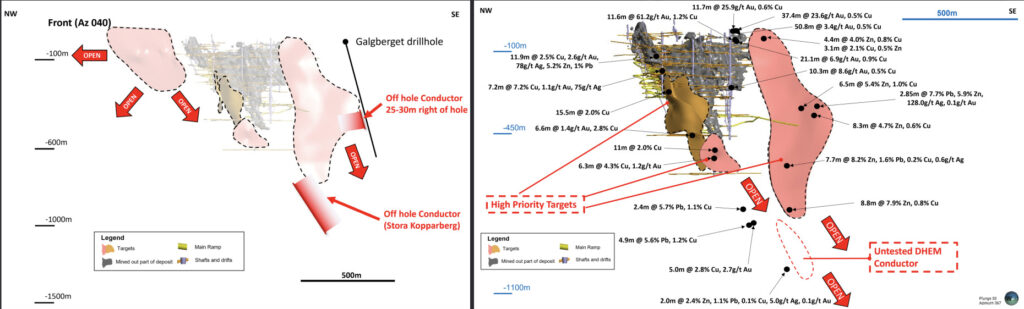

It has a name that rolls off the tongue like it’s been spoken by a lonely housewife in a southern romance novel. But the copper and silver explorer has been more Scandi than Salsa for a number of years having pivoted to explorer some of the most intriguing assets on the ASX.

It is yet to hit the big one at its Sala or Falun projects, but is without doubt sitting on mines ironically well poised for a future where the energy transition generates higher copper and silver prices.

Acquired early last year, Falun is of vampiric age, one of Europe and the world’s oldest operating mines when it closed in 1992 after historic recorded production of 28Mt at 4% Cu, 4g/t gold, 5% zinc, 2% lead and 35g/t silver. For centuries it was the West’s largest supplier of copper.

It goes without saying those are the sort of grades you rarely see in modern copper projects, and a number of historic unmined intersections have been identified in historic drilling with stellar gold, copper and zinc grades. Nearby hits at the Skyttgruvan-Naverberg prospect 3.5km away — previously a small open pit and underground deposit — have come up with weaker copper grades but tasty zinc and silver numbers and mineralisation that mirrors Falun suggest there’s plenty of potential to make new discoveries along the 10km belt.

Over at Sala, once among the highest grade silver mines in Europe with historic production of 200Moz of silver at average grades of 1244g/t from the 15th century to 1908, Alicanto has defined an inferred resource of 9.7Mt at 4.5% ZnEq.

Alicanto, which has Bellevue Gold (ASX:BGL) founders Ray Shorrocks and Michael Naylor on its board and counts former BGL MD Steve Parsons as a corporate consultant, says Sala bears strong analogies to Boliden’s massive Garpenberg mine, which has 198Mt of zinc rich ore in resources even after being mined to a depth of 1500m over the past six decades.

Market cap: $18.3m

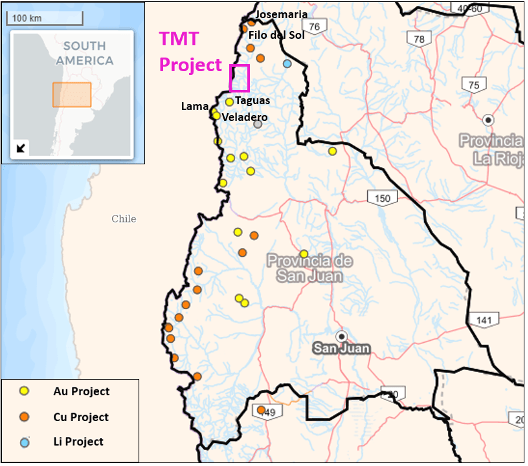

Belararox has tapped one of the godfathers of porphyry drilling, Dr Steve Garwin, to light up targets at its Toro-Malambo-Tambo project high up in the Andean region of Argentina, where the recent approval of the environmental impact assessment for the Lola target will open a new exploration front.

It is the 10th ranked of 12 targets identified by Garwin, known for his porphyry expertise and role in major discoveries like Solgold’s Cascabel, an Ecuadorian find that drew giants BHP and Newcrest (now Newmont) in as major shareholders.

Just one EIA remains to be approved a Malambo 4, where exploration remains in the early greenfields stage.

Sitting in a a belt that hosts over 40% of the world’s copper production across multiple South American countries, previous explorers have identified strong zinc grades and gold rock chips.

Once kicked over by Rio Tinto in the 1990s but incredibly still untested, the project has grown in significance with one of the world’s best recent copper discoveries being made nearby at C$3 billion capped and TSX-listed Lundin Group investment Filo Mining’s Filo Del Sol.

