ASX Resources Top 5: Uranium stocks on the move as spot prices stir

Mining

Mining

Here are the biggest small cap resources winners in morning trade, Tuesday April 6.

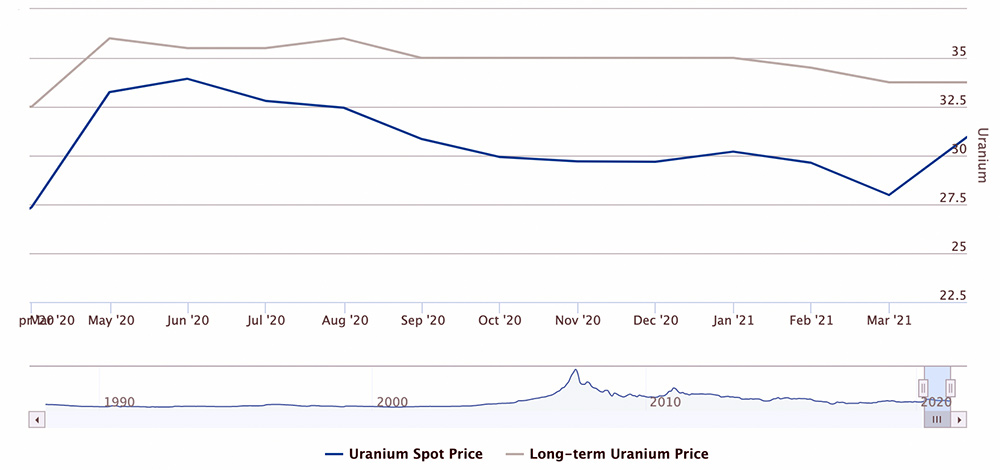

Spot uranium prices have made a move past +US$30/lb, sparking a surge in US uranium stocks yesterday.

Aussie stocks followed suit in early trade Tuesday, led by Toro Energy which has started development studies at the ‘Lake Maitland’ uranium and vanadium project in WA.

This scoping study will be the first proper look at whether the project is economic or not to build.

Lake Maitland is one of three uranium projects in WA that have environmental approval for mining from both the state and federal governments, the company says.

Other Aussie uranium stocks to make gains in early trade include Bannerman Resources (ASX:BMN), Vimy Resources (ASX:VMY), Peninsula Energy (ASX:PEN) and Boss Energy (ASX:BOE).

The Colombian explorer pulled up a spectacular from-surface intercept of 460.9m @ 1.11g/t gold at ‘Tesorito South’.

That includes 34m @ 3.03g/t gold and 0.12% copper from 214m – which far eclipses the best drill intercepts to date and elevates Tesorito South to a “globally significant recent gold porphyry discovery”, Los Cerros says.

“On a gram-metre basis TS-DH16 is the best hole ever recorded in the entire Quinchia district and has raised exciting questions about the potential scale of this gold system,” managing director Jason Stirbinskis says.

Assays are pending for four holes.

Drilling is ongoing at the wider Quinchia project, with two diamond rigs at ‘Tesorito South’ and a third diamond rig drilling at the ‘Chuscal’ prospect.

(Up on no news)

In late March, Rumble kicked off drilling at the 75% owned Earaheedy zinc-lead-silver project (Zenith Minerals (ASX:ZNC) 25%) in WA.

Earaheedy could turn into a large scale deposit, Rumble says.

This 2500m drilling campaign will test the size of the ‘Chinook’ and ‘Magazine’ discoveries, which are 10.5km apart “with the Zn-Pb-Ag mineralisation completely open”, Rumble says.

The drill program was expected to take three weeks, with assays to follow.

(Up on no news)

The newly listed Chile-focused gold and copper explorer has three projects including ‘Capote’.

Capote is home to the historic San Juan gold mine, where 500,000 ounces of gold was produced at an ore grade of 40 grams per tonne through to 1954.

That’s a very, very high grade gold operation.

Capote has been untouched for almost 70 years and never explored by modern means.

“In the coming months, we will deploy a systematic exploration program, including detailed geological mapping, surface geochemistry, airborne magnetic and hyperspectral data,” the company says.

(Up on no news)

Orminex was one of only ~6 gold stocks which struggled last year.

Its small, loss-making Comet Vale mining operation was mercifully mothballed in September.

In December, Orminex sold 50 per cent of its undeveloped Penny’s Find gold mine for $1.5m to Horizon Minerals (ASX:HRZ), which will shell out another $1m to fund early development.

The high grade project has a current resource estimate of 248,000t at 7.04g/t gold.

“Penny’s Find is a quality high-grade gold project with considerable work completed enabling an accelerated pathway to production with approvals and toll milling agreement in place for the first phase of development,” Horizon managing director Jon Price says.

“We look forward to working with the Orminex team and releasing the drilling results, updated resource model and mine optimisation and design work in coming months enabling a development decision in the September Quarter 2021.”