This junior has ground between two of only three uranium mines in Australia, and a historical resource to boot

Koba Resources is acquiring 5,100km2 between two of Australia's three producing uranium mines. Pic via Getty Images

- Koba Resources is closing a deal to acquire 5,100km2 of ground in South Australia’s premier uranium district

- The Yarramba tenements are located between the longstanding Beverley operations and the Honeymoon mine being revived by Boss Energy

- Previous owner Curnamona Energy’s market cap hit $120 million during the last uranium boom in 2007

Everybody needs good neighbours. Just a friendly wave each morning, helps to make a better day. With a little understanding, you can find the perfect blend.

The lyrics to Australian entertainment royalty Barry Crocker’s most famous anthem could not be more apt for Koba Resources (ASX:KOB) and its newly acquired uranium tenements in South Australia.

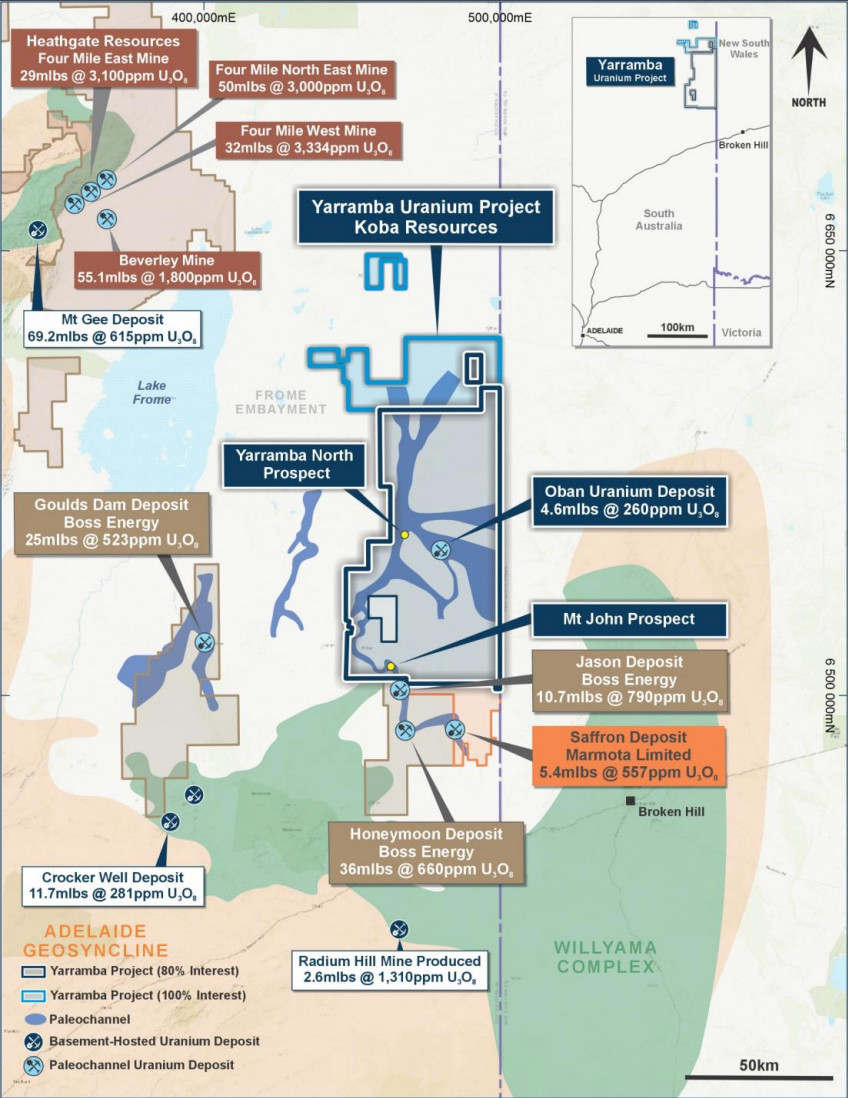

Pending shareholder approval next month, Koba has grabbed hold of an 80% interest to the uranium rights over the 5,100km2 Yarramba project which lies barely 120km southeast of the longstanding Beverley mine and immediately north of the high-grade Jason deposit being developed by Boss Energy (ASX:BOE) as part of its imminent restart of the Honeymoon operations.