Drilling is expected to take place at the Tambo South prospect later this year.

“Initial exploration shows a complex geological environment at Tambo South, with multiple intrusive events, breccias, strong fracturing and high-level quartz veining which are all characteristic of the upper levels of a porphyry system or high-sulphidation epithermal system,” BRX exploration director Jason Ward said.

“Geochemical results and airborne magnetics will sharpen our understanding and given the very large alteration footprint and favourable structural setting; we eagerly anticipate drill testing these targets this year.”

BRX also boast significant Australian copper, base metals gold and lithium targets at its Belara project in NSW’s Lachlan Fold Belt (inferred resource of 5.0Mt at 3.41% ZnEq) and the historic Bullabulling gold field near Coolgardie in WA.

Market cap: $10.15m

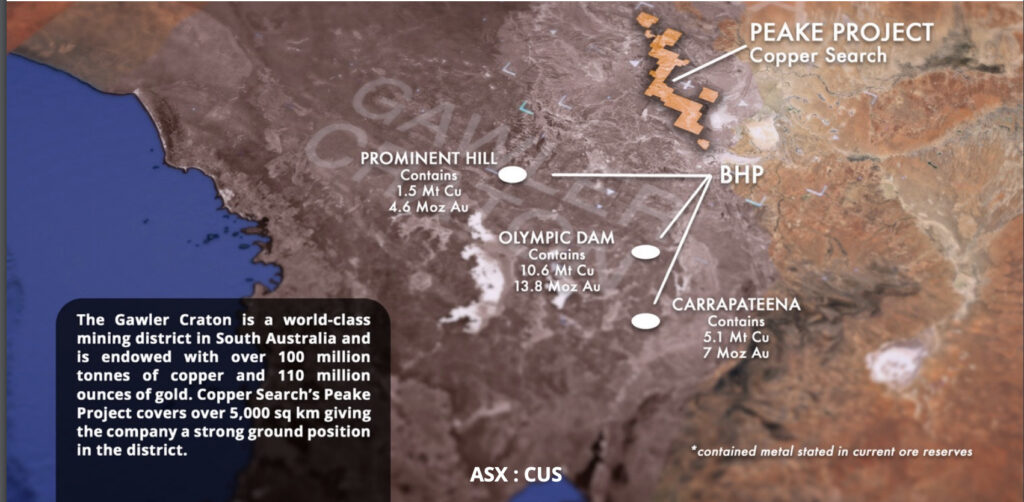

Copper Search is one of only a handful of explorers operating in South Australia’s Gawler Craton where it has zeroed in on the Paradise Dam prospect after a catching strong whiff of IOCG elements including copper and gold in narrow intervals.

A second drill rig was recently rolled out to Paradise Dam, part of the Peake project, around 18km southwest on the Karari Shear Zone from where Demetallica found visual copper mineralisation at the Wills prospect before its merger with North Queensland producer AIC Mines (ASX:A1M).

Led by geologist and adventurer Duncan Chessell — one of a small number of people who have reached the peak of the tallest summit on every continent on Earth — Copper Search is chasing its excitement at depth instead.

Significantly, Copper Search holds an enormous tenement holding in the Gawler, covering some 5000km2 within trucking distance of BHP’s Prominent Hill, Olympic Dam and Carrapateena mines, where the world’s biggest miner controls over 20Moz of gold and over 17Mt of copper metal in resources.

Any discovery of commensurate scale by Copper Search would no doubt come on BHP’s radar, which has flagged plans to turn South Australia into one of the world’s great copper basins, producing more than 500,000tpa.

Chessell’s presentations have noted BHP’s Oak Dam discovery 75km from the Olympic Dam smelter, which contains and exploration target of 500Mt to 1.7Bt at 0.8-1.1% Cu, highlighting the size of the prize if a major IOCG find can be made in the Gawler.

And CUS is a far cheaper entry point to the well-endowed region, with BHP worth in excess of $200 billion and OZ Minerals sold to the mining giant for $9.6b cash in 2023.

A heritage survey is currently ongoing, opening the door to more drilling at Paradise Dam to test an IP chargeability anomaly containing 3km of strike intrepreted to be due to the increasing scale of disseminated sulphides at the site.

Market cap: $14m

Look up underexplored in the dictionary and there’s little doubt a map of the West Musgrave region of WA will be in there.

Located on WA’s border with South Australia, the region is intended to be the site of the $1.7 billion West Musgrave nickel and copper project BHP is planning to bring online later this decade … if sliding nickel prices don’t nix the development.

That discovery was made back in the late 1990s by Western Mining Corporation, with precious little capital invested to follow up other targets in the region since.

That means there could be massive discoveries waiting to be found. GCX recently kick-started a 7000m RC drilling program looking for magmatic copper-gold sulphide and PGE reef targets extending over a whopping 17km of strike at its Dante project.

Drilling has started at Cronus, a 7km by 1.5km interpreted intrusion which bears strong anomalism for copper, gold and palladium.

“We are very pleased to have successfully established the camp and commenced our maiden drill program at the Dante project,” MD Thomas Line said last week.

“This drill program will mark the first broad scale systematic drilling to have been conducted at Dante.

“The scale and quality of the targets are exceptional and we look forward to learning more as the program progresses over the coming weeks and months.”

Dante sits just 15km north of the Nebo-Babel deposits at West Musgrave, with GCX already holding a native title agreement with the Ngaanyatjarra Land Council as well as an historical dataset containing results from over 3000 auger holes, RC and diamond drill holes, ground EM and gravity surveys.

GCX boasts a string of other gold, lithium and base metals projects, including the Onslow copper-gold project in the Pilbara.

Market cap: $5m

SER has a very big backer in its corner inking a deal last year that would see Andrew Forrest’s Fortescue (ASX:FMG), one of the world’s largest mining companies, spend up to $8m in six years exploring the Canobie project in Northwest Queensland.

FMG is looking to diversify from iron ore into other fields. Alongside its move into green energy, the mining behemoth has also spent years looking for other commodities like lithium, copper and rare earths.

While its attention has previously been centred on leases on South Australia and South America, FMG has pinpointed SER’s Canobie IOCG project as a potential hotbed of the style of mineralisation common to the famous Mt Isa region.

Covering 1800km2 wihtin the Mt Isa Eastern Succession, FMG can earn an 80% stake in two stages, which will incorporate at least 6000m of basement drilling.

FMG drilled three geophysical prospects for 3300m in the December quarter. And while Twiggy’s geos didn’t hit the next Ernest Henry, SER believes it is definitely within the right rocks.

“The first field season at the Canobie Project has confirmed our view of the prospectivity of the project to host Ernest Henry style IOCG deposits,” MD David DeTata said in February.

“All three targets tested this year were magnetite rich with IOCG geochemical pathfinders present. The team has already incorporated these new datasets to design additional geophysical programs to rank the dozens of remaining targets across the project prior to drill testing this year.

“This is the science driven approach to exploration that SER strives for in search of the next Tier-1 discovery undercover’.”

Meanwhile, SER is also hunting nickel and copper targets in New South Wales, including the West Koonenberry project, on a belt already explored by majors INCO/VALE, IGO and currently being scoured by Nova founder Mark Bennett’s S2 Resources (ASX:S2R).

Market cap: $20m

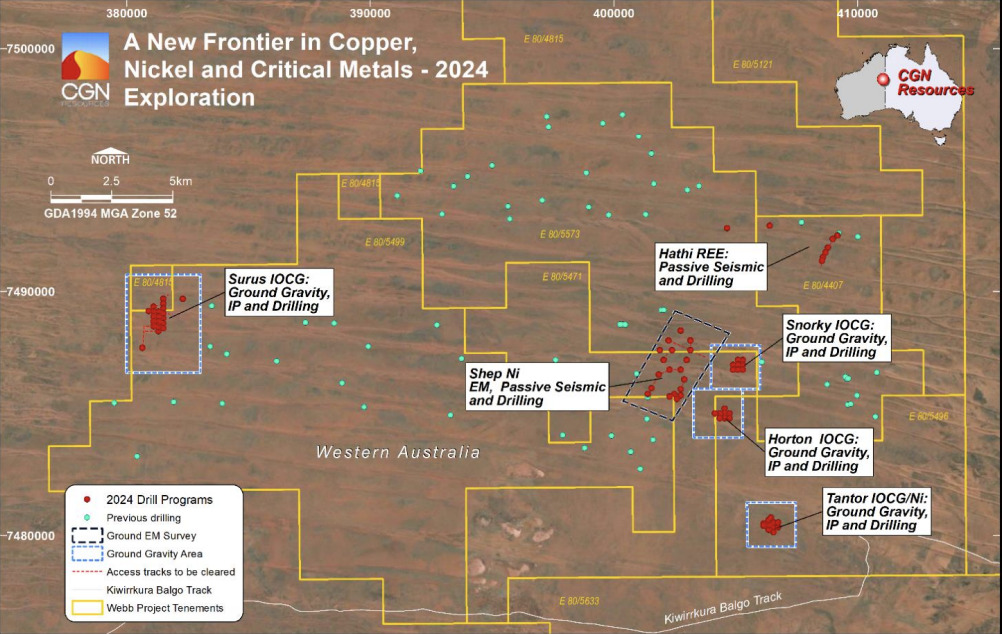

CGN was one of only a handful of floats to make it all the way to the boards of the ASX last year in a weak market for risk capital.