The uranium potential of Yarramba has not been tested since 2012 when Curnamona Energy was wound up by its major shareholder Havilah Resources (ASX:HAV) via an off-market takeover.

With Havilah firmly focused on developing its Kalkaroo and Mutooroo base metals projects near Broken Hill and Koba’s uranium-loving management team looking to scratch an itch, the two parties recently struck a deal over one of the hottest pieces of yellowcake real estate in the country.

“It’s a fantastic nearology play in the best uranium mining jurisdiction in Australia,” Koba managing director Ben Vallerine told Stockhead.

“There’s only three operating uranium mines in Australia – all in South Australia – and two of them are in the same district as us.”

‘We were actually slightly ahead of the curve’

Spun out of New World Resources (ASX:NWC) in 2022, Koba was originally focused on developing cobalt projects in Idaho and Nevada before picking up a suite of early-stage lithium exploration asset in Canada.

It was always the desire of Vallerine and Koba chairman Mike Haynes to find a more advanced project for the company to sink its teeth into. The initial plan was for that to be a lithium asset, but after being outbid on several opportunities, the focus turned to other commodities.

Uranium seemed the most natural fit. After all, Haynes spent more than a decade at the helm of uranium-focused explorer Black Range Minerals and Vallerine also dedicated a large chunk of his career to finding yellowcake deposits across North America.

“We thought we’d try and be a little bit countercyclical and move to uranium, so we started looking at a few deals and pretty much agreed on one by early November,” Vallerine explained.

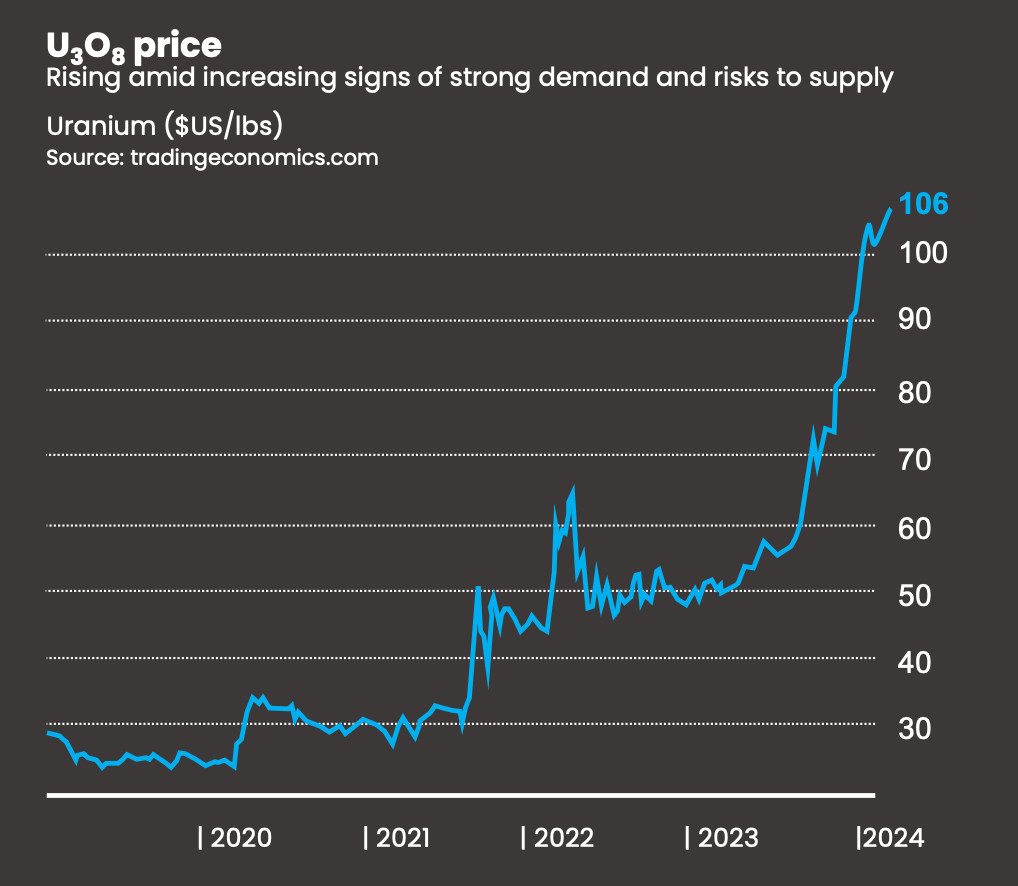

“Uranium, as we know, has had a couple of false starts over the last decade. Even in 2021, when it ran from US$20/lb to US$40/lb, it was a bit of a false start. But we thought uranium was the only way to go, we could see the mentality was slowing changing towards nuclear power and uranium. Our largest investors thought the same.