Exploring the West Arunta region of WA on ground it picked up before it was trendy, the wave CGN rode to the bourse was largely off the back of the Luni niobium discovery made by WA1 Resources (ASX:WA1).

While CGN would no doubt be happy with a niobium company maker if that’s what transpires, it is more keen on the original reason explorers flocked to the remote and underexplored region originally — IOCG targets that reminded geos of OZ Minerals’ famous Prominent Hill mine in South Australia.

“The chance of finding an IOCG to me that would be the Holy Grail, I think; copper is in a long term supply deficit. And it looks like it gets worse out over time,” MD Stan Wholley told Stockhead before CGN’s float in August last year.

“It’s not getting a great deal of love right now. But going forward, if you have a good copper discovery on your books, it’s easy to get money to develop it yourself, it’s easy to get partners in, majors will take it off your hands if it’s good enough.”

It views the Surus target as a compelling IOCG prospect confirmed by IP and gravity anomalies, with WA Government Exploration Incentive Scheme supported diamond drilling set to begin there next month.

Market cap: $15m

Unlike many copper stocks at the nano-cap level, Coda already boasts a large resource base including 1.1Mt of copper equivalent metal at its Elizabeth Creek project in South Australia.

A little further away from Olympic Dam, Coda has already delivered a scoping study suggesting the project could produce 25,400t of copper cathode and 1300t of cobalt sulphate a year.

That would involve two stages of open pit mining followed by an underground development, producing 307,000t of copper and 16,900t of cobalt after a $306m build that will deliver $1.674b of net cashflow before tax over its life.

The underground component at Elizabeth Creek’s Emmie Bluff deposit contains 40Mt at 1.87% CuEq, lying flat at a depth of 400m.

That’s similar in nature to mines like Khoemacau in Botswana’s Kalahari copper belt, where resources at almost three times as thick but sit at a depth of 650-1200m below surface.

Since the release of its scoping study, Coda has said a shift to pillar support mining at Emmie Bluff could improve recoveries, boosting its pre-tax NPV by $91m to $826m and IRR from 27% to 31%.

Market cap: $20m

Great Western is looking to follow up arguably Australia’s most exciting copper discovery this century, looking to do something even its founder couldn’t do.

A high grade volcanogenic massive sulphide discovery, Sandfire Resources (ASX:SFR) produced in excess of 60,000tpa at DeGrussa’s peak.

Opened just three years after its discovery in 2009, DeGrussa was one of the lowest cost copper projects on the ASX for over a decade, helping Sandfire go from minnow to the bourse’s flagship pure play copper exposure and funding its acquisitions of the Motheo and MATSA mines overseas.

But the only satellite discovery ever mined was the Monty deposit, discovered by Kerry Harmanis’ Talisman Mining (ASX:TLM).

Great Western’s Fairbairn, located 120km from DeGrussa, boasts geophysical targets sitting between 80-190m below surface beneath surface samples grading up to 0.19% Cu and 0.15g/t gold.

Drilling is expected to commence by the end of this month.

“These targets have been identified and refined using cutting-edge geophysics and assessed by leading people in this field,” GTE MD Shane Pike said on announcing the drill program.

“Geological mapping completed by our team found the targets are located in a geological setting expected for a DeGrussa style copper-gold deposit and share many other key geological characteristics.”

An early adopter of the shift in markets that saw TSX explorers hunting for capital seek a secondary listing in the hotter Australian market, Kincora timed its listing perfectly, hitting the ASX in early 2021 just before copper prices hit all time highs.

But it has meandered since, its shares falling from 34c in May 2021 to 3.1c today.

However, KCC has simplified its portfolio in recent months, acquiring its minority partner RareX’s 35% stake in the Trundle, Fairholme, Jemalong Cundumbul and Condobolin projects in New South Wales in December.

At the same time, Kincora said it was looking at potential third party investors to take a stake in the portfolio to secure funding and avoid future dilution.

RareX (ASX:REE), which owns a rare earths and phosphate project in northern WA, now holds 18.2% of Kincora’s shares.

KCC’s flagship project is the Trundle prospect, located in the rich Macquarie Arc of the Lachlan Fold Belt, where it is hunting porphyry style copper and gold mineralisation that boasts over 3.2km strike and is open at a width of 900m.

At Stockhead, we tell it like it is. While Strategic Energy Resources, Alma Minerals, GCX Metals, Belararox, Copper Search and Alicanto Minerals were Stockhead advertisers at the time of writing, they did not sponsor this article.