“We had to get ASX approval and draft up agreements, all those kind of things, so by the time we did all that, it was January 21 this year and the uranium price had run to US$106/lb. So we were actually slightly ahead of the curve, but it didn’t necessarily look like we were because we announced the deal with Havilah right in the middle of the boom period.

“A lot of stocks have come off since then, but the uranium price is still above US$100/lb, so it’s still a good place to be.”

A massive landholding to explore for uranium

Curnamona Energy achieved a market cap of $120 million during the height of the last uranium boom in 2007.

Between its IPO in 2005 and eventual acquisition by Havilah in 2012, Curnamona drilled more than 100,000m into the Yarramba tenements and delineated a JORC 2004 resource of 8.2Mt @ 260ppm U3O8 for 4.6Mlb at the flagship Oban deposit.

Vallerine believes plenty of opportunities exist to discover extensions to the known mineralisation at Oban, based on historical drill intersections such as 7.5m @ 831ppm, 4.5m @ 964ppm and 3.9m @ 1,104ppm U3O8, as well as hits of 1.3m @ 827ppm and 1.75m @ 626ppm U3O8 reported outside the existing resource.

“The original package we acquired from Havilah was over 4,000km2 and we’ve since picked up two more tenements to the north, taking us to 5,100km2,” he says.

“It’s an enormous project with 250km of paleochannels all through it. We’re optimistic that we’ll be able to make a new discovery, either in an area where there’s been sniffs previously or somewhere totally new.”

Then, of course, there’s the proximity to other uranium resources in the region.

The Beverley operations, which also comprise the very high-grade Four Mile uranium mines, host some 165Mlb @ 2,766ppm U3O8. Over two decades of continuous production, privately-held owner Heathgate Resources is understood to have delivered more than 40Mlb of yellowcake.

Boss Energy will begin its restart of the Honeymoon operations with a 36Mlb @ 660ppm U3O8 resource at the main mining centre, as well as 10.7Mlb @ 790ppm U3O8 at the high-grade Jason’s satellite deposit, which is just 4km north of Koba’s Mt John prospect where eight priority targets have been identified within a 15km stretch of paleochannel.

“The paleochannel that hosts Honeymoon and the Jason’s deposit runs from their properties straight into ours, so we believe there’s excellent upside to make further discoveries on our property,” Vallerine says.

Boom recruit added ahead of maiden drilling

Koba has agreed to issue Havilah with 25 million shares, plus options and performance shares, for the tertiary uranium rights over the Yarramba project.

Once the transaction is finalised, Havilah is expected to emerge with ~23% holding in Koba.

“Further to that, we’re spending $6 million in the ground over four years,” Vallerine says.

“This arrangement means Havilah get to maintain their tenements for longer because some of the tenements they are also exploring for base metals.”

Koba recently appointed seasoned uranium geologist Mark Couzens as its new exploration manager to oversee its planned maiden drilling campaigns later this year.

Applications have been submitted for a heritage survey to be completed next month with the company keen to sink the drill bit into both Oban and the Mt John prospect as soon as possible.

“In the meantime, we’re also going through all the data, assessing all the other prospects, looking for new targets,” Vallerine says.

“We’re basically starting from scratch with true exploration that we’re hoping to do towards the end of the year.

“Of course, we also want to increase the size of the resource at Oban to JORC 2012 compliancy and, ideally, increase the grade and all those good things that comes with a bit of exploration.”

Koba is also set to resume some early-stage exploration work at its Whitlock lithium project in Manitoba, Canada over the coming months, while also remaining on the lookout for other acquisition opportunities in the resurgent uranium sector.

“We’re still looking to grow,” Vallerine says. “We’re looking at other opportunities wherever we can.”

Koba Resources (ASX:KOB) share price today

At Stockhead, we tell it like it is. While Koba Resources is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.